As competition grows, plans need to win their members’ trust—and their renewal—every year. Here’s how to do it.

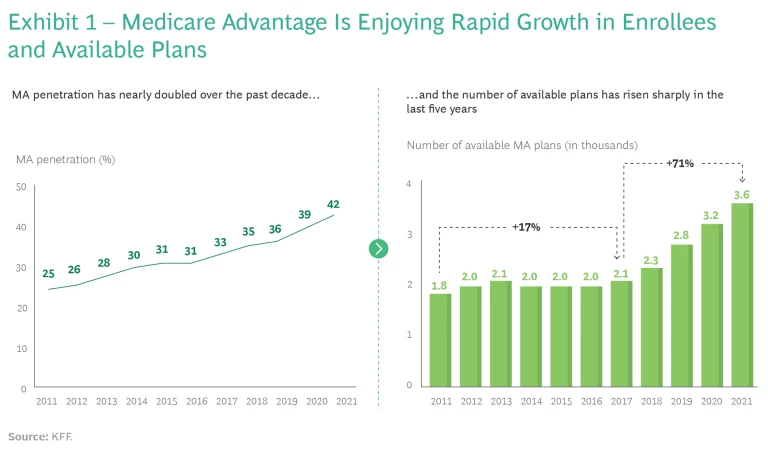

It’s been one of the fastest growing segments of the health insurance market. Since Medicare Advantage (MA) was established in 2008 as a lower-cost alternative for seniors looking to save on monthly premiums, benefits have proliferated and MA plans have attracted more than 26 million members—42% of all Medicare recipients—according to the Kaiser Family Foundation. MA accounted for more than $340 billion, or 46%, of Medicare spending in 2021.

The allure of such a large and growing market is obvious. But managing a profitable MA plan is challenging, especially as competition intensifies and consumer choice expands. The number of MA plans has risen as quickly as the number of new members—to more than 3,800 in 2021, a jump of 71% since 2017. (See Exhibit 1.)

Plans require substantial investment in design and features to attract members. Payers must also manage complex systems of rewards and incentives. As competition has accelerated, plans have invested more and more in expensive features and benefits, including dental and vision coverage, high-touch on-demand support, customizable plans, companionship programs to reduce loneliness, and enhanced pharmacy benefits. To provide in-home and virtual service and support, more payers are partnering with, building, or acquiring their own medical groups; to expand network options and enable members to get faster access to care, payers are working in closer partnerships with providers.

At the same time, payers are trying to lower costs for members through, for example, cash payments ranging from Part B buydowns to gift cards and reductions in premiums and out-of-pocket costs. All told, benefits that were once considered novel and extravagant are now considered table stakes as the arms race to attract new members builds.

Achieving significant scale has therefore become a prerequisite to profitability—but the level of competition makes scale a difficult nut to crack. The top three MA payers, which have made the largest investments in plan design, features, and technology, own more than half of the MA market, and the top 10 companies control more than 75%, according to Mark Farrah Associates, which aggregates CMS data. While the large players have taken a considerable share of the market, interest and investment in MA from regional plans and venture-capital backed start-ups have also increased.

In such a competitive market, how do plans effectively differentiate themselves?

In such a competitive market, how do plans effectively differentiate themselves? Are payers locked into a race to the bottom with ever richer benefit design, or are there other ways of competing?

As is often the case, the customer provides the answer.

The Evolving MA Consumer

Consumers continue to educate themselves. As we wrote in 2016 and again in 2019, consumers, including seniors, have learned to expect a high degree of personalization and customization from the companies they do business with. So to win in MA, payers must develop a consumer-centric plan design with offerings tailored to meet the needs of subsegments within the patient community . The Center for Medicare Services (CMS) brings a high degree of transparency to the MA market through its STARS rating program , and CMS is now doubling the weight of member-experience measures starting in 2023.

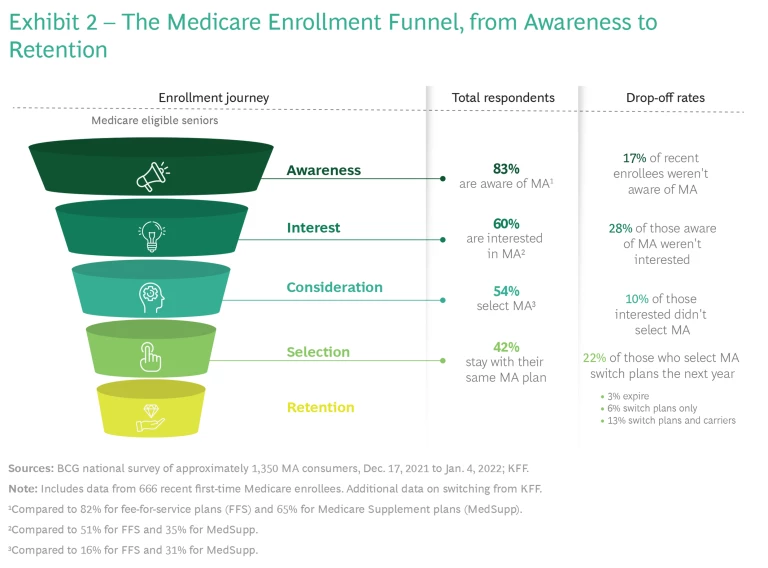

Our latest market study, which involves a representative sample of 1,350 seniors across the US, reveals that consumers are better informed than ever about MA. Fewer than 20% of seniors who recently made an enrollment decision reported that they were not aware of MA. Fewer than 30% of those who were aware of MA said they had discounted it as an option, and about 90% of those who considered MA an option ultimately selected an MA plan. (See Exhibit 2.)

Among MA enrollees, we found that many consumers are willing and able to do their own research, and they are more open to switching to find the right plan for them and their needs—which heightened competition facilitates. As MA plan offerings have mushroomed, MA consumers have also demonstrated more diversity in terms of need. Many members chase benefits, others look for network breadth, and still others look for payers to differentiate on experience, customer service, and brand. The strong growth of PPO (preferred provider organization) plans further demonstrates the growing preference for choice and for plans that bridge the historic gap between strict HMO networks and fee-for-service or Medicare supplemental coverage.

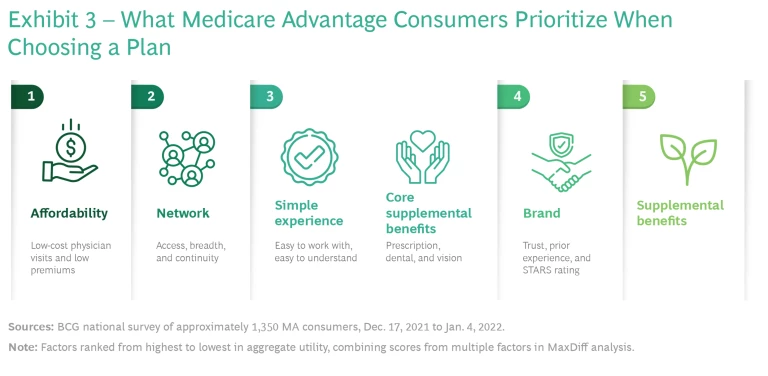

Across the board, consumers still tend to prioritize affordability and the breadth of access and continuity that networks provide them, but the importance of different factors varies by consumer segment. (See Exhibit 3.) Our latest research surfaced four broad types of MA member, which we have grouped into stylized personas for descriptive purposes.

Value Seekers. These people often struggle financially, and they may be continuing to work past traditional retirement age. They don’t go to the doctor very often and don’t take many medications. They want health care that doesn’t break their budget, and they are more likely to shop each year for the best deal. Their priorities include affordable payments, extra benefits (such as dental and vision care), and cash benefits. They represent about 30% of the Medicare market. About 80% of consumers in this segment choose MA plans.

All the Extras. These people live in a variety of home situations, and they are likely to have some health concerns. This segment is much more likely than the others to report low levels of social support and poor social determinants of health. They keep their eyes open for plans that offer more support in managing health. They want to maximize the benefits they get from a health plan. Their priorities include affordability, both in terms of monthly payments and cost of care, but also a wide range of supplemental benefits, including dental, vision coverage, and various forms of cash benefits and more novel benefits such as transportation reimbursements, in-home care, or companionship. They represent a narrow slice of the Medicare market (roughly 10% to 15%) but some 60% choose an MA plan.

Experience Seeker. These people tend to have college educations and comfortable living situations. They may have a chronic condition (such as arthritis) but they are not overly concerned about their health. They want a smooth and easy health care experience and they prioritize affordability, a trusted carrier, easy-to-understand benefits, and access to doctors nearby. They are willing to compromise on other elements in favor of convenience and a positive experience with their carrier. They are not willing to pay more for supplemental benefits they don’t expect to use, but they are willing to pay for coverage in general (as evidenced by the 40% of this segment that choose Medicare plus a supplemental plan over an MA plan). They make up about 20% of the market and about 45% of them choose MA.

Provider-First Shoppers. This is the largest segment of the Medicare market—about 40%. Provider networks are top of mind for these consumers, who tend to be of average income and wealth but diverge slightly in priorities according to health status. Roughly half are managing ongoing health conditions and prioritize continuity of providers over brand or experience. The others are relatively healthy and prioritize “marquee” providers, trading off on other benefits for access to the “best” doctors and hospitals. This segment is split between MA and Medicare supplemental plans, with roughly 40% choosing falling into each category.

Choose Your Strategy…

Changing consumer behavior is causing payers to adjust the ways in which they compete. They can no longer focus primarily on attracting members when they age into Medicare under the assumption that those same members will stay with a plan for a prolonged period. Plans now need more comprehensive strategies that anticipate competition at multiple stages—continuing to raise awareness of MA as an option, creating products to attract members as they age in, and retaining the customers they attract while convincing others to switch.

While companies still need to be competitive in several dimensions, they now have multiple distinct ways to differentiate by focusing on one or more of the following strategies:

- Continuing to innovate on the products they offer and providing maximum benefits. This will likely remain the best way to appeal to the broadest consumer segments. As a large set of consumers will actively look for a better deal during each annual enrollment period, payers need to keep pace with the latest, most innovative, and richest benefit offerings. Benefits offered in the past have included dental and vision care and transportation. Going forward, we believe that benefits such as cash payments, assistance in finding long-term care solutions, financial health planning, and personalized or customized benefit structures will be increasingly common lures for attracting members who value affordability and supplemental benefits. This strategy requires cost effectiveness and the ability to select the right benefits to offer.

- Improving choice and access. Offering the most flexible networks and access to care—trading off benefit richness for flexibility—can be effective for plans and attractive to certain consumers. Offering benefits such as prioritized physician appointment scheduling, guaranteed access to select providers, on-demand second-opinion services, telehealth services, and curated and on-demand experiences to enhance care (such as physical therapy and sleep training) can be plan differentiators.

- Simplifying the experience. Offering ease of interaction and a less transactional relationship that is streamlined and characterized by high degrees of trust and service (often using digitally enabled tools for member engagement) is an attractive approach for a growing number of members. Popular benefits include “concierge” customer service, member-specific help navigating the health care system, simplified appointment booking, an extensive but easy-to-use digital interface for member self-service, and marketplaces consisting of payer-vetted providers.

…And Know Your Strengths

As we wrote in 2019, how each company—or type of company—approaches the MA market depends in large part on its starting point. Large national incumbents, such as Humana and UnitedHealth Group, have much greater scale and share than smaller regional players, for example, and the latter should assess whether entering MA makes sense as part of their overall business strategy. Blue Cross Blue Shield plans can draw on longstanding relationships with members, robust commercial books of business, and established provider partnerships.

These factors, which traditionally have underpinned the success of Blue plans in the Medicare supplemental market, could be similarly leveraged as part of age-in and retention strategies to accelerate MA growth. Other, smaller plans—such as new analytics-driven entrants (Devoted Health and Clover Health, for example), provider-sponsored plans, and pure-play MA plans—can bring unique differentiating capabilities to the market. But they will need to focus on delivering outsize value through an improved customer experience and network curation, because they probably cannot compete effectively on price and scale.

Each type of plan also needs to identify which segments to target and the strengths it can bring to bear. New market entrants should carefully select the consumer segments they want to attract and invest disproportionately based on the differentiated value they offer, as trying to be everything to everyone is a sure recipe for failure. They should design their products with a willingness to make the necessary trade-offs among affordability, supplemental benefits, cash back, network, and customer experience that are in line with their focus and the needs of their target customer. They should build out a sales, marketing, and network strategy that is aligned with the core value proposition.

For new market entrants, trying to be everything to everyone is a sure recipe for failure.

Niche players need to recognize their market position and understand the consumers they are trying to win in order to inform future moves and investments. A key strategic question for these plans is whether the goal is to penetrate more deeply into segments where they are succeeding today or to broaden appeal for wider reach. Either way, they must continue to win the hearts of their target customers. With the increased shopping today, it is no longer sufficient to focus exclusively, or even primarily, on members who are new to MA. Smaller players in particular must ensure they stay relevant, continue to push the envelope, and innovate to maintain the loyalty of their current customer base.

Larger market incumbents with significant market share also need to understand their consumer mix and how it links to their current offerings so they can play effective offense and defense. On the offensive side, their offerings and go-to-market strategies need to evolve with the market. They should continuously evaluate opportunities to expand their presence by tailoring products and sales and marketing efforts to capture new segments as the market expands. At the same time, they need to be mindful of increased competition from new entrants and niche players and ensure that they are offering value to existing customers, whether through benefit design, experience, or network.

For players of all sizes, winning consumers when they first age into the MA market isn't enough, and relying on customers staying for life is a faulty assumption. Plans need to win members’ trust and renewal every year in ways that weren’t required in the past. With the increased heterogeneity of the market, providing personalized messaging and customized experience becomes a valuable capability. Since it typically takes two to three years to break even on memberships, reducing churn and improving customer acquisition costs is critical. These needs put a premium on building a strong chassis that supports the strategy, including the core capabilities to deliver the product and the cost structure that can support it.

MA will continue to be an attractive, growing market, but it is easy to get lost in the tangle of choices and trade-offs and fall into the trap of trying to maximize for everything at once. There are multiple ways to differentiate and compete—but knowing what your focus is and sticking to it are becoming prerequisites for success.