Learn more about where to integrate FWA into your broadband-at-home strategy and how to play in this area.

Historically, fixed wireless access (FWA) has been plagued by slow speeds and poor reliability, something that mobile network operators (MNOs) hope will finally change as more spectrum in higher-frequency bands opens up for 5G . But MNOs shouldn’t fall for the hype that it’s an easy route to near-term 5G revenue—or default to the old pessimism that FWA is a spotty, slow service. The truth is more nuanced.

There’s no question that FWA should be part of an MNO’s integrated broadband-at-home strategy and can play a significant role in many locations. But the economics of using FWA to bring internet access to houses and businesses are challenging, and telcos need a strategy to assess individual micro regions . First, they must determine if FWA is an attractive option today or whether fiber-to-the-home (FTTH), fiber-to-the-building (FTTB), or some other solution is better; and second, they must determine if FWA is a sustainable option or whether customers must eventually be migrated to a fixed infrastructure. When FWA is appropriate, there are five distinct plays that MNOs can pursue to capture value.

The Revival of FWA

In the past, telcos usually offered FWA by simply selling the residual capacity of existing 3G or 4G mobile networks. This led to a mixed reputation for FWA because operators sometimes underestimated FWA data consumption or sold the service to far too many FWA customers. In these cases, shared capacity with mobile users was not sufficient and service quality was poor.

Now, the performance and cost to deploy FWA depend primarily on three variables: spectrum band and available amount, customer premises equipment (CPE), and technology and network topology. There have been significant developments in all these areas.

Spectrum Band and Available Amount. In many European and Asian countries, MNOs still offer FWA using 4G on a lower mid-range spectrum (such as 1800 MHz, 2100 MHz, or 2300 MHz). But what has renewed interest and excitement about FWA in Europe and other regions is that it’s now possible to offer 5G FWA using 3 GHz (C-band) spectrum, which many countries have recently auctioned. When deployed on existing network grids, this spectrum significantly increases capacity and speed while offering decent coverage.

In other regions, particularly in the US, 5G FWA is also delivered using mmWave spectrum. This higher-frequency spectrum can theoretically bring enormous capacity and top speeds, and some significant technical improvements have been achieved. But adoption has been constrained because of existing technical challenges and higher costs (such as limited reach, near-line-of-sight requirements, and professional outdoor-antenna installation).

About 16% of operators worldwide currently deliver FWA over 5G. The Global Mobile Suppliers Association (GSA) reports that 516 operators in 171 countries offer FWA services, and 85 operators use 5G. That will increase as more spectrum in higher-frequency bands becomes available for mobile usage, which together with new antenna systems will improve capacity and speed.

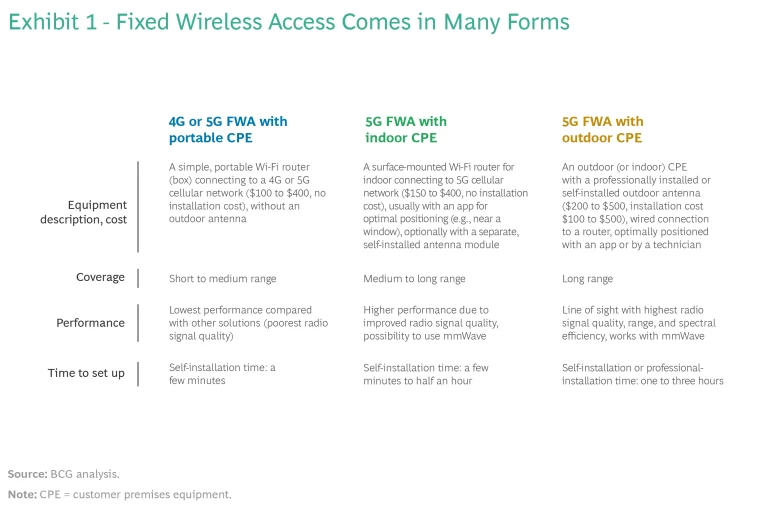

Customer Premises Equipment. Until recently, MNOs usually delivered FWA in one of two ways. The first option involved simple, portable CPE boxes, which can be placed anywhere and are easy to install. They don’t work well with higher-frequency bands, however, and deliver relatively low performance. The second approach was to provide FWA using CPEs with outdoor antennas. These work better with higher-frequency bands and deliver improved performance. But the antennas require significant space and professional installation, which makes them cumbersome and expensive.

Now, CPEs with optional self-installed indoor- or outdoor-antenna modules are available. (See Exhibit 1.) The equipment is surface mounted and typically supported by an app for optimal positioning (such as near a window), while an optional antenna module is easily connected using a flat cable. This convenience, along with falling prices, may substantially boost the attractiveness of FWA.

Technology and Network Topology. MNOs need to act quickly. Being the first to market is often an advantage, and MNOs are not competing just with other mobile-only MNOs, integrated MNOs, or fixed network operators. New FWA-focused attackers are building dedicated, fully optimized FWA networks.

Companies such as Starry, Eolo, Linkem, and Tarana are developing technology and rolling out purpose-built FWA networks, often using self-developed, proprietary protocols and exploiting unlicensed and/or licensed spectrum bands. This gives them an edge over MNOs, which usually piggyback on their multipurpose mobile network. The advantages of purpose-built networks include:

- Placing transceivers in the best locations. These transceivers can establish links to many static client antennas using multiple-input, multiple-output antennas with the ideal tilt, high-power output, and optimized beams for receiver positions.

- Allowing experts to install and find the ideal position for an outdoor antenna on the client’s premises.

- Custom designing hardware and software, and optimizing them end to end for static point-to-multipoint links (for example, no moving objects, no handovers with other cells, no new devices).

It’s still too early to tell how successful these new operators will be, but we expect them to create significant competitive pressure because they can have better economics compared with MNOs.

Designing a Broadband-at-Home Strategy

Today, FWA is most prevalent in countries where fixed-line infrastructure and fiber deployment (such as FTTH or FTTB) have been uneconomical, slow, or difficult. Fiber typically delivers the fastest, most reliable internet access, but for the business case to work, the average revenue per user (ARPU) and population density must be significant. That means that houses in large parts of the world won’t get connected with fiber anytime soon. Even in developed countries, the economics of fiber don’t pan out in all areas, creating an opportunity for FWA. Where fiber is not available, FWA is often the next-best option.

But FWA can’t simply be deployed anywhere fiber isn’t. FWA works in specific locations, such as suburban areas where cable is the main alternative, rural environments where no fixed broadband is available, suburban locales where FWA is used to bridge the last mile to homes, or neighborhoods with multistory buildings where it can be used to create dedicated point-to-point links. FWA might also be appropriate in locations where no other option is available (or will be in the foreseeable future), so customers will be willing to accept “a best-effort solution”—in other words, the operator does not promise any minimum quality of service, which means service interruptions are possible if there’s data congestion.

FWA is a valuable tool that MNOs can use for certain strategic plays.

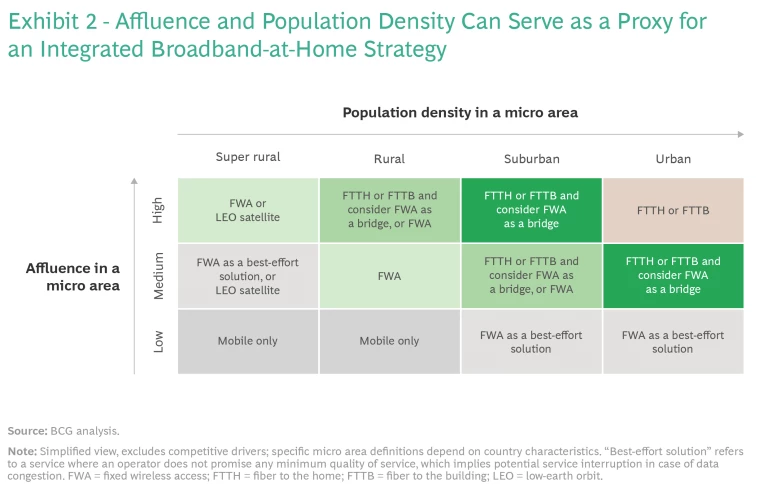

While FWA will not replace large-scale fiber rollouts, it is a valuable tool that MNOs can use for certain strategic plays and should be part of an integrated broadband-at-home strategy. In our experience, MNOs can get a rough approximation of how to prioritize their fiber versus FWA rollouts by examining locations, customer affluence and behavior, and competing infrastructures. (See Exhibit 2.) This high-level view also reveals if neither fiber nor FWA is appropriate and some third option might be a better fit. For example, very rural locations and areas with low affluence create challenging economics for both fiber and FWA.

When analyzing and designing an integrated broadband-at-home strategy, an MNO needs a nuanced view of its FWA deployment. To get this view, an operator should develop a detailed model of the mobile network and integrate it with a detailed model of the fixed network (and future developments). This modeling allows the operator to compare the business case for FWA and fiber in different locations.

The modeling requires many inputs, including a rich set of geospatial data (such as census numbers and commercial information), the cost of FWA, and spectrum options. Modeling must also consider capacity utilization implications on the mobile business given that fixed customers typically use 20 to 50 times more data. Another important factor is the infrastructure competition (meaning the available and planned fixed offerings) and hence the ability to win customers. Furthermore, MNOs need the processes in place to update their model assumptions and revisit decisions on a regular basis.

Developing this type of detailed model is not an easy lift, but it’s a prerequisite for designing a truly integrated broadband-at-home strategy and making smart decisions about the multibillion-dollar investments necessary to build out the networks over the next decade.

The Five FWA Plays

Ultimately, when FWA is appropriate, one of five plays could apply. Some involve simply piggybacking off an existing multipurpose mobile network, while others require specific FWA investments (see Exhibit 3):

- An MNO might offer FWA solutions temporarily by opportunistically exploiting spare capacity on the mobile network, without making significant network investments. In this play, MNOs are not committed to FWA users long term. If FWA traffic creates an overload and threatens the network’s performance, the MNO can react by, for example, prioritizing more profitable mobile traffic, throttling heavy FWA users, lowering video quality, or allowing FWA customers to churn. Because this play has reputational risk, however, an MNO needs be sure the move doesn’t hurt its strategic positioning overall. This approach is most relevant for mobile-only attackers.

- A second play is to attack copper or cable operators by offering FWA with superior speed. This is a move to win over FWA customers permanently. An MNO can execute this competitive maneuver quickly compared with the time it takes for the rival to roll out upgraded fixed lines. One medium-term risk is that the operator of copper or cable might upgrade its network or overbuild with fiber—a possibility that needs to be assessed on a case-by-case basis. This option is most relevant for mobile-only telcos and FWA-focused attackers.

- Alternatively, an MNO with plans for a fiber rollout could use FWA to land-grab customers quickly before competitors move in—and then transfer those customers to fiber once its slower fiber rollout is complete. In this scenario, FWA serves mainly a strategic role. The FWA business case is not long term and needn’t be profitable as a standalone service. This play is most relevant for integrated telcos.

- In another move, the MNO can use FWA to extend beyond its fiber footprint into outer regions surrounding fiber areas, such as suburban locations along streets into houses and businesses. This can be a long-term maneuver but depends on future actions by competitors. This play is also most relevant for integrated telcos.

- Finally, an MNO can leverage FWA to target convenience-seeking or price-sensitive customers. For a variety of reasons, some customers prefer FWA even when a fiber solution is available. They might value the convenience of being able to take it to their vacation home, or its shorter contract period or lower price, or its simpler installation and setup. Targeting these customers can be either a long-term or a short-term play but strongly depends on the preference of customers (and existing offers) in a specific market. This option is relevant for all players.

When it comes to FWA, MNOs shouldn’t expect a quick-fix revenue booster—but they should recognize that FWA offers new ways to play. FWA is not always the right solution, though it is often an important tool in the toolbox. Determining how and where to use FWA is not easy. It requires the right data, very detailed modeling, and the capabilities to pull it off. These are key to designing and implementing a robust broadband-at-home strategy and securing future success.