Russia’s invasion of Ukraine has had major implications for energy markets. In the immediate wake of the invasion, oil prices rose to nearly $130 a barrel; while prices have come down, they have remained volatile due to continued stress on the system. Meanwhile, trends that were evident before the war—including the decommissioning of refinery capacity as well as the rapid return of demand as the COVID-19 pandemic eases—have also contributed to the increase in refined product prices, resulting in unprecedented margins for refineries around the world.

Yet even as many industry participants are wondering if a durable shift has occurred, it is worth taking a step back and examining the underlying fundamentals of the business. And despite the current favorable market conditions for refineries, it is increasingly clear that the industry is at a crossroads.

Consumer demand for refined products is likely to peak in the next ten years, and the imposition of additional carbon pricing schemes will add costs to what has historically been a low-margin business. As costs rise and margins contract, many refineries will become unprofitable.

Remaining profitable amid industry headwinds—and seizing the opportunities presented by the energy transition—will be the key to survival.

In short, the next decade will separate the winners from the losers in the refining business. The winners will be those that can remain profitable in the face of industry headwinds—including demand destruction, the physical impacts of climate change, the cost of carbon-pricing policies, and increasing pressure from regulators. Winning will also require that refiners take advantage of the opportunities presented by the energy transition , such as the evolving product demand mix, advances in digital technologies, and regulatory and consumer support for decarbonization.

The refining business will remain vital for some time to come. But the present conditions won’t last forever. Accepting that reality—and making the necessary changes sooner rather than later—will be the key to survival.

Declining Demand, Increasing Costs

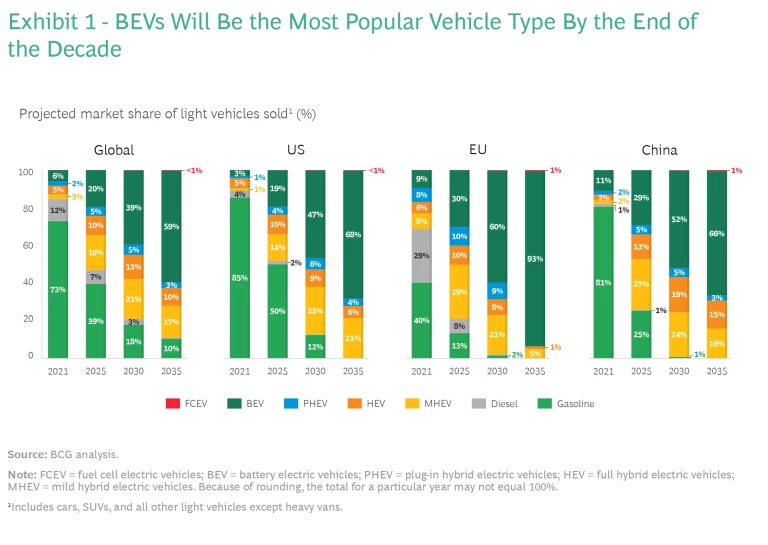

A wide range of adverse factors is clouding the long-term future of the refining industry. The ongoing shift away from the internal combustion engine (ICE) will significantly reduce demand for its products. Battery-electric vehicles (BEVs) will be the most popular type of light vehicle sold globally by 2028—three years earlier than we projected in 2021 . In fact, global BEV sales are expected to surpass sales of all types of hybrid vehicles combined, and to far exceed sales of ICE-powered vehicles, by the end of the decade. (See Exhibit 1.)

To accommodate the expected decline in demand for transportation fuels, production capacity will have to be reduced by the equivalent of an entire refinery every year after 2030—reductions that will most likely occur among refineries in higher-income nations, where operations are typically more expensive. In addition, modern, highly efficient capacity is still coming online in China, India, and elsewhere—fully six million barrels per day of new refinery capacity has already been announced—putting further competitive pressure on assets in higher-income countries.

Meanwhile, the costs associated with refinery operations are steadily increasing. The cost of emitting carbon, in the form of taxes and offsets, is expected to rise considerably in the next decade—to $100 per metric ton or more in some regions—as governments and regulatory agencies support the push toward net zero. The implications for refiners are huge, given that refineries produce an average of 1.2 million metric tons of CO2-equivalent (CO2-e) per year, according to the US Environmental Protection Agency—the second highest emissions per facility, after power plants. In fact, we calculate that if you were to add up the greenhouse gas (GHG) emissions from the global refining industry, it would rank sixth in emissions per country, behind only China, the US, India, Russia, and Japan.

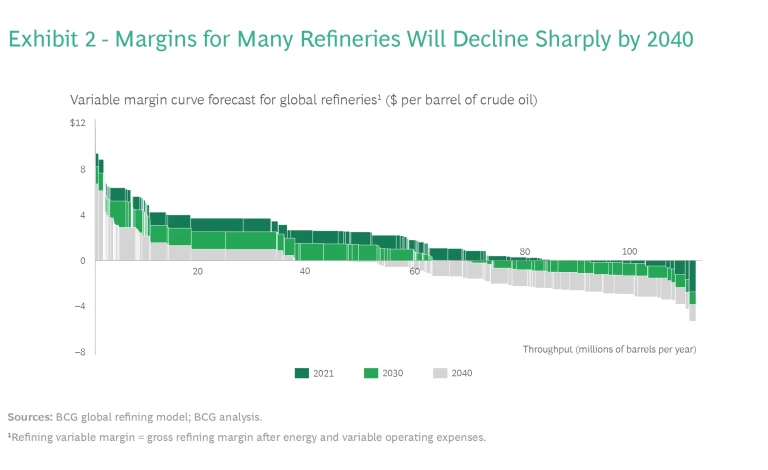

Ultimately, there will likely be close stewardship and scrutiny of the carbon impact of every barrel of crude oil, from drilling and extraction to transportation, refining, and final combustion. As a result, on a global basis, gross refinery margins are expected to deteriorate significantly over the next two decades. As Exhibit 2 shows, most refineries were profitable in 2021, but by 2030, margins will be sharply lower.

The increased cost of carbon isn’t the only cost associated with regulations that’s expected to rise. Regulations will also become more stringent with respect to noise, odor, particulate matter, and other emissions that can affect the health of those living near refineries, and that will increase costs further. The US Environmental Protection Agency is planning to pursue increased compliance with rules covering air pollution and is currently reviewing its National Ambient Air Quality Standards. China, too, plans to tighten its enforcement of air pollution regulations.

Refineries must also be prepared for the physical risks associated with climate change . Many refineries are located in low-lying areas near shorelines and thus are subject to the increased frequency of major hurricanes, typhoons, and other extreme weather events, as well as the longer-term effects of rising sea levels.

Hurricane Harvey, which struck the US Gulf Coast in 2017, highlighted the need to focus on increasing dike levels and improving drainage systems. Facilities that hadn’t made these improvements sat beneath salt water, shutting them down for months as they replaced electrical distribution systems as well as numerous pieces of rotating equipment. In some cases, the combined cost of repairs and lost margins ran over $150 million. Refiners that had focused on hardening their facilities for the impacts of climate change—raising and reinforcing their river dike walls, for example—were able to come back online quickly once external power was restored, with minimal repair costs; this also allowed them to provide financial support for hurricane recovery efforts in local communities.

With regulations tightening and climate risks growing, low-carbon refinery production is a must.

Climate change is likely to impact refineries in other ways. Rising temperatures will create additional capacity limitations—especially during the warmer months, as the cooling capacity of traditional cooling towers becomes even more limited. Changes in weather patterns will result in reduced water flows on major inland transportation rivers, impeding refiners’ ability to bring in crude and to ship products to customers.

To sum up, refinery operators must prepare for a far more problematic future, one in which the key to survival lies in transforming how they operate and placing their bets on their strongest assets. Under these conditions, low-carbon refinery production is a must—including cleaner sources of operating power, world-class operational efficiency, alternative products, and full tracking of how refinery products are used downstream.

The Low-Emissions Refinery of the Future

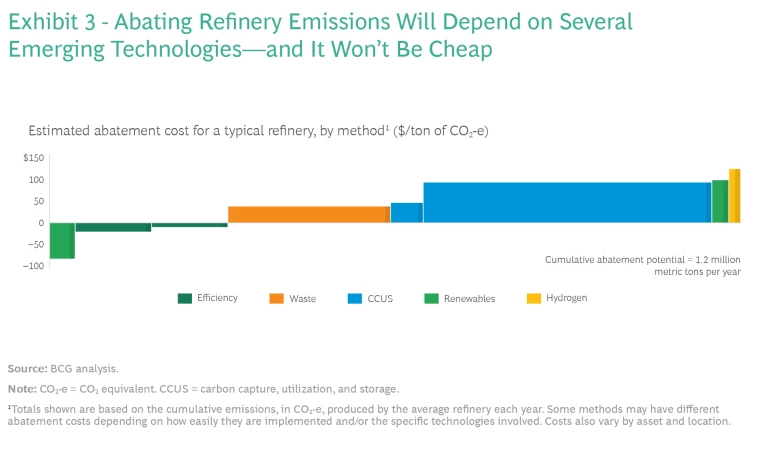

Many refinery operators have announced ambitious goals for reducing their carbon emissions, but achieving those goals won’t be easy. As Exhibit 3 shows, abating a refinery’s Scope 1 and 2 emissions will require actions across multiple levers. The price will be high, with considerable portions of refineries’ emissions costing close to or exceeding $100 per ton of CO2-e to abate. And abatement efforts will depend in part on a variety of technologies that have yet to become practical at scale.

While reducing Scope 2 emissions will largely be a matter of increasing efficiency and buying renewable power when its available, operators looking to reduce their Scope 1 emissions must develop and implement plans to reduce their refineries’ emissions intensity—the amount of CO2-e generated per unit of energy produced. Here are the techniques and technologies refineries should consider.

Renewables. Refineries can offset their emissions by developing their own renewable energy sources, both to power their own operations and to sell back into the power grid. The degree of CO2-e abatement, however, depends largely on the refinery’s configuration and the ability to store the energy generated. And storage costs are still high.

Fuel Switching. A further tactic for both abating GHG emissions and lowering costs is to switch to alternate fuel sources, including biomass, synthetic gas produced from biomass, biogas produced from other organic sources such as municipal waste and sewage sludge, and biomethane, which is produced by upgrading biogas. The cost of these fuels—and thus the economics of using them—depends heavily on the availability of the required feedstocks and their proximity to where they are to be used.

Green Hydrogen. Refineries can lower emissions further by shifting away from the production of hydrogen via steam methane reforming and to green hydrogen made from entirely renewable sources of power. The business case for green hydrogen is heavily dependent on the cost of production, which is currently too high to be economically viable. But the cost is dropping, and over 800 green hydrogen projects have been announced, with a total capacity of approximately 29 million tons per year. Increased regulatory and political support will be required to further speed up development.

Carbon Capture, Utilization, and Storage (CCUS). The development of economically viable technologies for capturing, storing, and using the CO2 released during refinery operations, including the production of blue hydrogen, will be essential if refineries are to meet their net-zero emissions goals. For refiners, the technologies associated with precombustion and postcombustion capture are not new, but the economics depends largely on the volume of CO2 being captured.

Subscribe to our Energy E-Alert.

Moreover, the economic value of carbon capture ultimately depends on the ability to store the captured CO2 and put it to use. It can be stored underground in depleted oil and gas reservoirs, saline aquifers, basalt formations, and coal deposits that cannot be mined. Then it can be used in a variety of industrial processes, including mineralization, chemical synthesis, algae synthesis, and artificial photosynthesis.

Developing large-scale CCUS infrastructure, however, will require considerable up-front investment, which may require partnering across the value chain. Governments can help by developing supportive regulation and incentives, as the US, the UK, and Norway are doing. The US’s recently passed Inflation Reduction Act, for example, is increasing the CCUS incentives to $85 per ton of CO2 and providing a tax credit of $3 per kilogram of hydrogen production.

Energy Efficiency. The least costly means of reducing refineries’ carbon footprint, and the most effective, involves improving their operational energy efficiency. Refineries can make significant gains in their business-as-usual activities through the optimization of their plants and reduction of the gas, steam, and power needed to operate them, and by implementing a new energy sourcing strategy to lower the cost of energy inputs.

Several new technologies also have the potential to increase refinery efficiency. These include new heat-recovery methods, low-emission furnaces, separation membranes, alternative uses for fuel gas, and the storage of thermal energy. Refineries can also take advantage of new digital solutions to ensure the efficient use of energy in each refinery unit. Indeed, digitization will be crucial to all aspects of the effort to decarbonize refineries, and thus to ensure their license to operate while also driving increased margins and minimizing operating expenses.

What About Scope 3 Emissions?

Refinery operators also have an obligation to promote the reduction of their Scope 3 emissions to the fullest extent possible. Operators can begin to understand their Scope 3 emissions by developing a baseline and using AI and other tools to track the impact on the environment through customers’ use of their products. Refiners can most directly lower these emissions by shifting to less carbon-intensive products such as biodiesel, renewable diesel, and sustainable aviation fuel.

Ultimately, they must collaborate with their customers to develop strategies for lowering Scope 3 emissions. (See the sidebar, “Can a Truly Net-Zero Refinery be Profitable?”)

Can a Truly Net-Zero Refinery be Profitable?

If refineries are to reach net zero in their Scope 3 emissions, they must either stop making fuels from crude oil—the very core of their business—or offset all of their Scope 3 emissions, a prospect so vast as to be entirely impracticable.

Yet there are reasons to be optimistic. The alternative low-carbon fuels that refineries could produce to drive down their Scope 1 and Scope 2 emissions could also significantly reduce their Scope 3 emissions if produced in sufficient quantities.

Second-generation biofuels are produced using feedstocks considered waste and not also produced for food. Because many refinery process units can coprocess or convert fully to biofeedstocks, biofuels processing can offer significant capital-expenditure synergies with traditional oil refining assets.

Many refinery assets are directly compatible with the production of biofuels and e-fuels.

Low-carbon hydrogen, produced with natural gas supplemented with carbon capture technologies or by electrolysis powered by renewable energy, is fundamental to the production of so-called

Moreover, traditional refineries’ utility systems and infrastructure, as well as their personnel, are all directly compatible with the production of biofuels and e-fuels. BCG estimates that a traditional refinery could coproduce these fuels for between 20% and 60% lower capital expenditure and 10% to 30% lower operating expenses than building a new biorefinery—although this is highly dependent on refinery configuration and local market dynamics.

These technologies offer a path for refiners to reach net zero in all three emissions scopes while transforming their assets to produce the clean energies of the future.

Winning Strategies

As the cost of refining fossil fuels grows and the pressure on margins ramps up, refinery owners must decide on the strategic role of each refinery in their portfolio and how best to position them for the future. We expect the refinery of the future to fall into three general archetypes: global competitors, regional champions, and new energy platforms.

Global Competitors. To ensure their survival, global competitors will need to invest in deep decarbonization, climate hardening, petrochemical integration, advantaged logistics, and the full range of digital tools needed to reduce production costs.

These world-scale operations will be located in refining hubs such as the Gulf Coast of the US, the Middle East, Northwest Europe, and Singapore, but they will be in a position to remain competitive in global markets—Gulf Coast refineries will be able to economically export fuels to Central and South America, for example. Integration with the petrochemical industry will be essential to maintain margins—and for some, a willingness to take risks through activities such as asset-backed trading will help prop up revenue.

Regional Champions. These operators will be located in nonhub markets and will be able to maintain the lowest cost to serve their regional customers. For these players, survival will depend on investing in whatever it takes to remain profitable in their markets as they face gradually declining demand and heightened competition from rivals. They must take care that refiners from adjacent markets don’t try to encroach on their regions and capture their market share.

New Energy Platforms. Some operators will be able to take advantage of the synergies between their existing operations and the opportunities arising from the energy transition. They should consider both converting to biofuels production and building a terminal for storing and distributing biofuels sourced elsewhere. They could also shift some operations to the production of hydrogen—converting their steam methane operations to produce blue hydrogen and using industrial-scale clean power infrastructure to run electrolyzers for green hydrogen. Converting hydroprocessing units to process renewable diesel is a further possibility.

Refiners willing to take advantage of the opportunities available in the shift to new climate-sensitive products can prosper. Survival will be contingent on choosing the right strategy for each asset depending on its location, capacity, and customer base—and most importantly, being willing to make the technological and operational changes necessary to increase revenue and maintain margins.

The winners will be those that begin now—determining and implementing strategies that best fit their current capabilities and a realistic vision for the future.