This article was produced in collaboration with CTIA.

Introduction

The US leads the world in mobile communications. It is the country with the most sustained and intensive investment in both networks and radiofrequency spectrum. The US mobile industry’s investments have been particularly effective in deploying the initial wave of 5G networks and providing a platform for further 5G innovations that will continue through the 2020s.

Although the nation’s commercial mobile networks are expanding, they could soon face capacity constraints – unless they receive an infusion of additional transmission power, through additional licensed spectrum. Additional spectrum—particularly licensed mid-band spectrum, which provides the performance necessary to support large-scale wireless networks—is essential if the US is to continue to lead and grow the 5G economy.

The 5G economy is the US economy as powered by wireless high-speed connectivity. On the basis of BCG’s ongoing research , we estimate that by 2030, the 5G economy will have contributed from $1.4 trillion to $1.7 trillion in US economic growth. Deployment of this wireless system will have created from 3.8 million to 4.6 million jobs and will have driven innovation throughout the country.

The first phase of this growth, which began in 2019 with the introduction of 5G, has affected the economy directly through network infrastructure development and deployment. A second phase is now underway, as 5G networks continue to roll out and improve. The new wave of economic potential derives from advanced applications that 5G makes possible, such as augmented reality (AR) , precision robotics and manufacturing , and the Internet of Things (IoT) at a massive scale. As these applications become integrated into the country’s economic and social systems, they expand opportunity and raise productivity across the country.

In an earlier article evaluating the economic relevance of 5G networks, “Building the US 5G Economy,” we identified five key success factors that would enable the 5G economy to thrive over the next decade. The conventional narrative of a race among nations for technological dominance in the 5G arena often focuses on narrow metrics, such as the number of subscribers or cell towers. Although such measurements may be relatively easy to gather, they tell an incomplete story of the potential performance of wireless networks and the integration of 5G capabilities into economic production. In this article, we examine five factors that we believe serve as more accurate, holistic indicators of 5G’s ongoing positive impact on business innovation and activity:

- Spectrum Availability. The lifeblood of wireless networks, spectrum is responsible for sending calls, texts, and data from device to device. To meet escalating demand for wireless capacity, providers need a sufficient mix of low-, mid-, and high-band spectrum to provide the right combination of coverage and capacity for delivering services over the range of population densities from rural to suburban to urban. Spectrum should be made available through a transparent, market-based set of forward-looking auctions, and should be licensed to deliver performance characteristics that support reliable, robust wireless service nationwide. (See the sidebar “High-Band, Low-Band, and Mid-Band.”)

High-Band, Low-Band, and Mid-Band

- High-Band Spectrum. This spectrum category, also called millimeter wave (mmWave), can achieve the highest speeds because it uses large amounts of spectrum, generally above 10 GHz. These frequencies, which were not previously considered useful for communications, are available in relative abundance. Furthermore, these high-frequency waves’ short wavelength allows them to better leverage recent advances in antenna technology. Unfortunately, these signals generally travel only a short distance—about one city block—and are easily obstructed by buildings or objects.

- Low-Band Spectrum. This region of the spectrum is historically the range used for most cellular transmission. Low-band spectrum provides blanket network coverage for mobile operators. Low-band signals can travel many miles and penetrate buildings. On the other hand, not much of it is available, and it offers the slowest data throughput capacity and speeds of the three types of spectrum bands, making it inadequate for the most data-intensive applications.

- Mid-Band Spectrum. This part of the spectrum sits between high-band and low-band. It can take advantage of improvements in antenna technology and, if made available in sufficient quantities, can offer high data throughput capacity and wide coverage (up to about half a mile). C-Band spectrum, between 3.7 GHz and 4.2 GHz, is a good example of mid-band spectrum used for mobile communications in the US today.

- Networks. Capital investments in network infrastructure are critical to building strong 5G telecommunications infrastructure. Such investments cover cell towers, 5G base stations, security systems, and more. Local policies on rights-of-way, streetlights, and other public assets can play an important role in facilitating network deployment.

- Innovation Ecosystem. A virtuous cycle of innovation and development—funded by private-sector R&D spending, aligned with government policies, and backed by strong intellectual property protection—is essential for 5G’s evolution, as well as for the development of products and services that ride on the networks.

- Business Climate. A commercial culture that is conducive to technological innovation will help 5G-enabled technologies thrive and will encourage the continued rollout of 5G networks. It flourishes when enabled by access to funding, openness to risk, and business-friendly government policies.

- Talent. Widespread availability of tech-related training and certification is important to ensure that the US workforce has the skills needed for future technological changes in 5G and beyond.

In the years since our initial research in this area, the opportunities associated with 5G have grown stronger. Companies have built initial 5G networks throughout the US, and consumers and businesses are taking advantage of the improved speed and performance that 5G provides. Wireless service providers are building and scaling early use cases that capture the potential of 5G, such as enhanced mobile broadband (eMBB) and fixed wireless access (FWA). (See the sidebar “Four Categories of 5G Service.”)

Four Categories of 5G Service

- Enhanced Mobile Broadband (eMBB). Companies in this category provide fast, reliable broadband service for mobile subscribers. Enhanced mobile broadband offers peak download speeds of 10 Gbps (tripling previous offerings) and can be used for videoconferencing and high-resolution (4K) video streaming. Phones can connect reliably even in challenging locations such as high-rise neighborhoods, airports, moving transit, and stadiums.

- Fixed Wireless Access (FWA). FWA delivers high-speed, high-capacity stationary broadband to homes and businesses, transmitting through radio frequency towers. It can reach clusters of homes and businesses in rural and suburban areas at a lower initial cost than fiber optic.

- Massive Internet of Things (IoT). The IoT offers efficient, low-cost, broad internet coverage to enable the interconnection of many smart devices and processes. Applications include smart manufacturing, logistics and tracking innovations, data-driven agriculture, wearable devices, and AI-enabled utilities and smart-city projects.

- Ultra-Low-Latency, High-Reliability Communications. Services in this category provide high-performance broadband access for connected devices that perform mission-critical vital functions such as the IoT, self-driving vehicles, telemedicine, government applications, and AR. During the remainder of the 2020s, advanced IoT use cases will continue to mature, enabling a broader array of 5G capabilities.

It’s a start. But building out the full US 5G economy will require the entire decade. Each year, more progress will be made toward the envisioned end state.

In this report, we review the current state of the US 5G economy, assessed in terms of each of the five success factors noted above. We then examine the question of what to expect with regard to those factors during the second half of this decade.

The report concludes with five recommendations for US policymakers: increase the availability of licensed full-power mid-band spectrum for mobile use; create a future pipeline for licensed spectrum auctions; provide further incentives for 5G innovation; develop a 5G partnership function in governments; and promote and support the development of large-scale IoT deployment. Adopting these measures can help secure the future of the 5G economy with targeted efforts related to spectrum availability and overall support to help 5G networks reach their potential and yield all of the benefits that attend them.

The US 5G Economy Today

Since 2020, the 5G economy has made significant technological and institutional progress in the US on each of our key success factors. Collectively, spectrum availability, networks, innovation ecosystems, business climate, and talent serve as an index of 5G growth and influence.

Spectrum Availability. In the 2010s, US mobile data traffic grew considerably. It expanded almost a hundredfold over the decade. By contrast, since 2012, low- and mid-band spectrum availability increased by only about two times. Today, as 5G networks roll out, demand for US data traffic will continue to grow. BCG’s analysis of Omdia’s 2022 data suggests that by 2027 the amount of annual 5G data traffic will expand to seven to nine times the level of annual data traffic before 5G.

Recent research by The Brattle Group projects that mobile traffic will increase in the next five years by roughly 2.5 times, and almost sixfold increase in the next ten years. But if no new spectrum bands are allocated for commercial wireless use, the study estimates that the US could face a spectrum deficit of approximately 400 megahertz by 2027—a deficit that could more than triple to 1,423 megahertz by 2032.

These estimates represent the projected demand curve for 5G data traffic. However, doubts are growing about whether US wireless operators will be able to meet that demand. Capacity is directly related to spectrum availability, but the future availability of high-performance 5G spectrum to enable carriers to meet this demand is by no means guaranteed.

The US has not yet developed a current national spectrum strategy and has not identified any specific mid-band spectrum to make commercially available in the next five to ten years. Given the time required to make more spectrum available in the future, the lack of a pipeline of licensed full-power spectrum for 5G is an increasing concern.

Networks. Wireless network capital expenditure per capita in the US has increased by about 12% since 2019. By year’s end in 2022, about 95% of the US population had access to a 5G network, and about 80% of the population had access to networks capable of download speeds of 200 Mbps, up to ten times faster than 4G. To achieve this expansion, the major wireless operators invested about $35 billion in wireless networks in 2021, or about $105 per capita, compared to $95 per capita in 2019.

5G networks deliver higher speeds and lower latencies. Wireless networks provide enough speed to support current enhanced mobile broadband, as well as new 5G FWA that rivals average speeds over cable today.

However, 5G does have limitations. First, performance depends on how many users are sharing limited spectrum resources in a given area. For example, network capacity can struggle to keep up with demand in dense urban areas with many simultaneous users. Second, rising data use as broadband service categories grow will intensify customer demand further. Accommodating this growth in wireless broadband use will require additional spectrum, particularly in the mid-band range. Third, the ability of network operators to increase the density of their networks and integrate new spectrum bands will depend, in part, on land use and right-of-way policies at the federal, state, and local levels. Although stakeholders have made some progress in this area, providers still face opaque permit approval processes and other challenges to optimizing the location of network infrastructure.

Innovative Ecosystems. The US remains a center for wireless innovation and continues to add new 5G research labs as the demand for advanced 5G applications increases. Wireless companies and their network and technology suppliers are offering simpler and more effective broadband solutions to their customers, and companies are developing advanced applications that leverage 5G capabilities.

Several innovative use cases are gaining traction in the market. In cooperation with basketball and hockey leagues, Verizon has used 5G to establish immersive virtual reality (VR) and AR fan experiences in more than 60 stadiums and sports venues. These systems process and present data about players in real time and make predictions about each game as it is being played.

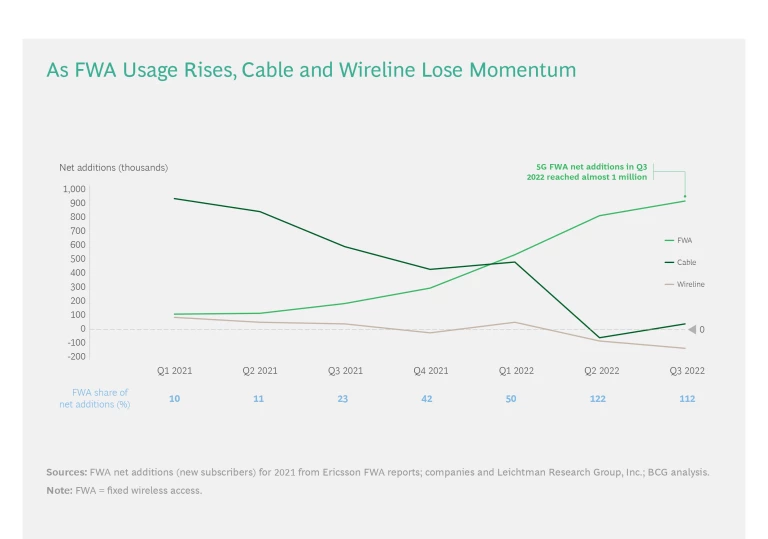

FWA usage in the US is growing rapidly, too, bringing a new dynamic to the US broadband market. This 5G service category grew by more than 70% in 2022, and mobile service operators now compete with cable TV providers in offering home internet connections in many locales. T-Mobile and Verizon are expected to reach 11 million to 13 million FWA customers by 2025. (See the sidebar “The Great FWA Rollout.”)

The Great FWA Rollout

Subscriptions have expanded rapidly as FWA broadband service becomes available. In the third quarter of 2022, the number of subscribers grew at a rate 450% above that of the year before, to 3 million in the US. It is now on track to reach 11 million or more by 2025.

FWA is transforming the geography of internet access. Its speed and versatile reliability appeal to businesses in densely populated areas, and yet urban users constitute only about 30% of the total subscriber base. In the US, suburbs lead in FWA 5G market share, with about 45% of all subscribers. Here, FWA brings new competition to markets that have had limited broadband options. In rural areas, FWA appears to be the primary home broadband of choice. Rural customers make up about 25% of the FWA market—a relatively high share, considering that the rural share of the country’s population is about 18%.

The rural story is a triumph of persistent innovation and implementation, leading over time to a step-change in national connectivity, with a do-it-yourself component that adds to the technology’s appeal. Before FWA was introduced in the early 2000s, most broadband connections in small towns required cumbersome antennas, typically installed by a specialist on a roof or tower in a town.

In contrast, FWA provides a MIMO-based platform, enabling directional antennas that make more efficient use of the available spectrum. Hardware manufacturers can more easily develop indoor, compact, and portable antennas. The new platform has revolutionized the scale of local loop wireless internet access, enabling local ISPs to provide enhanced access for their communities and allowing some individuals to set up their own connection points out of the box. The single 5G standard fosters collaboration among wireless service providers and alignment across customer and business needs.

Innovative 5G enterprise initiatives—ranging from smart-city urban deployments to remote locations such as oilfields and mining operations, which need connectivity for reliability and performance—are taking advantage of 5G capabilities. Other areas such as industrial IoT and cellular vehicle-to-everything (C-V2X) applications are still in development and early testing stages. These and other emerging areas, including health care and agriculture, will require time to solve challenges related to scale, cost, and ecosystem management. Nonetheless, they hint at the great potential impact of this technology.

For example, the Ford Motor Company and AT&T are outfitting Ford’s Rouge Electric Vehicle Center in Dearborn, Michigan, with 5G connectivity and autonomous assembly line technology. This massive IoT project will automate production of the 2022 Ford F-150 Lightning, the first electric F-Series truck. Working with sensors and interconnected controls, these lines will improve the efficiency, safety, and design of the F-150 fleet.

An example of mission-critical IoT is taking place in Peachtree Corners, a smart city in Georgia. T-Mobile has partnered with the community to launch a fleet of self-driving vehicles that the city has dubbed Piloting Autonomous Use Locally (PAUL). The shuttles are equipped with gateways to the city-owned 5G network. They navigate by picking up signals from sensors on traffic lights, crosswalks, buildings, and roadside fixtures, as well as law enforcement messaging systems, input from pedestrians, and sensors on the vehicles themselves.

In the health care arena, Emory Healthcare is collaborating with Verizon to provide a 5G platform for accelerating a host of smart-hospital innovations related to remote patient monitoring, medical imaging, pre-surgical planning, and more. The platform provides integrated access to mobile edge computing, IoT devices, artificial intelligence/machine learning, and artificial reality tools to drive innovation across a wide variety of health-care use cases.

Business Climate. As a global center of digital technology, the US is a magnet for telecommunications innovation. According to Startup Genome’s 2022 report, the US is home to 12 of the top 30 startup ecosystems in the world; it also hosts four of the top six cities for startups. That makes the US the highest-ranked country for both number of startups and quality of startups, in terms of the factors that make them likely to succeed.

Awareness of the value of 5G is growing in the digital sphere, with increased investment and noteworthy publicly funded innovation projects. The US Department of Defense is prototyping a 5G-to-Next-G smart warehouse system, the first in a series of DoD 5G investments that will total more than $500 million. Idaho National Laboratory has opened its 5G-based Wireless Test Range for exploring security risks and military capabilities. The National Science Foundation supports the Platforms for Advanced Wireless Research program, providing test platforms for a wide array of use cases and enabling research into cutting-edge technology to solve business challenges. All of this and more will contribute to rising demand.

Private company R&D will do the same. Many major wireless and tech businesses—including Verizon, AT&T, and T-Mobile—as well as startups such as the AR company Taqtile are investing in 5G research. For its part, Warner Media has incorporated 5G research into its work on virtual reality storytelling.

Talent. There is reason to be concerned about the staffing requirements associated with a 5G rollout, particularly the engineers, technicians, installers, equipment operators, and other professionals needed to install and maintain service. Talent levels have adequately kept pace with growth so far—but as early as the late 2010s, HR experts were warning industry leaders that more needed to be done to address the impending talent gap. Now, some stakeholders are taking action to address the issue.

The FCC released an interagency group report in January 2023 to propose methods for maintaining the telecommunications workforce. The report’s recommendations include new recruitment efforts (for example, with veterans), new apprenticeship programs, a greater emphasis on diversity and inclusion, the use of Pell grants and other funding sources, and guidelines for emphasizing safety in the field.

Since 2020, for example, the US government has allocated about $80 billion in federal funding for technical training in wireless and broadband. The 2021 Infrastructure Investment and Jobs Act (IIJA) includes another $2.75 billion for workforce deployment grants. The number of apprenticeships has grown by about 16% annually since 2018. Telecommunications providers and technical schools have established new partnerships to upskill the workforce.

The Future of the 5G Economy

As the US continues to build out its 5G economy, it must maintain progress along all five key success factors: spectrum availability, networks, innovative ecosystems, business climate, and talent. Bringing the technology to scale and managing the barriers and risks that hold back full deployment will take time.

Planners must also manage the risks inherent in any new technology. For example:

- Unpredictability in the spectrum pipeline represents a risk. Areas of concern include unpredictability in the future supply of full power, the licensed spectrum for 5G (particularly mid-band spectrum), and the risk of falling behind global peers in enabling future 5G use cases.

- Orchestrating the many ecosystem players for advanced 5G use cases is an ongoing challenge. Planners must explore ways to overcome orchestration challenges among players in the innovative ecosystem in light of the complexity of B2B integration owing to the number of players involved and the transformative changes often required within businesses.

- Digital talent will play an increasingly important role in the 5G economy going forward. The US needs to develop the requisite digital talent domestically and continue to upskill its workforce to meet the needs of the 5G economy.

All of these risks are manageable. In this section, as we look at the future of success factors, we’ll also consider ways to manage and mitigate risk.

Spectrum Availability. Congressional authorization for the FCC to conduct spectrum auctions expired in March 2023. In the meantime, policymakers have not developed long-term plans for future auctions or spectrum reallocations.

The primary way for policymakers to fuel the supply side of the 5G ecosystem is by making more licensed full-power spectrum available for mobile use. This will ensure that the US is fully equipped to foster and respond to new 5G use cases. Future applications, whatever form they take, will likely demand more capacity, speed, and reliability from 5G networks.

On the other hand, spectrum shortages may lead to congestion issues for existing mobile services, impeding companies’ ability to scale FWA or other data-intensive applications, and discouraging innovators from taking full advantage of 5G’s potential. Establishing a clear plan for allocating the 5G spectrum is also important to give wireless service providers the certainty they need for long-term capacity and capital expenditure planning.

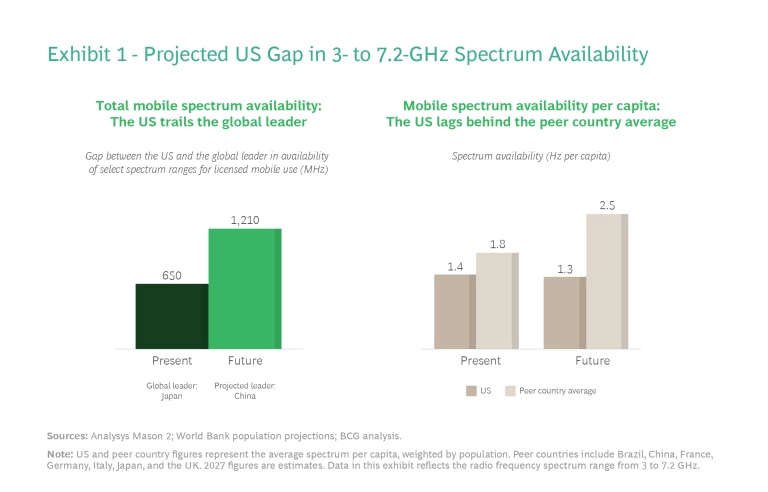

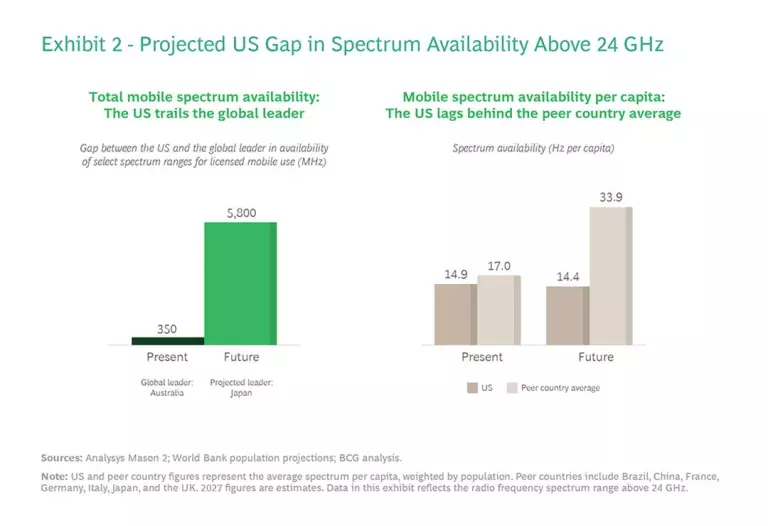

Today, the US trails a number of other countries—including Brazil, China, France, Germany, Italy, Japan, and the UK—in 5G spectrum availability. This gap will probably grow wider over the coming years if the US government does not hold further spectrum auctions.

Exhibit 1 shows the gap in spectrum availability for the 3- to 7.2-GHz range if there are no further FCC auctions. Spectrum in this range is especially important for adding capacity to high-performing, wide-area networks. Exhibit 2 shows spectrum availability in the range above 24 GHz in the absence of further FCC auctions.

The potential impact on the 5G ecosystem of a stronger international alignment on spectrum allocations for such services is quite large. If the US steps out of the global debates on spectrum allocations for 5G—whether because it lacks of a plan, lacks auction authority, or opts out for some other reason—peer countries are ready to fill that void and identify their own suitable bands for 5G development. The US may then lose its first-mover advantage in identifying globally harmonized spectrum for 5G, and be left with a more insular approach to spectrum allocation outside the international consensus. That eventuality would have negative downstream effects on equipment, handsets, and services, and would limit the economic growth associated with 5G.

Networks. After years of building out 5G networks, the US is likely to see expanding use of its networks. Projected momentum will move penetration among US subscribers from 15% of the population in 2021 to 68% by 2025. Only South Korea is expected to have a greater proportion of 5G subscribers, at 73%. Network density will increase, too, with more towers and cells installed. Although the pace of increased network density is difficult to predict, it will not outstrip the need for additional spectrum investments.

This expansion will catalyze the innovation of more applications, requiring better network performance and higher speeds. Wireless service providers will bring mmWave to more parts of the network and will continue to upgrade in other ways—migrating to standalone 5G core networks, for example, to enable greater speed and less latency.

In 2022, the Creating Helpful Incentives to Produce Semiconductors and Science (CHIPS) Act authorized more than $1.5 billion in federal funding for wireless supply chain innovation. Industry and regulators may form partnerships to use that money more effectively. Collaboration with international providers, trade mechanisms that encourage the collaboration, and new sourcing relationships will probably help diversify the manufacturing base. Telecommunications manufacturers will learn to source from friendly and near-shore suppliers, especially for components that the US is unlikely to produce.

Innovative Ecosystems. As 5G use proliferates, wireless providers and their hardware suppliers will play a critical role in deploying private 5G networks as a catalyst for more general innovation. Companies in many different fields—health care, financial services , transportation, and urban planning, among others—will use 5G to accelerate their efforts and coordinate their offerings. For example, the Japanese telecom company Docomo has established collaborative innovation partnerships with more than 5,200 companies and 100 local governments. (See the sidebar “Learning from Docomo’s Open-Partner Program.”)

Learning from Docomo’s 5G Open-Partner Program

The results have included many 5G-related applications. In a partnership with BMW, for example, Docomo produced an eSIM that permits enhanced navigation and voice recognition, along with connections to up to ten smartphones or tablets. Another joint project produced smart glasses for factory and construction workers. These devices can exchange text, audio, and video with offsite advisors, enabling employees to raise issues and receive guidance instantaneously. Docomo’s Virtual Design Atelier supports remote collaboration on visual and architectural design. Its Temi system is a hospital guided robot system that uses the IoT to navigate. It reduces staff burdens and manages communication in situations where human contact is not feasible.

Docomo cites a number of key lessons from its experience with its open partner program:

- Invest in 5G use cases before a demonstrated product demand exists.

- Build general solutions that are applicable to multiple companies across different industries.

- Emphasize co-creation, with R&D and testing facilities accessible to members of the partner network.

- Set up digital exchanges where businesses can post their technical needs and others can answer with solutions.

- Monetize use cases by selling solutions to incoming members.

Advances such as the IoT and automated vehicles will involve 5G development in leading-edge technologies. Health care is another example. Wearable devices can now monitor arrhythmias and EKG data as well as basic heart rates, and many benefit from 5G transmission of data.

As innovative uses roll out, cities with high levels of digital activity will need to increase their supply of mid-band 5G service. GSMA estimates that these cities will require 1,300 to 3,700 megahertz by 2025 to 2030. To meet this demand, the US would need to add 30% to 250% more mid-band spectrum for mobile use than it currently allocates.

Adding full-power spectrum availability will ensure a higher-quality user experience and better 5G coverage. It will support greater mobile traffic demands and will permit scaling of data-intensive applications in an economically feasible manner.

Business Climate. Regardless of how the economy unfolds, the US appears to be in a relatively strong position to continue building out its 5G networks over the coming decade. The US government remains a thought leader in adopting 5G applications, with the DoD and the Department of Veterans Affairs among the most advanced users of 5G innovations.

Current macroeconomic trends—including tight labor markets, positive wage gains, and high operating margins—suggest that markets and supply chains could be more resilient than many people expect. There are structural issues to contend with, however, such as the continuing effect of the COVID-19 pandemic and the war in Ukraine, and these may lead to further supply constraints and price shocks. Tax policy changes, especially if they are related to the expensing of network infrastructure and R&D, could also impact wireless investment strategies. Even so, the basic upward growth curve of the 5G economy seems unlikely to change soon.

Talent. In the future, talent will be even more of a differentiator for business than it is today. As the 5G innovative ecosystem develops new use cases—for example, in IoT, AR, VR, wearables, real-time analytics, and other consumer and industrial technologies—the requisite design and software engineering skills will be increasingly in demand. Already, several US states (Hawaii, North Carolina, North Dakota, Oklahoma, and Pennsylvania) are applying some of their IIJA funding to foster digital skill development in K-12 and adult education.

BCG’s analysis of job-related data has found that talent disruption is at least as strong today as it has ever been, spurred in large part by the upskilling that is continually needed for proficiency in digital technology. Public and private education efforts will become increasingly important in 5G development, and schools will most likely use 5G-based tools and platforms to convene and instruct students.

The US has always demonstrated an unparalleled ability to attract digital talent from around the world. Today, foreign-born talent represents almost a quarter of the US STEM workforce, compared to about 16% in 2000. With the advent of remote work as a standard employment option, participation in the US workforce by people from around the world will grow even more rapidly. This will help fuel the growth of the 5G economy.

Tech + Us: Monthly insights for harnessing the full potential of AI and tech.

Recommendations for Policymakers

The future of the 5G economy in the US will depend to a large extent on decisions made by government. Policymakers can help this essential technology expand by focusing on spectrum availability and the innovation ecosystem. We propose five key initiatives:

- Increase the availability of licensed full-power mid-band spectrum for mobile use. Doing so will enable the US 5G economy to better support innovative use cases and further scale existing successes. As noted earlier, mid-band spectrum is in short supply, and more of it is sorely needed. Adding capacity in this range will provide the greatest benefit for users in urban, suburban, and rural locales. With additional exclusive-use licensed spectrum, telecom companies can provide a consistent, reliable, and robust experience for consumers and businesses through 5G connectivity.

- Create a pipeline of licensed full-power spectrum. To provide predictability in this pipeline, policymakers should aim for clear visibility with regard to the future spectrum bands to be auctioned, the auction dates, and the availability dates. Predictability is essential to wireless service providers as they undertake their capex planning. It enables informed participation in spectrum auctions, efficient spectrum planning, and effective sequencing of network improvements to deliver the best experience for end users. It also will position the US to lead international spectrum allocation discussions, facilitating the nation’s ability to build international scale for the wireless ecosystem. This was extremely important in the development of 4G. Finally, spectrum predictability will give innovators the security they need to advance the US domestic tech ecosystem, cementing the US’s economic and national security.

- Provide incentives for 5G innovation. Give businesses and organizations reasons to build and operate robust 5G innovation hubs and testing facilities to develop broad use cases. The expanded footprint would benefit wireless companies in several ways. It would centralize solutions, collocating innovation hubs and testing facilities. It would cultivate supply-side innovation before demand overtook capacity. It would encourage the co-creation of 5G solutions across industries. And it would leverage the next wave of solutions to productize and monetize new offerings with subsequent partners.

- Develop a 5G partnership role for governments. At the federal, state, and local levels, specifically appointed officials should promote 5G development, coordinate collaborative efforts, and mitigate roadblocks. This would encourage collaborations, particularly on complex projects like smart-city initiatives. Using 5G connectivity to revamp traffic control patterns, for example, could benefit from an in-depth partnership between government and businesses from several sectors.

- Promote and support the deployment of the IoT. This technology represents one of the highest-leverage ways to advance the 5G economy. Like many large-scale innovations, the IoT may need extra support when introduced in a city, before it achieves economies of scale or has been integrated into local operations.

US competitiveness depends on the nation’s ability to provide leading wireless communications networks and innovative applications and uses that enhance consumers’ lives and improve business efficiencies. With the rollout of the 5G economy, the US is poised not just to catch up with other countries, but also to establish a body of activity that promotes innovation and growth throughout the coming decade, and in the years that follow.