Infrastructure players and telcos are forging different paths to create shareholder return, but both sectors are automating, modernizing, and adopting digital throughout their operations.

The telecommunications industry’s performance remains split between infrastructure companies, which have seen valuations skyrocket, and telecom operators, which have not realized the same upside benefit despite the vital role they play in keeping business and society connected through good times and bad.

Infrastructure companies that erect and operate cell towers were among the industry’s top value creators. In our analysis of the telecom industry for BCG’s 2022 Value Creators report, infrastructure companies outdistanced telecom, wireless, and cable operators in five-year average annual total shareholder return (TSR).

The two groups will have to continue to pursue different paths if they are to grow their business and retain or advance their value in the future. The hit that infrastructure companies took from a volatile early 2022 stock market underscores the need for those businesses to continue to look for ways to evolve and grow in order to retain value. For starters, infrastructure companies need to increase tenancy ratios for existing assets. To grow, they need to find new, financially attractive projects to invest in, including projects that help them expand into related businesses. And they need to optimize and automate provisioning and maintenance of their existing networks, and adopt a digital-first approach throughout their operations.

Telecom operators must modernize by adopting artificial intelligence (AI) throughout their operations, establishing digital and sustainable business practices, and rolling out improved networks and new services. In addition, they should explore partnerships to expand into adjacent services. Those actions can make operators more attractive to customers and other stakeholders and put them on a path to stronger value creation.

While Infrastructure Assets Soared, Telecom Operators Struggled

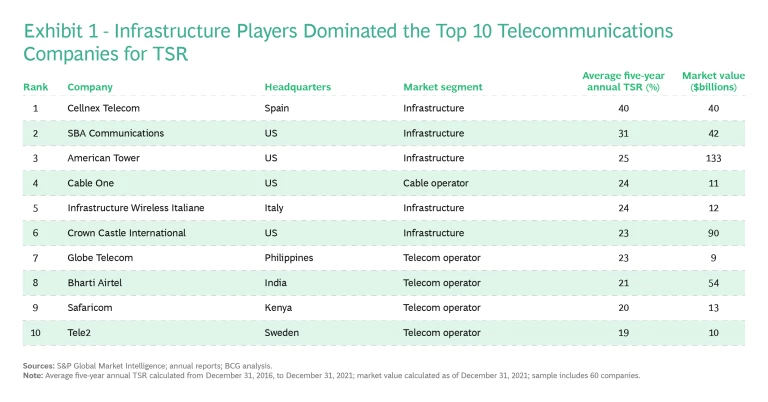

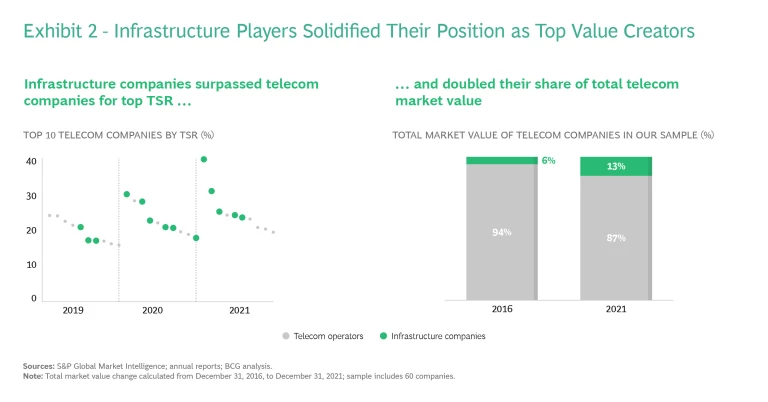

Infrastructure players, including companies created from carve-outs from telecom businesses, often have simpler business models, streamlined operations, higher profits, and more stable cash flow than traditional telecom operators—all of which contribute to value creation. Although only 8 of the 60 companies analyzed in our Value Creators report are infrastructure players, they made up half of our list of the top 10 telecom companies for TSR. (See Exhibit 1.) Since 2016, infrastructure companies more than doubled their share of the aggregate market value of all telecom companies in our sample, to 13%. (See Exhibit 2.)

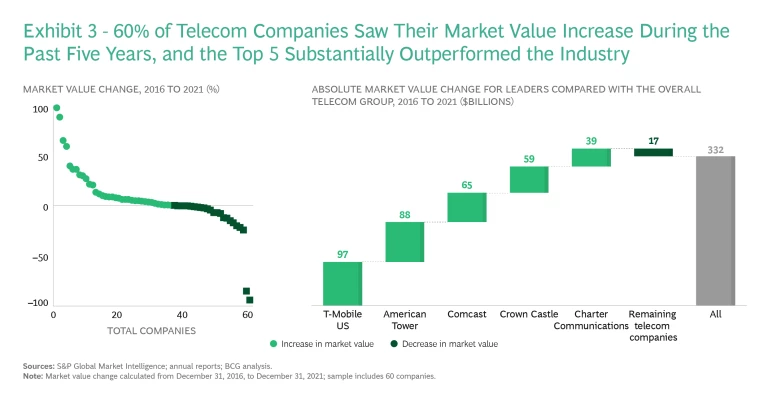

Infrastructure companies in our sample posted an aggregate median five-year annual TSR of 24%, almost twice the cross-industry median TSR of 13% and more than three times the 7% aggregate median TSR for telecom operators. Because telecom and other operator companies significantly outnumbered infrastructure companies in our sample, the overall median five-year TSR for the telecom industry improved only slightly, from 6.3% in 2019 to 7.2% in 2021. As the TSR performance of many industries improved substantially on the back of a strong 2021 market, telecom lost ground, dropping from 28th among the 33 industries in 2019 to 29th in 2021. The industry outperformed only automotive OEMs, automotive components, travel and tourism , and oil—four industries that experienced severe pandemic-era financial challenges. Still, over the past five years, 60% of the telecom companies in our sample delivered at least some increase in market value. (See Exhibit 3.)

Telecom Value Standouts

The value that infrastructure companies have created from simplified business models, streamlined operations, and steady cash flow have attracted an array of investors. Funders have financed or acquired ownership interest in operator-owned independent business units and industrial tower companies. Infrastructure valuations increased as global investment firms such as KKR made acquisitions in the segment, and pension funds and insurance companies such as Allianz bought into infrastructure stocks to take advantage of their stable returns. In addition to funding tower companies, private equity firms and other funders are actively investing in purveyors of fiber, data centers, and undersea cables for telecom networks.

If infrastructure companies are the telecom industry’s bright spot, one of the brightest stars has been Cellnex Telecom. The Spanish company operates 71,000 cell towers throughout Europe, and from 2016 to 2021 had an average five-year annual TSR of 40%, topping our list.

By contrast, traditional telecom operators struggled to create value. Regulated prices limit telecoms’ ability to raise rates. In addition, many operators refrained from raising prices during the pandemic, when the world depended on them to stay connected. Industry experts estimate that telecoms lost billions of dollars in revenue from lower roaming charges as people stopped traveling. At the beginning of the pandemic, revenue from traditional services fell by 3% even as internet traffic increased by 47%.

Still, some telecom operators remain standouts. Our list of the top 10 telecom value creators includes four: Globe Telecom, which grew by offering adjacent services and on the strength of its Mynt fintech startup and other partnerships; Bharti Airtel, which improved its core business through better pricing and customer service; Safaricom, which expanded its business by providing adjacent services such as payments; and Tele2, which used a recent 5G upgrade to improve its service. Bharti and some other telecom operators also added short-term value by spinning off an infrastructure business or selling a partial interest in such a business to an investment or joint venture partner.

Given their large average size, telecom operators continued to lead other companies in the industry in terms of the absolute value they created during the five-year period we studied. T-Mobile US topped the list, generating $97 billion in additional market value from 2016 to 2021.

How the Telecom Industry Can Create Value in the Future

The diverging outlooks that telecom infrastructure companies and operators face will lead them to pursue different paths to retain or add value in the future.

Infrastructure companies must continue to improve networks, coverage area, and service. The capital pouring into infrastructure companies is buoying their valuations. But rising interest rates could cause investment firms, pension funds, and other current and potential backers to look elsewhere for better returns. To remain attractive, infrastructure companies should take action on several fronts:

- Find investment opportunities. As the field expands, competition has made it more challenging for infrastructure owners to find towers to add to their portfolios. Attractive opportunities are still out there, but to come out on top, companies must position themselves well and be smart about how they bid. When looking for opportunities to grow, companies should evaluate the benefits of expanding their holdings to include related assets such as fiber, data centers, and undersea cables.

- Manage clients’ operations. As opportunities to increase value through new builds or acquisitions become less frequent in some regions, tower companies in those areas have to look for other ways to add value. One option is to expand into managing the active layers of the networks that run on their hardware—specifically, to manage active radio access network (RAN) equipment . Mobile operators own this equipment, but increasing numbers of them are outsourcing the business of running it in order to focus on higher-value operations and to fund 5G network expansion. Revenue from managing RAN assets could fund companies’ other ventures.

- Digitize value chains to improve service. If tower companies assume responsibility for managing RAN assets or other aspects of their mobile clients’ business, upgrading to digital for those operations can unlock substantial value through reduced costs and improved service and customer experience. An upgrade to digital can also create additional avenues for future growth.

Telecom operators need to modernize to operate more efficiently, and offer new services. Telecom companies face multiple challenges to value creation, including regulatory hurdles, the need to increase utilization of existing mobile and fixed network assets, and the need to invest in 5G before having a clear picture of how it will generate revenue. Operators must also replace aging copper networks with fiber to provide customers with better bandwidth, durability, range, and speed.

For telecom operators, there is no single path to follow in meeting these challenges. Instead, they should consider taking action on a short list of must-dos, along with other options:

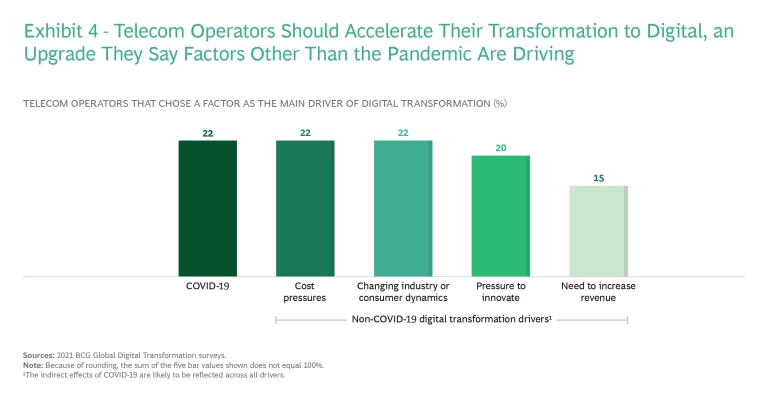

- Digitize and radically simplify internal operations. Accelerating the transformation to digital and becoming bionic companies are key steps that telecoms can take to create value, and cost pressures are among the chief factors moving companies to do so. (See Exhibit 4.) To transform, operators need clear goals that are tied to business outcomes, leaders who are committed and engaged, and talent with the right skills working on the initiative. (See Exhibit 5.) They also need to adopt modern, scalable systems, agile ways of working that accelerate change, and data-backed metrics to measure results.

- Employ next-generation personalization and AI. Another must for telecom operators is to adopt advanced personalization and AI to improve network planning and network operations. Using AI and extensive network probes ensures that operators deploy networks in the best way possible, and helps prevent outages. Adopting AI also enables operators to customize offers and provide better customer service. By tailoring offerings to what customers want, companies minimize churn and improve price realization , developing more effective discounting structures and price management.

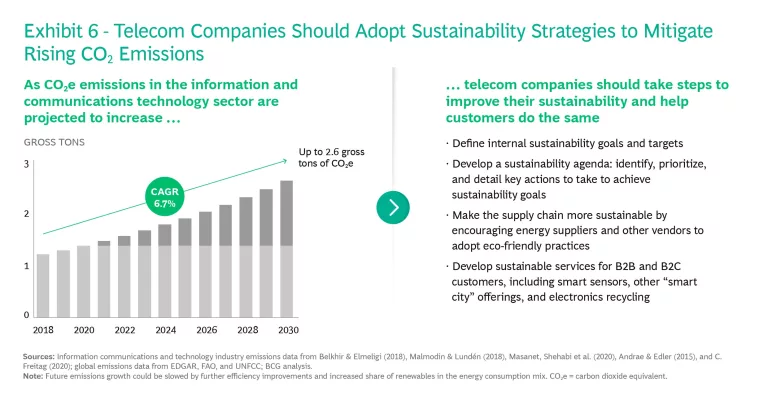

- Increase sustainability. As the world gobbles up more data, it has turned the telecom industry into a significant producer of greenhouse gas emissions. By incorporating more digital and sustainable practices across their operations and supply chain, telecom operators can improve their sustainability and help their customers do the same. (See Exhibit 6.)

- Map out a fiber strategy. Telecom operators that replace aging copper networks with fiber can build reliable fiber-to-the-home (FTTH) networks that yield higher average revenue per unit and lower operating costs. Depending on their location, operators may be able to tap into government subsidies, such as those included in the $1 trillion US infrastructure law passed in late 2021, to offset upgrade costs.

- Consider working with partners to offer 5G. Although companies know that they must deploy costly 5G networks, they will have to determine how to do so in a way that maximizes their return on investment. One option is to work with partners to monetize 5G . Once operators roll out commercial networks, they can combine 5G with innovations such as edge computing for both enterprise uses (including Industry 4.0 services and industrial automation) and consumer uses (including connected stadiums and gaming).

To keep creating value, telecom infrastructure companies must continue to innovate and evolve their business model to digitize processes, optimize networks, expand coverage and services, and provide high-quality service. For full-service operators, digitization will be a key driver of profitable growth, along with solid strategies for 5G, fiber rollout, and sustainability .