Banks’ rich customer data helps them create customized insurance products that give them a significant advantage over traditional insurers. For bancassurers, it’s time to get personal.

Banks have sold insurance products to their customers for decades and with good reason: best-practice players can generate 30% of their profits from these products. Yet we think banks can develop their bancassurance business even further—with artificial intelligence as the essential enabling technology.

By using AI to drive a high degree of personalization, banks can capture a substantially greater share of their customers’ insurance spending. Some bancassurance players are concerned about the evolution away from branch distribution and the loss of prescriptive power from bank relationship managers. In reality, AI-powered personalization means the transition to digital is an opportunity for growth.

AI-powered personalization means the transition to digital is an opportunity for growth.

Personalization is also an answer to the challenge created for bancassurance as banks shift away from fee-based offerings and toward core banking products based on savings and lending. This pivot is a natural consequence of higher interest rates but means bancassurance operations may get reduced exposure in banks’ physical channels and hence experience lower volumes of leads. But personalization can deliver increased conversion rates by ensuring that every offer is pitched with the right price, messaging, and timing. The result is that new business volumes remain strong.

In our work with bancassurers, we see wide disparities between best- and worst-practice players. We believe doubling down on personalization can move any bank closer to best-in-class.

Looking at the Key Metrics

We have seen a best-practice European bank sell life coverage—typically the most significant revenue opportunity—to an impressive 26% of its personal banking customers. That’s 3.7 times higher than one laggard player, which has sign-up rates as low as 7%. The difference can be even more significant in health insurance: one best-practice player has take-up of 6.5%, 18.6 times greater than the rate of 0.3% for laggards.

The slow movers are not just losing a painful amount of revenue. Historically, insurance has grown more quickly than core banking services, generated better margins, and been valued more highly by capital markets. Looking at the average across Europe and Latin America, we see a decade-long trend of insurers improving gross written premiums by 1 or 2 percentage points a year faster than banks increase revenue. Insurers also enjoy about twice the return on equity of banks. And if we look at the top 20 insurers in the same regions, they have approximately double the price-to-book ratio of the top 20 banks.

In addition to adding growth, bancassurance operations can help the banking business: properly sold insurance products boost retention and customer satisfaction in the core banking business.

Getting the Value from Data

When trying to access these revenues, a key asset is banks’ rich customer data; indeed, they have much richer data than pure-play insurers. We see the most innovative bancassurance players using customer data to create personalized offers that substantially enhance distribution and deliver long-term competitive advantage.

Banks’ rich customer data gives them a competitive advantage over traditional insurance players.

Access to customer data is not banks’ only competitive advantage in the insurance market. They have frequent customer touch points with multiple channels and a vast amount of digital “real estate.” Banks also have a trusted relationship with their clients. This provides many opportunities to sell insurance and enables a test-and-learn approach that can fine-tune the offerings. Moreover, bancassurance players can access the bank customer base at marginal cost, avoiding the acquisition expenses of the incumbent, pure-play insurers.

But pure-play insurers also have their own source of advantage: the expertise and focus of their distribution network. Their agents’ deep product knowledge means they can distribute more complex products. They are adept at engaging customers and can therefore ensure a better product fit. In addition, the agents are highly incentivized.

Better use of data by bancassurers, however, can counter many of these advantages and redefine the competitive landscape.

For bancassurers, AI and personalization can:

- Double the cross-selling rate.

- Increase lead conversion by a factor of three or even five.

- Add 4 percentage points to profitability—at a minimum.

- Reduce churn in the core banking business by at least 10%, maybe even 30%.

To measure the impact on the bottom line, we modeled the impact of improved, personalized bancassurance sales for a typical European bank with 10 million customers.

The Low, Baseline Case. Boosting the insurance equipment rate by a mere 1 percentage point adds around €80 million to net banking income. As a result, operating income increases by about €30 million or 5 percentage points.

The High, Best-Practice Case. We think personalization can drive a doubling of equipment rates across all products. Modeling this scenario shows an uplift in net banking income approaching €300 million and approximately €150 million in additional operating income. That’s an increase in bank operating income of a remarkable 25 percentage points.

Putting Personalization to Work

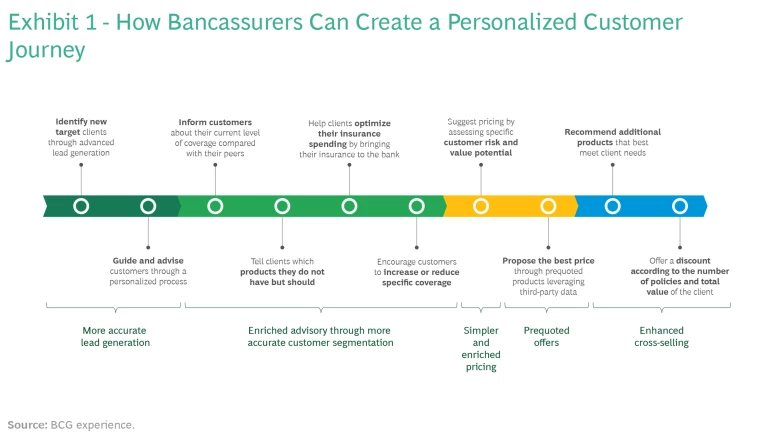

So what does data-powered, personalized bancassurance look like? At a conceptual level, it typically involves four steps:

Data-powered, personalized bancassurance can be made real via a wide variety of tools and systems, from customer-facing advisory tools to pricing engines.

- Identify whether the client has an insurance need by assessing the customer’s profile and behavior data.

- Assess the right time to approach. Data on previous, unsuccessful quotes can be vital here.

- Prioritize offers according to the expected profitability, inferred loss ratio, likelihood of contracting, and whether the client has shown a preference to buy all insurance products from a single provider.

- Select the best channel and sales arguments by looking at the customer profile and data on previous sales success. Some additional data crunching may be needed to calculate discounts.

This conceptual model can be made real via a wide variety of tools and systems, from customer-facing advisory tools to pricing engines. (See Exhibit 1.)

A key question is: Where do we begin? A successful, company-wide bancassurance transformation using AI should start with a high-impact, flagship deployment at scale. This will not only deliver business benefits but will help accelerate the organizational transformation. A project like this will have significant ripple effects—upskilling teams, triggering the deployment of enabling technology, and driving integrations in business processes.

Full-scale deployment in a meaningful use case can be achieved in less than a year and could substantially impact the bank’s bottom line. Better yet, the first use case could fund the next one, allowing for a cashless transformation.

Choosing the first project carefully is crucial. The decision should be based on the size of the impact and fit with strategic objectives, as well as any constraints in the technology and bank’s current AI skill set. Because of this, the first project will differ between banks. We see three “usual suspects”:

- Improving Digital and In-Branch Sales Conversion Rates. This leverages the bank’s real-world and digital assets to personalize the customer experience using sophisticated qualification of leads, prequote offers, tailored messaging, and discounts. As outlined in our arithmetic above, banks that take these steps can improve their conversion rates by a factor of about four.

- Pricing 2.0. Optimized pricing can make a big difference to profitability. It is a data-based capability, so bank transactional data is vital. Optimization increases conversion rates and can help prioritize good risks as part of the lead generation process. Banks doing this boost their profitability by at least 4 percentage points —and in exceptional cases even 10 percentage points.

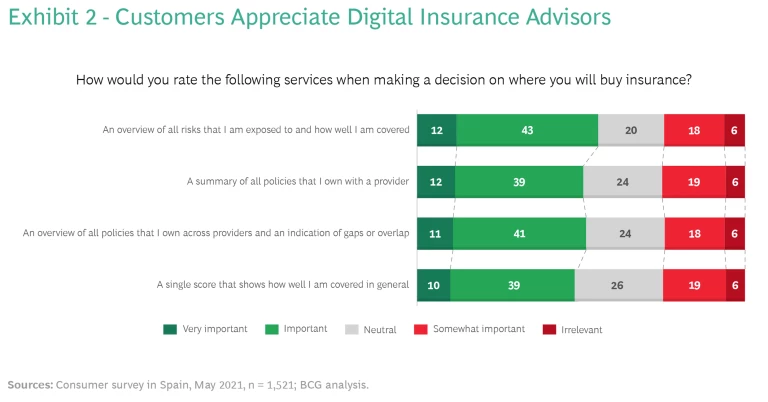

- Delivering Advice Digitally. This can tackle one of the insurance industry’s fundamental challenges—making customers aware of their risks and ways to reduce them. Digital tools can help them compare policies with those held by similar clients, find coverage gaps, and optimize their insurance spending. We observe that every step toward digital advice substantially drives engagement. Customers also testify that tools like this can be helpful.

To assess customer views on personalization and innovation, we surveyed insurance consumers in Spain. The survey confirmed our observation from multiple markets that consumers are enthusiastic about features such as a single score that explains their overall coverage level or a tool that highlights gaps in coverage. (See Exhibit 2.)

Getting on the Road to Success

With such clear benefits, why are so many bancassurance players struggling to execute at scale? We see four complex issues that bancassurers need to tackle before the road to success opens up:

- Develop an effective, relevant operating model that links the bank and insurer and that works in both the “build” and the “run” phases.

- Incorporate AI capabilities seamlessly into customer journeys and internal processes.

- Master the complexities of AI, such as integrating internal and external data sources and deploying the appropriate data science.

- Ensure continued compliance with privacy regulations, such as the EU’s General Data Protection Regulation (GDPR).

For many in Europe, this last issue seems the most daunting. Even if the bank entity has most of the data needed for personalization, a 360-degree view of the customer still requires at least some data from the insurance partner and usually external data too.

It’s important not to be disheartened by this. There are many ways to ensure GDPR compliance while achieving the necessary business outcomes. For instance, anonymized data can be used to train AI algorithms, with no significant damage to the quality of the model developed. Viable workarounds are also possible for other problems, such as banks lacking customer consent to offer third-party products.

Making an Impact

Tech and data analytics are the foundation for any AI implementation, but it’s vital to remember that, like most AI projects, the real impact of the transformation is highly dependent on adapting processes and creating new ways of working. Indeed, these may contribute 70% of the impact.

For that reason, change management and seamless integration with company processes are key. By combining well-oiled human processes with end-to-end technology, a bancassurer can create a virtuous cycle of AI implementation and improvement.

Every bank is at a different stage of its AI-driven transformation journey, and exciting use cases are possible throughout the organization. But we believe AI’s use in bancassurance is one of the most compelling. Selling insurance to people is an activity that will be enhanced by personalization; after all, purchase decisions are often driven by individual motivations such as protecting a home or loved ones.

The journey can appear daunting for banks at the start of the process. But as we’ve shown, the financial benefits are substantial—and the perceived barriers to success can be overcome by astute management. For bancassurers, it’s time to get personal.