While humankind has used hot springs for spiritual and medicinal purposes for thousands of years, modern geothermal wells have generated electricity and heat from the energy contained in the earth’s crust only since the beginning of the last century. To improve their economics, most of these wells have been built in the vicinity of hot spots, subduction zones, and thin crust where subsurface temperatures are high. Areas of geothermal potential that are further away from these features, and so less economical, have largely been ignored—limiting geothermal’s role as a source of abundant, renewable, and reliable energy.

That looks set to change. Multiple factors are poised to revolutionize the sector by making geothermal wells viable across far larger areas of the globe. These include:

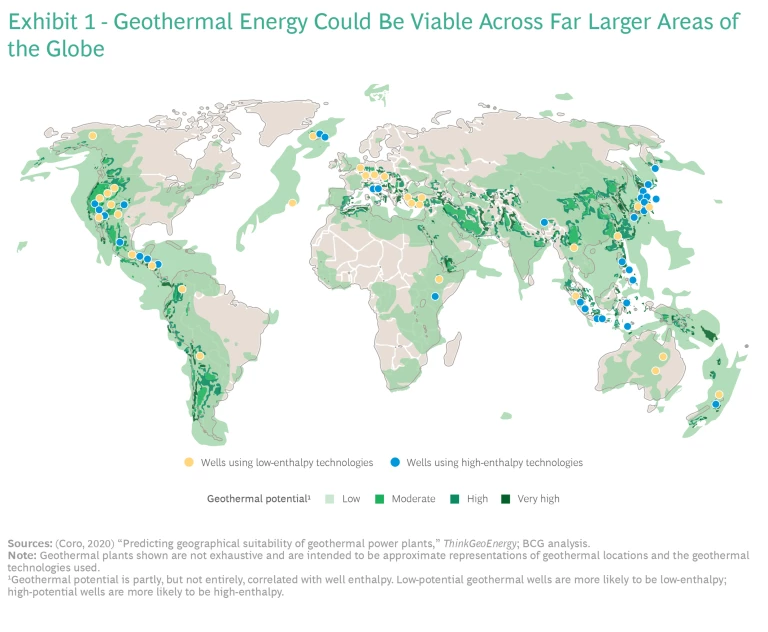

- New development approaches enabling electrical energy generation using steam at lower pressures and temperatures (known as “low-enthalpy” conditions). (See Exhibit 1.)

- Fresh interest in the minerals contained in geothermal wells.

- Use of geothermal energy for industrial and district heating.

These forces could also forge a much bigger geothermal market and turn geothermal energy into a significant driver of decarbonization worldwide.

Technical advances are propelling the geothermal sector to the verge of a major expansion. Many of the drivers that are poised to transform geothermal energy are still nascent or in the development stage. However, we expect the pace of change to accelerate, creating myriad opportunities for players. Companies will need to move early and decide how they want to play in this space if they wish to make the most of these opportunities. They will need to work closely with policymakers to ensure that a country’s geothermal potential is leveraged to achieve its energy security and decarbonization goals.

The Market Opportunity in Geothermal

Up to now, geothermal investment has largely focused on Iceland, Turkey, eastern Africa, and the countries and regions that lie along the Ring of Fire—a horseshoe-shaped belt in the Pacific Ocean characterized by volcanic activity that includes parts of Indonesia, the Philippines, and the US. Geothermal wells in these areas are typically rated as “high-enthalpy” because of their strong thermodynamic qualities, boasting average subsurface temperatures exceeding 180oC at economically viable depths.

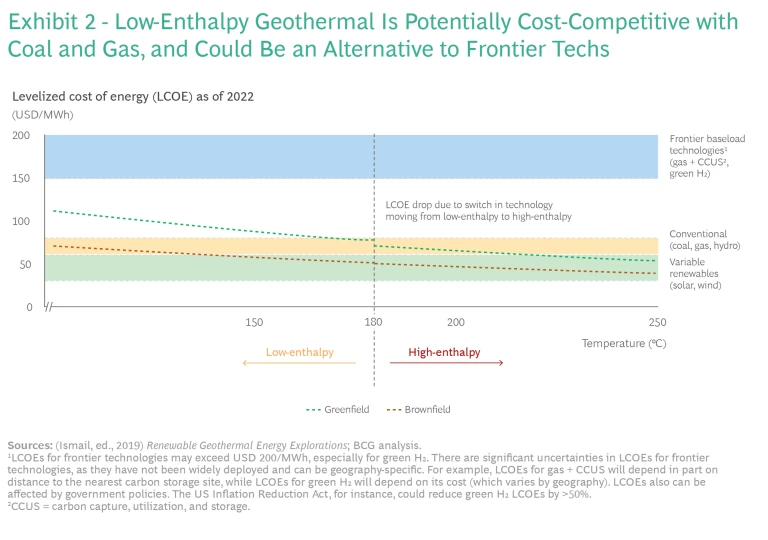

As a result of these characteristics, high-enthalpy wells can produce more energy and make use of cheaper energy-extraction technologies than wells in low-enthalpy areas (which have less favorable subsurface temperature gradients and so are cooler), thus delivering higher returns on investment. In addition, electricity generated from high-enthalpy sources is generally about 50% less expensive than electricity from low-enthalpy wells.

Based on current industry projections, cumulative installed geothermal capacity is likely to reach 18 gigawatts (GW) of electrical power worldwide by 2025, up from 15.7 GW in 2020. Most of the additional wells that will be needed to achieve this figure are likely to be located in high-enthalpy areas such as Indonesia. We estimate that this volume of generating capacity will be equivalent to a global market in equipment and services worth about $7 billion.

The world’s total geothermal resources are estimated at 600 GW of generating capacity—and if developed using existing methods, the market worth could exceed $100 billion.

These projections are modest when compared to those for total geothermal resources, which are estimated at 600 GW of electrical generating capacity. If all the world’s geothermal resources were developed—assuming the use of existing drilling technologies and a typical well depth of no more than two to three kilometers—the market could be worth in excess of $100 billion. Since two-thirds of these reserves are in low-enthalpy areas, this scenario would depend on low-enthalpy wells becoming far more commercially attractive as well as a huge global commitment to developing the world’s geothermal potential.

Moreover, if advances in drilling technologies were to allow for exploration at even higher pressures and temperatures, enabling developers to drill even deeper below the surface, both market size and geothermal capacity could be even greater. Indeed, given the almost limitless amount of heat contained within the earth, geothermal could theoretically supply all humankind’s energy consumption many times over.

Geothermal’s Decarbonization Potential

Low-enthalpy geothermal could also play an important role in the decarbonization of global energy systems, provided it can be made commercially viable in more locations. The 600 GW of estimated geothermal resources globally is almost equivalent to one-third of current global coal-fired capacity today.

According to our models, low-enthalpy geothermal may already be cost-competitive with fossil fuels and renewables as a source of power generation in some areas. (See Exhibit 2.) This assessment depends on companies using brownfield sites to build geothermal wells, an approach that is still being trialed. (See “How Brownfield Sites Can Cut Development Costs.”)

How Brownfield Sites Can Cut Development Costs

How Brownfield Sites Can Cut Development Costs

Depleted onshore oil and gas fields are prime candidates for geothermal development, given that they have been thoroughly explored and wells have already been drilled. India’s Cairn Oil & Gas (now merged with Vedanta Limited) and Baker Hughes, for example, are jointly studying the possibility of producing geothermal energy from Cairn’s fossil fuel assets. Offshore wells that have ceased to produce oil or gas could also be turned into geothermal plants. Iceland’s North Tech Energy is investigating this option and plans to use subsea cables to transport electricity onshore.

Brownfield opportunities also exist outside oil and gas, such as in existing geothermal fields. In Turkey, China’s Exergy has built its Akça low-enthalpy plant in a region that is already widely used for geothermal developments, thereby reducing exploration costs. Equally, geothermal installations can be constructed along with solar or wind farms to optimize land use or cable investments. For example, Italy’s Enel Green Power operates a hybrid power plant in Nevada that combines geothermal energy with solar thermal and solar power. Similarly, Climeworks, a Swiss technology company, is optimizing land use by using geothermal energy to power its new direct air capture facility. And Microsoft is relying on a geothermal plant, located on site, to heat a major extension to its corporate campus outside Seattle.

We anticipate that greenfield low-enthalpy power generation may also become cost competitive with conventional energy sources once regional carbon prices—an important growth driver of geothermal development—exceed $50 per ton of CO2 equivalent. Carbon prices in the EU and New Zealand have crossed this threshold, while those in California and Quebec are starting to approach it.

One key advantage of geothermal energy is its reliability, which means that unlike wind or solar it can play a role as a generator of baseload power. It is also an effective solution for governments concerned about energy security, since it does not require fuel imports. Consequently, because it provides clean, green energy, countries may opt to build low-enthalpy geothermal capacity to complement their variable renewable energy portfolios. For example, Singapore is already exploring the use of geothermal to decarbonize its power generation mix.

Owing to its better cost profile, we expect low-enthalpy geothermal to be an especially competitive alternative to frontier technologies—such as green hydrogen and natural gas-fired plants with carbon capture, utilization, and storage (CCUS)—for baseload power. The levelized cost of energy (LCOE) for greenfield low-enthalpy geothermal could approach $100 per megawatt hour (MWh), while the LCOE of green hydrogen or natural gas-fired plants with CCUS is likely to exceed $150 per MWh. A mix of these technologies will be needed to achieve net-zero power systems worldwide once countries’ ability to build solar and wind farms has reached its limit.

Key Growth Drivers

We believe that two factors are likely to improve the attractiveness of low-enthalpy geothermal.

Emerging technological innovations. Several technologies on the horizon could expand the reach of geothermal energy, such as Advanced Geothermal Systems (AGS), Enhanced Geothermal Systems (EGS), ultra-deep geothermal, and plasma drilling. AGS, which is being developed by companies such as Eavor, utilizes a closed-loop system, making it suitable for locations without sufficient naturally occurring geothermal fluids or certain geological characteristics. Similarly, EGS works by fracturing reservoir rocks to enable conductive flows of geothermal fluids. Ultra-deep geothermal taps into significantly higher geothermal temperatures by drilling deep beneath the surface (for example, Quaise Energy is targeting a depth of 20 kilometers). This could be achieved through emerging technologies like millimeter wave drilling or plasma drilling, which enables companies to cut drilling costs by removing the need for drill bits and thereby reducing expensive wear and tear.

Decarbonization commitments from countries and companies will drive a need for clean baseload energy sources—an area where geothermal has a major role to play.

Decarbonization commitments and environmental policies. Governments’ growing adoption of carbon pricing is supporting the transition away from fossil fuels by making green energy sources, including geothermal, competitive with conventional generation. At the same time, the number of national and multi-jurisdictional policy tools that specifically target geothermal energy is growing. These tools include:

- New feed-in tariffs (which provide a guaranteed price to generators for power they produce) that make geothermal a cost-competitive alternative to solar and onshore wind.

- Faster permitting processes for geothermal projects.

- Increased R&D funding for promising pilots.

In tandem, decarbonization commitments from countries and companies will drive a need for clean baseload energy sources, an area where geothermal energy (power and heat) has a major role to play.

Business Model Innovation Using a Multi-Service Approach

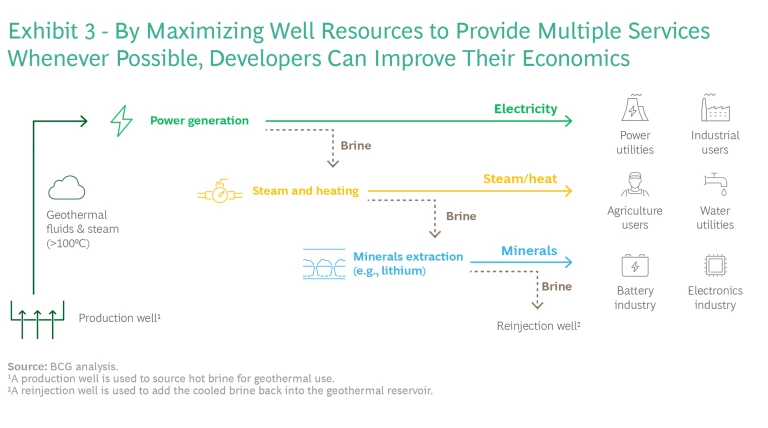

Because of the growing global demand for both green energy and rare minerals, savvy companies are starting to take a “multi-service” approach to geothermal development that harnesses all the resources contained within a given geothermal fluid.

With this approach, high-temperature brine from a well is converted into steam which generates electricity by driving a turbine. In the process, the brine cools down but remains fairly hot. The brine is then used to produce heat and steam for applications with lower temperature requirements, such as district heating systems, hot baths, and drying wood and vegetables—provided these activities are located within a 10-kilometer radius of the well. Finally, when the brine is relatively cool, minerals such as lithium can be extracted. (See Exhibit 3.)

Mining lithium and silicon from geothermal wells has traditionally been ignored due to high extraction costs. But skyrocketing prices for these minerals are changing that. The price of lithium, a key component in electric vehicle batteries, doubled to $75,000 per ton during the first quarter of 2022. Silicon, which is used in pharmaceuticals and semiconductors, has also risen sharply in

These high mineral prices are turning the extraction of minerals from geothermal fluids into a viable alternative to the cheaper but more environmentally damaging method of mining hard rock and sand. They are also creating new revenue opportunities for geothermal developers. However, sufficiently high concentrations of these minerals are generally required to make extraction worthwhile.

Developers are already improving project returns by combining power generation with mineral extraction. For example, BCG estimates suggest that, by doing this, geothermal companies near California’s inland Salton Sea may have increased project returns by up to 10 percentage points. Importantly, we believe that a multi-service approach could increase the number of revenue streams from low-enthalpy, mineral-rich fluids, so that wells become commercially viable.

Geothermal use cases and business models will likely increase through new applications based on enabling technologies and policies.

Geothermal use cases and business models are likely to increase as entrepreneurs identify new applications resulting from enabling technologies and policies. In the future, as developers seek ways to create additional revenues and cut costs, geothermal wells could be used for green hydrogen production or to support CCUS. In theory, green hydrogen can be made more efficiently with geothermal energy than with wind or solar power because the pressure inside a well enables more hydrogen to be produced with the same amount of energy. US start-up GreenFire Energy is currently trialing technology that would enable this possibility. Similarly, Chevron and Indonesia’s Pertamina are exploring combining geothermal and carbon sequestration wells with the aim of reducing drilling expenses and creating new potential sources of revenue.

A New Landscape

The emerging possibilities in low-enthalpy geothermal enabled by technological advances and a multi-service business model will open the door to new players and reward incumbents that are able to adapt to a changing environment. In the future, we expect a range of players to participate in the sector, including:

- Oil and gas companies looking for ways to maximize their use of depleted hydrocarbon fields.

- Investors and start-ups acquiring legacy oil and gas fields or areas of geothermal potential so they can exploit them, using new development approaches.

- Technology players creating fresh solutions, such as deeper drilling methods, that drive sector growth.

- Geothermal incumbents using a multi-service approach to make low-enthalpy wells more commercially viable and expand their portfolios.

- Power utilities diversifying their fleet of generators to include geothermal wells.

- Governments using regulatory incentives and streamlined permitting to kick-start or support geothermal investments.

- Developers and operators of hybrid dispatchable energy systems (which combine geothermal with other renewables sources), direct air capture facilities (which use geothermal to lower capture costs), and residential and commercial heating, ventilation, and air conditioning solutions (which use geothermal for heating and to lower the greenhouse gas footprint of buildings).

In this landscape, players that form alliances with others, ensuring they have a range of capabilities and can act quickly when bidding for projects, may be well placed to gain a competitive advantage. For example, oil and gas companies could partner with geothermal developers. In return for sharing their drilling know-how, the oil and gas players would have access to the developers’ power market expertise. Utilities and technology companies could also be included in alliances because of their role as major off-takers or key technology suppliers.

Stay ahead with BCG insights on climate change and sustainability

Geothermal has huge potential. With greater investment, technological advances, and more supportive policies, it promises to be an affordable source of energy. It is also sustainable and provides a secure and reliable energy supply. Consequently, geothermal could play a significant role in tackling the global energy trilemma.

However, tapping geothermal’s potential is not necessarily straightforward or easy for companies—especially when their plans involve leading-edge technologies or multiple services. Companies should start by assessing their current capabilities, deciding what new geothermal services they can offer, and understanding the drivers required to unlock these revenue streams.

Once they have done that, they will need to acquire or put in place key enablers to achieve their goals. These are likely to include an appropriate operating model and capabilities that support their intended business model, an effective ecosystem of players that complements that business model along the value chain, access to financing and the right technologies, as well as supportive regulations and permitting processes.

With these enablers in place, players—and governments—will be well positioned to capture the significant benefits offered by geothermal.