Most business leaders are only now beginning to realize the true importance of trust. More than a mere sentiment, trust has economic value—and in the digital age, its relevance continues to grow. At the macro level, it enables new disruptive products, services, and strategic moves; at the micro level, it smooths the way for smaller transactions at scale among a vastly greater number of buyers and sellers who have no prior relationship. The business value of trustworthiness is not just monetary: trust is becoming increasingly important to a company's success in recruiting talent; to its Net Promoter Score; to its environmental, social, and governance (ESG) performance ; and to its very license to operate.

It’s no secret that shareholder sentiment is no longer the sole driver of a company’s business value. The views of many different stakeholders about a companies’ related practices and responses to specific issues are increasingly relevant. Hence, the ability to gauge stakeholder trust in near real-time can be enormously useful in an era when investors’ perceptions are no longer the predominant measure of business success.

This article highlights analyses that we conducted using BCG’s Trust Index to measure and decode stakeholders’ perceptions of the trustworthiness of more than 1,000 of the world’s largest companies. We contrast the most- and least-trusted companies, deconstructing the elements that shape stakeholder perceptions of trustworthiness and distilling from emerging patterns some valuable insights about the characteristics and practices that build and sustain or destroy trust.

What Is Trust, and Why Is It Hard to Measure?

In academic literature, trust is defined as the willingness of a party (the trustor) to be vulnerable to the actions of another party (the trustee). In a business context, broadly speaking, stakeholders (trustors) put a certain level of trust in a company (trustee) to fulfill a promise—whether that promise takes the form of a value proposition (product or service) to customers, an intangible such as corporate purpose to employees, earnings guidance to investors, or some other commitment. In doing so, stakeholders put themselves in a vulnerable position, trusting that the business will act in a way that aligns with their own interests. For example, you might trust your bank to safeguard your money, or your employer to live up to its societal aims, or your Tier 1 supplier to honor its pledge to reduce its carbon footprint.

As a latent psychological state and a predisposition to engage, trust is only indirectly measurable, through indicators such as transaction costs, or inferred from the attitudes and behaviors that people convey explicitly or implicitly in their communications and actions. Trust is naturally dynamic. It fluctuates, as individuals reevaluate their perceptions in response to new information and changing circumstances.

Introducing BCG’s Trust Index

The elements that generate, sustain, and enhance trust among stakeholders—the traits, decisions, and actions of companies—are many and complex. Until now, it has been difficult to distill them in order to understand their interrelationships and to link them to business performance. BCG’s Trust Index does just that.

Unlike traditional efforts to measure trust, BCG’s Trust Index draws on real-time stakeholder communications, and applies natural language processing (NLP) and AI to analyze and quantify stakeholder perceptions. Constructing the Trust Index involves scraping the internet (traditional news sources as well as Twitter), combing through thousands of articles and posts on each company, and using a research-validated list of more than 200 trust-related keywords to identify instances in which the text mentions the company in the context of trust. Working with an NLP engine, we then analyze the trust sentiment behind each mention to gauge whether the perception is positive, neutral, or negative. (For this report, we searched only English-language sources, but the index can be applied in other languages as well. A detailed explanation of the methodology appears in our full report.)

To identify the mentions that relate specifically to trust (or distrust), we categorize keywords according to four dimensions of trust, which we identified in our

past research:

- Competence—whether the company can effectively accomplish a specific task at hand, or (in other words) whether it can deliver on its promise to stakeholders

- Fairness—how equitable and empathetic the company is in delivering on its promise

- Transparency—how open and unambiguous the company’s decision making and actions are

- Resilience—how effectively the company avoids or recovers from challenges and crises

This approach enables us to analyze a company's trust score on an overall level and by individual dimension—for example, how its competence score has trended over time—so that we can more deeply understand its perceived trustworthiness. Dimensions also provide a window into context-specific reasons that encourage people to trust (or mistrust) and into the multifaceted nature of trust. Thus, we might notice that people trust a particular business for its competence in delivering its products and services to customers, but do not trust it for its fairness because of its weak commitment to social responsibility. Because the NLP engine can identify common themes in the trust-related mentions, we can assess the rationale underlying the scores. By analyzing the influence of each of the four trust dimensions and examining the more granular themes associated with companies that earned high and low trust scores, we obtain a useful reading of a company’s trust “health,” and we start to decode the "why" behind that reading.

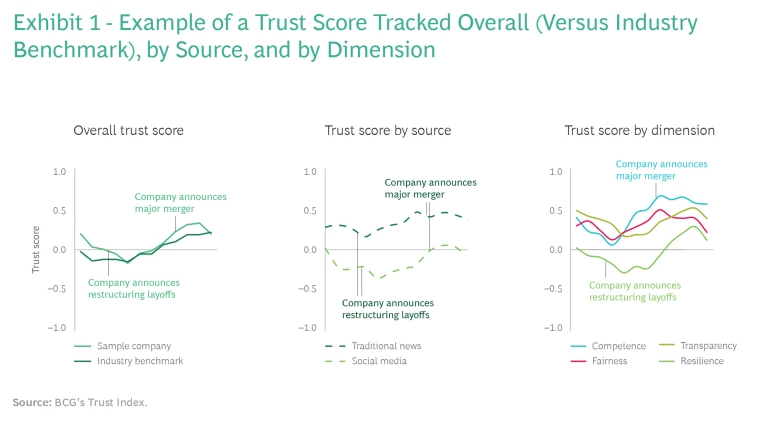

Exhibit 1 illustrates this multidimensional tracking capability, using data underlying the trust score of one company in our data set. The graph on the left compares the company’s trust score to its industry benchmark. The center graph shows that social media mentions had a powerful impact on the company’s drop in perceived trustworthiness. The graph on the right shows that, despite the company's relatively high competence score, its overall trust score has been trending downward as a result of declining scores for fairness, transparency, and resilience.

What the Index Reveals

In addition to uncovering the trust performance of individual companies, the Trust Index gives us a macro view of the trust record across a full data set—in this case, 1,100 of the world’s largest public companies (those with market capitalizations exceeding $20 billion) from 2018 through 2021. We break down perceived company trustworthiness along different lines to discern broader trends: by the entire set of companies, the Top 100, or the Bottom 100; by region or sector; and by a given point in time or an entire time period. We also deep-dive into the sentiment underlying trust scores to better understand the dynamics and patterns that govern how trust in businesses is built, maintained, and destroyed.

In the full report, we probe a wide range of questions, including the following:

- Do the most trusted companies generate more financial value?

- In what regions and industries are the most- and least-trusted companies found?

- How dynamic are trust scores? And how much does the roster of Top 100 companies change from year to year?

- On average, has trust in the world’s largest companies increased or decreased over the past four years, pre- and mid-pandemic?

- How does trust correlate with other business metrics, such as ESG ratings?

- What types of actions or events lead a company to be perceived as most- or least-trusted?

Among our many noteworthy findings are the following:

- Trust pays off. The 100 most trusted companies generated 2.5 times as much value as comparable businesses at year-end 2021. They also had 47% higher P/E multiples. The link between trust and value highlights the need to take trust seriously.

- Trust is highly dynamic. Fewer than half of the Top 100 companies from any given year were still in the Top 100 the following year. For the Bottom 100, turnover was as high as 70%. So business leaders need to measure and manage trust on an ongoing basis.

- Trust levels rose during the pandemic. For all but the Bottom 100 companies in our study, average trust levels grew between 2018 and year-end 2021. Trust score CAGR grew less for the Top 100 than for the overall group (likely because the Top 100’s levels were already high), but it eroded the most among the least-trusted companies.

- Ten themes commonly affect companies’ trust positions. We identified ten specific themes that most frequently establish, enhance, or destroy trust. The ability to track performance at such a granular level can help leaders devise strategies to improve their companies’ trust position. We found that the impacts of these themes vary markedly, depending on the company’s starting trust position. For example, for low-trust companies, crises are a major trust destroyer, especially when caused or exacerbated by negligence or recklessness. In contrast, high-trust companies, while not immune to major unexpected difficulties, avert, handle, and recover from crises in ways that maintain or even strengthen their perceived trustworthiness.

How Can Businesses Decode and Improve Their Trust Position?

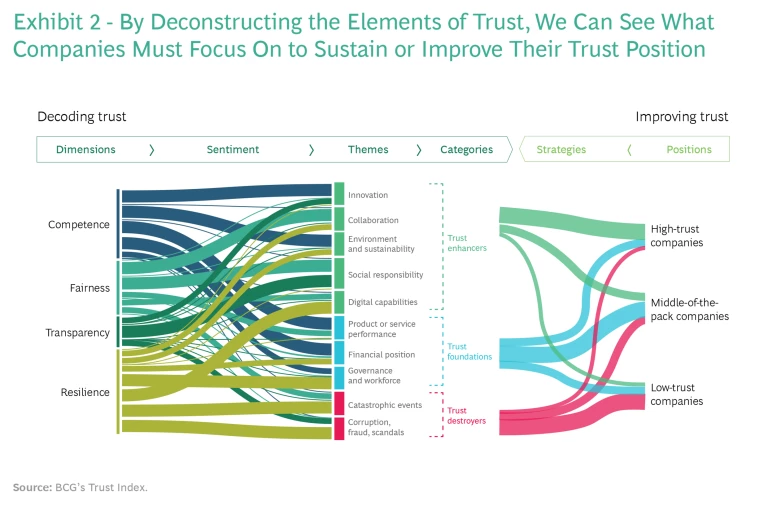

The left-hand side of Exhibit 2 shows the correlations between the four trust dimensions (competence, fairness, transparency, and resilience) and the ten themes most commonly associated with establishing, enhancing, or destroying trust, based on the analysis of our dataset. The right-hand side indicates which areas companies need to focus on to sustain or improve their trust positions.

Consider the transparency dimension, for example. The theme that, by far, correlates most strongly with transparency is social responsibility. In other words, transparency scores were most influenced by mentions of social responsibility; the thick dark green wavy bar linking the two reflects the high volume of online mentions of social responsibility (whether positive or negative). The next-strongest influence on transparency involved discussions of corruption, fraud, and scandals, followed by discussions about innovation. Conversely, while innovation correlates strongly with transparency, it correlates even more strongly with competence, as the relatively greater thickness of the bar connecting innovation and competence shows.

The right-hand side of the exhibit shows how companies can advance their trust improvement efforts by targeting trust enhancers, trust foundations, or trust destroyers, based on their existing trust position. High-trust companies should continue to concentrate on trust enhancers, while also keeping an eye on trust foundations. Those with middling trust scores would get the greatest benefit from building up their trust foundations, while also tending to enhancers and guarding against destroyers. Low-trust companies should prioritize efforts to mitigate trust destroyers, while they work on building trust foundations.

Leveraging the findings from our Trust Index analysis, our report provides a set of actions that leaders can take to improve their company’s trust position. It also offers case examples and recommendations to business leaders for managing and improving their company’s perceived trustworthiness.

Trust has never been more essential to business than it is today. Yet being trusted today is no guarantee of being trusted tomorrow. People tend to think that trust rises or falls more or less spontaneously in response to dramatic developments such as the announcement of a new executive or the exposure of a corporate scandal. But as our research shows, trust reflects the influence of myriad inputs and levers, many of which, until now, were not associated with it in any demonstrable way. As this report and our previous research indicate, companies can indeed forge and manage trust in business and socioeconomic systems. Those that do so can enjoy long-lasting advantage.