For at least two decades, companies have assiduously built up their digital capabilities. They’ve upskilled their staffs and shifted product development to agile, multidisciplinary teams. They’ve embedded software in everything they sell, and they’ve invested in innovation and design thinking supported by enterprise-wide digital platforms.

The next step is to leverage these strategic assets to accelerate growth. Business building—whether inventing, launching, and scaling new business lines, units, and services or accelerating the growth of existing enterprises—is the most consistently successful way to do this.

It’s not just a matter of releasing additional products and services, adding a brand name, or even pursuing natural adjacencies. A company that builds businesses can repeatedly create high-growth opportunities through new go-to-market efforts, acquisitions, or entire new subsidiary companies.

A company that builds businesses can repeatedly create high-growth opportunities.

Business building does not mean abandoning the stability of the core business. It involves finding new growth potential in existing capabilities—becoming, in effect, a continuous business-building company. This might sound risky, since many businesses fail. But digital capabilities can change the odds. Company leaders can feel confident about business building—if they follow a playbook based on proven results.

Priorities and Preparedness

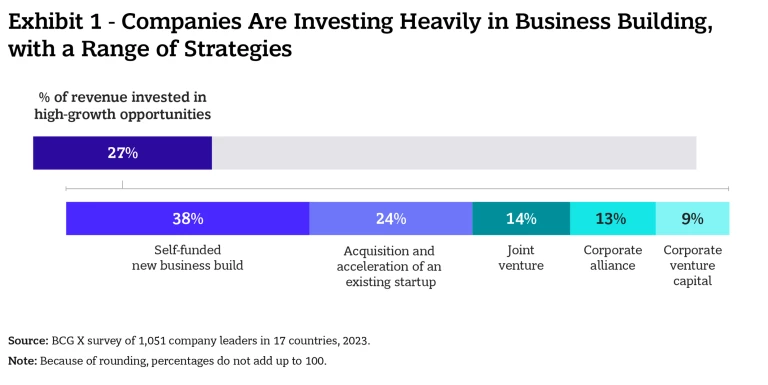

BCG X recently surveyed more than 1,000 senior leaders in 17 countries about their business-building efforts. The findings show that companies are investing heavily in high-growth opportunities of this sort. Of the executives surveyed, 73% said that business building is a major priority for them, and their actions confirm it. Their companies have pursued, on average, five new high-growth opportunities each year since 2021. More than a quarter of these companies’ annual revenue is typically invested in launching, acquiring, or colaunching startup ventures. (See Exhibit 1.)

Most of these company leaders said their business-building efforts were successful. Yet a closer look at the survey reveals a gap between individual efforts and sustained viability: Only 52% of the respondents said their companies are well-prepared to pursue new high-growth opportunities. While they have produced a few new businesses, they have not developed a consistent track record of business building. Even after a successful launch, they are not sure they could do it again—and thus they miss opportunities for further expansion. In short, making business building an immediate priority is no guarantee of long-term success.

Survey respondents generally attributed failures to externally driven factors: a poor market fit for their product or service, or the nonviability of the business model. Some also singled out internal clashes over the company’s direction, insufficient available funding, or the inability to recruit essential talent.

Companies with a record of sustained business building have shown they can address these factors, often in the early stages of a project. For example, to manage poor market fit, a company can actively test new offerings with customers before the launch. Much depends on preparedness—on having an array of strategic assets in place, along with the capabilities and leadership support for using them.

Nine Strategic Assets Critical for Success

In business building, a company’s strategic assets are the key elements that enable a launch to break through. Based on our experience launching more than 200 builds, we see the following nine strategic assets as most critically important:

- Intellectual property (IP), including patents, trade secrets, and methodology

- Data (drawn from inside and outside the company)

- Access to sales and distribution networks

- A strong brand

- A financial position with healthy cash flow

- A culture of innovation

- Strategic partnerships (with other companies, universities, community groups, and government agencies)

- The requisite technology

- Talent

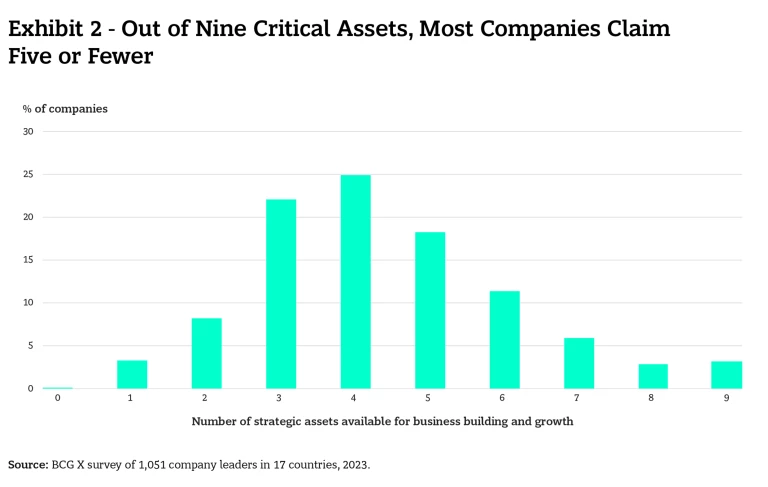

You might expect a large company to have an edge in accumulating these strategic assets, given its resources and years of doing business. But most survey respondents said they have five or fewer of these assets available, and only 3% of the companies claim access to all of them. (See Exhibit 2.)

Even when they do have the assets, only half of the companies surveyed are effective in leveraging them to build new businesses. This explains some of the perennial difficulties large companies have in this sphere. Business building requires new ways of thinking and operating.

Getting There Early

The survey also asked company leaders about the time involved in business building. The responses revealed more cause for concern:

- On average, companies spend up to three years considering whether to add a new business to their portfolio. It then typically takes another three years to commercially launch the offering.

- Leaders are willing to invest for three or four years before the business needs to turn a profit.

These answers suggest a high level of patience. However, slow starts can leave value on the table. Moving quickly, especially in the early stages of building a business, usually leads to a higher success rate. Company leaders acknowledged that their launches are too slow:

- 48% of those surveyed said it would take them longer to release a product than it would take a startup.

- Among the leaders, a large majority identified two or three instances where their competitors launched businesses that they believe they could and should have launched first.

Lack of preparation is a root cause of this indecision and paralysis. A large company engaged in business building must develop stage gates that allow more rapid progress and less investment up front. There should also be a faster way to consider and reduce risks. These changes, in turn, require some new capabilities for the business.

If you are a leader of a company looking to capture growth, a well-designed preparedness plan could change your trajectory and accelerate your time to value. This plan would require investment in underlying capabilities, not just in the individual business-building efforts. For example, it would include a strategic examination of internal resources, talent strategy, and acquisitions. BCG X recommends three basic steps to start.

1. Get Prepared

The difference between a single launch and a serial launch capability is preparation. Do you have the capabilities you need to build businesses time after time? How do you stand up against your competitors? Do you have the governance structures and leadership you need to make business building a way of life? In short, do you have a plan for increasing your preparedness?

Take a sober look at your strategic assets compared to those of your competitors. Your rivals in the market may not have the same strengths you do, or even realize their value. For example, you might envy most startups for their speed, agile mindset, and multidisciplinary talent. But they don’t have the sales and distribution network that large companies have developed over the years. You can leverage that network as a massive accelerator for new businesses.

Your existing IP, brand, networks, or other assets may have more value than you realize.

Another often-overlooked asset is the potential for strategic partnerships with other companies, based on your scale of operations and the mutual trust you have developed with other players in the business ecosystem. Whether or not these partnerships are technologically driven, they can be particularly helpful in sharing risk, combining investment, and facilitating expansion.

You may also have unique access to robust bodies of data. According to our survey, more than two-thirds of companies today are considering launching businesses that leverage artificial intelligence and machine learning. These technologies rely on large language models that must be trained on that type of data.

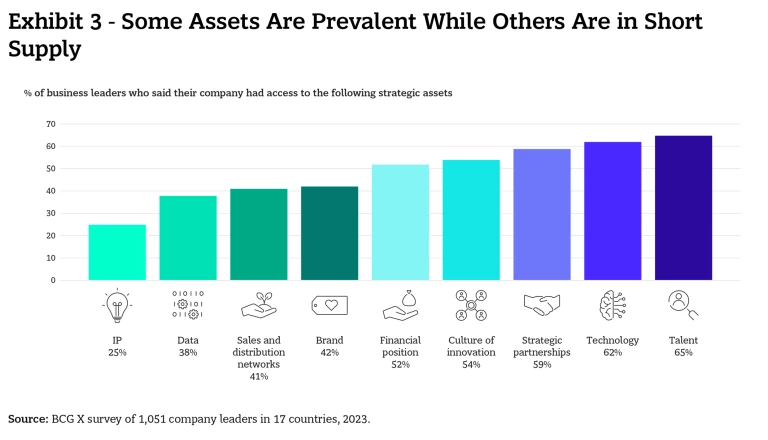

For future business-building success, it’s critical to look at all your potential assets in this light. Your existing IP, brand, networks, or other assets may have more value than you realize. Note which assets you already have and which are in short supply. Our survey found the greatest asset deficiencies are in IP, data, and sales and distribution networks. These may require upfront investment. (See Exhibit 3.)

A plan for preparedness also considers the underlying organizational design and top-level support. Do you have a governance system wherein the people who sign off on a venture’s activity genuinely understand the issues and opportunities at stake? Your financial systems, meanwhile, should move away from the year-over-year growth assumptions of the past toward more dynamic metrics and rewards.

Put in place training, if necessary, so managers and employees can operate effectively on agile teams or use generative AI and other digital innovations to streamline their processes. As you reassess these, also consider the underlying structure that makes these assets viable. Set up investment runways and related expectations to reflect the benefits of business building as well as the challenges. As the company gains experience, shorten the timeframes.

2. Attract and Deploy Entrepreneurial Talent

In general, there’s a mismatch between the talent that exists in established companies and the talent needed for new ventures. Entrepreneurially minded people are the heart of a business-building effort. The organizational environment around them also needs to be set up to support and even nurture their inner innovator.

Our survey suggests that leaders might be overestimating the entrepreneurial talent they have on hand. Of the nine strategic assets most crucial for business building, talent is the area where leaders expressed the most confidence: about 65% of respondents said they already have the internal talent they need, and that they merely needed to reassign them to entrepreneurial tasks, while 77% said they rely on their internal staff for business building. Meanwhile, only 54% of survey respondents said they actively recruit entrepreneurially skilled people; instead, they said, they found entrepreneurial talent through acquisitions (53%) and partnerships with other companies (32%).

In large companies, the organizational structures and incentives that support an entrepreneurial mindset are often missing.

In our experience, these sources are not enough to provide the necessary talent for business building. In a large company, it’s often very difficult to retain entrepreneurial talent or pivot the existing workforce toward more entrepreneurial endeavors. That’s not just because of the people themselves or their ways of thinking—it’s because such companies typically use the same operating model for their core businesses and innovation arms. The organizational structures and incentives that support an entrepreneurial mindset are missing.

If your company is in this position, you may need a new talent-support model for business building, with four key components:

- It should offer people many opportunities to explore and fail, with longer timeframes that allow teams to test new ventures—and to learn from failures as well as successes.

- It should provide alternative compensation and incentive structures aligned to entrepreneurial KPIs.

- It should establish distinct entrepreneurial teams with a more agile way of operating.

- And its performance evaluation metrics should be oriented to entrepreneurial success, including taking risks and learning from their experiences.

Only 9% of the leaders surveyed recognized all four of these critical factors as important, with performance metrics the one factor most likely to be dismissed.

3. Acquire What You Need

Our survey results show the increasing popularity of acquisitions: 61% of the surveyed leaders said M&A is more important to their business-building strategy than it had ever been before. Indeed, acquiring startup ventures can be one of the most powerful ways to accelerate a growth strategy.

When you acquire a startup, one of the most valuable parts of the acquisition is the cultural synergy it offers. The market presence or product lineup are obvious incoming assets. Even more important, but easy to overlook, are the entrepreneurial thinking and operating models the acquired company adds. To integrate your acquisitions, work closely with incoming leadership—at levels ranging from top leadership strategy meetings to on-the-job functional training—so they learn “how we do things around here.”

The people coming on board have built and scaled up the business you just purchased. Incorporate their thinking with your own and streamline your processes to match theirs rather than making them fit into yours. This will make it easier for you to continue accelerating your growth curve and to capture more opportunities.

A company with strong business-building capabilities can balance acquired enterprises with those it generates itself.

Don’t embrace acquisition for acquisition’s sake. It’s just one vehicle for business building, and it’s not always the best path. Acquiring a new company is typically more expensive than building a team internally, for one thing, and the acquisition can fall flat if the two companies don’t integrate. What’s more, the incoming company may not be precisely aligned to your goals or to the best growth path.

The best starting point for assessing any deal is to look at your own assets and value proposition, begin building your business internally, and then use the new company as a complement and accelerator for your existing effort. A company with strong business-building capabilities will tend to balance acquired enterprises with those it generates itself.

An Inside and Outside Game

Business building is always a viable path to accelerated growth, but this moment in history may be particularly good for it. To be sure, 2023 has been fiscally difficult for many companies. Traditionally, however, some of the most powerful businesses were launched under tough circumstances.

There are also reasons to be bullish. More technological innovation is taking place today than at any time in recent history, especially in AI-related technologies and the life sciences. There is also a great deal of consumer openness to new products and services, and an enormous middle class is developing in some emerging economies. Meanwhile, new tools and methods exist for product development, mergers and acquisitions, and going to market.

These can all help you launch new businesses and move rapidly beyond your current growth trajectory. By making sure you have the right people, partners, and assets in place, you can maximize the value of your business-building investments—and realize your company’s entrepreneurial potential.