In recent years, many organizations have pledged to support diversity, equity, and inclusion . But how can they back up their commitments and move from pledge to promise? As a first step, organizations can engage in a thorough and open-minded examination of their own impact—both current and historical—on communities that have been marginalized because of race, gender, or class.

Equity assessments are a relatively new tool that can help organizations measure the effects of their DEI practices—or the gaps therein—and respond appropriately. They can also underpin other organization imperatives: a DEI strategy designed to address consumer and shareholder pressures, for instance, or one designed to attract and retain talent. An assessment of equity and inclusivity in products, services, and operations could also provide a foundation for the societal component of ESG.

Getting DEI and ESG right can, in turn, yield broader benefits by increasing team diversity, satisfying stakeholder demands, mitigating risks, and promoting economic growth.

The scope and impact of equity assessments can and should vary, depending on the goals and requirements of a particular organization and the industry in which it operates. But in general, we recommend that organizations take a holistic approach that engages people at every level—leaders, investors, customers, and employees—and addresses equity across the board. Always, though, an equity assessment should open windows and doors for an organization—first providing a baseline view of DEI and ESG status and then illuminating, inspiring, and measuring progress toward equity.

How to Assess Equity

A holistic equity assessment should be designed to:

- Encompass the diversity of an organization’s employees as well as the inclusiveness of its people and talent practices.

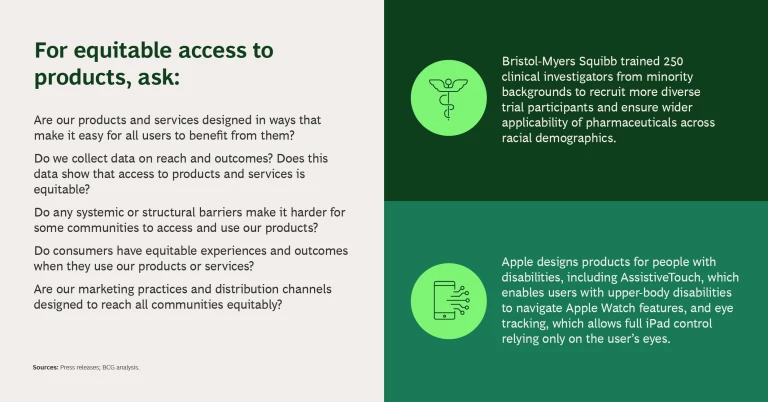

- Consider the design of products and services ; that is, whether the design allows for equitable access across communities.

- Address the secondary implications of policies, operations, and practices. Are certain groups disproportionately affected by negative or harmful byproducts? Consider, for example, any disproportionate environmental impacts of an organization’s facilities on low-income or immigrant communities, or the data protection concerns that might arise from the use of consumer data to inform company strategy or product development.

Currently, though, standards are lacking and approaches vary. In the US, groups such as the Corporate Racial Equity Alliance are making progress on codifying how organizations should approach equity assessments. In the UK, employers are required to annually report specific figures about their gender pay gap; failure to report can result in fines. In Germany, the Supply Chain Due Diligence Act, which will go into effect in 2023, asks companies to ensure that human rights are being considered and protected within their supply chains and internal operations. And across the EU, the Corporate Sustainability Reporting Directive, which is set to be adopted in late 2022, will require large, listed companies to report on ESG in alignment with European Sustainability Reporting Standards.

Although standards are still coming together, organizations can nevertheless undertake an effective equity assessment. They must develop a strategy that involves the right stakeholders—beyond the CEO, chief information officer, chief investment officer, and chief marketing officer, the stakeholders involved will depend on the scope of the assessment and its specific goals. The scope could be narrow, focusing on a single initiative or aspect of equity, or (for maximum value) holistic, spanning the organization. (See “Conducting an Effective Equity Assessment.”)

Conducting an Effective Equity Assessment

Before the Assessment. Organizations should activate leaders, get their buy in, and consider how to conduct the assessment and communicate about it to their organization and beyond.

- Get grounded. Educate the leadership team on the societal context surrounding equity in their given industry with a mix of demographic data, customer insights, and historical context.

- Set the stage. Think proactively about how the organization will identify processes and gather data, assess its current state, and determine how results will be used and shared afterwards.

- Align leaders. Make sure that leaders understand the goals and process of an equity assessment before it begins and that they are committed to the effort and prepared to think differently about the organization. Use leaders to get the broader organization on board and keep messaging regarding the purpose and goals of the assessment consistent.

- Find the right partner. Bring on partners to help with implementation and design—including experts on change management as well as corporate responsibility and equity who have established credibility in the space.

- Set a standard. Establish a set of KPIs, metrics, and dimensions for the assessment; remember that there isn’t yet an industry standard for equity assessments, so engaging expert partners will help to avoid excluding any critical components.

- Leverage the output. Think about how the assessment’s results will be used and decide if they will be shared externally or not. If the assessment is designed to yield targets for change under a broader ESG strategy, consider who will lead those efforts and how.

- Be consistent. Conduct assessments on a regular basis and with consistent metrics to show changes (both positive and negative). Determine what intervals make the most sense for the organization’s goals and allow for conclusions to be drawn over time.

- Learn from experience. Though consistency is key, assessments shouldn’t be so rigid that they aren’t improved iteratively based on lessons from the prior cycle. Make sure to track feedback and refine the process with each iteration.

A Broad Range of Benefits

When any societal group is ignored, marginalized, or underserved, economic growth is limited—for society in general and for organizations that could otherwise do business with that group. The economy can reach its full potential only when all people are able to fully participate. Research from the Washington Center for Equitable Growth estimates that overcoming gender and racial discrimination in innovation could result in a 2.7% uptick in US GDP per capita.

Equity assessments could be the key to unlocking that kind of value. They have often been regarded as punitive actions—sometimes, for instance, they took the form of racial equity audits forced by proxy votes. But these reviews are emerging as rich opportunities for the companies that use them. Among the benefits:

Guiding the ESG Journey. Equity assessments should be a core component of an organization’s overall ESG journey, particularly given that investors recognize DEI activism as a signal of ESG impact. A thorough assessment of business practices, current and prior, can inform the targets and goals for the company’s ESG program and help to mitigate the risk of future incidents that might harm the organization’s standing in the community. These assessments can help companies to establish a baseline for their performance across a set of equity metrics; in future assessments, they can measure progress on those goals.

This is critical because ESG progress brings financial growth. According to BCG research, more than 80% of studies assessing ESG impact have found that ESG funds outperform traditional funds over one-, five-, and ten-year periods. Further, companies with the highest degrees of ethnic and cultural diversity among their workforce and boards outperform less diverse peers.

Managing Risk and Responding to Stakeholders. In 2020, approximately 40% of S&P 500 companies discussed diversity on earnings

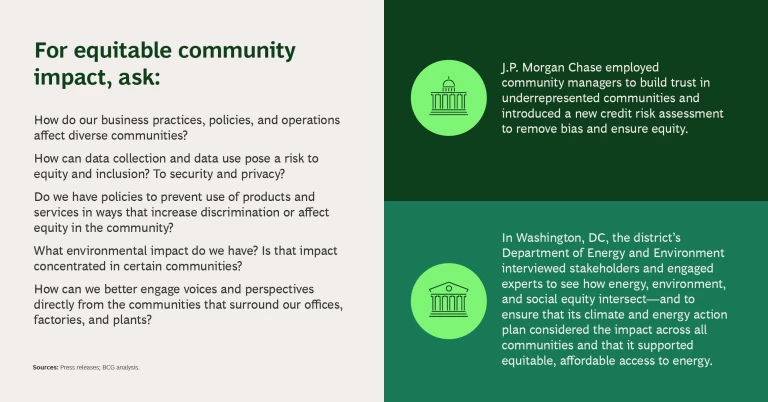

In March of this year, JP Morgan Chase announced that it would engage a third-party firm to conduct an assessment of the company’s equity efforts—in particular its $30 billion, five-year racial equity commitment, announced in 2020 with the goal of helping to address racial wealth disparities across Black, Hispanic, and Latinx communities. The effort was originally proposed by shareholders as an audit. That request has been withdrawn, but the company is voluntarily continuing with an assessment. Several other companies have also conducted assessments, including Airbnb, BlackRock, and Facebook.

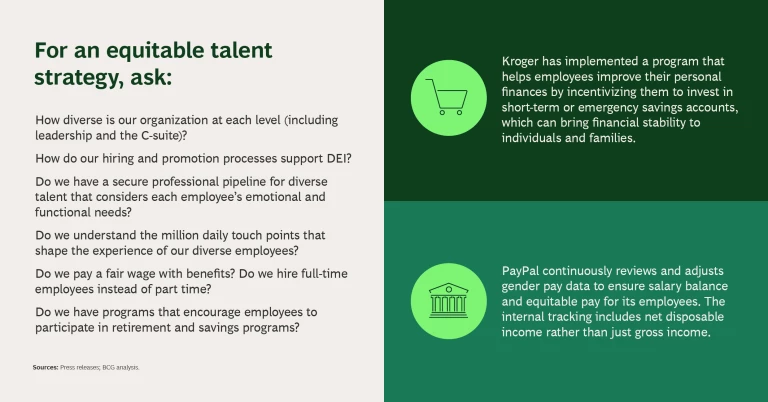

Building for the Future. The actions companies take following an assessment can have broad benefits across three main constituencies:

- Society. Using its identity, voice, and influence, an organization can catalyze social change.

- Talent. Robust strategies and assessments help organizations attract and build a diverse workforce and ensure an equitable and unbiased workplace.

- Business. Ignoring or underserving certain groups limits the economic growth of those groups as well as the organizations that could otherwise do business with them. An equity and inclusion lens can help limit the economic toll.

Overall, DEI progress across society, talent, and business is critical in order to avoid the potential economic and societal costs of discrimination.

How Different Industries Can Drive Impact

A holistic approach to equity is best: organizations across industries should examine their equity performance throughout the value chain. But specific industries will find that they have different opportunities to make changes and drive impact. Industries often know, or at least strongly suspect, that they have particular DEI shortcomings that need to be addressed—gaps created and sustained by historical and current practices. Looking to better understand these gaps can help reveal opportunities for impact.

For example, financial institutions can focus their equity assessments on hiring a more diverse workforce, cultivating professional pipelines to support diverse talent, and ensuring more equitable access to financial products and services . In the US, 64% of unbanked or underbanked adults are Black or Latinx, according to the FDIC, and neighborhoods and communities with predominantly minority populations are less likely to have access to local bank branches. Financial institutions that have assessed their products and services are launching alternatives with more inclusive cash-flow-management features and digital interfaces for language and smartphone access, for instance, and reaching underserved communities through channels such as neighborhood-focused branches, community development financial institutions, and local partners.

Subscribe to our Social Impact E-Alert.

Company leaders in the

energy sector

are concerned about both access to reliable and affordable power and the benefits of renewable energy. Majority-Black neighborhoods tend to have less access to new clean energy technologies like rooftop photovoltaics (solar panels), and Black families are more likely to live in homes that have faulty energy systems, inefficient appliances, and poor insulation—resulting in higher energy burdens for Black

Understanding an industry's DEI shortcomings can help reveal opportunities for impact.

Companies in the

industrial goods

sector are likely to focus on equity issues related to plants, factories, and mines, which tend to have health implications for their surrounding residents. Studies show that historically redlined districts are five degrees hotter than districts that were not redlined, contributing to greater heat-related morbidity and mortality in neighborhoods and communities of color. Black communities in the US are exposed to 50% more hazardous pollution, which can cause lung and heart problems, higher rates of asthma, and other health

A Moment for Leadership

Equity assessments are relatively new, and they require organizations to take a hard look at themselves. But the rewards can be profound. Organizations that undertake assessments now have the opportunity to help shape the approach and highlight the benefits of examining equity. And by incorporating these assessments into their regular practices and corporate strategies, organizations not only can advance their equity work but can set themselves apart as leaders in the equity and corporate responsibility space.