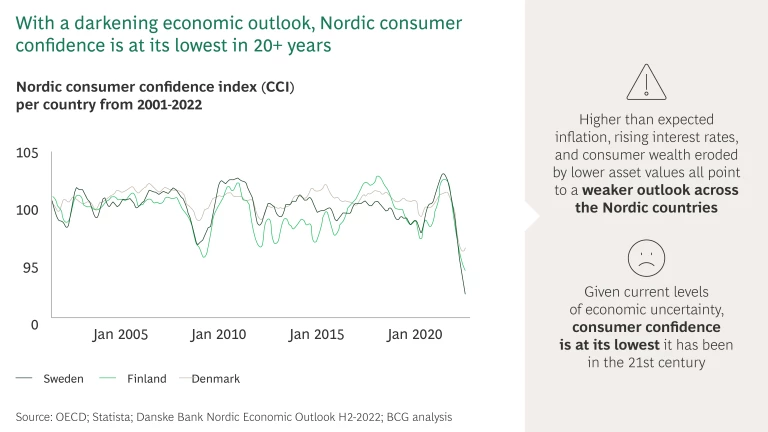

As the economic outlook across the Nordics worsens, the Nordic consumer confidence index hits its lowest point in 20 years—dropping below that of the COVID-19 crisis and the financial crisis of 2008.

In October 2022, BCG surveyed 4,000 consumers across Sweden, Norway, Denmark, and Finland to understand consumer sentiment and the resulting behavioral and spending changes at this time of economic uncertainty. Our research focused on key insights for retailers and consumer goods companies that can enable them to respond to the cost-of-living crisis and emerge stronger. The survey confirms that Nordic consumer sentiment has weakened. Consumers have seen a significant decrease in how much they can afford—and they expect this trend to continue.

In mid-2021, when Covid began to subside, Nordic consumers were very optimistic about increasing their spending, especially in categories hard hit during the pandemic, such as restaurants, leisure travel, and live entertainment. However, these plans have now been abandoned, with consumers reporting that they plan to spend less across categories and focus on essentials.

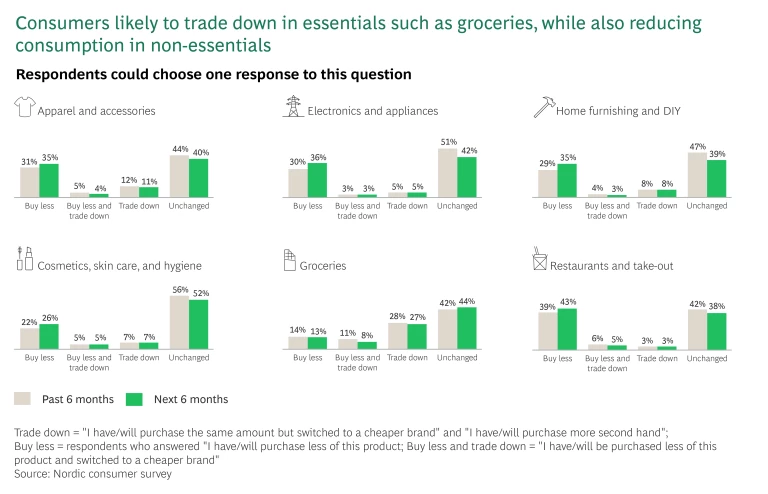

Consumers are planning to buy less and trade down by purchasing more from discounters and opting for cheaper brands to cut down on their spending.

We also see that the e-commerce share of retail seems to be stabilizing after the post-pandemic drop, with consumers intending to keep their current online share of purchases. However, online shopping is often perceived as more expensive than in-store shopping which makes price perception a key driver for e-commerce in the new environment.

With less money to spend, consumer willingness to pay for sustainable products have also decreased. Nonetheless, they still see sustainability as important, and the cost-of-living crisis accelerates trends toward other more sustainable consumer behaviors, such as purchasing secondhand goods and consuming less meat.

It is time for retailers to act—revisiting price and price perception across channels, lowering costs, and revamp sustainability efforts to offer more affordable options for consumers.

We Are in the Middle of a Spending Shift

CONSUMERS EXPECT THEIR DISCRETIONARY INCOME TO DECLINE FURTHER

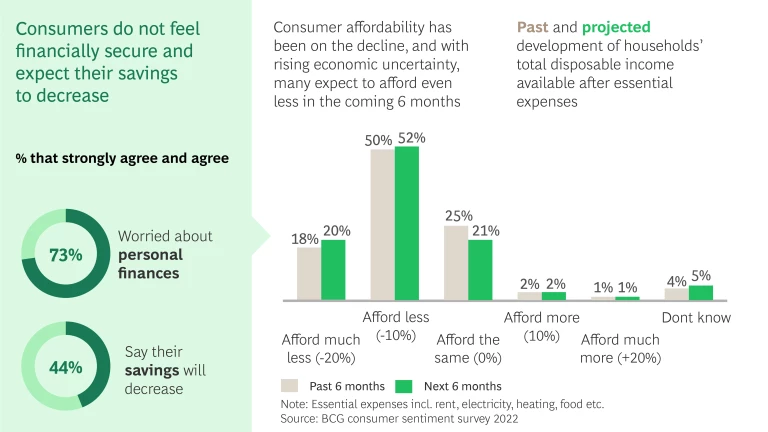

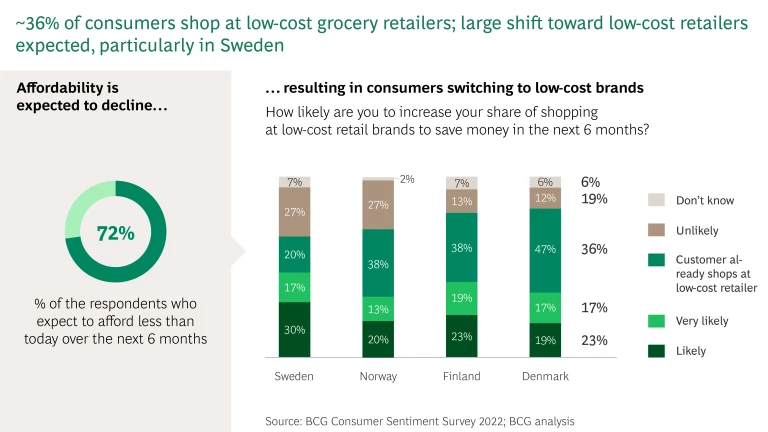

No less than 68% of surveyed consumers report that their discretionary income has declined over the last six months. However, it will get worse before it gets better, with 72% expecting that their discretionary income will take a further hit in the next six months.

Among Nordic consumers, 25% do not feel financially secure with the current status of their household economy. Another 47% feel secure at the moment, but are worried that this will change—driven mainly by concerns around rising energy costs, eroding savings, and skyrocketing inflation. As expected, low-income consumers and households with children are feeling the least secure. Almost half of surveyed consumers, 44%, report that they will either save less, not save at all, or even have to tap into their existing savings.

From a Nordic perspective, although the sentiment is similar across the region, consumers in Norway and Finland expect their discretionary income to decline more than their Nordic counterparts.

TIGHTER BUDGETS MEAN FOCUSING MORE ON ESSENTIALS, BUYING LESS, AND SHIFTING TO CHEAPER OPTIONS

Although spending will decline across categories, the biggest drop is expected to be in discretionary categories. Apparel, restaurants, leisure travel, live entertainment, and cultural events—in which spending boomed immediately post-Covid—are expected to show a strong decline (5%–7% in overall spending) in the months to come. A similar trend is expected for other discretionary categories such as jewelry; home furnishing and DIY; electronics and appliances; sports and sporting equipment; as well as food delivery.

Essentials such as fresh fruits and vegetables; packaged, frozen, and canned food and beverages; and transportation are the least impacted in terms of reduction in sales. Within essentials, consumers are planning to cut their spending primarily by switching to cheaper brands and shopping at discount stores, rather than buying less. Among respondents, 35% plan to trade down in groceries, while only 13% feel that they will buy less groceries in the next six months.1 39% of respondents are already shopping at low-cost grocery brands, and another 40% state that they are likely to increase their share of grocery shopping at low-cost brands, creating a big opportunity for retailers.

E-Commerce Share of Retail Is Expected To Stabilize With Price Perception the Key to Success

POST-COVID DECLINE IN ONLINE SHARE IS LEVELING OFF

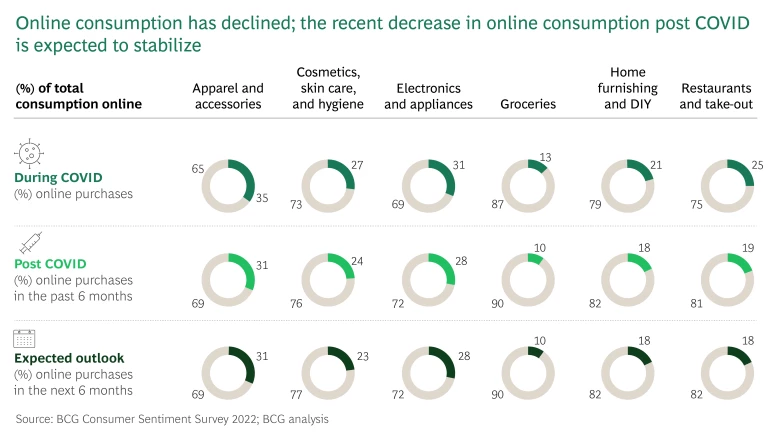

During the pandemic, a large share of consumers moved online due to lockdowns and other restrictions.

However, as soon as those restrictions were lifted, they started returning to brick-and-mortar stores, leading to a decline in online’s share of consumption. Going forward, the online share is expected to plateau at current levels.

Consumers have reported two main reasons for choosing to shop at a physical store instead of online: 1) the need to touch and feel products before purchasing, and 2) convenience of bringing the products home directly. Consumers value the inspiration they find in stores, the ease of finding the products they want and the availability of customer support, all of which are missing online.

Consumers also started getting back to re-discovering experiences they were missing out on during the pandemic. For example, footfall increased in restaurants, resulting in a strong decline in online share of consumption, going down 6 percentage points, from 25% to 19%. Home furnishings, electronics, cosmetics, and groceries were hit less hard and only saw a 3% decline in online consumption share.

PREFERENCE FOR ONLINE OVER PHYSICAL STORES RELATED TO PRICE PERCEPTION

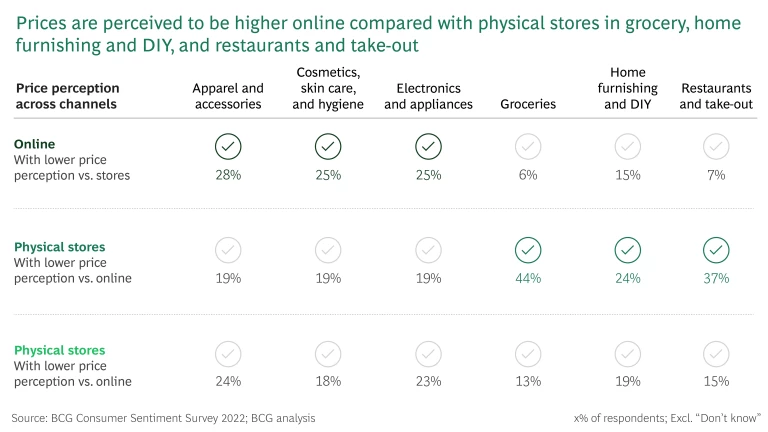

The low share of online consumption in groceries (10%), home furnishings and DIY (18%), and restaurants and take-out (19%) seem to be linked to a higher price perception of online products (price including delivery) in these categories.

This trend seems to hold true for all Nordic countries—the lone exception being Finland, where, surprisingly, all categories have a higher price perception online. Despite this, the country’s stated online consumption in most categories is at par with its Nordic counterparts.

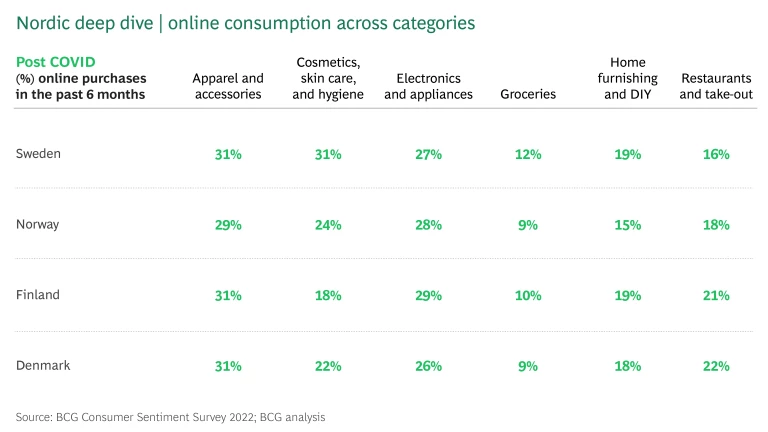

Also, it is interesting to note that Swedish consumers state that 31% of their total consumption was online in the past six months in cosmetics, skin care, and hygiene compared with only 18% in Finland, 22% in Denmark, and 24% in Norway.

Overall, this shows a possibility for retailers that want to drive online sales to revisit the actual prices and price perception. This is especially relevant in the groceries and home furnishings categories.

CONSUMERS WANT FAST DELIVERY BUT ARE NOT WILLING TO PAY EXTRA FOR IT

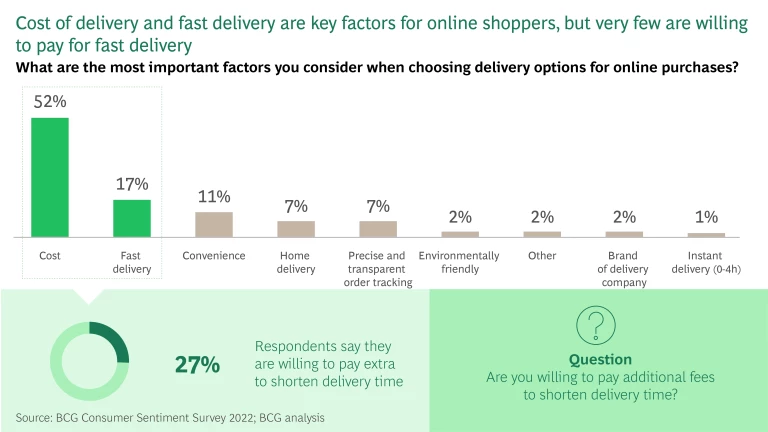

Price and speed are the top two factors influencing shoppers when choosing delivery options for online purchases. However, only 27% of consumers are willing to pay an additional fee to shorten delivery times.

Consumers have also reported being able to bring products home with them instantly as a key reason for shopping in physical stores, ranking just below ability to touch/feel the products.

This points to a possible systemic shift away from the high-convenience, instant-delivery model as consumers’ ability and willingness to pay for shorter delivery times decreases along with retailers’ ability to fund these models.

Companies should revisit their online offering and delivery pricing to align it to changing consumer expectations. This also presents an opportunity for companies that have established efficient supply chain models to position themselves as offering fast delivery options at low costs.

Sustainability Remains Important for Consumers but Fewer Are Willing to Pay for It

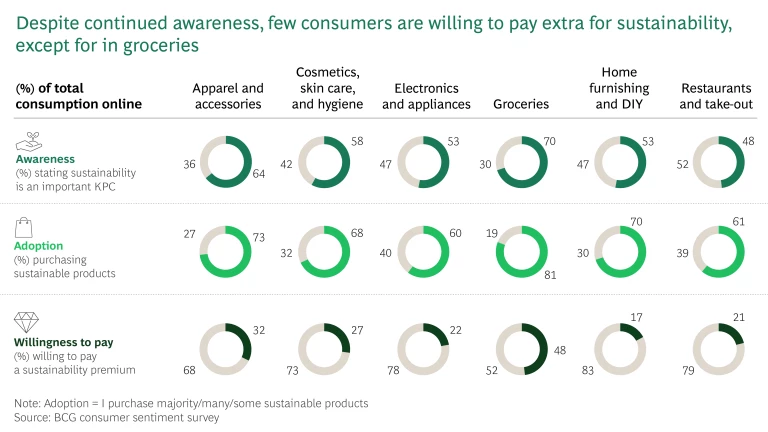

Currently, 29% of consumers on an average report that many to most of their purchases today are sustainable. Those who report few or none of their purchases being sustainable indicate that high price is a key barrier to purchasing sustainable products.

Consumers in Sweden and Finland are more frequent buyers of sustainable products, with 34% and 40% consumers, respectively, reporting that many to most of their purchases are sustainable, compared with 25% and 19% in Norway and Denmark.

Sustainability holds a high value in consumers’ mind, with 58% of surveyed consumers reporting that sustainability aspects are important to them when purchasing a product.

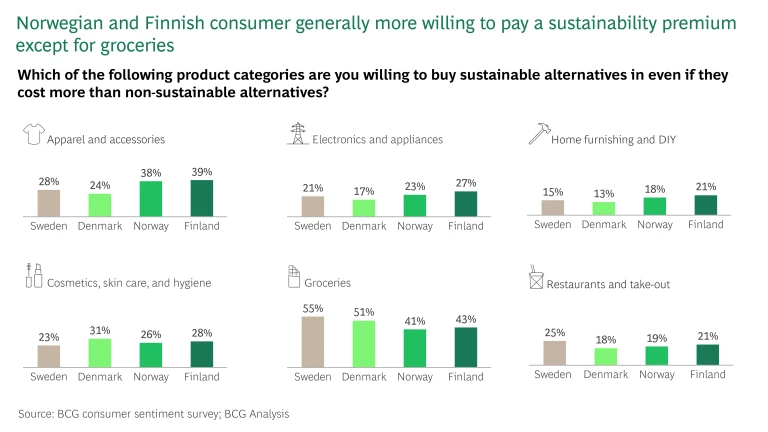

However, as is often the case, there is a clear say-do gap. The majority of consumers are not willing to pay a premium for sustainability. Only 20%–30% of respondents stated that they would prefer sustainable products even if they cost more than non-sustainable alternatives. An exception to this is groceries, where no less than 48% would open their wallets to buy sustainably even if it costs extra.

It is worth noting that Norwegian and Finnish consumers have a higher willingness to pay a sustainability premium in many categories, including apparel and accessories, electronics and appliances, and home furnishings and DIY. Danish consumers take a lead in cosmetics skin care and hygiene, and Swedish consumers in groceries and restaurants/take-out.

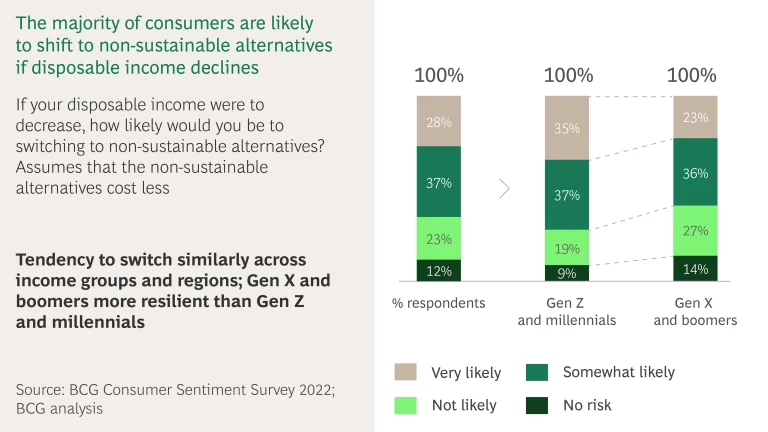

As the cost-of-living crisis continues, consumer willingness to pay extra for sustainable products is likely to decrease even further. A majority of surveyed consumers (65%) stated that they will shift to less-costly non-sustainable alternatives if their discretionary income decreases. Interestingly, 52% of consumers who are currently willing to pay a sustainability premium also echoed this sentiment.

Price and quality are top of mind for consumers when purchasing sustainable products, keeping them above sustainable raw materials, country of production, low carbon dioxide footprint, etc. This indicates that there is a potential for companies to offer affordable sustainability. The key is to find a positioning focusing on the product value in terms of price/quality rather than believing the products sustainability will outweigh other aspects.

THE COST-OF-LIVING CRISIS ACCELERATES THE TREND TOWARD MORE SUSTAINABLE CONSUMER BEHAVIORS

The silver lining for sustainability in the cost-of-living crisis is that it seems to accelerate the trend toward more sustainable consumer behaviors, such as buying more second hand, eating less meat, and buying only what is needed.

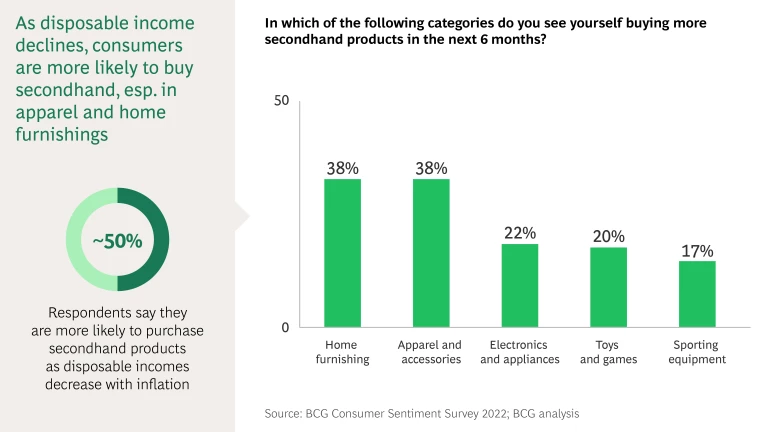

Circular business models: Among consumers, 50% report being more likely to purchase second hand products—especially in home furnishings and apparel—as their discretionary incomes decline.

However, it is worth noting that limited cost benefits, difficulty in finding products, items being too worn down, and low quality are key inhibitors slowing down the adoption of secondhand alternatives.

Reduced consumption of fresh meat products: The survey indicates a stronger decline in spending on fresh meat products compared with other food products, with consumers stating that they “plan to buy less meat, due to sustainability reasons, as well as to save money.”

Reduced overconsumption: The cost-of-living crisis has made consumers more cautious. They plan to buy only as much as they need, with many planning to buy less across categories. Consumers are, for example, stating that they “think a lot more before they commit to a purchase” and “only buy products that they need and will use for a long time.”

Priorities to Win in the Cost-of-Living Crisis

After reflecting on the latest consumer sentiment, we believe retailers should focus on six things to better navigate the cost-of-living crisis:

- lowering prices and revisiting product mixes to compete with discounters;

- better manage price perception online to drive e-commerce sales;

- reduce cost in order to afford a better price positioning;

- revisit online delivery offering to match consumer expectations and willingness to pay;

- guide consumers to affordable sustainable options;

- and rethink their business model to incorporate sustainability and circularity. Retailers that manage to develop affordable circular business models will be able to meet consumer demand for secondhand products and low-cost sustainable options, while also insulating them against e.g. geopolitical instability and supply chain disruptions.

It is said that Winston Churchill once quipped,” Never let a good crisis go to waste”. Now is the time for businesses to invest in resetting their positioning, redefining their setup, and reducing waste—coming out of the cost-of-living crisis with a stronger offering and a more efficient and resilient setup.