The biopharmaceutical industry is undergoing a revolution in oncology and other complex diseases, thanks to a wave of innovation and new drug modalities. Traditional drug platforms such as small-molecule therapies and monoclonal antibodies are now established in the health care industry; new modalities that have emerged in the past 20 years include gene and cell therapies, RNA drugs, and complex biologics. Many of these have achieved scientific breakthroughs and are nearing approval for clinical use. Others are already in the market and competing with traditional drugs in terms of both R&D resources and commercial sales. To date, annual sales for new modalities (excluding mRNA) have reached approximately $20 billion, boosting the overall market cap for biopharma companies by more than $300 billion.

As emerging technologies advance through development pipelines and bring new treatments for diseases, they create unprecedented opportunities for the biopharmaceutical firms that actively pursue them, and they put latecomers at a disadvantage. Yet these new, potentially high-reward modalities are also high risk. Some have high clinical failure rates, and others pose tremendous commercialization challenges. For example, gene and cell therapies are extremely expensive; Zolgensma, a gene therapy product for spinal muscular atrophy, costs approximately $2.5 million per dose in the US.

For biopharmaceutical and biotech companies, investors, and other participants in the ecosystem, novel modalities require deliberate thinking about R&D risks and rewards, new operations and manufacturing models, and commercialization, pricing, and reimbursement. To determine how they can best compete, companies must understand the maturity level of the modalities already in the market, along with the many factors that influence decisions about which modalities and diseases to target.

An Inflection Point in the Industry

After decades of development, new modalities are reaching an inflection point. In 2021 alone, approximately 100,000 journal articles were published on these new therapies. Some 4,000 clinical trials of new modalities (92% at the early stage) are underway. And approximately 1,500 new companies have been formed in the past 20 years to develop new treatment modalities and technologies, of which approximately 150 went public. The US and Europe are still the main centers of R&D activity, although China is advancing rapidly. In terms of investment, new modalities have attracted $250 billion in public-market capital and another $100 billion in private-market investments.

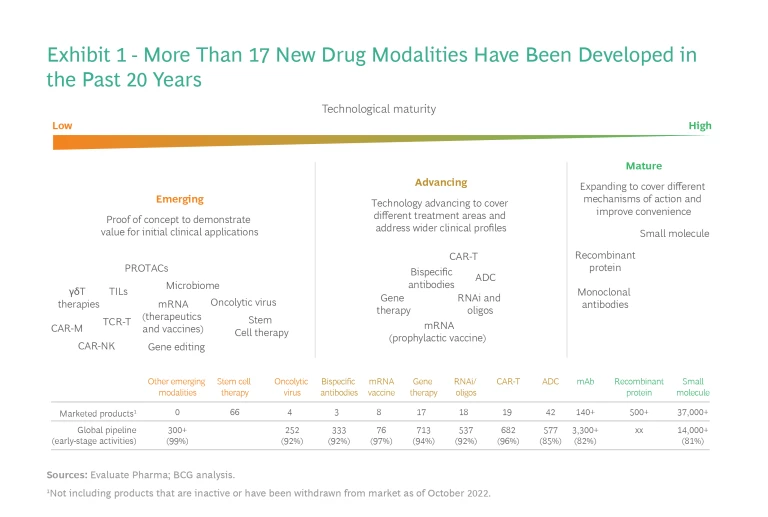

We group new drug modalities into three categories according to their maturity, as reflected in their technological advancement, clinical application, and commercial readiness. Over the past 20 years, more than 17 new modalities have been developed spanning all three categories. (See Exhibit 1.)

Mature. These modalities—including small-molecule drugs, recombinant proteins, and monoclonal antibodies—make up the foundation of many existing treatments. They have been clinically proven and are in wide use, especially small-molecule drugs, which are in more than 30,000 products. In their next phase of growth, these modalities will expand into additional disease areas, incorporate more difficult mechanisms of action, and improve convenience (for example, through new delivery technologies that allow for easier administration or less frequent dosing). Advanced technologies such as artificial intelligence could potentially accelerate breakthroughs in these areas.

Advancing. These modalities arose in the past 20 to 30 years, and many have passed the initial proof of concept, are through late-stage clinical trials, and are being launched commercially. They include RNAi therapeutics (which generated $2.7 billion in sales in 2019), antibody–drug conjugates and derivatives such as antibody–radio conjugates ($2 billion), bispecific antibodies and derivatives ($1.7 billion), CAR T-cell therapies ($743 million), and gene therapies ($500 million, primarily AAV-based in vivo therapies). However, each of them faces major challenges before it can generate significant sales.

Emerging. These are modalities still in the proof-of-concept stage (in preclinical or early clinical trials to demonstrate their initial efficacy and safety). Only a few have gone through pivotal studies or regulatory approvals. They include oncolytic viruses, mRNA-based therapeutics and vaccines, stem cells, in vivo gene editing (through, for example, CRISPR/Cas, ZEN, TALENs, or other meganucleases), microbiome treatments, PROTACs, and several others. These modalities are at the proof-of-concept stage and are typically focused on a narrow range of indications such as blood tumors or late-stage solid tumors. Although these modalities entail the highest level of R&D risk, they could also address unmet medical needs by targeting novel disease mechanisms and overcoming challenges faced by many of the modalities in the first two categories. Thus, they could bring revolutionary changes to current standards of care.

An Opportunity for Biopharma Firms to Differentiate

The new modalities have the potential to create value for biopharmaceutical firms in four ways.

Expanding Beyond Oncology and Rare Diseases

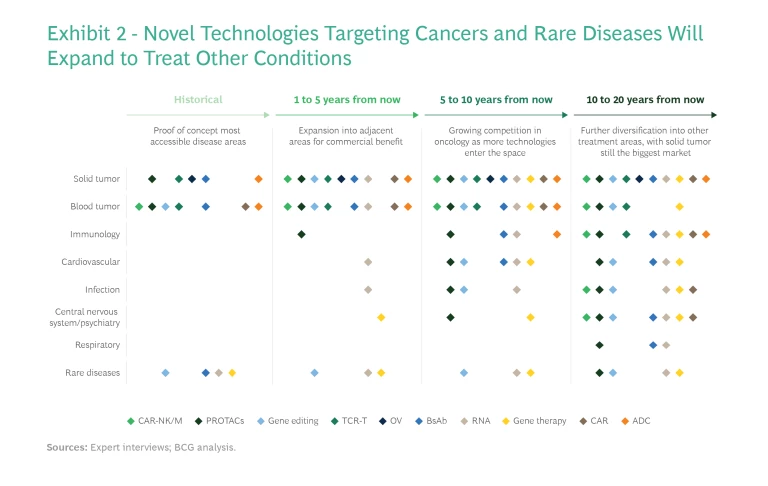

Initial proof-of-concept applications are focused on oncology and rare genetic diseases where unmet medical needs are extremely high. Many of these diseases were previously thought to be incurable or untreatable. About three-quarters of the roughly 180 diseases targeted by the 700 gene therapy trials now underway are rare diseases or cancers, of which the majority lack any treatment. One such disease is AADC deficiency, an ultrarare genetic disorder in which AAV-hAADC gene therapies are showing promising clinical signals. These diseases have minuscule patient populations, so although novel modalities could provide cures, the market likely would not support multiple competitors.

Other drug pipelines are aiming beyond oncology and rare diseases to conditions that can be treated through similar mechanisms of action—expanding, for example, from immuno-oncology to immunological disorders, or from rare neurological disorders such as AADC deficiency to more common neurological diseases like Parkinson’s disease. In the longer term, most of these modalities will be used to treat a broader array of diseases, including metabolic, neurological, infectious, and respiratory diseases. (See Exhibit 2.) This is evidenced by the increasing number of preclinical and early-stage pipelines targeting indications other than cancer and rare diseases.

Treating Diseases Through New Mechanisms of Action

Novel modalities can bring new treatments through novel mechanisms of action. They can permanently affect the human genome through gene editing, or they can combine multiple therapeutic effects into a single treatment. For example, oncolytic virus therapy is able to simultaneously kill tumor cells, block angiogenesis, and activate innate or adaptive immunity against tumors.

Novel modalities can also expand into areas resistant to traditional treatments. The approximately 600 antibody–drug conjugate (ADC) trials underway include about 75 mechanisms of action, of which approximately 30 address conditions that currently have no treatment.

Providing Superior Therapeutic Effect or Convenience

Even when a new modality doesn’t produce its effect through a new mechanism of action, it can still be an improvement over current treatments by making them more convenient or effective. For example, the CD19 antigen is a common target of multiple modalities, such as ADCs, CAR T cells, monoclonal antibodies, and novel antibodies. Yet some new modalities show a marked improvement in treatment efficacy.

In other cases, novel modalities add value through a more sustained or even a permanent therapeutic effect. For example, a single injection of Roctavian, an AAV-delivered gene therapy targeting hemophilia A, can provide treatment for four to six years, compared with three days for previous treatments. Inclisiran (an RNAi treatment targeting the PCSK9 gene) is administered every six months in the treatment of cardiovascular disease, compared with monthly injections of established monoclonal antibodies.

Complementing Traditional Modalities

In some cases, new modalities will not replace but complement and significantly boost the therapeutic effect of established treatments, such as small molecules and traditional antibodies. For example, both oncolytic viruses and personalized mRNA cancer vaccines activate endogenous immune cells to clear cancer cells; combining them with programmed cell death protein-1 (PD-1)-targeted immunotherapy could result in greater efficacy. Such synergies could allow biopharma companies with mature marketed therapies to leverage novel modalities to achieve better clinical effects—and better patient outcomes.

Stay ahead with BCG insights on the health care industry

A Strategy for Betting on New Modalities

These new biotech platforms will create huge opportunities for a subset of the industry—and put latecomers at a disadvantage. Incumbent players that want to compete in new modalities have a wide range of options—potentially partnering with or acquiring smaller competitors or developing internal capabilities. Understanding how to pursue these opportunities requires careful analysis of technologies, indications, and targets.

Understand the Challenges

Companies need to understand the full scope of challenges that the new modalities present. Each has its own technological issues. For example, more than 20 clinical trials for gene therapies have been halted by the FDA over the past three years owing to safety concerns. Most emerging modalities are at the proof-of-concept stage, which entails significantly higher risk for R&D. Many are still waiting for technological improvements to fully unlock their potential, and how long those will take to develop is unpredictable. After many years in development, gene and RNA therapies still lack an efficient, safe, and organ-specific delivery system.

Companies need to understand the full scope of challenges that the new modalities present.

There are also manufacturing and operational demands that are different from those of traditional platforms. Gene therapies and oncolytic viruses still face challenges in large-scale production efficiency and consistency. Similarly, autologous CAR T-cell therapy and personalized mRNA cancer vaccines both require new manufacturing workflows. In addition, commercial, pricing, and reimbursement models will need to be developed to accommodate the high costs of production and personalization of such new modalities as gene and cell therapies.

Balance Risk and Reward

Companies need to balance the risks and potential rewards of investing in new modalities, starting with the choice of technologies. There is no single answer, but it’s essential to think through the tradeoff between technologies that target of a range of diseases and those that offer superior clinical benefits for fewer diseases. Companies must also assess the maturity of specific modalities, along with development barriers and areas where they can add value over existing treatment options. For example, while one technology may offer a cure—completely replacing current therapies—another may complement existing treatments and bring only marginal benefits.

Companies also need to determine which diseases and indications to target. Straightforward “low-hanging fruit” diseases could be a first proof of concept, while “hotspot” diseases could entail less risk, since the target is clear and clinical trials are relatively straightforward to design. But less risk means more competition. In contrast, “moonshot” indications entail fewer competitors but also higher risks. Meanwhile, some modalities offer potential synergies with existing platforms and sales channels, which could create opportunities to build on other targets or combination therapies.

Companies also need to determine which diseases and indications to target.

Partnerships—either targeted alliances or M&A—are another option. Most of the top 25 biopharma companies have some level of investment in new modalities. Some are developing them through their internal R&D pipeline, but most are targeting specific segments through M&A and licensing arrangements. As a result, a network of partnerships has formed among small biotech firms and larger, established players. Yet many smaller firms with promising modalities in development are still independent and available to partner with incumbent biopharma companies.

Finally, companies should consider downstream manufacturing and operations. Depending on the maturity of their manufacturing technology and the complexity of the relevant supply chain, companies will need to manage the tradeoff between building internal manufacturing capabilities and outsourcing. There may also be opportunities for specialized players to take on a new role in the ecosystem as manufacturers of novel modalities.

A Platform Approach

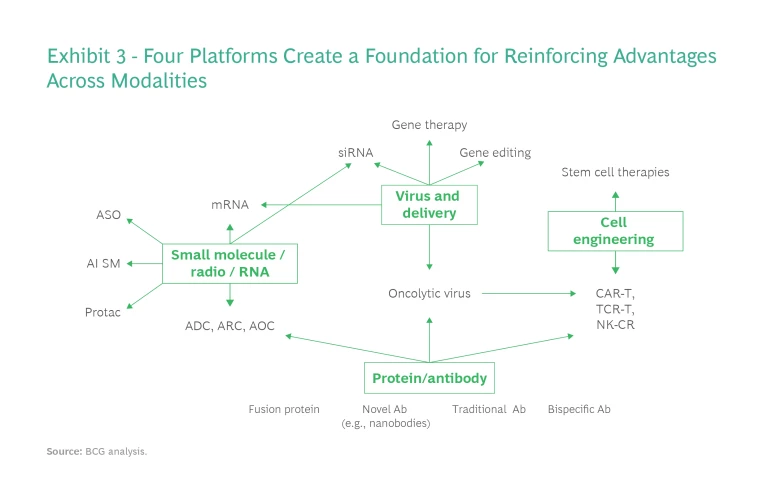

Success with new modalities requires not only specific R&D domain knowledge but also experience in regulatory, manufacturing, supply chain management, and commercialization issues, which can take years to develop. Yet once a company has developed those capabilities for one modality, it can apply them to other, related modalities. For that reason, a platform approach can help companies target multiple modalities and generate synergies across them. There are four such development platforms, each with its own specific requirements. (See Exhibit 3.)

Protein/Antibody Platform. The capabilities required to develop the monoclonal antibodies, bispecific antibodies, fusion proteins, and other complex biologicals that are the focus of this platform could support other novel modalities, such as oncolytic viruses and CAR T cells. This platform requires robust antibody generation, screening, and engineering capabilities. Companies that build a protein/antibody platform can create a competitive advantage by generating antibodies rapidly, addressing challenging biological targets, developing proprietary formats, generating better therapeutic effects, manufacturing with higher yield, and lowering immunogenicity.

Small-Molecule, Radio, and RNA Platform. The second major platform entails a focus on small-molecule, radio, and RNA therapies. Success depends on adopting AI to modernize the discovery process for small molecules, as well as to small-RNA/oligo synthesis, engineering, and mRNA generation/modification. Companies may also need robust next-generation sequencing for personalized cancer therapies, such as mRNA vaccines.

Virus and Delivery Platform. This platform requires critical capabilities in support of gene, oncolytic virus, and cell therapies, as well as a deep understanding of viral genetic engineering, production, and immunogenicity (for in vivo therapies). Companies that focus on a virus and delivery platform also need to develop novel nonviral delivery systems—for example, lipid nanoparticle and viral-like particle capabilities—to compete in gene therapy, mRNA, and gene editing.

Cell Engineering Platform. This platform focuses on cell culture and engineering for multiple cell types, including stem cells and terminally differentiated cells. Chemistry, manufacturing, and controls are critical, with companies experiencing multiple failures recently because of problems in these areas.

New modalities are generating new ideas about how drugs could function in the future. One or more of them could become the next blockbuster that transforms the therapeutic landscape for a disease area. They are at different stages of maturity, however, with different levels of R&D risk, different degrees of readiness to address unmet needs, and different timelines to potential commercial use. It’s critical for companies to land on a strategy tailored to their specific portfolio and strength, balancing the rewards and risks and allocating resources to maximize the potential value.