By building a durable competitive advantage in emerging climate-friendly tech, US players can unlock a huge global market.

Tackling the climate crisis is both a global imperative, and a huge opportunity for countries and organizations that can produce the clean technologies needed to deliver a decarbonized world. As an energy and technology leader, the US is well positioned to become a dominant player in these technologies. But it must build on its existing strengths and use targeted policy actions and investments to create a durable competitive advantage in global clean-tech markets.

We’ve identified six technologies that have the potential to play a major role in the energy transition and that exist in areas where the US can either build or maintain such an advantage—one that is much longer lasting than those achievable by short-term drivers such as incentives alone.

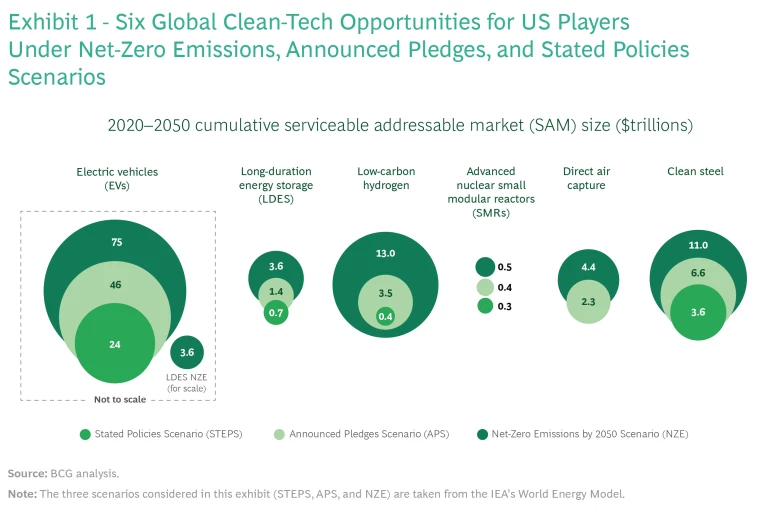

The six technologies in question—electric vehicles, clean steel, low-carbon hydrogen, long-duration energy storage, direct air capture, and advanced nuclear small modular reactors—represent a significant market opportunity for US companies. In Potential for US Competitiveness in Emerging Clean Technologies, a BCG study commissioned by Breakthrough Energy and Third Way, we estimate that US players could enjoy a cumulative domestic market in these technologies that will be worth from $9 trillion to $10 trillion from now through 2050.

However, US players stand to gain far more by developing a competitive edge that gives them a leading position in global markets. We estimate that the cumulative global serviceable addressable market (SAM) for US companies in the six technologies—which encompasses all countries where US exports are possible—could be worth a staggering $60 trillion through 2050 in prioritized value chain segments.

Our estimates assume that the world will follow the Announced Pledges Scenario (APS) developed by the International Energy Agency (IEA), the most likely of three IEA outlooks, which builds on the premise that governments will meet their current emissions reduction commitments in full and on time. But if the global community achieves net zero emissions by mid-century, the figure for each technology could rise significantly. For example, the cumulative SAM in prioritized value chain segments for electric vehicles could increase from $46 trillion to $75 trillion (See Exhibit 1.)

Recent legislative steps, particularly the adoption of the Inflation Reduction Act and its $369 billion of climate-related provisions, give us confidence that the US is on the right track. So does the country’s history of innovation and investment in scaling clean technology, its dynamic private sector, and its strong R&D base. But policymakers and other stakeholders must take further action to unlock flourishing domestic and international markets for US companies in these technologies and create a durable competitive advantage for the US ahead of other players.

A Snapshot of the US’s Current Position

Achieving a leading position in these six technologies would enable the US to develop export sales worth an estimated $330 billion in annual value in 2050—more than the approximately $200 billion in value of US fossil-fuel-related exports in 2021—and to create new jobs. In addition, if adopted at scale by 2050, these six technologies could enable approximately 20 gigatons per year in global emissions abatement as the world moves toward a net zero economy.

Here is a summary of the US’s current position, along with future challenges and opportunities, in these important technologies.

Electric Vehicles (EVs). Electric cars offer the largest global market opportunity for US companies among the six technologies. EVs are set become the fastest-growing segment of the automotive market, and US players are in pole position to serve the domestic market and to capture market share abroad. Legacy automakers in the US are rapidly transitioning from internal combustion engines to electrified powertrains. Meanwhile, US technology startups are leading the way in cutting-edge areas, such as autonomous cars and smart, connected vehicles. Legacy players must address two key challenges: ensuring that supply chains for batteries and battery materials are adequate, and retraining existing workforces in the skills necessary for the new age of electrified mobility.

Clean Steel. The US is among the world’s lowest-carbon-intensity producers of steel. US steelmakers have strong in-house capabilities in building, operating, and maintaining mini mills that use electric arc furnaces and direct reduced iron or scrap to make clean steel. Major opportunities exist in selling clean steel and in developing new technologies such as molten oxide electrolysis. In addition, the US can cement its position as a low-carbon steel producer through further deployment of renewable power generation. Wider adoption of carbon border adjustment mechanisms—which would create greater price parity between clean and traditional steel products and protect US players from higher-carbon imports—would also support the development of a strong domestic clean-steel industry.

Low-Carbon Hydrogen (H2). The US can take a leading position in the market for low-carbon H2, including both green H2 (produced using renewable energy and electrolysis) and blue H2 (produced using natural gas and carbon capture, utilization, and storage (CCUS) to sequester CO2 emissions), because of the country’s abundant renewable energy resources, natural gas resources, and CCUS technology and related infrastructure. To win in green H2, however, the US will need to quickly reduce costs through economies of scale and R&D so that it remains competitive with other parts of the world. And to win in blue H2, the US will need greater international alignment on what constitutes zero- and low-carbon H2, determined through life-cycle analysis, in order for European export markets to open to US-made blue H2. In addition, investment in innovative transportation and storage technologies, such as liquid organic hydrogen carriers, can strengthen the US’s market position.

Long-Duration Energy Storage (LDES). Electrochemical LDES comprises a set of nascent storage technologies that could permit higher penetration of intermittent renewable energy resources, such as wind and solar, into electricity systems. The US has a greater need than most countries for LDES solutions because of its aging transmission grid infrastructure and its decarbonization goals. Building a domestic LDES industry will support the achievement of those goals. Mastering the advanced manufacturing processes required to efficiently make battery modules at scale would enable US companies to create a long-term competitive advantage that can drive exports.

Direct Air Capture (DAC). The US is well placed to lead technology developments in DAC, the direct capture of carbon from the atmosphere, thanks to its expertise and storage potential. To build a competitive advantage, the US needs to rapidly create scale to drive down costs and secure international agreements in areas including carbon offsets. Notably, the global market opportunity in DAC would increase fourfold—greater than any of the other technologies—if the world were to achieve the IEA’s NZE scenario, rather than its APS. There are also opportunities to support oil and gas workers during the energy transition by locating DAC facilities near oil wells and upskilling the labor force.

Advanced Nuclear Small Modular Reactors (SMRs). SMRs can provide zero-carbon power generation with lower costs and greater safety than traditional reactors can. The US is the global leader in SMR-related patents. However, market potential is limited by the fact that a handful of countries dominate uranium mining, with Russia alone owning nearly half of all enrichment capacity. The US should consider building its own fuel production capacity by sourcing uranium from trusted allies, notably Australia and Canada. By doing so, the US can reap energy and national security benefits and enjoy a reliable source of green power.

Varying Market Opportunity Along the Value Chain

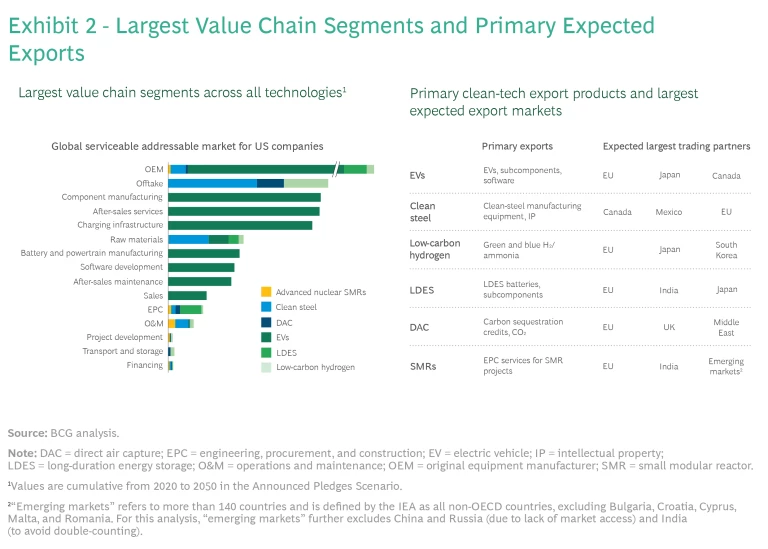

We believe that the US should target investment and growth initiatives in the value chain segments of these technologies that provide the greatest potential for building and protecting a competitive edge. Although the sizes of individual segments vary by technology, our analysis indicates that in general the original equipment manufacturing (OEM), after-sales services, and offtake segments stand out (Offtake involves the sale of final products such as H2 molecules and steel.) US companies can also use their R&D prowess across the value chains of all six technologies to create innovations that transform how the technologies operate. (See Exhibit 2.)

For example, electric cars will require new batteries with different inputs to reduce the industry’s reliance on scarce raw materials. In steel making, opportunities exist to create clean steel more efficiently. The DAC sector needs more effective and lower-cost sorbent technologies. And in low-carbon H2, there is scope to develop and scale up electrolyzers that can work well without rare metals.

Still, if strong global markets for many of the technologies we examined are to emerge, international agreements on regulations and standards are crucial. As mentioned above, the lack of consensus on carbon offset standards is holding back the DAC market. Agreement with Canada and Mexico on emissions intensity standards for clean steel is essential if the US is to capture the lion’s share of the North American clean-steel market. Meanwhile, the European Union’s focus on low-carbon H2 made from renewable energy threatens to shut out US producers of blue H2.

Key Enablers to Create Competitive Advantage

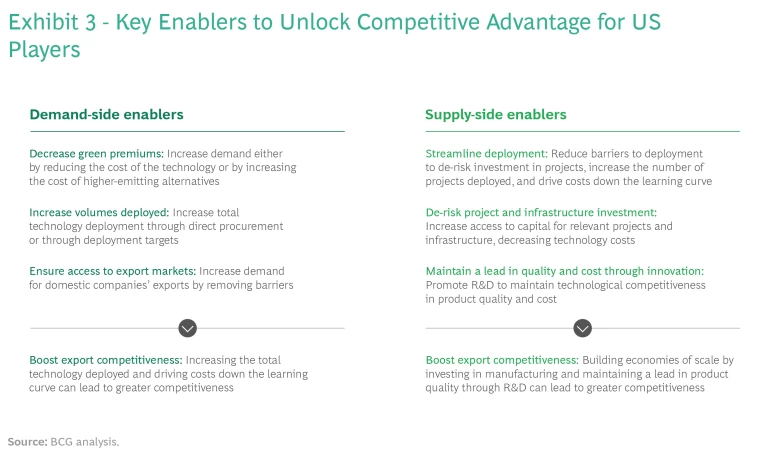

In addition to success with international agreements, several enabling factors may support US players as they seek to build a durable competitive advantage in our six technologies. These include demand-side factors, which can create a more favorable demand environment, and supply-side factors, which can help companies become more competitive by encouraging greater investment and economies of scale in manufacturing and can allow them to maintain a lead in product quality through R&D.

On the demand side, for example, players can increase market demand by reducing or removing the extra cost of choosing a clean technology over a conventional option or by increasing deployment volumes through government-directed procurement plans and targets. On the supply side, players can remove barriers to deployment by de-risking project investments and improving access to capital. (See Exhibit 3.)

Putting these enablers in place will require action from both policymakers and the private sector. Together, these players must create targeted, well-crafted policy proposals and investment plans that build support domestically and in key export markets. By doing so, they will permit the US to build a highly valuable competitive advantage and become a dominant player in technologies that could help avert the worst impacts of climate change while also growing the US economy.

Click here to see Third Way’s materials on this effort, along with the complete appendix for the report.