Urban mobility is the source of multiple pain points. We believe that ride-hailing fleets made up of autonomous, electric vehicles are the best solution.

Sure, you love your vintage Mustang or whatever dream car has captured your heart. We focus on the automotive industry , and we certainly understand. But for a lot of people, owning and operating a car, particularly in an urban setting, is a pain. It’s expensive, given upfront costs as well as insurance, repairs, parking fees, tickets for infractions, and so on. And time that could have been spent more productively is lost to traffic jams or searching for parking.

Society at large suffers from the shortcomings of today’s urban mobility offerings, too. In lower-income areas, affordable and dependable access to mobility is lacking, making it difficult or impossible for residents of those areas to commute to many jobs and contributing to economic inequality. In Chicago, for instance, commutes in low-income areas take an hour longer than they do in high-income areas. The proliferation of vehicles on the road contributes to pollution and poor air quality that is detrimental to health: light-duty vehicles emit 6 gigatons of CO2 annually, making up 12% of total global emissions. Health is at risk from traffic accidents as well. More than 1.3 million lives are lost annually because of traffic accidents. Alarmingly, the number has risen during the pandemic, by 17.5% from the summer of 2019 to the summer of 2021—the largest two-year increase since the World War II era.

In fact, urban mobility is the source of multiple pain points—and not just for car owners.

Take ride hailing. Service providers in this business are still struggling to make their economics work. They’re dependent on contracted drivers, who constitute some 70% of their operating costs. Ride-hailing services are not efficient, given today’s relatively low vehicle utilization rates. And the pending reality of mandated vehicle requirements—like the push for electric vehicles—will disrupt the model, at significant cost to providers.

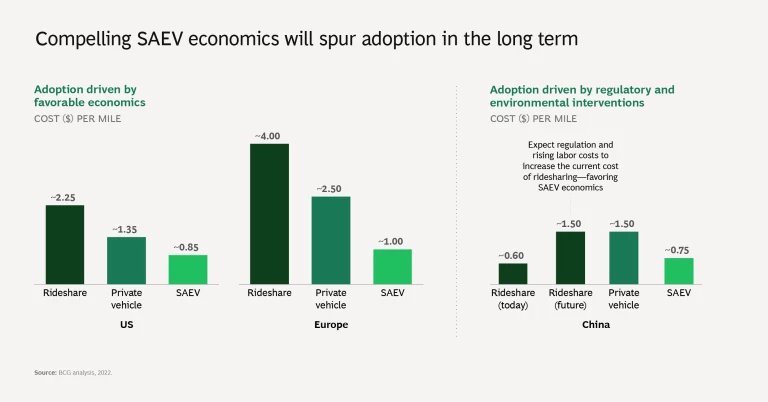

Some solutions to the urban mobility challenges are in play, but they have yet to resolve the pain points. Ride hailing is one of these options, though it doesn’t meet all urban mobility needs (on a cost-per-mile basis, ride-hailing services are still more expensive than personal-car ownership, for instance, and currently they contribute to congestion and pollution). Attempts to push city dwellers to shared or electric options are not well coordinated. Multimodal integration is extremely limited, and, with few exceptions, it generally remains expensive and inconvenient to stitch together trips across modes (such as ride hailing, public transportation, and micromobility options like bicycles and scooters).

Service providers in the ride-hailing business are still struggling to make their economics work.

We believe the best solution is shared autonomous electric vehicles (SAEVs; also called robotaxis).

This is an ideal moment to take a close look at SAEVs. In June 2022, San Francisco approved the first commercial SAEV fleet in a major US city, a ride-hailing option operated by Cruise (whose majority owner is GM, maker of the Chevy Bolt cars that will populate the fleets). Initially, the passenger service will operate in certain areas of the city, at certain hours, and in certain weather conditions. The plan is to extend usage over time depending on the results of the initial rollout.

The Promise of SAEVs

Done right, SAEVs can address long-standing pain points:

- They can give consumers an affordable, door-to-door means of reaching nearly any destination in a metropolitan area, thus increasing access to jobs, education, and more. And they can make it possible for many people in urban areas to forgo vehicle ownership affordably. (Of course, these benefits do not apply to people with certain travel characteristics, like needing car seats or commuting with pets—at least, they do not apply yet.)

- SAEVs can give ride-hailing service providers the means to become profitable (by allowing providers to increase the utilization of their active assets to 70% or more). SAEV fleets can be standardized to improve the customer experience. These vehicles can also be moneymakers beyond the fare that covers the ride: the software and sensors that power the cars in these fleets generate data that can be monetized for advertising and other revenue streams, and advertising can directly target passengers while they are in the vehicle.

- Society as a whole can benefit from SAEVs, which can reduce vehicle ownership and miles traveled, leading to less congestion and safer, more livable and walkable cities. And because SAEV fleets run on electric power, they would also decrease pollution.

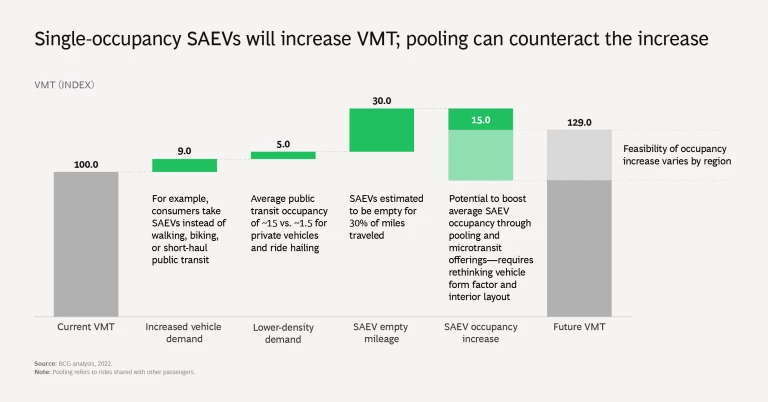

Getting it right, though, depends on effective policies and regulations. Without these, SAEV deployment could actually exacerbate pain points. BCG, in conjunction with the World Economic Forum and the City of Boston, simulated SAEV deployment in the city . We found that unregulated SAEV-based ride-hailing fleets would cannibalize public transit for shorter downtown trips and thus worsen congestion and overall mobility throughput. Policymakers need to create the right incentive structure to increase the average occupancy per vehicle (accomplished through ride pooling) beyond today’s levels and incorporate SAEVs into the public transit network as a complementary offering, not a replacement. That will tip the scales on total vehicle miles traveled, suppressing the potential increase in VMT, congestion, and pollution. (Policymakers must also work to ensure that ride pooling is a safe option; our research showed that some commuters hesitated to pool in an autonomous car because of safety concerns.)

The Encouraging Economics of SAEVs

Although the tech stack for level 4 (L4) autonomy (which is required for SAEVs) costs more than $20,000, key components (like lidar) are now significantly less expensive than they were five years ago. And, as we look to 2030, we expect the cost of tech stack components will fall to less than half of today’s level, down to about $9,000 per vehicle.

We envision the typical SAEV as a purpose-built or van-based vehicle with an eight- to ten-seat capacity as well as automatic doors and a lift gate for convenient entry and exit. We estimate that, in 2030, a SAEV—including the electric powertrain, battery, and tech stack—will cost about $55,000 (in 2020 dollars).

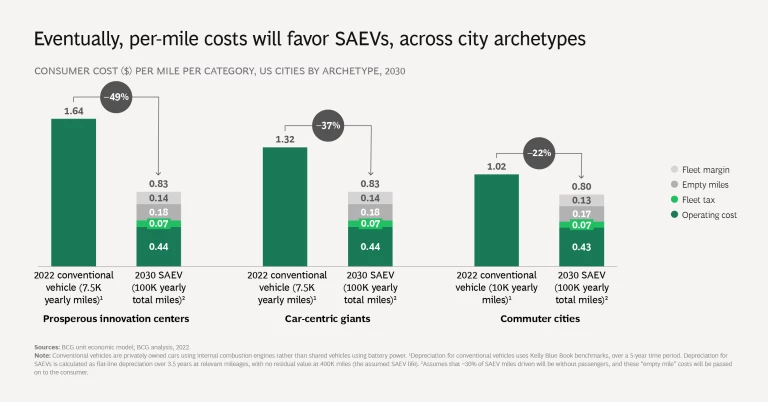

At this vehicle cost and with the high degree of utilization that we anticipate—70%, meaning that each vehicle will operate about 100,000 miles per year, carrying passengers for 70,000 of those miles—the per-mile economics are very attractive: approximately 80 cents. This is 20 to 50 cents cheaper than owning and operating a personal car, depending on the city archetype in the US. (Archetypes are based on factors such as city size and roadway infrastructure. We looked at three SAEV-attractive archetypes: prosperous innovation centers, such as London, with a population of 2 million to 8 million and an urban pattern consisting of several medium-density “towns”; car-centric giants, including Toronto, with a population of 3 million to 7 million in small, widely distributed clusters; and commuter cities, a US archetype encompassing places like San Antonio, with populations of 1 million to 3 million, and an urban core that is quickly becoming suburban.) Although fleet operators initially may elect to keep higher margins as they launch services in a city, we have modeled a 15% fleet margin as a steady-state assumption.

The economics are also very compelling in Europe. The per-mile cost of SAEVs will be less than half the personal-vehicle cost and a quarter of the ride-hailing cost.

The context is different in China. There, ride hailing is already very inexpensive, so SAEVs won’t provide a better offering on economic terms—at least not today. In the future, though, we expect environmental regulations and driver protections to increase the costs of traditional ride hailing, creating an opening for SAEVs to become a more attractive option in the 2030s.

The Likely SAEV Adoption Path

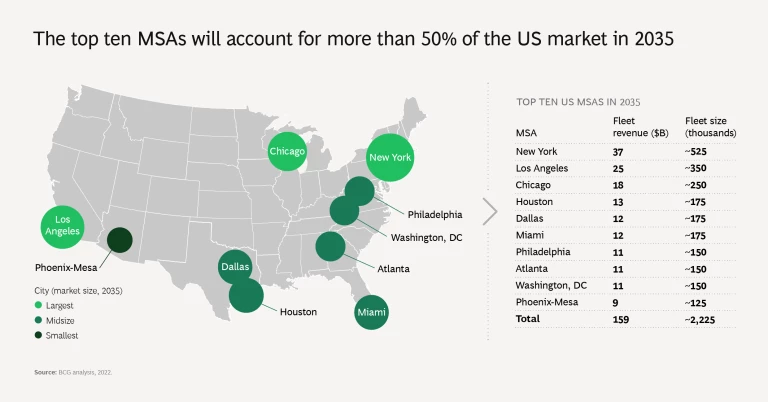

SAEV fleets won’t work everywhere. The economics are attractive only in large metropolitan statistical areas (MSAs), where consumers can be guaranteed a good level of service (for instance, a wait time for a ride that doesn’t exceed three minutes) and operators can count on profitable vehicle utilization of 70% or higher. Even within these MSAs, only 65% to 75% of miles traveled can be addressed through SAEV fleets, given drawbacks related to population density and roadway infrastructure.

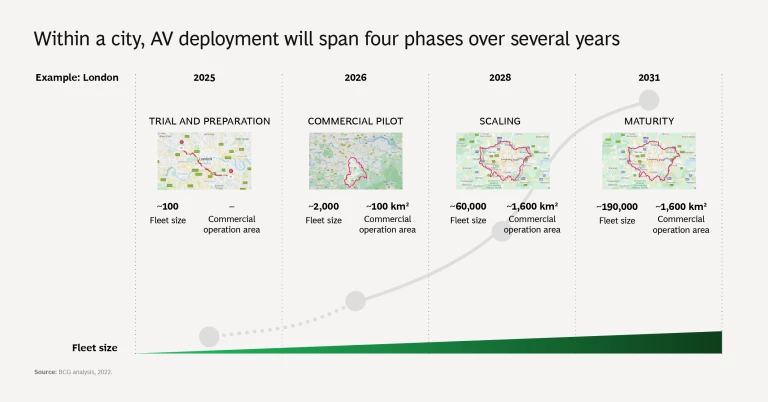

There are still significant and costly regulatory and technical hurdles to overcome. For instance, issues of liability and safety need to be addressed. And it will take years to move from initial mapping to scaling up fleets and coverage areas. L4 autonomy is not yet ready to scale. While it’s not advisable to give a hard deadline—many previously proclaimed industry milestones were missed—we believe fleet scaling will start in the latter part of the current decade, such that the first set of cities will have at-scale fleets by 2030.

At initial scale, SAEVs could account for up to 25% of passenger miles in the largest MSAs in the US, 14% in Europe, and 18% in China. BCG research showed that about 50% of urban residents have functional or emotional barriers to adoption (they smoke when in the car, travel with pets, travel with children, travel with cargo, or wouldn’t trust autonomous vehicles, for example), so we excluded them from our initial projections. Over time, all these use cases could also be addressed—but not in the initial scale-up of SAEVs.

The SAEV Contenders

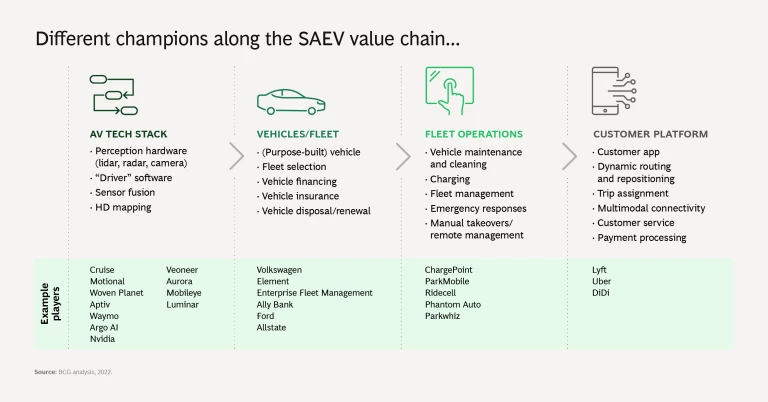

Currently, the competition to bring SAEVs to market is dominated by champions at each individual stage and value pool.

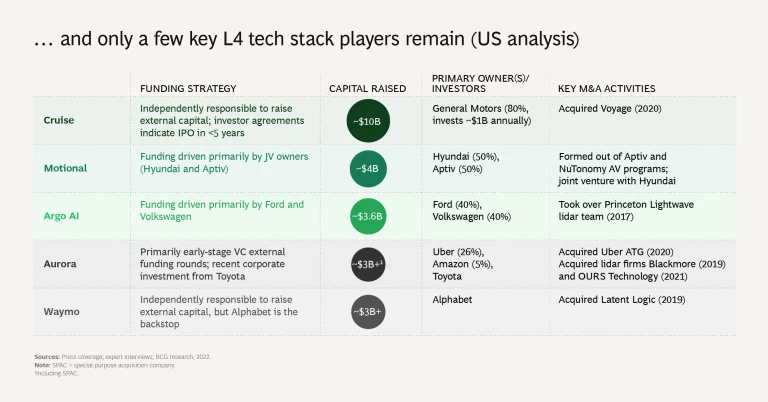

As SAEVs come to market, most regions will be served by just two or three major AV players, given the need for scale and multimillion-dollar R&D budgets. These requirements are spurring consolidation.

Local scale will be critical, which suggests that addressable cities will have one or two local AV leaders.

In the meantime, market participants are competing fiercely for funding and technical talent. Cross-pollination is common, with many players sourcing employees from the same prior employers.

Within the AV tech stack, the actual “driver” software is the most R&D-intensive element. Only a few companies have the funding to continue to push forward here. In the US, the field has narrowed to five players that are still serious contenders to commercialize L4 driving software for a SAEV use case: Cruise, Motional, Argo AI, Aurora, and Waymo.

As these companies look to capitalize on their R&D investments and tap into the largest possible profit pools, we have identified a trend toward more vertically integrated plays. This is the situation Waymo is in. While its focus is the AV tech stack, other members of the Alphabet family of companies extend the reach across the entire value chain, all the way through the customer platform with Google Maps and Android. The Alphabet companies appear to partner with third parties for two elements that are far from their core capabilities: the actual vehicle (teaming up with OEMs like Stellantis and Geely) and fleet maintenance (working with car rental companies such as Avis).

Mobileye is another interesting example of a company coming out of the AV tech stack and looking to vertically integrate to capture multiple profit pools. It announced that it is launching a robotaxi with Sixt in Germany this year while continuing to build out its advanced driver assistance system (ADAS) offering to OEMs in parallel.

It will be interesting to see where the key control points emerge—they will not be the same as in today’s ride-hailing landscape. Currently, ride-hailing fleets control a two-sided marketplace by connecting drivers with riders and managing willingness to pay. But in a future of SAEVs, those traditional capabilities will become obsolete; there will be no drivers, and cars will be owned as part of fleets. The advantage, then, will go to those that control other aspects of the marketplace: on the demand side, the consumer platform; on the supply side, the AV tech stack and AV fleet operations. The value of these control points is compelling competitors toward vertically integrated strategies. It remains to be seen how vertically integrated offerings will fare against a more platform-based approach, in which ride-hailing specialists like Uber, Lyft, and DiDi control the platforms on which cars made by the likes of Waymo operate. This is what Aptiv/Motional is doing in Las Vegas and Argo is doing in Miami.

The SAEV hype of the late 2010s has subsided, as has the outlook for the potential reach of SAEVs. But SAEVs are still highly viable, in the right setting. Granted, it might take until the end of the decade to see L4 robotaxi fleets on city streets at scale. But the core economics of SAEVs remain very compelling; thus, we are still bullish about SAEVs. Although adoption will be limited to the largest MSAs, SAEVs have the potential to claim up to 25% of miles traveled there. It’s not yet clear which companies will command these markets, but the competitive dynamics are extremely interesting.

Once L4 technology has reached scalability, regulation and multimodal integration will be the keys to making SAEVs a success story. Regulators have some questions to ponder. Among them: How does the law need to be adjusted to allow L4 AV operation (consider the steering-wheel requirement, for instance, and driver responsibilities)? How can the safety of passengers be ensured? How are the large array of AV players kept in line with safety standards? What’s the driver’s license equivalent? How can passengers and operators be incentivized to use these vehicles, and how can transportation authorities develop a system that blends SAEVs with other modes of transit—particularly those that are shared and electric?

Answers to these questions will help shape the marketplace—as will any other mobility-related moves that regulators choose to make. Currently discussed options, for instance, include banning personal vehicles in city centers and/or offering incentives to use multimodal transportation. Another possibility: making current public transportation systems free to encourage use and reduce congestion.

Any or all of these moves—among others—could figure into the transformation of urban mobility. While the precise route remains to be determined, we are certain of the ultimate destination: safer, more equitable cities with a better quality of life, thanks to the reimagined car.

The authors thank Benjamin Fassenot, Andrew Gillespie, Grant Guan, Will Jackson, Juliane Klein, Patrick O’Brien, Dario Remmler, and Brian Tung for their contributions to this research and analysis.