The Australian Consumer Sentiment Snapshot series shares insights from a BCG consumer survey undertaken with our coding and sampling partner, Dynata. The survey aims to uncover how consumer perceptions, attitudes and spending behaviours are impacted by the inflationary environment. This snapshot presents insights from Round 7 of the survey, gathered in September 2023. We have drawn comparisons with research completed in previous rounds and other countries.

Continued inflationary conditions are keeping consumers in Australia on edge about their economic status, lifestyle, spending and saving. But our most recent survey also found some rays of sunlight that could bode well for companies who adjust their strategy to evolving consumer needs.

This snapshot highlights 6 key themes focused on consumers:

- While fewer consumers expect recessionary conditions in Australia (7ppt drop from 68% in our last survey), Australians are some of the most concerned about inflation when compared to other developed markets, with only New Zealand more concerned than us.

- Despite the concern over rising prices, 40% of Australian consumers are optimistic; 56% of these optimistic consumers are from the silver generation (aged 52 years and above) while younger generations are being hit harder by inflation induced mortgage or rent pressures.

- 50% of Australian consumers are prioritising value for money over experience and increasingly going after deals, promotions (9 ppt up from previous round) .

- While 40%+ of consumers expect they will continue to spend more on essentials in the next 6 months. Travel is set for sustained growth as +16 ppt difference observed in net % of consumers travelling for business today compared to November 2022. Leisure travel is also set for steady growth as 8 ppt increase seen in number of leisure travellers today vs. previous round.

- Consumers are embarking on more complex purchase journeys, averaging almost 8 touchpoints to inform their purchasing decisions. Over 40% of consumers stated using greater number of sources of information than they used to before COVID-19.

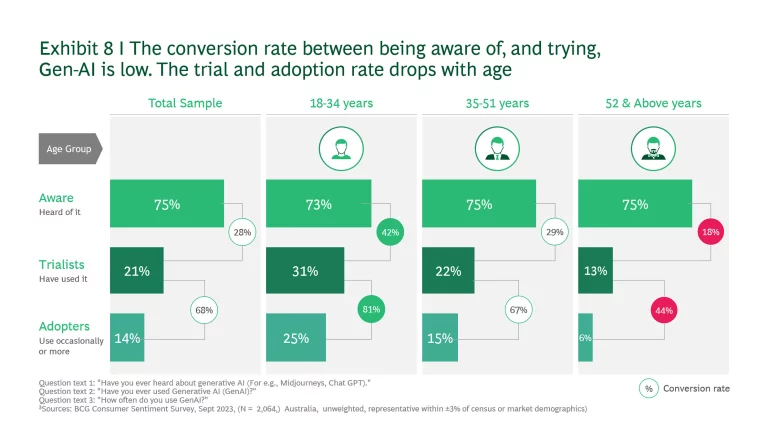

- 75% of Australian consumers are aware of Gen-AI, however only 14% use GenAI regularly today, mainly due to data privacy concerns. Adoption rates among millennials are 4 times higher than the silver generation. Adoption is likely to accelerate quickly from 14% today to 22% in the near future.

1. Australian Consumers Are Some of the Most Concerned About Inflation and Its Impact on Their Personal Finances

Since our last survey, concerns over economic recession have subsided in Australia; 61% of consumers in this round expect recession compared to 68% of consumers in November 2022.

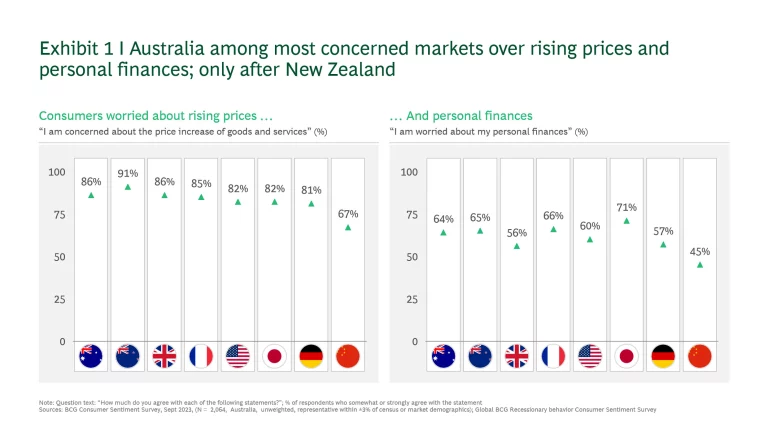

However, inflation and its impact on the price of goods and services has become a major concern for the global economy. The prolonged nature of the crisis is putting 64% of consumers under pressure when it comes to personal finances. We found that consumers from the most developed markets have the highest economic concerns. In Australia, 86% of consumers are concerned about recent price increases, compared to global average of 81%. Of these developed markets, the most concerned is New Zealand (91% of consumers are concerned) and China is the least concerned (67% of consumers). See Exhibit 1.

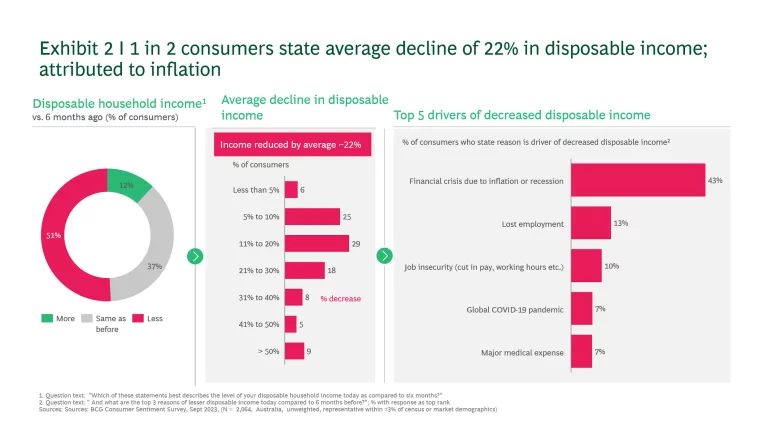

Half of our Australian respondents claim their household disposable income has reduced due to inflation compared to what it was 6 months ago. For some, their disposable income has reduced as much as 22%. See Exhibit 2. Survey data also shows that, as a result, there is a 15ppt net increase in the number of consumers saying they will be spending less and saving less.

2. Despite the Concern over Rising Prices, 40% of Australian Consumers Are Optimistic about the Economic Outlook. Younger Generations Are Feeling the Impact of Inflation While the Silver Generation Remains Resilient.

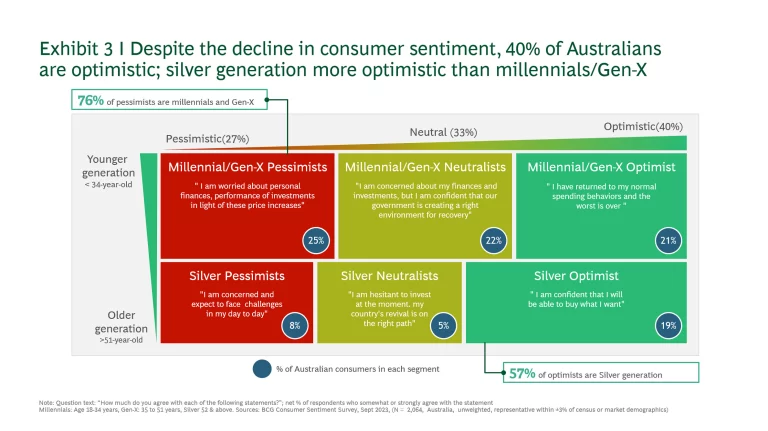

A breakdown of our survey results by demographic reveals that younger generations (Millennials and Gen X) are more impacted financially and hence less optimistic about their personal financial situation. Meanwhile, consumers aged 52 years and above – the silver generation – are more financially stable and confident in their situation. See Exhibit 3.

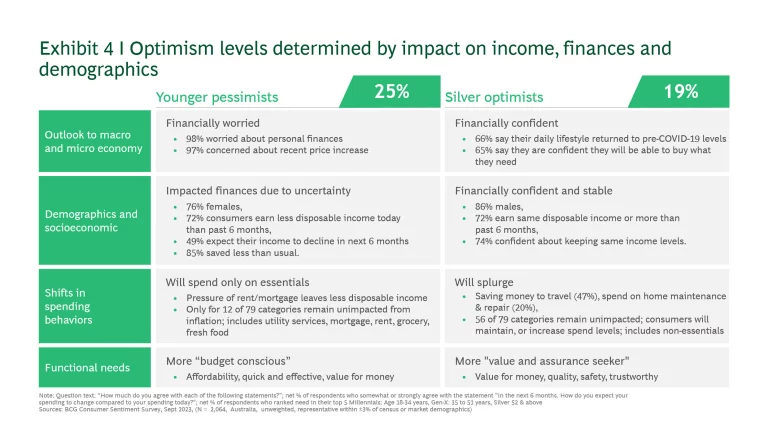

Let’s take closer look at 2 extremes of these consumer segments. See Exhibit 4.

Silver optimists – who make up ~1 in 5 consumers in Australia are the most resilient segment during uncertainty. Over 65% of these consumers state that their life is back to pre-COVID levels; they can buy what they need and are confident about their personal finances. These consumers are predominantly male, have a stable income, don’t have dependents, and the next thing they want to do is travel overseas.

We tested impact on spending plans for 80 categories and found that this segment will continue to spend as usual, or even more, on 56 of those 80 categories. Of all consumer segments, they will spend significantly more than other segments on medical procedures, medical devices, home decorations and renovations, clothing, private health care, alcohol, pet food and supplies.

Younger pessimists – who make up 1 in 4 consumers in Australia, are the first ones to feel the brunt of rising prices. They have altered their shopping behaviours to focus on day-to-day essentials and survive the downturn. Of this segment, 44% are millennials (aged 18–34) and 56% are generation X (aged 35–51) and most are female. 95%+ of this segment is worried about personal finances and the state of overall economy.

These consumers have plenty to be pessimistic about; 76% have less disposable income than they did in the past 6 months, diverting much of their income to daily essentials, particularly on increased mortgage and house rent costs (which ranked #2 and #3 in categories of increased spend). Utility services, packaged food, sim connection and ready-to-cook food were also in their top sources of increased spend. Our impact testing indicated this segment’s spending intentions remain as usual or positive only for 12 of 79 categories, especially mortgage and rents.

In summary, we see surprising resilience across generations for sustained spending intentions on essentials. However, discretionary spending will be driven by silver optimists until younger generations can emerge out of mortgage/rent pressure in this inflationary environment.

3. Consumers Are Increasingly Prioritising Value for Money Over Any Other Needs.

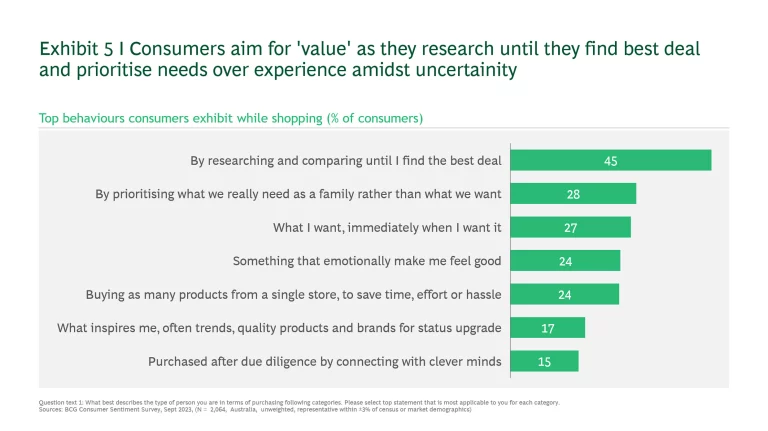

Consumers believe it will take close to 4 years for inflation to stop rising in Australia. With the increased price of essentials and discretionary categories, 48% of consumers stated they are buying less. Of those that have spent more in the past 6 months, 26% state inflated prices have forced them to spend more. As a result, when purchasing goods or services, consumers are prioritising functional needs over experience and seeking value for money across categories. See Exhibit 5.

‘Value for money’ means different things across different categories, but no matter the spending category, it remains the priority for consumers. In food categories, value is important in terms of affordability whereas for home categories, high quality is more important.

Consumers showed unprecedented resilience during COVID-19 by adapting their spending to areas of most need. Now, they are under pressure to change their spending again. Approximately 60% of consumers are checking prices on the internet – more than ever before (10ppt up from November 2022). While 54% are choosing affordable or accessible brands to compensate for increased prices, and 56% are hunting for deals and discounts (up 8ppt from November 2022).

4. Consumers Continue to Spend More on Essentials. They Expect to Spend More on Discretionary Categories as They Intend to Buy More and Pay More Due to Price Hike– and Certain Segments Will Drive This Demand.

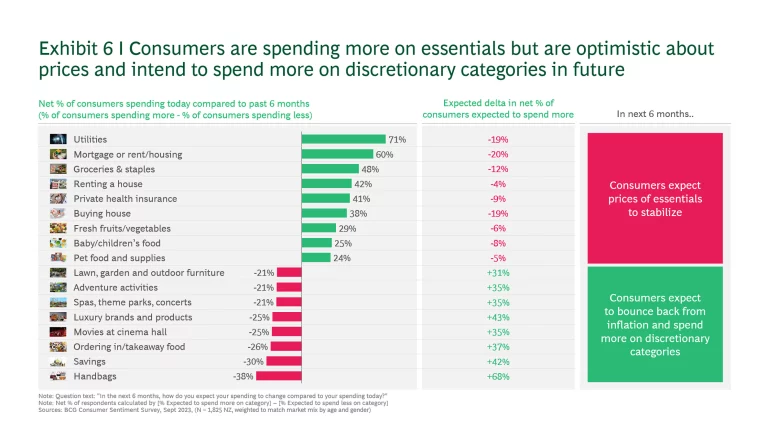

As a result of recent price hikes, consumers claim they are spending more on utilities (71%), mortgage (60%), groceries (48%), rent (42%) and private health insurance (41%) that they did in the past 6 months. While categories like fresh food, baby food and pet food show continued resilience, outdoor furniture and out-of-home entertainment take a backseat as consumers focus on their needs.

Although the rising price of essentials is the primary driver of increased spending, consumers are optimistic about spending on select discretionary spend categories in the near future. They expect that the impact of inflation will recede to stabilise prices on essentials, allowing them to spend more on non-essentials. See Exhibit 6.

If we break down this view by various demographics, we see windows of opportunity to grow these discretionary categories:

- More consumers intend to increase spend on future on discretionary spend categories such as luxury products and accessories and bags. Between 7% and 10% of consumers are expected to stop cutting down on spending on these categories. Out of home entertainment including cinema, theme parks and gaming zones will likely follow a similar positive trajectory in next 6 months as consumers expect prices to stabilise.

- Of those who intend to spend more in future, consumers earning >$115,000 per annum will continue to show demand for indulgent categories including leisure travel (34%), savings (28%), plants (21%), streaming subscriptions (23%), ready-to-cook food (21%), dining in (23%), alcohol (21%) and bed and bath (21%).

- Travel is set for sustained growth as +16 ppt difference observed in net % of consumers travelling for business today (+13%) compared to November 2022 (-3%). Leisure travel is also set for steady growth as 8 ppt increase seen in number of leisure travellers today (-3%) compared to previous round (-5%). Among consumer segments, silver neutralists (5% of Australian population) show strongest resilience in demand for travel followed by younger neutralists (22% of population).

- Millennials and Gen-X optimists intend to spend more than other segments on business and leisure travel. These categories are on a sustained growth trajectory as the number of consumers who intend to spend more on travel will jump from -3 to 3% for business and -10 to -5% for leisure travel from November 2022. Furthermore, 10ppt increase is expected in net % of consumers who will spend more on business travel. We also observed strong growth trajectory for paid streaming services among this segment.

- Silver optimists intend to spend more across essentials and discretionary. In addition to utilities and grocery, this segment will spend more on pet care, clothing, alcohol, and private health care etc.

5. Consumers Are Embarking on Increasingly Complex Purchasing Journeys Post-COVID.

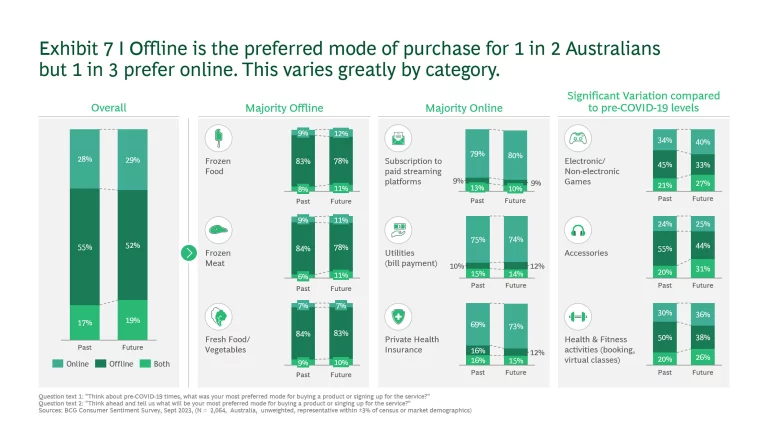

More than 45% of consumers are researching deals to find value and over 50% of consumers are looking for deals online before purchasing. As a result of behaviours like this, improved online experiences and a post-COVID desire to visit brick-and-mortar stores, the average purchasing journey almost 8 touchpoints between business and consumer.

We asked consumers to choose their preferred mode of purchasing by category. For 1 in 2 consumers, in-store purchases dominate but 1 in 3 consumers prefer online. These preferences vary greatly by categories. See Exhibit 7 to see how today’s preferences compare to pre-COVID.

Our data also shows that consumer journeys have become more complex and multi-touchpoint after COVID-19 (especially for furnishing, utility, accessories, DIY, Work from home furniture where more than 40% of consumers started to rely on more sources that they used before COVID-19). It will be important for retailers to monitor the consumers coming to their stores or buying from them online to tailor their offering to categories they are after.

Across the purchasing journey, consumers leverage an average of 3.7 unique channels and 7.7 non-unique channels to inform their purchasing decisions. Consumers purchasing categories including alcohol, pet food and medications follow fewer touchpoints whereas those purchasing accessories, sim cards, furniture and broadband follow complex pathways. For accessories, consumers use YouTube and Facebook or Instagram to discover, consider and decide on a product. Whereas for alcohol and pet food, it is all about a business building great engagement with a single touchpoint.

Having said that, wanting everything at one place is among top 5 needs of consumers when selecting a business to purchase from. Over 60% of consumers are looking for simpler digital experiences for complex journeys of broadband connection, utility services and furniture. For these categories, interactive digital platforms including Gen-AI could be potential disruptors.

6. Gen-AI Could Provide Consumers with the Simplified Purchasing Journey They Seek, but Ensuring Data Security Will Be Critical to Gaining Consumer Trust.

We did a pulse check on Gen-AI. Despite 75% of consumers being aware of Gen-AI tools, only 14% adopt it for personal or professional usage and the adoption rate is even lower among the silver generation. However, once consumers try it, Gen-AI soon becomes a go-to tool for 68% of consumers. See Exhibit 8.

When asked about benefits of Gen AI, consumers believe Gen-AI saves time, solves problems and enhances creativity but they don’t believe it will provide them with personalised or tailored products and services.

The adoption of Gen-AI is likely to increase from 14% to 22% in near future. We observed that Australians remain hesitant to adoption of Gen-AI as data privacy concerns are prevalent for 60% of consumers.

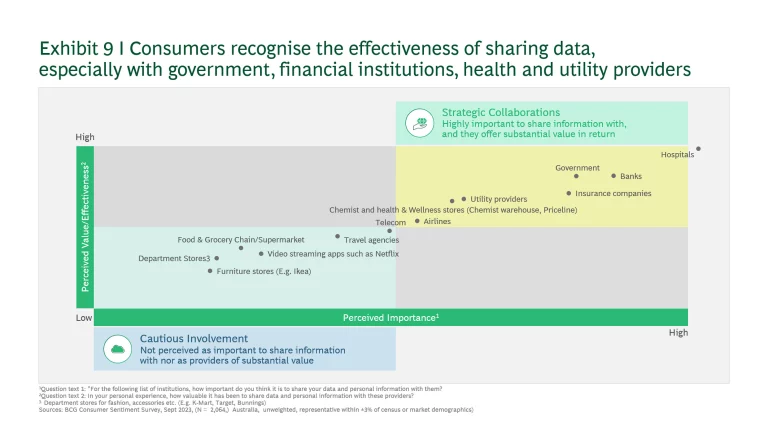

At the same time, they believe the more data they share with an entity, the greater value they should receive from that entity. See Exhibit 9.

Implications for businesses

Economic downturns affect categories and consumer segments in non-linear ways but some categories and segments show resilience. In these downturns, growth is an even more nuanced story, but it is highly rewarded. BCG research in the USA shows that 14% of companies improve growth and margins in downturns, while 44% decline in both and the performance gap between them is substantial (CAG gap of +14ppt 8.8% Vs.-4.7%).

Based on our survey insights, we have identified 4 implications for companies to increase their chances of growth in this ‘gloomy’ economic climate.

Maintain hope and a growth orientation. Rapid shifts in consumer needs have sped-up product and service innovation and altered the competitive landscape, changing the customer value proposition and creating new white spaces. To outperform in recovery, companies require clarity on the shape of demand rebounds and changing consumer needs.

Companies must also innovate and invest in growth, even in the face of a deep post-crisis inflation. The evidence is clear: the best time to grow differentially, is when aggregate growth is low. Companies that flourish in a downturn do reduce costs to maintain viability, but they also innovate around new opportunities and reinvest in growth pillars to capture opportunity in adversity and shape the post-crisis future.

- Deliver value – whatever it means. While consumers are making budget-conscious decisions, think about consumers’ criteria for value and how to best deliver it. While consumers are already spending more, the top-down approach of passing costs onto consumers will fail if it increases by ~20% of and item’ average price (varies by category). Learn more in BCG’s Build Resilient Pricing in Uncertain World publication.

- Identify resilient segments to position products and services to. Even though inflation continues to exact economic pain and deep anxiety, certain segments show endurance:

- Target the needs of silver optimists. Focus on delivering products and services to higher income, silver optimists who remain resilient to inflation. They need to feel valued with quality, reliable solutions and offers.

- Support younger pessimists in tough times. As younger pessimists reset their spending plans to curb inflation, companies must identify drivers that will build sustained demand among the segment. This segment needs to feel supported as inflationary environment negatively impacts them. Making products and services affordable and accessible to younger generation will be critical.

And when positioning products to these segments, or any segment for that matter, target them with the right channel and stay with them throughout their complex purchasing journeys. Read BCG’s article on Building Customer Experience for the future and learn more about capturing shifting consumer demand with BCG’s Demand-Centric Growth Compass for Retailers .

Embrace Gen-AI to consolidate complex purchasing journeys as consumers look for tailored one-stop solutions – but secure consumers’ data. Our survey found that consumers are seeking a one-stop shop for complex purchases. This kind of one-stop shop will likely require ‘conversational selling’ – a platform with a Gen-AI chat bot for consumers to interact with to explain the product or service. Just as Amazon emerged as an eCommerce giant a decade ago, we will likely see ‘conversational’ giants emerge. Every consumer-facing business needs to get its strategy in place to create successful conversational platform. The potential seems boundless, and executives across industries are under pressure to incorporate GenAI into operations and capture benefits. By some estimates, GenAI could amplify global GDP by 7% and double productivity growth over the next decade. But will these rosy estimates actually become reality? It’s a question worth asking because there are still a lot of divisions and skepticism in the executive ranks—not just between companies

but within companies. Please read more about it in BCG’s report What’s Dividing the C-Suite on Generative AI? .

Concerns over data security are a barrier for many companies in adopting Gen-AI. However, our experience suggests that some of these concerns are based on perceptions of data security that are no longer true or are easily avoided. For example, the change to Zoom terms and conditions to allow Zoom to use its customers’ conversations to train AI models was widely reported, but their swift withdrawal from that policy was not as well reported.