The metaverse is the next generation of the internet, potentially heralding a new virtual, interconnected reality, seamlessly woven into our physical world. This paper looks at how to unlock the promises of the metaverse in the MENAT region, focusing on UAE, Saudi Arabia, Turkey, and Egypt. After introducing metaverse definitions, broad opportunities, and risk considerations, it examines ten illustrative, regionally relevant use cases. These range from virtual collaboration to enhanced education to digital twinning. But what will it take to turn potential into reality? Key enablers – related to infrastructure, technology, user adoption, content, and economic environment – are discussed from general and country-specific perspectives. Finally, recognizing the key role that MENAT governments must play in advancing their countries‘ metaverse participation, the paper explores policy considerations and best practices for responsible deployment.

This paper looks at how to unlock the promises of the metaverse. This section introduces metaverse definitions, structure, promises and risk considerations. Chapter 1 presents an overview of possible use cases for the metaverse across individual and enterprise users, and examines illustrative, regionally relevant examples in greater detail. Chapter 2 discusses the key enablers required to implement these use cases and the metaverse more broadly. It introduces a framework of enablers, and reviews the readiness of our four focus countries to embrace the metaverse, identifying key strengths and gaps for each. Chapter 3 discusses the necessary policy considerations and best practices for responsible deployment.

What is the metaverse?

Enthusiasts see the metaverse as the next generation of the internet, building naturally on the evolution we have experienced so far. Web 1.0 (roughly 1991 – 2004) featured mainly static, read-only pages hosted on ISP-run web servers. Web 2.0 (2004 onwards) was essentially an enhanced version of web 1.0 with user-generated content including video, and web applications, connecting people hosted on cloud services. Web 3.0 (2010 onwards), known as the semantic web, creates, shares and connects content through search and analysis based on the ability to comprehend the meaning of words through AI, blockchain and decentralized protocols. Web 4.0 (current and emerging) is the metaverse – potentially a virtual, interconnected reality seamlessly woven into our physical world.

Yet it remains an emerging, fluid concept. Technology leaders offer different explanations and descriptions, recognizing that many different forms of metaverse may arise into existence. Meta Platforms, formerly Facebook Inc., defines the metaverse as “a set of virtual spaces where you can create and explore with other people who aren’t in the same physical space as you.” The company’s founder, CEO and Chairman Mark Zuckerberg envisions “an embodied internet, where instead of just viewing content — you are in it and feel present with other people as if you were in other places”. Huateng Ma, founder and CEO of Asian internet and technology giant Tencent describes the metaverse as “a virtual world that connects to the world that we live in and shared by many people with a real economy and real avatar that belongs to and is the user”.

Despite the metaverse’s current nascent state, these comments highlight some common themes. The metaverse can be understood as a mix of virtual and physical-life, enhancing (not replacing) experiences in the physical world. Its most significant distinction from today’s internet is the feeling of real presence. Even if today’s technology only gives us a glimpse of what it could become, the applications of early metaverse platforms are moving beyond gaming experience, expanding rapidly into other high-impact sectors like healthcare, education, and tourism. Looking forward, the metaverse might eventually be interoperable in terms of both software and hardware, with aligned platforms, networks, and technical protocols and standards allowing the various technologies (in phones, AR glasses, VR headsets, etc.) to interact.

We see a set of emergent properties or capabilities achieved through different technology combinations characterizing the metaverse:

- Spatial immersion: reproduces a sense of presence within the digital space, whether through simple 3D-digital avatars or today’s more sophisticated VR or AR technology

- Collective shared space: the virtual universe is shared among users becoming increasingly more synchronous as connectivity and computing capabilities increase

- Synchronous live reality: metaverses can make virtual reality more persistent like in the real world, maintaining our actions and assets and evolving the metaverse in real-time even when we are not connected

- Inter-connected space: metaverses can have different degrees of space inter-connection, including to the physical world (e.g., through AR, IoT) or to different metaverses (e.g., through standards)

More concretely,

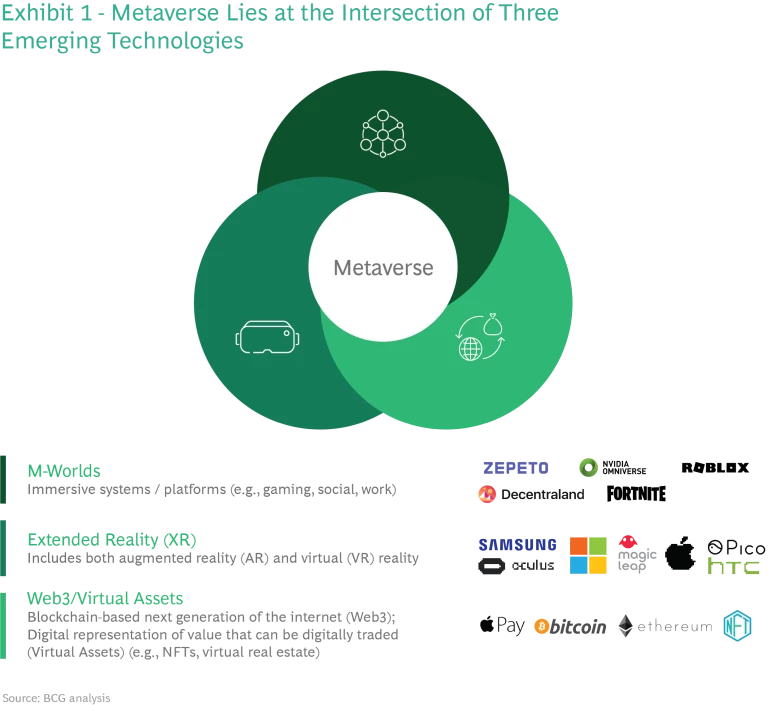

the metaverse lies at the intersection of three emerging technologies

(Exhibit 1). The first is M-Worlds, which refers to immersive systems or platforms used for purposes including gaming, social interaction, and work.

The second is Extended Reality (XR), which encompasses both augmented reality (AR) and virtual reality (VR). However, while these emerging technologies and devices are being developed, we can already experience glimmers of the metaverse today in two-dimensional worlds. Being able to move seamlessly between different spaces is part of what makes online games like Roblox or chat apps like Discord so popular. There is already so much creative world-building that happens in experiences like Minecraft, and Fortnite, as well as Meta’s Crayta. VR is becoming more mainstream where the sense of presence and immersion is driving real growth, especially for social experiences like VR Chat, Beat Saber, Meta Horizon Workrooms or fitness apps like Supernatural. And AR is already making many 2D apps better. More than 700 million people are using AR across existing Meta apps and devices - blending digital overlays onto the physical world in apps like Instagram and Messenger for things like filters and virtual try-ons.

The third is a digital economy, powered by creators, businesses and consumers being able to access virtual assets. This economy could be powered by a blockchain- based next generation of the internet (Web3) and digital representations of value that can be digitally traded like NFTs and virtual real estate.

How is the metaverse structured?

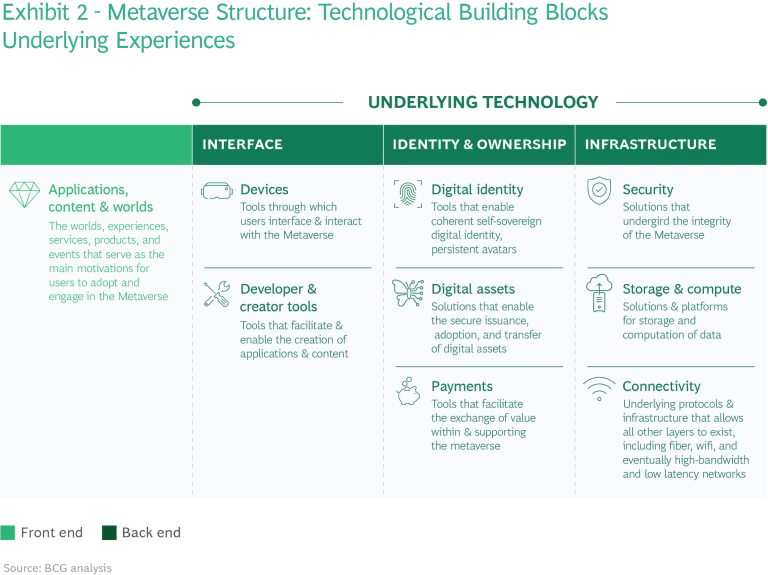

We are starting to see a clear structure for the metaverse (Exhibit 2). The core products and experiences – including applications, content, worlds, services, products, and events that users see and interact with – can be thought of as the front end. Supporting this front end is a suite of technological building blocks. These can be grouped into three broad categories: interface; identity and ownership; and infrastructure:

Interface

- Devices – tools through which users interface and interact with the metaverse

- Developer and creator tools – tools that facilitate and enable the creation of applications and content

Identity and ownership

- Digital identity – tools that enable coherent self- sovereign digital identity; persistent avatars

- Digital assets – solutions that enable the secure issuance, adoption, and transfer of digital assets

- Payments – tools that facilitate the exchange of value within and supporting the metaverse

Infrastructure

- Security – solutions that undergird the integrity of the metaverse

- Storage and computing – solutions and platforms for storage and computation of data

- Connectivity – underlying protocols and infrastructure that allow all other layers to exist, including fiber, wifi, and eventually high-bandwidth and low latency networks

Promises and considerations

Business leaders, technologists and investors foresee enormous economic potential in the metaverse. As with many aspects of the metaverse, precise figures vary widely depending on the source. BCG estimates a metaverse market opportunity of $250 billion to $400 billion by 2025. Most of this will be in the virtual-asset economy, predicted to rise from $90 billion in 2021 to $150-$300 billion in 2025, with VR/AR/MR ($47 billion), cloud ($28 billion), and network ($19 billion) related products and services comprising the rest of the market2.

Beyond revenue upside, the metaverse promises a range of exciting benefits for all types of users as well as the technology companies supporting the back end. Reasons to embrace the metaverse include:

- Expanded access to services, information, and career potential, including in remote areas and especially for people with disabilities, those with lower income, women, and other traditionally marginalized groups

- Elimination of distance as a barrier, as presence will decouple from physical location (and resulting sustainability benefits from reduced need for travel)

- Increased convenience and opportunity to participate physically or virtually in many services and experiences

- Expanded potential for learning and training in risk-free environment (e.g., mining, firefighting, surgery), also for self-expression and exploration

- New business models, especially related to services and creative sectors, along with new jobs in knowledge and technology

- Ability to coordinate collective action and gather inputs across larger groups and geographies

- Greater opportunities for personalization of products, services, and experiences

- Potential to accelerate innovation and adoption of new technologies

However, it also brings a number of considerations that must be proactively and collaboratively addressed through responsible regulation and policy. Specific considerations include:

- Privacy of personal data and potential for misuse

- Cybersecurity and cybercrime including virtual identity theft, deepfakes, and data breaches/attacks

- Magnified impact of cyber harassment and bullying in AR/VR

- Possibility for misrepresentation via avatars, leading to loss of trust between people in virtual and real-world settings

- Mental health implications, including addiction and/or engagement in the metaverse at the expense of reality

- Conflicting regulations and/or lack of clarity on regulatory roles

- Clarity about property right and various jurisdiction, e.g., of digital representations

- Potential widening of gaps in equity and inclusion if broad access and participation is not established early

- Revenue substitution away from some sectors and elimination of some jobs, especially in service

- Sustainability impacts related to high energy usage of data centers and computing infrastructure

The metaverse represents a rich source of opportunity for Dubai, placing us at the cutting edge of important, fast-changing digital technologies, and creating business prospects far beyond our physical borders. We embrace this new reality with an open mind, in the spirit of curiosity, entrepreneurship, and innovation.

– His Excellency Omar bin Sultan Al Olama, Minister of State for Artificial Intelligence, Digital Economy, and Teleworking Applications and Chairman of The Dubai Chamber of Digital Economy

Opportunities

Metaverse opportunities highlighted in this chapter are ones we judged most relevant to the MENAT region. As noted previously, we focus on four major, technologically advanced markets: UAE, Saudi Arabia, Turkey, and Egypt.

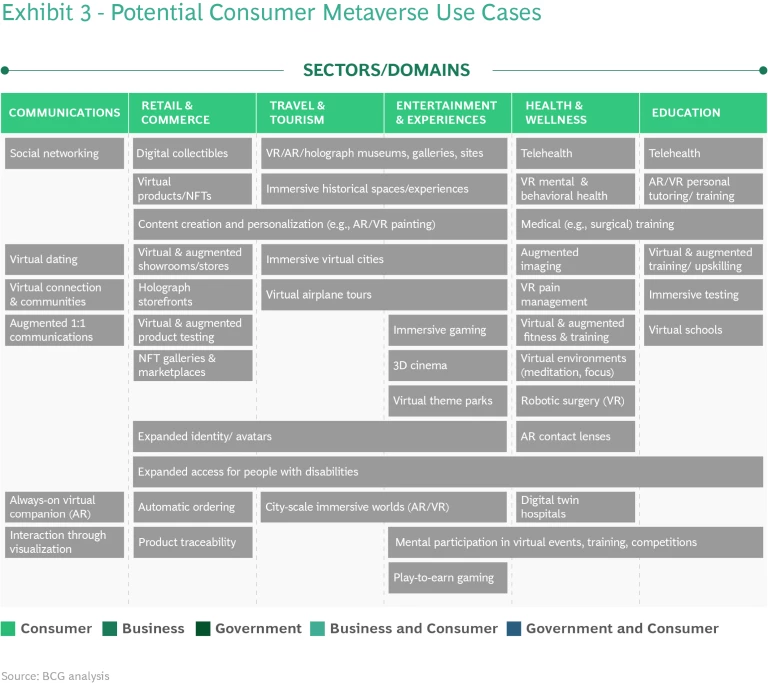

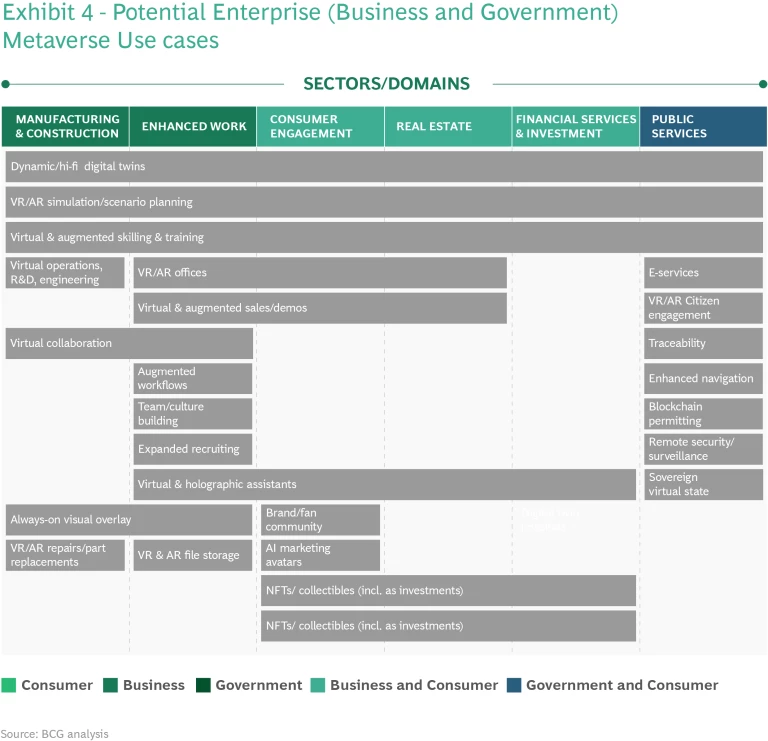

Selection Process: We first created and mapped a long list of possible use cases, based on what we know today, spanning consumer, business, and government sectors (Exhibits 3 and 4). We then identified key sectors based on market size, growth potential, and government focus in our target countries and MENAT more generally. This analysis focused on key countries’ dominant economic sectors and growth forecasts, as well as their governments’ stated national plans and investments. Finally, we assessed use cases’ disruptive potential and social impact.

The resulting short list highlights the 10 most regionally relevant use cases for more detailed examination.

These are: virtual collaboration, digital skilling/training; enhanced education, telehealth; digital twins; augmented tourism; live augmented events; gaming; virtual and augmented shopping, and virtual assets. Each use case featured here includes an in-depth look at its potential benefits and risk considerations, and offers current examples of its adoption. Because most of our focus countries intend to be metaverse leaders, not just adopters, prioritized use cases take a broad perspective with global as well as regional examples.

Virtual collaboration

Virtual tools can expand and augment employee collaboration across distance, complementing physical office spaces.

Businesses will enjoy greater productivity and efficiency from closer remote collaboration, as well as cost, time, and CO2 emissions savings from reduced business travel. They also benefit from a wider and deeper talent pool, removing geography as a barrier to hiring, and facilitating access to top talent all over the world. Increasing flexibility with respect to their location means expanded career potential for workers in remote locations or those traditionally marginalized in the labor force. It also increases employee satisfaction, by shortening or eliminating commutes, and giving people more control over where they live and when and how they work. Considerations include high bandwidth connectivity, the right devices, and digital literacy. Because all are necessary prerequisites for effective and equitable deployment, they hold the potential to widen access gaps in short term. Companies must recognize the risk of cyberbullying and harassment in virtual worlds, and be prepared to take decisive action when it occurs. Substitution of online for in-person collaboration can limit the development of essential working relationships and “soft” management skills. Businesses may face resistance to online work, related to employees’ age demographics, functional specialties, or geographic location. Finally, concerns about personal and institutional data security, individual privacy, and cybercrime need to be understood and managed.

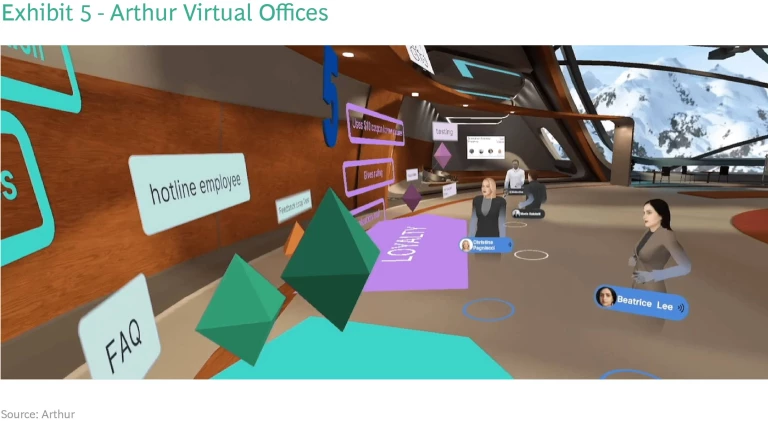

Arthur (USA) is a company that provides virtual office spaces and services for its business clients. Its VR offices allow employees to meet, collaborate, and manage work online through their Arthur app and VR headset / laptop (Exhibit 5). Virtual office can be utilized in the same way as physical ones, with 3D flowcharting and billboards, 3D “audio zones,” and 3D interaction through professional avatars. Embedded productivity tools include whiteboards, personal notes, and speech to text options. Arthur’s VR meetings are designed to feel closer to in-person than existing video conferencing tools and platforms.

Digital skilling / training

Digital skilling and training can improve employee performance in current jobs and equip talent with skills needed for future careers.

The metaverse can help unlock a compelling range of benefits, offering expanded access to skills and jobs/ economic participation, especially for marginalized groups, and reducing skill and income gaps. It offers the potential for deeper learning and improved results through realistic simulations, and customized learning paths based on specific individual needs. Digital skilling is substantially more scalable and cost effective than in-person – for example, VR training can more than halve L&D costs, especially at scale. It also improves timeliness and consistency: all individuals can receive the same training, which can be quickly and simultaneously adapted when company or government policies change.

Responsibly deploying metaverse-enabled skilling or training, however, comes with important considerations. The high cost of connectivity and devices in the short term has the potential to widen access gaps, especially in developing countries. Concerns about personal data security, privacy, and cybercrime must be addressed. Digital literacy is required to access virtual learning opportunities, and limited group interaction cannot fully replace face-to-face practices. For these and other reasons, some individuals and enterprises may bring a strong cultural resistance to online training. Educators and institutions face challenges in monitoring/tracking attendance and performance, which in turn undermine the widespread recognition of e-learning certificates.

And the emerging state of digital skilling and training brings conflicting regulations and a lack of clarity around regulatory roles.

However, despite these considerations, many organizations have embraced digital training. For example, Takeleap’s (UAE) immersive VR simulations enable medical students to refine their skills in a no-risk environment by practicing procedures on virtual patients, deepening their understanding of human anatomy (Exhibit 6). Meta has partnered with the Children’s Hospital of LA to build a VR simulation that places medical students and staff in rare, high-risk pediatric trauma situations where split-second decisions determine whether a patient lives or dies. Boeing (USA) has also used AR to improve training efficiency for engineers. They use detailed 3D models of airplane bodies, enhanced with text pop ups and voice-overs to work through modules. The company expects to reduce training time by 75% as a result.

Virtual reality is a cost-effective, low-risk way to train people in industries like healthcare, retail, manufacturing and the military, where large-scale training demands extensive time, resources, and coordination. VR simulation training is used by astronauts, healthcare workers and pilots to prepare for high-stakes, low frequency, events using simulations. In VR, mistakes can be made without real-world consequences, preparing professionals to act quickly in an emergency, whether it be in flight, in outer space, or in the ER.

Enhanced education

The metaverse holds the potential to close digital divides by expanding access to high-quality education, particularly for students in the developing world, rural areas and/or with lower incomes.

Perhaps its greatest potential benefit is the expanded access to quality education at a lower cost, especially in rural areas. But it also promises personalization and adaptation of content and instruction to students’ individual needs, including physical and cognitive limitations. The virtual format allows users to connect with other students around the world. Improved learning outcomes are expected to lead to higher incomes, while the acquisition of digital skills is increasingly required for many jobs. Like healthcare, discussed below, education is a fundamental social good, requiring careful consideration of several key factors.

The effectiveness of metaverse-enhanced education is dependent on high bandwidth connectivity, which must be expanded globally to ensure equitable access. Likewise, the requirement for digital literacy and high cost of devices (e.g., expensive VR headsets) have the potential to widen access gaps in the short term. Virtual education also attracts a number of social concerns, from limiting students’ opportunitiesfor socialization and “soft” skill development to the risk of cyberbullying and harassment in virtual worlds. Potential cultural resistance and low in-class retention may also lead to lower rates of learning. Students may also suffer from the lack of local geographic ownership and inclusion in their surroundings. As with other use cases, concerns about personal data security, privacy, and cybercrime must also be addressed.

Nevertheless, education providers are already using the metaverse to enhance the classes they offer. In Labster Virtual Labs (Denmark), for example, students complete lab experiments in a gamified 3D virtual environment, using software that provides feedback on areas for further development. The program enables students to learn lab skills in XR simulations when schools may lack the resources or budget for equipment and materials. In the Office of Vocational Training and Labor Promotion (OFPPT) metaverse hub (Morocco), educators offer “hands-on” training to students with fewer logistical restrictions. Lifelike 3D models and immersive virtual environments allow instructors to create stimulating and interactive lessons and experiences for those at

OFPPT sites as well as those studying remotely. In Turkey, Halic university has already hosted a course in the metaverse, and students reported positive experiences.

Telehealth

The metaverse and extended reality hold great potential to expand access to and enhance healthcare services. This includes the possibility of international experts virtually joining in-person appointments with local providers, as well as fully-virtual consultations and treatments for selected conditions.

The potential benefits of providing selected metaverse- enabled healthcare services which used to require physical visits are many and varied. Patients – including those with limited ability to physically travel for care – would enjoy broader access to specialized care providers and technologies, regardless of geography. They may also experience improved care based on enhanced data from virtual visits. Virtual appointments would afford greater convenience and efficiency for both patients and providers. In many cases, this format could also lower the cost of care, further increasing access. Finally, eliminating some visits to physical healthcare facilities would decrease their occupancy, potentially reducing illness risks and cost.

However, there are several considerations to address in order to realize the benefits of metaverse-enhanced telehealth. Personal and health data must be kept private and secure. Healthcare and insurance policies will need to be updated to reflect the absence of geographic boundaries. Healthcare providers must plan for and guard against potential service disruptions due to technical outages or cyberattacks. With the substitution of virtual interaction for in-person care comes a risk of misdiagnoses. And the initial high cost of establishing virtual capabilities has the potential to widen access gaps in the short term.

A pioneer in metaverse-enabled telehealth is UK-based Latus Health. It is currently developing the world’s first VR hospital and wellness center, which will be accessed via headset. Said CEO Jack Latus, “our metaverse healthcare strategy could allow us to go from helping one million people per year to one million people per day.” Treatments will initially focus on counseling and physiotherapy, with the latter employing computer vision cameras to investigate the range of motion in damaged joints and the progress that patients are making towards recovery. Medical records will be stored using blockchain technology.

Digital twins

Digital twins – identical digital replicas of construction projects or other large-scale assets – will increasingly be built before their physical counterparts. Such digital twins enable simulations and tests which reduce costs and errors in cities, real estate megaprojects, and individual buildings, during construction and on an ongoing basis. More broadly, such twinning will ultimately allow us to develop any physical thing the way we develop software: first creating a digital original, interacting with it, market testing it and then building a physical twin of the iterated version.

The greatest benefit of metaverse-enabled digital twinning is the efficiency gained through optimization in 3D simulations, resulting in cost reductions and shorter project timelines. Digital twins improve planning as well as crisis management by including many data points and sources in their virtual and 3D models/simulations. Virtual tests and modeling reduce errors and improve safety during physical construction. The virtual environment provides much greater flexibility, making it easy for organizations to customize and adapt plans, incorporating feedback from users, residents, clients, and other stakeholders through engagement in virtual simulations during the planning process. This leads to greater community engagement in digital before physical projects are built, and faster diffusion and scaling of innovation.

Alongside their significant benefits, digital twins bring their share of considerations. The high cost of connectivity and devices in the short term may widen access gaps, especially in developing countries. Concerns about data security, privacy, and cybercrime are magnified with the scale and strategic importance of the underlying projects. Users may need to consider the sustainability impacts of simulations’ high energy consumption. From a broader economic perspective, the efficiencies granted by digital twinning carry the risk of potential job loss in planning and construction. And the shifting in timing and location of key tests may give rise to conflicting regulations or loss of clarity around regulatory roles.

Saudi Arabia’s NEOM announced earlier this year that it is creating a 3D digital twin metaverse platform, built in advance of the physical NEOM city. Core features include live “cognitive” virtual versions of real-world spaces, avatars enabling simultaneous presence in physical and digital worlds, matching of user profiles to foster interaction, gamified experiences, instant language translation, and built-in crypto and NFT digital asset platforms. Another example is UAE-based Bee’ah headquarters. The digital twin at HQ is a virtual replica of the physical structure and systems, tracking parameters and data in real-time.

AI technologies run simulations, studying the building’s occupancy rate, temperature, and light preferences. AI proposes solutions or implements actions that will help realize ultra-efficient energy consumption.

In December 2021, VictoryXR and Meta Immersive Learning announced efforts to launch digital twin campuses, replicas of existing campuses constructed in fully spatial 3D, at colleges and universities in the United States. This includes the construction of digital twin campuses where students can move about, socialize, learn and compete in activities, as well as live classes that students can access remotely. Victory XR worked with Morehouse College to launch the first digital twin “metaversity” in the spring of 2021 as a way to improve remote learning during the pandemic. Nine additional metaversities are expected by the end of 2022. This example highlights the potential for synergies across metaverse applications, in this case enhanced education and digital twinning.

Augmented tourism

Augmented tourism can enhance in-person experiences, help to overcome physical disabilities, and draw more visitors with the attractions of mixed reality – both in virtual and real-life.

Among its many benefits, metaverse-enabled augmented tourism can enhance and deepen in-person tourism experiences, including through realistic simulations, overlaying additional information, or enabling travelers to share their experiences across distance. These technologies also offer greater opportunity to personalize experiences. They increase access through lower cost, and more convenience for people with disabilities. Destinations will enjoy increased revenue from “add-on” augmented experiences and digital souvenirs, as well as expanded demand for in-person tourism, growing markets for local businesses, and job creation.

There is, however, a risk of revenue substitution from in-person visits to virtual, and the possibility that virtual features will draw attention away from the in-person travel experience. Additionally, augmented tourism presents similar considerations to other metaverse-driven use cases. The high cost of connectivity and devices in short term may widen access gaps, especially in developing countries. Destinations must address concerns about personal data security, privacy, and cybercrime. And the changing mix of real-life and virtual offerings may give rise to conflicting regulations or lack of clarity on regulatory roles.

The historic Saudi Arabian city of AlUla is already offering virtual, AR and VR tourist experiences, including a 15-minute VR journey accessed with specialized VR “pods”, 3D tours on the website accessible via desktop, and an AR experience using Snapchat with a Portal Lens that transports users into an augmented world using their smartphones. In another example, Qatar Airways has partnered with Unreal Engine to create the ‘QVerse’ VR flight simulation and discovery experience, featuring the world’s first MetaHuman Cabin Crew´ (Exhibit 7).

Live augmented events

Live augmented events bring immersive, real-time connectivity between physical and virtual worlds, deepening visitor engagement.

The greatest benefit of this metaverse application is the ability to accommodate far larger audiences than physical events, as technology reduces geographic, cost, and health barriers to event attendance. The more immersive, realistic, and social experiences compared to traditional audio/video help bridge the gap between virtual and in- person attendance. Participants benefit from cost, time, and CO2 emission savings from reduced travel. Organizers, promoters, artists, exhibitors, and speakers can enjoy revenue potential from add-ons to in-person events,

as well as increased awareness and demand for live visits after virtual events. Participants can meet virtually before or during events, fostering community building and deepening the event experience.

There are, however, several considerations that come with such live augmented events. These include potential substitution away from in-person events, lowering revenues, the risk of virtual harassment like physical threats and stalking, and sustainability concerns stemming from high energy consumption at gaming and similar events. As with other metaverse use cases, the high cost of connectivity and devices in the short term may widen access gaps, especially in developing countries.

One recent example of a live augmented event was the Expo Dubai Xplorer. This digital twin of the Dubai Expo site enabled real-time connectivity between on-site and virtual visitors, with interactive 360º video tours of the physical pavilions. Digital World Viewer smart screens across the physical Expo site acted as portals for visitors between the two worlds. Also earlier this year, Decentraland (Argentina) organized the first ever Metaverse Fashion Week, where brands staged shows, opened virtual stores and pop-up shops, hosted after parties, and offered other immersive experiences. Visitors could purchase NFT-based digital wearable products to personalize their avatars as well as order physical products.

Gaming

The metaverse is making gaming experiences more immersive, realistic, and social, with a more fully adapted sense of place.

These developments promote community building among gamers from around the world, increasing a sense of belonging and further enabling games to reduce stress and create enjoyment. Avatars expand gamers’ ability to express themselves through their online identities. Generally, countries will enjoy GDP contribution and diversification from a large and growing gaming sector, while individuals engaged in play-to-earn gaming may increase their earning potential. More specific to the metaverse, innovations in gaming often spill over into other sectors and uses.

A key consideration is that, as gaming becomes more compelling and immersive, health concerns including anxiety, depression, obesity, sleep disorders, stress, risk of addiction, and disconnection from reality all increase. Gamers will participate in increasingly emotional experiences with less regulation and control than in real life, and the risks of virtual harassment, data security and privacy breaches, and cybercrime all rise. From an economic perspective, there is a risk of revenue substitution from in-person activities to gaming, and the high cost of connectivity and devices has the potential to widen access gaps in the short term, especially in developing countries. Gaming’s high energy consumption also brings sustainability concerns.

The Sandbox (Hong Kong), a community-driven platform where creators monetize gaming experiences on the blockchain, is embracing metaverse-driven capabilities. Their Metaverse is made up of LANDS, owned by players to create and monetize experiences used to host games, build multiplayer experiences, create housing, etc. Participants can directly create content such as games, avatars, and items (Voxel NFT), make SAND (utility token) transactions, and purchase assets from other games. Created works can be transferred between platforms.

In June ‘22, Meta launched Crayta on Facebook Gaming at fb.gg/crayta. Crayta is a free-to-play creation platform made up of thousands of user-generated games and virtual worlds. The product is created and maintained by Unit 2 Games, a UK-based development studio that joined Meta in 2021. Crayta marks the first time a user-generated world building product is available on Facebook. It highlights work underway to bridge today’s 2D experiences with the immersive, 3D, deeply interactive experiences of the metaverse.

Virtual and augmented shopping

The metaverse will deepen engagement throughout consumer journeys, including virtually viewing, testing, and purchasing products.

As well as increasing revenues, deeper consumer engagement from enhanced and/or gamified experiences strengthens brand building, increases loyalty, and unlocks marketing potential unlimited by geography. Technologies enable the personalization of consumer experiences and customized products (e.g., digital wearables and physical items), enhancing users’ potential for self-expression. Shoppers enjoy the convenience of browsing and testing products virtually, less time to and in stores, and more reliable availability of the products they desire. At the same time, these features expand companies’ market reach and offer potential cost savings if fewer physical stores are needed. They may also generate sustainability benefits by reducing returns and re-orders.

Consumer and enterprise data security and privacy are key considerations. Companies must also plan for and mitigate potential service disruptions due to technology or power outages, and their accompanying revenue risk. Success of virtual and augmented shopping may be limited by the high costs of quality devices, modeling, and connectivity, at least in the short term. From a broader perspective, metaverse-enabled shopping may cause store closures and job loss, as well as sustainability issues related to high energy consumption and the expanded use of shipping.

Dior’s virtual showroom (France) currently invites shoppers to virtually wander the store and explore product offerings, learn more about products before making purchases, and order products directly in the virtual environment (Exhibit 8). Clicking on arrows allows viewers to see video clips about items, placing them in specific environments. UAE’s INFINITI dealer hosted a mixed-reality ‘test drive’ at Sahara Centre in Sharjah. Using Magic Leap glasses, shoppers could experience features of the INFINITI XQ80 with digital interventions such as product information overlaid on the display car and an opportunity to experience INFINITI’s Drive Assist technology as if they were behind the wheel. And Turkish textile manufacturers are already engaging with foreign buyers via metaverse platforms, using VR showrooms and 3D simulated fabric samples. While not yet available to consumers, that is the logical next step.

Virtual assets

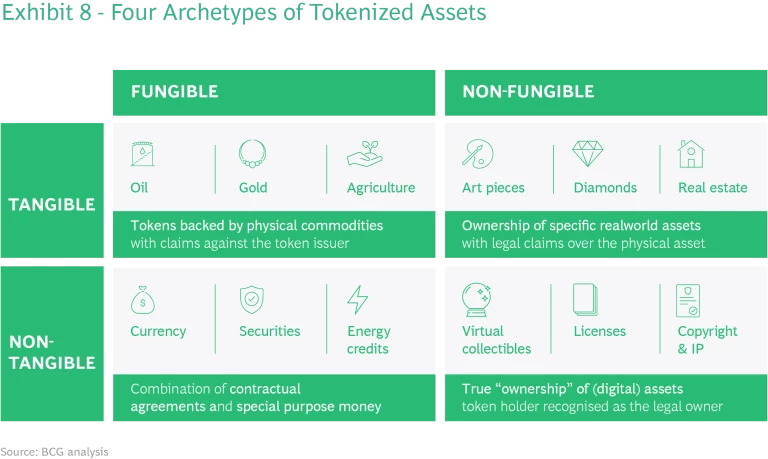

Digital assets, including non-fungible tokens (NFTs), can be independent digital objects or virtual replicas of physical objects, and either unique or interchangeable (Exhibit 8). Accessible, blockchain-based data records confirm assets’ authenticity and the attribution of creation and ownership. While we are presenting virtual assets here as a distinct use case, they critically boost several of the other use cases described above like live augmented events, gaming, and virtual and augmented shopping.

Virtual assets may be prized for their uniqueness, innovation, or limited availability. They offer creators and users a novel means of self-expression. Virtual assets provide a revenue upside for content creators through expanded markets for their work, unconstrained by geography, and royalties from secondary sales. They also hold potential for value growth: NFTs will become more valuable if they are usable across different games, metaverses, and blockchains.

However, there remains considerable economic uncertainty around virtual asset markets and valuations. The regulatory landscape is fragmented, often conflicting or unclear, impeding the worldwide acceptance of these assets. They raise concerns about personal data security and privacy, cybercrime, and asset theft. Sustainability is also an issue, as the computing power needed to operate blockchain consumes a great quantity of energy.

Dubai-based real estate agency USH has announced plans to sell metaverse mansions as NFTs, with or without purchase of their physical twins. The initiative will allow customers to explore the residences in AR and interact with their digital neighbors. Lenders have also started offering mortgages for the purchase of such virtual properties. In Turkey, Türkiye İş Bankası recently prepared an NFT exhibition with a selection of works from the bank’s painting collection depicting “A Sail Along the Bosphorus”, hosted on the Decentraland metaverse platform. NFT invitations were specially produced for the preview, limited to a thousand pieces which quickly ran out.

From the use cases described above, it is clear that Gaming, Entertainment, Luxury and Virtual Real Estate sectors are enjoying early benefits from the metaverse. The gaming sector is the widely seen as at the leading edge of metaverse adoption, engagement, and innovation. It is already offering immersive, interactive virtual experiences and worlds. Live events, from concerts to sports games to fitness classes, are also attracting widespread interest in the metaverse. Travis Scott’s 2020 concert in Fortnite, for example, had >12 million attendees.

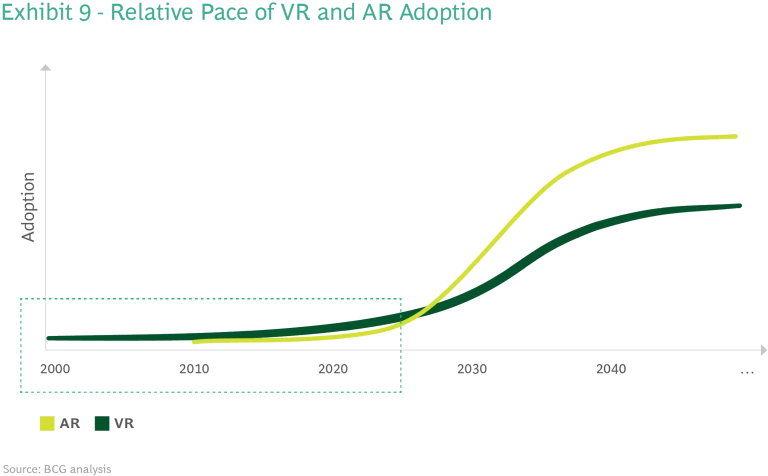

A range of well-known luxury retail brands already sell branded avatar skins and NFTs, have opened virtual stores, and host virtual fashion shows on early metaverse platforms. Meanwhile, individuals and businesses are actively purchasing virtual assets, including NFTs and real estate (land and property) for investment as well as virtual engagement. We expect VR to exceed AR adoption in the short term while technology continues to advance, then AR to take off (Exhibit 9).

Enablers

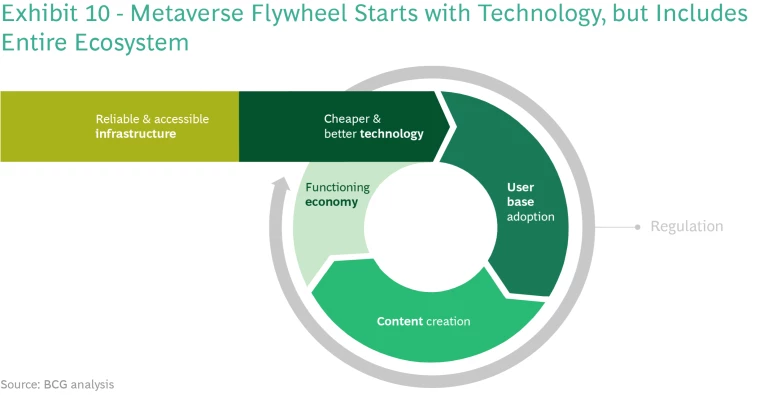

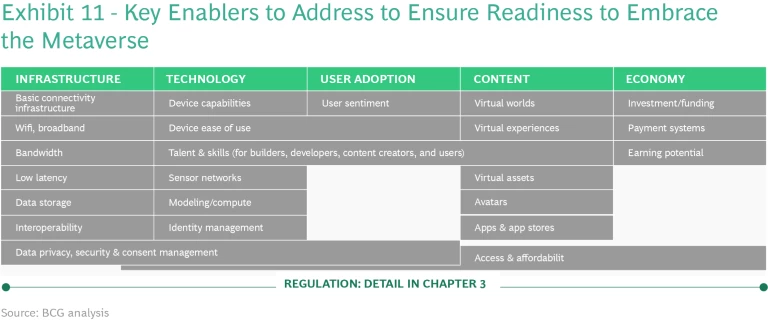

Several types of enabler must be in place for the metaverse to develop and function. We envision these operating as a flywheel, each one building on the previous and generating momentum that advances the entire system. Technology is critical, but is just one piece of this broader ecosystem required to unlock the metaverse. We have organized the enablers into categories or pillars: reliable and accessible infrastructure, cheaper and better technology, user base adoption, content creation, a functioning economy, and – foundational to it all – regulation (Figures 10 and 11). Note that Figure 10 also shows a “sub-flywheel” between content and user base adoption, with each one requiring and reinforcing the other. For example, users join a platform to engage in content, while content is only created if and when there is a user base to engage with it.

As the figure demonstrates, several key enablers – such as access and affordability, and talent and skills – span multiple pillars of the framework, emphasizing the interconnected nature of the ecosystem.

Assessment of country readiness

Countries have varying levels of readiness to embrace the metaverse across these enablers, which will affect the pace and success of adoption. These differences mean that the weighting or focus on specific enablers will also vary. For example, building a vibrant virtual content landscape will necessarily be a lower priority where people lack access to the connectivity infrastructure at the first step of the metaverse flywheel.

In the sections that follow, we look at some indicators to understand where UAE, Saudi Arabia, Turkey and Egypt are standing in terms of the five metaverse enabler pillars, identifying key strengths and gaps.

The United Arab Emirates (UAE):

The UAE is a leader in readiness for metaverse adoption across all key enablers, with some gaps to address, particularly cost of connectivity.

Infrastructure. The key infrastructure is in place to sup- port UAE’s metaverse adoption. An estimated 100% of individuals use the internet, and 100% of the population is covered by at least a 4G mobile network. In fact, UAE shows on average more than two active mobile broadband subscriptions per inhabitant. The country ranks first (among 130 countries assessed) both in household and school internet access (1), and boasts the world’s highest speed mobile internet (2). However, cost remains a barrier, as internet connectivity cost is high.

Technology. The UAE shows excellent readiness across key technology metrics. Its 84% smartphone subscription rate is the highest in region and amongst the highest globally, with on average 1.5 smartphones installed per person. The country has the highest sales of AR/VR headsets in the region, which are further expected to nearly double from 2020 to 2025. And it ranks 8th globally in cybersecurity.

User adoption. We see multiple indications of high consumer readiness for the metaverse. Eighty-five percent of UAE’s population has basic ICT skills, the highest in region (3, 4). Two-thirds of the population is under 40 and over half are aged 24-39, signaling a large potential user base. The country is ranked 1st globally in social network usage. Its 106% social media penetration rate is the highest in the region (5, 1) and YouTube penetration is 87% (7). UAE residents spend an average of 8.6 hours/day on the internet, also the highest in region. The UAE ranks 30th in Trust, which is high for the region (6). However, with 44% of small and medium-sized enterprises (SMEs) reporting no digital presence, it is clear that some gaps remain, particularly for enterprise metaverse users (8).

Content. Content creation is another area of high potential for the UAE. It is in the top quartile of all countries for mobile apps developed per capita, and 17% of the population has advanced ICT skills – ranking highest in region on both of these measures (9). Dubai’s Golden Visa program and Abu Dhabi’s Creative Visa attract creators to these cities. The country has a large and growing gaming sector, half the size of Turkey’s and on par with that of Saudi Arabia despite its much smaller population. NFT ownership in Dubai is approximately twice the global rate (10).

Economy. The economy of the UAE is well suited to the metaverse, with a few gaps. It boasts a strong technology investment landscape, with Dubai and Abu Dhabi emerging as hubs for metaverse investing and entrepreneurship. In 2021, Dubai was ranked 1st in MENA and 2nd globally for attracting foreign investment into its creative economy. The country, and especially Dubai – where the recently published Virtual Asset Regulation requires a permit for various virtual asset services – is positioned to become a crypto hub. Today, ~30% of the population already owns cryptocurrency.

Saudi Arabia:

Saudi Arabia shows high readiness for metaverse adoption across key enablers, although some gaps remain in SME readiness, ICT talent and cryptocurrency.

Infrastructure. Saudi Arabia possesses the key infrastructure needed for the metaverse, with 98% of individuals using the internet, 98% of the population covered by at least a 4G mobile network, and an average of 1.2 active mobile broadband subscriptions per inhabitant. It ranks 1st of 130 countries for school internet access, 4th for home internet access (1), and 5th worldwide for median mobile internet connection speed (2).

Technology. Saudi Arabia enjoys high readiness across key technological metrics, including 74% smartphone subscription – high for the region, and higher than the USA – and an average of 0.77 smartphones installed per person, which is in line with the regional average. The country is a leader in AR/VR headset sales and growth, with sales expected to double by 2025. It ranks 2nd (of 130 countries) in cybersecurity.

User adoption. Indications point to high consumer readiness for the metaverse: 60% of adults are familiar with the concept (3) and 78% of the population has basic ICT skills, which is high for region (4, 5). Saudi Arabia has 82% social media penetration, and 90% of the population uses Youtube (7). Residents spend on average 8.1 hours/ day on the internet. With 66% of the population under 40, there is a large potential user base for metaverse adoption. Saudi Arabia ranks 47th in Trust, which is average for the region (6). However, as in the UAE, some gaps persist for SMEs: 36% have no digital presence (8).

Content. Saudi Arabia’s content creation ecosystem is developing, with multiple key factors in place but some gaps to close. Fourteen percent of the population has advanced ICT skills, among the highest in the region, indicating a large base of potential content developers, but 60% of ICT companies say recruiting talent remains a challenge (9). Saudi Arabia has the 2nd largest gaming sector in the region, and it is growing quickly. The country has committed – including through its comprehensive Vision 2030 strategic plan – to becoming an entertainment hub, and has invested in making this a reality. At the same time, Saudi Arabia currently ranks 70th in mobile apps developed per capita, low for the region.

Economy. Saudi Arabia is a major start-up investor. In 2021 it made the highest number of VC investments (5 of 10 deals) in MENA-based start-ups of any country in the region. Its digital financial services are well established – 59% of people with a financial institution account use mobile banking. The country has made a $1 billion USD investment in NEOM’s cognitive metaverse, and additional large government investments in technology, including high-speed connectivity and cloud services. But KSA’s crypto readiness is low. Although there are no legal penalties for people who use cryptocurrencies and trade digital assets or NFTs, there are bans on banks processing crypto transactions, and only 1.3% of the population owns cryptocurrency. Laws governing the use of cryptocurrencies are currently being developed.

Turkey:

Turkey’s infrastructure and technology show moderate readiness for metaverse deployment, but user adoption, content, and use of cryptocurrencies suggest strong potential.

Infrastructure. Turkey shows medium to high infrastructure readiness across key metrics to support metaverse adoption. Ninety-two percent of its population is covered by at least a 4G mobile network. Although less than KSA and UAE, 78% of residents use the internet, and the country ranks 29th in households with internet access (1).

Technology. Technological readiness is positive in Turkey. While AR/VR headsets sales in Turkey are half those of UAE and KSA, volume is expected to double from 2020 to 2025. Turkey’s 0.73 smartphones per person installed and 0.62 subscribed are in line with regional averages. The country ranks 16th in cybersecurity, on the low end for the region.

User adoption. Turkey enjoys a high level of user readiness for and excitement around the metaverse. Eighty-six percent of adults are familiar with metaverse concept – the highest in world (2). The social media penetration rate is 81%, albeit lower than UAE and KSA, and 63% of population is younger than 40. Only 28% of people have standard ICT skills, which is low for the region (3, 4). Turkey ranks 44th (of 130 countries) in Trust (5). Nearly half of small and three quarters of medium enterprises have a website.

Content. The country boasts high content creation readiness, thanks in large part to its region-leading gaming sector. Turkey ranks 46th (of 130 countries) in mobile apps developed, which is high for the region, and is forecasting 60% growth in creative content employment by 2030. The country already ranks 2nd in TV series exports worldwide (6). While only 3% of population have advanced ICT skills, which is low for the region (7), institutions like Smartpro Computer Academy are preparing the next generation to work and participate in the metaverse. Highschools have also begun adding metaverse literacy topics to their curricula.

Economy. Turkey shows potential for metaverse deployment, especially in education, though key gaps should be addressed. The country’s $31+ billion USD ICT sector is already the largest in region, and expected to double by 2025. In 2021, it invested $1.5 billion USD in start-ups, 3x as much as in Egypt. And the most active VC investors in Turkey-based start-ups were all local, unlike in other countries in the region. Despite a ban on crypto currency by Central Bank, 2.9% of the population owns cryptocurrency – the highest in the region, though still lagging the 3.9% global rate. It should be noted, however, that currency devaluation may impact Turkey’s purchasing power and investment attractiveness.

Egypt:

Egypt shows lower readiness for metaverse adoption, especially in technology, however it is poised to lead in content.

Infrastructure. Consistent with other counties in the region, 96% of Egypt’s population is covered by at least a 4G mobile network. However, its cost of connectivity is high compared to USA or Turkey. Egypt ranks 70th (of 130 countries) for home and 42nd for school internet connection (1).

Technology. Egypt demonstrates lower technological readiness than other countries in the region, with just 48% smartphone subscription and averaging 0.65 active mobile- broadband subscriptions per inhabitant. The country ranks 30th (of 130) in cybersecurity, low for the region.

User adoption. Forty-three percent of residents have basic ICT skills, which is average for the region, but may indicate low user readiness for metaverse (2, 3). Egypt’s 49% social media penetration rate is also low for the region. Twenty-nine percent of SMEs have no online presence (4) and the country ranks 88th in Trust (5). However 73% of population is under 40, indicating a large potential metaverse user base.

Content. As a key regional hub for content creators, hosting international summits and originating major content platforms, Egypt demonstrates strong potential in metaverse content creation. Eleven percent of the population have advanced ICT skills, which is high for the region (6), and the country ranks 6th in gig economy employment by digital platforms. Egypt’s gaming sector is estimated to reach $257 million USD by 2025, placing it fourth in the region.

Economy. Egypt’s economy shows relatively low metaverse readiness for the MENAT region. The government has not publicly announced any major investment in the metaverse, and the country currently bans crypto trading and related platforms. Nevertheless, 1.8% of population owns cryptocurrency. The country does have a thriving start-up economy: Egypt-based start-ups raised ~$500 million USD 2021, representing 168% year- over-year growth. This ranks the country 1st by the number of deals in Africa during 2021 and 3rd in total funding (7).

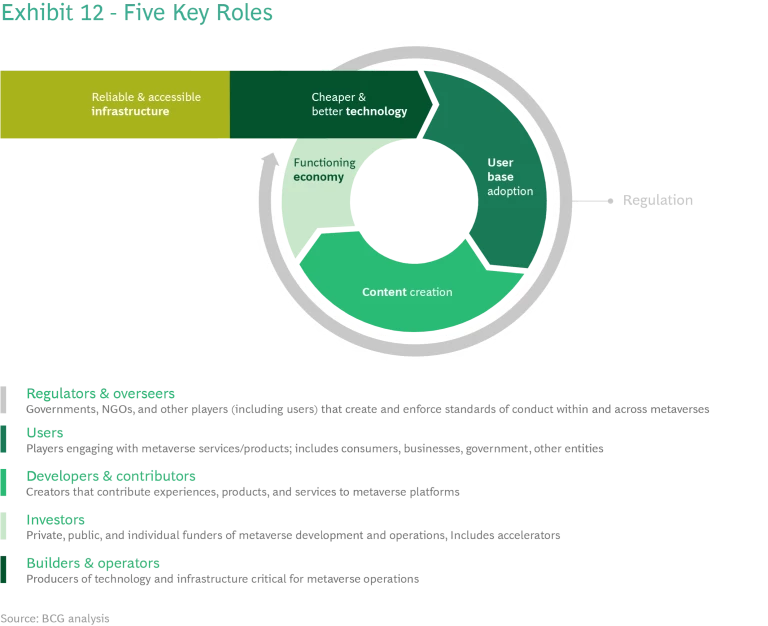

Five key roles will enable the metaverse flywheel to function (Exhibit 12):

- Builders and operators. These are the producers of technology and infrastructure critical for metaverse operations (e.g., Microsoft, Pico, Etisalat, Crypto Oasis, Global Foundries, Roborace).

- Users. A wide range of individual consumers and business or government entities engage with metaverse services and products (e.g., Dior, Adidas, BMW, Bee’ah, Dubai Municipality).

- Content contributors. These creators build and contribute content to metaverse platforms, providing the incentive for users to engage (e.g., Open Sea, Activision, Disney, Bedu, Playhera, Spyke, and individuals).

- Investors. Behind the scenes but critical to widespread adoption are the private, public, and individual funders of metaverse development and operations (e.g., Index Ventures, Andreessen Horowitz, Abu Dhabi Investment Office, Mubadala, Shorooq Partners).

- Regulators and overseers. Governments, policy makers, NGOs, and others (including users) who collaboratively develop and enforce policies and standards of conduct necessary for enabling and fostering trust and confidence in the metaverse system.

Note that players can fill multiple roles and support development of the broader ecosystem. For example, government entities may simultaneously act as builders operators, users, investors, and overseers of platforms in the metaverse ecosystem.

Several start-up accelerators/incubators in the region are also proactively assuming both operator and orchestrator roles. For example, UAE’s MetaIncubator—the first metaverse incubator in the Middle East – aims to develop early-stage Metaverse and Web3 projects out of Dubai, positioning the city as a global metaverse hub. It will also hold events to connect projects, investors, engineers, and the public, and has a skill-sharing network enabling users to find, connect and collaborate with other members.

For enterprises looking to tap into the metaverse, use cases are just the beginning. Strategy coherence, execution and the right competencies will be crucial to winning in this new market. Organizations must define their strategic objectives for metaverse participation, aligned to their overall strategy and brand positioning. As with other forays into new technologies and business models, it is helpful to identify and pilot select use cases, then modify, scale, and expand based on initial learning. They will need to invest in new technologies, hire for new roles and capabilities, and identify trusted partners who can help them navigate the new virtual world and markets.

More countries are aiming to become crypto and metaverse hubs. Notably UAE, Zambia, Singapore, France, UK, and Switzerland are working towards this ambition. However, to claim it, four prerequisites must be fulfilled:

- Commercial attractiveness: multiple factors make a country commercially attractive, including airport connectivity and reachability, a favorable customer perspective, and the promise of adequate funding through VC, PE, and capital markets.

- Favorable legal environment and political stability: the country’s legal/tax environment, accounting and regulation must promote business investment, development and innovation, while its credit ranking and political stability allow businesses to anticipate long- term operations.

- People availability: metaverse development demands a substantial pool of specialized talent, so the most successful countries will be those with adequate local staffing, technologically-oriented universities, available senior management, and an attractive quality of living.

- Existence of an ecosystem: the metaverse is an intrinsically interconnected space, so ambitious countries must offer proximity to other crypto/metaverse organizations, users, and funding partners -- as well as easy access to other hubs and IT services.

Policy Insights

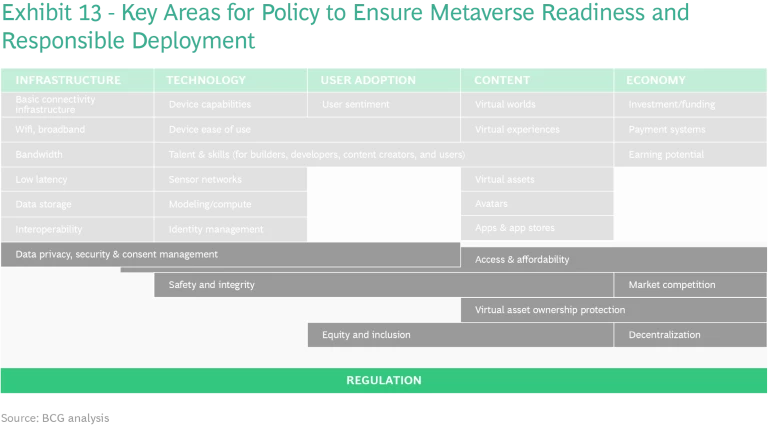

Policy plays a critical role across and around the metaverse flywheel, providing a stable, coherent, supportive environment and incentive framework for the other enablers (Exhibit13). Government support can facilitate the deployment of a responsible metaverse, capitalizing on its many potential benefits while addressing considerations. Specifically, a country’s policy framework should foster:

- Data privacy, security, and consent management: data privacy and security are the top concerns for many potential metaverse consumers, so policies need to address data capture and storage, tracking, control and transparency around data usage and any breaches. They must also reach beyond national boundaries, encompassing cross-border data flow, data management and governance.

- Safety and integrity: policies should maximize online safety for users. This includes protection from virtual harassment, abuse, and hate speech, provision of tools to report and access support in unsafe situations, and access to mental health resources to support victims of harmful experiences.

- Equity and inclusion: diversity, equity, and inclusion of users and content creators is paramount to ensuring the metaverse is designed and used in ways that are accessible and welcoming to all.

- Access and affordability: available and affordable connectivity infrastructure, services, devices, and training needed to access the metaverse are key to unlocking its potential and to ensuring equity and inclusion.

- Market competition: fair and equitable economic opportunities for small/local developers and content creators as well as a limitation of fees from metaverse owners (as seen in the phone space) are key to ensuring the choice needed to attract and retain users, and to maintain a thriving metaverse economy.

- Virtual asset ownership protection: regulations surrounding virtual asset production and ownership, including protection from property theft, vandalism, and destruction, are required to protect the virtual assets key to the metaverse economy.

- Decentralization: governments need to clarify the regulatory policies, roles, and oversight mechanisms that support interoperability and take advantage of decentralized metaverse-related technologies in safe, secure and appropriate ways.

Perhaps the most fundamental issue for policy makers in the metaverse ecosystem is ensuring the proper balance of openness and security. This includes when and how to involve key policy makers and other stakeholders in developing and adapting regulation. It will be critical – and challenging – to strike the right balance between centralized/closed and decentralized/open regulatory approaches, essentially determining the optimum trade-off between privacy and safety. The centralized approach allows governments to set easy-to-implement standards, but brings serious privacy considerations. Decentralized regulation offers more freedom, but also greater potential for dangerous behavior.

It is impossible to simply replicate existing social norms and rules online. The metaverse should have its own rules which are consistent with real-life laws, while reflecting the peculiarities of an immersive virtual environment. The challenge facing governments, lawmakers and society is how to enrich existing laws to meet the needs of metaverse: protecting civil rights and privacy, especially for marginalized communities and people with disabilities online. Since legal restrictions vary by country, while metaverse platforms almost always span geographies, aligning policies across nations will be a key challenge.

Beyond fostering an enabling regulatory environment, MENAT governments can help activate the metaverse in several ways (Exhibit 14). They can be important sources of funding and investment as well as non-economic incentives. They can support skilling and education efforts, both within and external to existing school systems. They can foster the development of the metaverse ecosystem, directly through government incubators and accelerators, or indirectly through platform connections and networking opportunities. Finally, through public participation in metaverse development and use of its platforms, governments can provide a practical and symbolic vote of confidence, encouraging citizens to embrace this new technology.

At the convergence of three of today’s most exciting emerging technologies, the metaverse offers the tantalizing prospect of a new kind of world – one where physical and virtual experiences complement each other and combine seamlessly to create something more expansive and compelling than we have ever imagined before. It is still early days. But past experience has taught us that major technological developments must be carefully anticipated and responsibly deployed in order to be our tools, not our masters. With bold new metaverse applications and content coming onstream every day, now is the time for MENAT governments to take stock of the opportunities, considerations, required capabilities and policy implications – and proactively map their paths forward.