Companies can use the disruptive power of gender diversity to elevate innovation, resilience, and financial performance to new levels.

Women are significantly underrepresented in the leadership of finance functions. A new BCG global study finds that, despite gender parity in these functions, women hold only about one-third of the senior finance positions. The discrepancy is even greater for the function’s top job: only 13% of the companies we studied have a woman CFO. Our study points to several root causes, including an insufficient leadership commitment to diversity, absence of role models, and a lack of inclusiveness.

The scarcity of women finance leaders hurts companies. Previous studies by BCG and other organizations show that a more balanced share of women, especially in senior positions, boosts innovation, resilience, and financial performance, among other benefits. Additionally, we have found that women in finance functions are more likely than men to have multidisciplinary backgrounds, potentially enhancing their abilities to lead enterprise-wide transformations.

To capture these benefits, it is imperative that companies increase the share of women in finance leadership positions and give junior employees better exposure to them as role models. This requires new initiatives that promote not only the recruitment of women but also their retention and advancement. To sustain the improvements, companies must embed gender diversity in the organization’s culture. Given their mandate to improve corporate performance and lead transformations, current CFOs can play a crucial role in designing and accelerating these efforts.

A New Study Details the Gender Inequality in Finance

Our study included analyses of data on diversity, equity, and inclusion (DEI) from BCG’s Diversity and Inclusion Assessment for Leadership (DIAL) database and the backgrounds and career paths of major companies’ CFOs. (See “About the Study.”)

About the Study

DIAL Analysis. We analyzed DEI data within and across industries and regions from BCG’s Diversity and Inclusion Assessment for Leadership (DIAL) database. The database has more than 14,500 responses, including more than 1,000 responses from professionals in finance functions. BCG uses a survey to gather responses relating to four topics: DEI governance, perceived inclusion, gender obstacles, and leadership support.

CFO Analysis. To estimate the number of women serving as CFOs and compare their backgrounds and career paths with those of men CFOs, we focused on the top 150 public and private companies in the US, Europe, and Asia-Pacific. We selected 120 public companies from the Dow Jones Industrials, EURO STOXX 50, and Dow Jones Asia/Pacific 50 Select Dividend indexes. We selected 30 private companies (10 from each region) on the basis of total revenues reported in 2021.

Women in Finance Face Diversity Obstacles

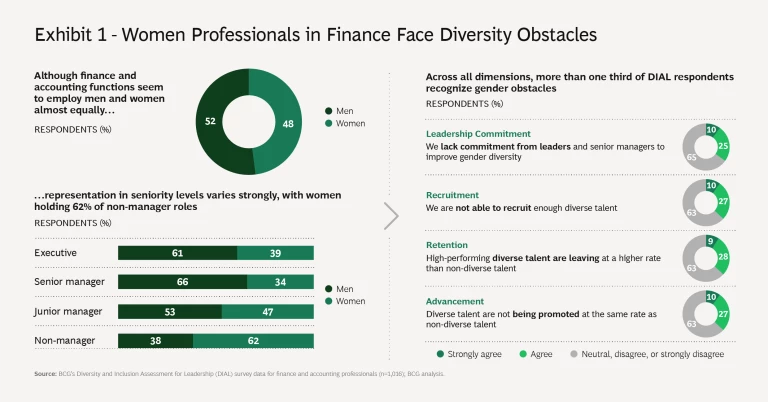

Based on the demographics of our DIAL DEI data sample, we estimate that gender representation in finance functions is nearly equal in aggregate. However, the proportions of men and women vary strongly across seniority levels. Men are significantly over-represented in leadership roles in finance, holding approximately two-thirds of senior positions (including directors and CFOs). Roughly the same percentage of non-manager finance roles are held by women.

Insights from the DIAL data point to potential root causes of gender discrepancies at senior levels.

Insufficient Leadership Commitment. Approximately 54% of finance professionals confirm that their company has programs, initiatives, or activities to promote gender diversity. However, 45% do not view the executive leadership team as committed to DEI.

Lack of Inclusiveness and Support. More than one-third of women finance professionals see room for improvement in how they experience day-to-day work—especially when it comes to having their perspectives recognized. They also want access to someone more senior who provides advice and actively supports their career. Approximately 17% of women finance professionals say that their direct manager doesn’t help them to develop their full potential, versus only 11% of men finance professionals.

Obstacles to Diversity. More than one-third of women and men finance professionals said that there are obstacles to gender diversity and inclusion in their company relating to leadership commitment, recruitment, retention, and advancement. (See Exhibit 1.)

Women CFOs Are Rarities and Often External Hires with Varied Backgrounds

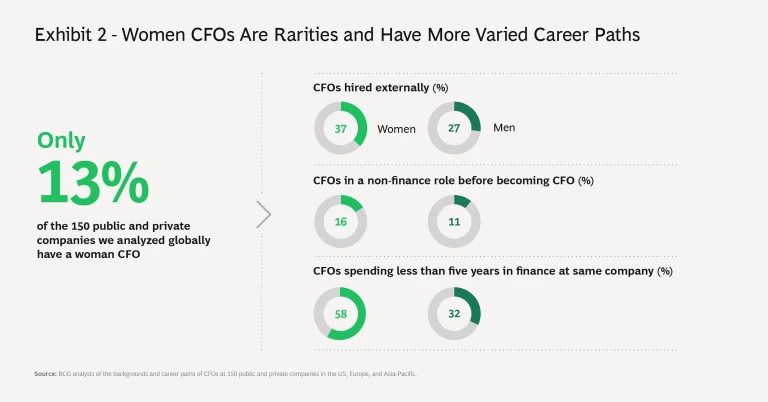

Of the 150 public and private companies we analyzed globally, only 13% have a woman CFO. The percentage is slightly higher for European companies than for those in the US and Asia-Pacific. Among European companies, we found the highest percentages in Belgium, the Netherlands, and the UK. Companies in Singapore and China had the largest share among the Asia-Pacific firms we analyzed.

Most of today’s CFOs—men and women—are “homegrown,” having been promoted to the role within their company. However, companies seem to be more open to bringing in women CFOs as external hires, which may reflect an absence of candidates within the company. Globally, approximately 37% of women CFOs were externally hired, versus approximately 27% of men CFOs. The difference is greatest in Europe: 56% of women CFOs are externally hired, versus only 22% of men CFOs.

Our study also found gender differences in career paths. More women than men have worked in areas other than finance before serving as CFOs. Globally, approximately 16% of women CFOs did not hold a finance role immediately prior to becoming CFO, and approximately 58% have worked less than five years in finance in the same company.

Women CFOs are more likely than men CFOs to have graduated from college with degrees in disciplines other than finance (32% versus 25%). The share with a non-finance degree is higher in the US (50%) than in Europe (33%) and Asia-Pacific (17%). Previous studies of CEOs have similarly found that women in the top job have more diverse experience than their men counterparts. (See Exhibit 2)

Women Finance Professionals Can Help Unlock a Company’s Potential

Addressing gender inequality in the finance function is imperative not only to promote equity—it also promises to boost corporate performance. This reflects the clear takeaway from our review of previous studies: companies can unlock their full potential by having more women professionals in the finance function.

Role Models Help to Attract and Retain Talent

A previous BCG study identified visible role models as a hidden gem for women. Many women are dispirited by not seeing a significant number of peers in more senior positions. They want role models who understand their situation or have faced similar struggles to balance work and home life. Additionally, another BCG study found that 51% of women would not accept a job from companies that do not match their DEI beliefs . Being perceived as a desirable place to work is especially important in today’s labor market, as many companies are finding it harder to retain qualified workers and hire replacements. For example, the number of Americans quitting their job is the highest on record, forcing employers to expand their search pools and increase the speed of hiring .

Gender Diversity Strengthens Resilience and Innovation

Because the finance function often drives corporate transformations , finance professionals play a crucial role in promoting resilience and innovation at the enterprise level. Studies have shown that diversity augments these capabilities, highlighting the valuable benefits of women in leadership.

Resilience. Greater diversity strengthens resilience—the capacity to survive the unexpected—which is a critical capability amid the uncertainty in today’s business environment. A BCG study found that diverse companies are better than their more homogenous counterparts at withstanding unanticipated changes and adapting to external threats.

Innovation. A BCG study found a statistically significant correlation between the diversity of management teams and overall innovation. Companies that reported above-average diversity on their management teams also reported innovation revenue that was 19 percentage points higher than that of companies with below-average leadership diversity—45% of total revenue versus just 26%. The same study found that the most significant gains for innovation come from changing the makeup of the leadership team with respect to executives’ national origin, range of industry backgrounds, gender balance, and career paths. Age and educational focus showed a lesser effect. Given that current women CFOs have more diverse professional and educational backgrounds than men, this finding suggests that their presence on a leadership team would promote innovation.

Research shows that women finance professionals help to boost corporate growth, returns, and market valuations.

Women Finance Professionals Boost Financial Performance

Growth, returns, and market valuations are key aspects of a company’s financial performance. Studies show that women finance professionals help to boost each of these aspects.

Growth. A BCG study shows that gender diversity is among the factors that best predict future corporate growth, which is the predominant driver of outperformance. Considering that finance functions are expanding their roles to become the “ custodian of performance ,” increasing the number of women professionals will be especially valuable as companies strive to grow.

Returns. Gender parity also makes a difference in the lower levels of an organization. A Morgan Stanley study analyzed 1,600 stocks globally, leveraging a framework with five major elements: percentage of women in the workplace, presence of women in key roles, equality in pay, company policies that promote equality, and programs that accommodate the needs of women and working parents. It revealed that companies with a larger proportion of women in the employee base realize higher returns with lower volatility and have moderately outperformed, on average, in the past five years.

Market Valuation. A recent academic study found that women CFOs have a more cautious approach to communication in earnings calls than men CFOs. They take a less optimistic tone, avoid obfuscation, and emphasize quantitative information. The researchers found that gender differences are especially evident in the questions-and-answers section of analyst calls and lead to favorable market and analyst reactions (as measured by abnormal stock returns in the three-day window around the call).

Additionally, the stock prices of companies with women CEOs and CFOs outperformed the market average, according to a study by S&P Global. In the 24 months after a woman CEO took the helm, stock price momentum increased by 20%. And 24 months after the appointment of a woman CFO, companies’ profitability increased by 6% and stock returns grew by 8%.

Companies Must Take Concrete Actions

To capture these benefits, companies need to accelerate their initiatives to advance the role of women in the finance function. Success requires taking actions across many areas—beginning and ending with leadership.

To sustain efforts to promote inclusiveness, companies must engrain an understanding of diversity in their company culture.

Leadership: Give Visibility to Role Models

The scarcity of role models in finance functions means that women are not benefiting from a “hidden gem” that they regard as one of the most effective ways to promote diversity. Women, like men, want to see that advancing in their careers in finance is possible—and normal.

Companies must create platforms that give better visibility to their women finance leaders. This includes appointing women ambassadors and spokespersons in the finance function and creating forums for the exchange of ideas and experiences among women and across seniority levels. Leaders should communicate their support of DEI initiatives and take visible actions to achieve improvements.

Recruiting: Seek Talent at All Seniority Levels

A substantial number of senior finance leaders are external hires or have not followed typical finance career paths. Especially among external hires, women from diverse disciplines have proven to be successful CFOs and can help improve gender parity in all seniority levels.

To capture the opportunities, companies should increase their lateral hiring efforts across all seniority levels and be open to filling finance positions with women who have nontraditional profiles.

Companies should also boost their employee value proposition by making traditionally women-focused benefits (such as parental leave, childcare, and flexible capacity programs) equally available to men and women. This helps to free women from the stigma of requiring extra support from the company to fulfill family and career obligations and signals a conscious effort to promote gender equality.

Retention and Advancement: Enable Women Throughout Their Careers

With fewer role models, women have less inspiration to draw from when managing their careers. Networks and trusted advisors can help women in finance navigate their way through career steps. To connect junior and senior women professionals, companies can develop formal sponsorship, mentor, and buddy programs as dedicated platforms for exchange. Such programs can help in retaining these professionals.

Companies also need to address advancement, which is still hampered by the unconscious biases of evaluators. The disproportionate number of men in senior positions in finance increases the probability that evaluators are men. To eradicate discrimination against women, companies need to counter the biases of evaluators, of either gender. Standardizing pay grades and offering equal pay helps to demonstrate commitment to equal treatment.

Culture: Build an Inclusive Workplace

Formal diversity programs and initiatives, at best, only offer partial or temporary solutions to the challenges of workplace equality. Many companies have hired more women and minorities, but few have created an environment that encourages them to stay for the long term. An adaptive, inclusive workplace makes it easier to maintain a diverse pool of talent over time, including a pipeline of leaders contributing to innovation and resilience.

To sustain their efforts to promote inclusiveness, companies must engrain an understanding of diversity in their company culture. Making benefits, such as parental leave and flexible capacity working models, available to both men and women, as noted above, is a powerful way to discourage stereotypical perceptions of women requiring special treatment. It also shows people that the company offers a viable path to balancing career and family commitments, which is crucial to enabling long-term employment.

Leadership: Continuously Monitor Progress and Recalibrate Targets

It is important not to become complacent about progress on DEI issues. Maintaining a well-established, inclusive workplace requires ongoing attention and prioritization. Companies should continually monitor the status of diversity efforts and consider the next steps needed to foster improvements. This requires defining clear metrics for measuring progress and holding leadership accountable for achieving strong results.

Two major action-oriented findings emerged from our study: First, companies would benefit from having more women in the finance function. Second, the women finance leaders of the future might not be traditional accountants or even come from the ranks of finance. These insights should be top of mind for executives as they seek to refine and accelerate initiatives to bring more women into all seniority levels of finance. The objective should not be to replicate the existing paradigm but to use the disruptive power of gender diversity to elevate innovation, resilience, and financial performance to entirely new levels.

The authors thank Francesca Fermanelli and Hannah Lu Schmitt for their assistance in the development of this publication.