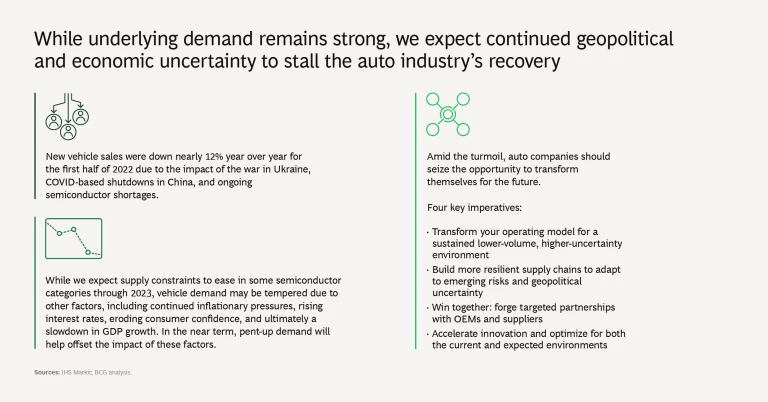

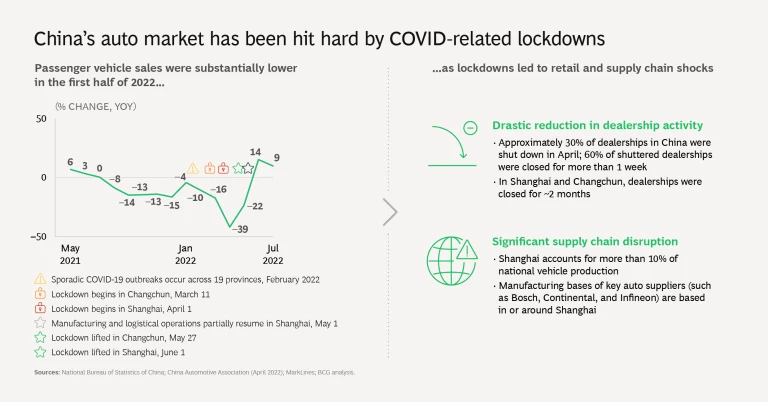

A year ago, many automotive industry insiders were anticipating smoother sailing in 2022. Unfortunately, this bullish outlook proved to be overly optimistic. Supply-side challenges have continued throughout the year, driven by ongoing semiconductor and labor shortages, intermittent COVID-19 lockdowns, and increased geopolitical instability. Amid this supply-constrained environment, sales fell by nearly 12% in the first half of 2022, measured against the same period in 2021.

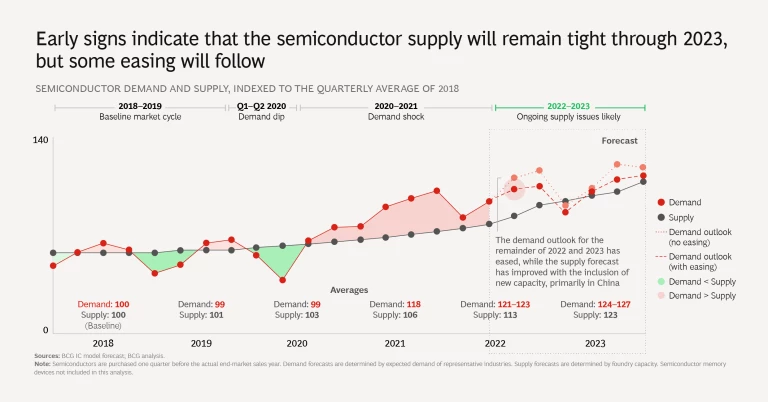

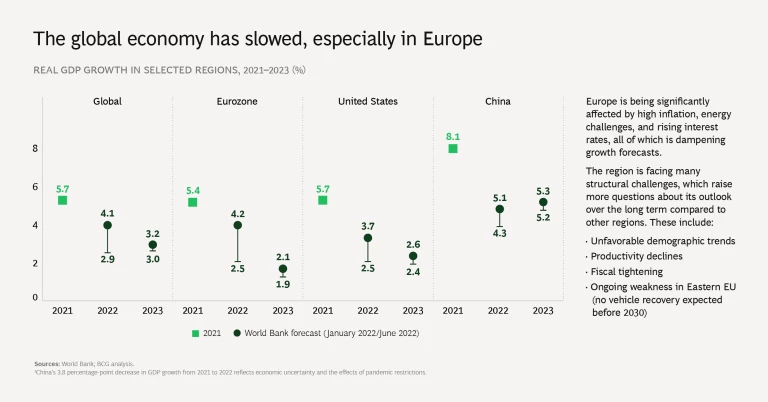

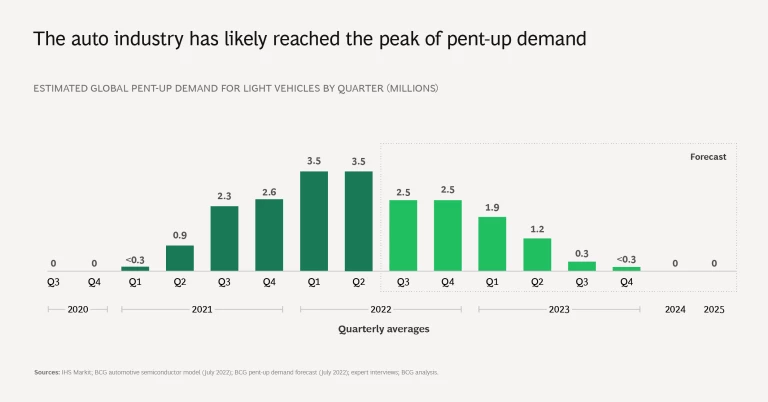

While these supply-side challenges will begin to ease in 2023, the industry should expect continued turbulence. We estimate that dealers are currently undersupplied by about 3.5 million vehicles—pent-up demand that has served to insulate the industry from the slowdown in growth, increased inflation, and rising interest rates. However, as this pent-up demand is fully addressed, the industry will increasingly feel the effects of the broader macroeconomic challenges. We expect to see a slowdown in demand for new vehicles beginning in late 2023.

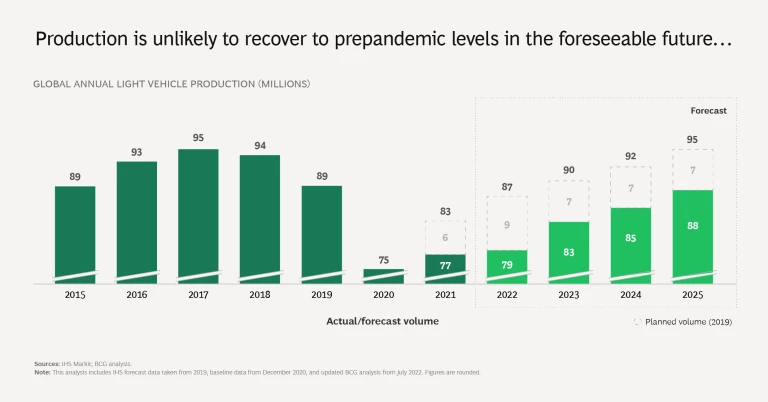

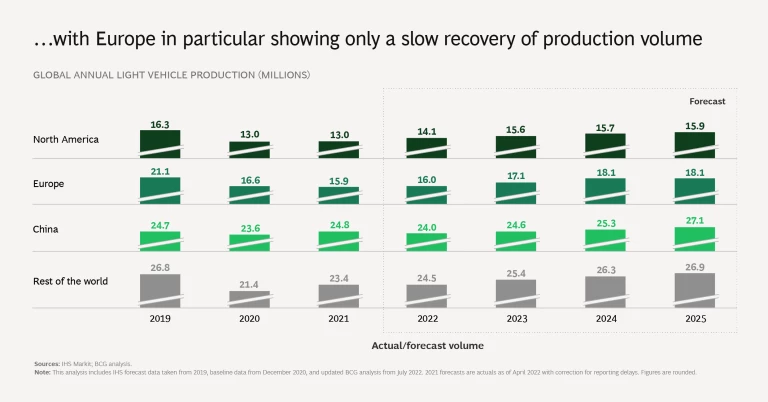

This slowdown in demand, combined with continued geopolitical tensions, ongoing labor shortages, and a lack of semiconductor availability for certain automotive applications, means the industry is in for a period of continued difficulty. The bottom line? It is unlikely that the auto market will revert to prepandemic volumes before 2025 .

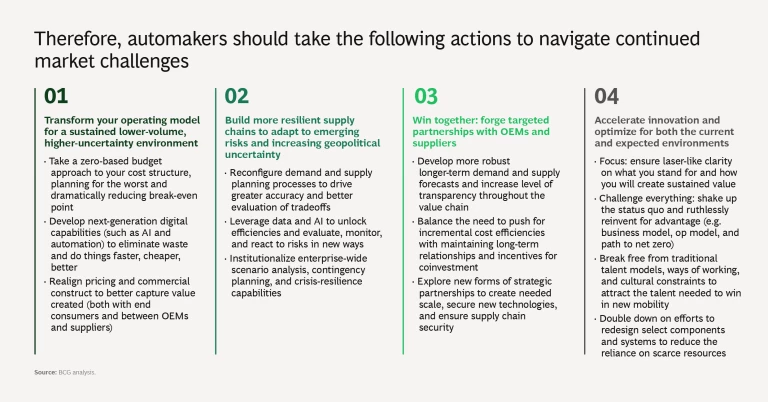

Against this backdrop, we see four key imperatives:

Transform your operating model for a lower-volume, higher-uncertainty environment. Take a zero-based budget approach to your cost structure, planning for the worst and dramatically reducing the break-even point. Develop next-generation digital capabilities (such as AI and automation) to eliminate waste and to do things faster, cheaper, and more effectively. Realign pricing and commercial structures to better capture value created with end consumers and between OEMs and suppliers.

Build more resilient supply chains to adapt to emerging risks and geopolitical uncertainty. Reconfigure demand- and supply-planning processes to drive greater accuracy and better evaluation of tradeoffs. Leverage data and AI to unlock efficiencies and evaluate, monitor, and react to risks in new ways. Institutionalize enterprise-wide scenario analysis, contingency planning, and crisis-resilience capabilities.

Embrace your supply-base relationships and forge targeted partnerships. Develop more robust longer-term demand and supply forecasts and increase transparency throughout the value chain. Balance the need to push for incremental cost efficiencies with maintaining long-term relationships and incentives for coinvestment. Explore new forms of strategic partnerships to create needed scale, secure new technologies, and ensure supply chain security.

Accelerate innovation and optimize for the current and future environments. Focus on what you stand for and how you will create sustained value with laser-like clarity. But don’t be afraid to challenge everything: shake up the status quo and ruthlessly reinvent for advantage. Break free from traditional talent models, ways of working, and cultural constraints to attract the talent needed to win in new mobility . Double down on efforts to redesign select components and systems to reduce the reliance on scarce resources.

The adversity is real, but so is the opportunity for automotive companies that aggressively tackle the near-term challenges—confronting the new realities and taking the strong steps needed to reduce costs and improve supply chain stability—while making the bold moves that are needed to reposition themselves for the future. These are Herculean tasks for sure, but those companies best able to navigate these turbulent times with purpose and decisiveness stand to come out stronger.

This article and slideshow have been published with a companion piece that examines the outlook for automotive semiconductors; crucially, our study disaggregates the market by chip type and manufacturing technology and offers steps for managing risks and securing supplies. To learn more, click here .