The pressure on companies to reduce their greenhouse gas (GHG) emissions is mounting—from investors, employees, consumers, and regulators. In response, companies in every industry are setting ambitious emissions reduction goals and taking steps to meet them and track their progress.

In our view, the best way to ensure action on meeting these commitments is to set an internal carbon price (ICP) on companies’ emissions and tie it to the financial performance of each asset and business unit across the company. An ICP allows companies to put a monetary value on each ton of carbon emissions, both current and future. This can support the drive to comply with decarbonization goals on both the corporate and asset levels and integrate those goals into decision-making. When properly applied, an ICP can be a powerful change management tool , linking action across the organization to incentives and decarbonization outcomes at both the asset and the product portfolio levels.

For an ICP strategy to be effective, companies must gain full and accurate transparency into the amount of carbon currently being emitted, assign a price to that carbon, and then carefully integrate the price into daily operations in ways that fully mobilize and motivate the company’s workforce to meet its decarbonization commitments.

We believe this effort should be led by a company’s finance function. Sustainability performance has become inseparable from financial performance, making companies’ ability to act on sustainability-related issues a key differentiator in achieving corporate success. According to BCG’s CFO Excellence Index , while finance divisions lead the climate and sustainability agendas of just 20% of companies, on average, these companies scored significantly higher in the index’s climate and sustainability performance ratings than companies where other functions take the lead.

Internal carbon pricing can offer substantial benefits, but it can be a complex undertaking. How should leaders go about putting an ICP into practice at their companies? And what role should the finance function play in getting it done?

ICP as a Key Tool for Carbon Footprint Reduction

In hopes of pushing companies to make progress in decarbonization, stakeholders across the board—regulators, employees, suppliers, and customers—are demanding greater transparency and real action. Organizations are expected to disclose their current emissions levels, their abatement goals, and the progress they are making. Indeed, the number of companies announcing net zero commitments has grown exponentially over the past five years.

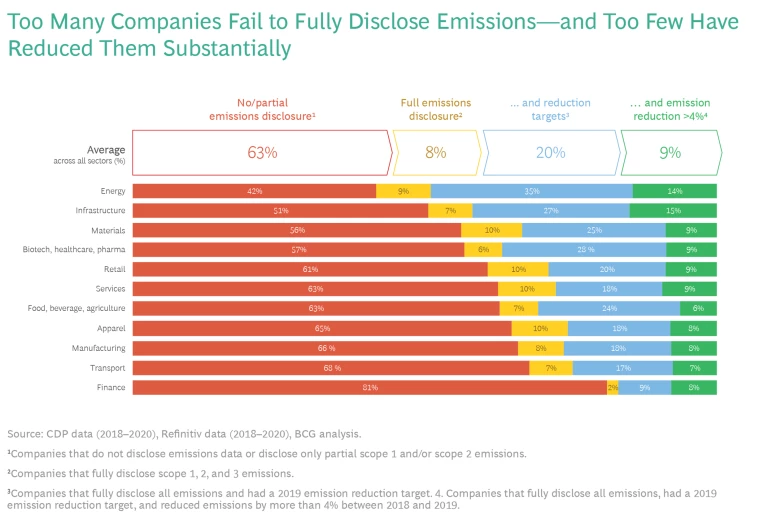

Few companies have succeeded in making real progress, however. According to CDP, a not-for-profit that tracks global emissions, more than 3,600 companies have announced net zero commitments to date, more than half of them based on science-based targets. Nevertheless, this accounts for just a third of the global economy by market capitalization—and less than 10% of companies have reduced their emissions by more than 4%. In fact, to date, more than 60% of companies across all sectors disclose only partial information on scope 1 and 2 emissions or provide no emissions data at all. (See Exhibit.)

The bottom line: companies continue to fall short in virtually every aspect of the journey toward net zero. To get there, business leaders must rally their broader organizations behind the decarbonization agenda and initiate ambitious actions to reduce their carbon footprint. This requires more than just measuring and disclosing carbon footprint data and defining actionable reduction goals and a timeline for the effort. Companies must also embed carbon footprint reduction targets in every aspect of their strategy, governance, corporate steering, investment decisions, and operations.

The most effective way to accomplish this is by assigning to all corporate GHG emissions an ICP—typically the conversion of tons of CO2 equivalents (CO2-e) to a monetary value. This allows for a high level of comparability among planned initiatives and investments, and in turn enables a direct assessment of the impact of carbon reductions on both opex and capex decisions. In fact, according to the CDP, in 2022 more than 2,000 companies were using or planned to use internal carbon pricing in their efforts to establish and meet their carbon abatement goals.

The corporate CFO and the finance function have expertise in financial planning and analysis, as well as investor relations, that is well-suited to assessing the ICP and managing its implementation across the company.

The Price Is Right

The great virtue of an ICP in reducing GHG emissions is that companies can apply it in a number of ways, taking into account both current and future emissions across their operations. In our experience, companies do best when they follow a consistent path to the full use of an ICP, which ensures that they gain the most value; however, each company’s ICP journey will be different.

Many start by using the ICP to reflect the cost of future emissions in investment decisions, effectively improving the economics of any low-emissions projects while penalizing high-emissions projects. This will help companies build a future-ready portfolio of low-carbon assets. At the same time, it is also critical to begin to accelerate the decarbonization of all current assets by charging each asset for the cost of the carbon it emits, and tying emissions to each asset’s P&L performance.

Depending on the ICP model used, the funds raised from the charges placed on assets can be spread evenly over years to finance the abatement of each asset’s carbon footprint and to invest in new low-carbon businesses and products. Companies can also embed the ICP in the procurement process for emissions-intensive materials, utilities, and services to reduce their scope 2 and scope 3 emissions and decarbonize their supply chains.

Ultimately, companies should be monitoring their ICP-adjusted P&L at both global and brand levels, and fully integrate the cost of carbon into their cost of goods sold, current and forecast commodity prices, margins, and other key financial metrics. Charging the CFO and the finance function with the responsibility for managing the ICP process, in conjunction with the sustainability and strategy teams, will ensure that adequate rigor is brought to the task.

Setting the Price

The ICP journey begins with companies determining the most appropriate model for pricing carbon—based on how the ICP will be used—and then integrate it into their operations. There are three possible models for the ICP, each with varying applications and benefits, depending on the circumstances. Some companies may choose to mix models to achieve their desired goals.

- Shadow Price. In this model, companies assign a pre-determined carbon price to the likely GHG emissions of all procurement and investment decisions. This may be a regulatory price as determined through external carbon tax, the price of offsets in voluntary markets, or a function of total estimated abatement costs. Shadow pricing enables the company to determine the cost of their GHG emissions and integrate it into future decision-making. This includes the potential abatement costs involved in reaching corporate net zero goals and all future savings. A shadow price calculated for procurement decisions aims to account for and control upstream scope 2 and 3 emissions by choosing suppliers that are willing and able to provide low-carbon materials and components.

- Carbon Fee. By charging a dollar amount for every ton of CO2-e emitted on every asset’s scope 1 and 2 emissions—and collecting actual cash as an internal tax—companies can encourage emissions reductions and use the cash flow to support abatement actions throughout the organization. The carbon fee is intended to directly impact the bottom line of each asset and should be part of the incentive scheme for the leadership of the asset. (See “Implementing a Carbon Fee.”)

- Cap and Trade. It is also possible for companies to allocate carbon credits to each business area and then devise a system that allows them to trade credits internally. If a business unit exceeds its allotted credits, it must buy additional allowances from other business areas. On occasion, a business unit might choose to offset its emissions using publicly traded credits, and then sell its remaining internal credits into the company’s trading scheme. Few companies, however, are likely to implement a cap-and-trade system given the high level of complexity involved in setting up an internal trading system that merely replicates available public trading systems.

Implementing a Carbon Fee

Implementing the roadmap, however, turned out to be a challenge—primarily because managers of the company’s assets were reluctant to make the decarbonization investments needed, preferring to protect their assets’ current bottom line.

Company leaders decided to institute an internal carbon fee, which, like a tax on emissions, would impact each asset’s bottom line and incentivize fast decarbonization action while penalizing inaction. The company’s CSO and CFO teams worked together during the planning process to review the abatement roadmap. In light of that analysis, the actual size of the fee was designed to adequately support the overall net spend on abatement levers through 2050, starting low and ramping up over time as the cost of abatement rises.

The company implemented the carbon fee by integrating it into finance and accounting policies and processes. The price is to be reviewed regularly to ensure that it evolves consistently with the company’s abatement roadmap. And funds generated from the fees will be collected centrally and used to support assets in their abatement initiatives.

Which model to use, and how high to set the actual price, depends on the activity, asset, and geography where it is being applied. Companies should use a shadow price in the procurement process when the goal is to control immediate scope 2 and upstream scope 3 emissions—and an investment process when the goal is to account for the cost of future carbon regulations and the social impact of carbon emissions in current investment decisions. Higher prices could be applied on assets with greater carbon intensity to incentivize decarbonization and improve the competitiveness of those assets. Companies with assets and supply chains in regions with stringent regulations could also adopt higher prices to ensure their overall long-term competitiveness.

Companies can set the actual ICP in three different ways. One option is to calculate an implicit price based on the company’s average cost of abatement across all assets. The total amount needed to abate all assets is then translated back to a set carbon fee, and the funds collected are then used to fully fund the abatement initiatives required.

Alternatively, an external regulatory price, such as a carbon tax or the EU’s Carbon Border Adjustment Mechanism, can be used as an ICP if the organization has high exposure to such markets, either through assets located there or by selling products into them.

Finally, companies could use an external offset price as another reference point if they are relying heavily on carbon offsets as part of their net zero strategy. However, certification standards such as Vera and Gold Standard are evolving quickly, so companies need to track them carefully and regularly update the ICPs derived from them.

The ICP in Practice

To ensure successful implementation, the ICP must be revised regularly in response to changes in market and business conditions. When regulatory carbon prices or external carbon offset prices change, for example, it is critical that companies reflect the change in both their current ICP and their forecast of future prices. Companies should also maintain a rolling forecast of the likely future ICP and embed it in their business planning processes, much like they forecast future commodities prices. This will allow them to better direct corporate steering and investments decision-making as markets and business conditions change.

To effectively implement and manage the ICP, appropriate procedures and policies must be put in place. To ensure proper collection and use of carbon fees, for example, companies could create a central carbon fund, cost center, and accounting procedures for deducting the fees from all assets and crediting them to the central fund. To determine how the collected fees should be used to fund GHG reduction initiatives, the proper investment criteria must be defined in line with the company’s decarbonization roadmap. This could include current emissions and intermediate abatement targets and the marginal cost of abatement. Finally, the ICP and associated processes should be incorporated into the annual capital allocation and business planning process.

Internal carbon pricing involves changes in the way an organization does business and how its employees work.

Companies choosing to implement a shadow carbon price need to consider how to incorporate it into both their procurement and investment decisions. For procurement, companies should establish processes and tools to gather emissions data from suppliers for critical categories of goods and services. This is particularly important in developing or underdeveloped markets, where companies and suppliers may not openly report their emissions. Then they will need to define a mechanism for incorporating the shadow price into the commercial evaluations of supplier bids. It is important to openly communicate to suppliers the company’s plans and procedures for using the ICP as part of the procurement process.

The Change Factor

Establishing an internal carbon price involves changes in the way an organization does business and how its employees work. As with most change management efforts, companies essentially have two options for implementing an ICP regardless of the pricing model they decide to use.

The first approach is to run small-scale pilots, either across individual business units or specific assets, to iron out the kinks, especially at a large organization. This can help to demonstrate that ICP activities can be successfully integrated across all supporting activities—such as finance, investments, and business planning—before rolling it out to the wider organization.

The second approach involves launching the ICP uniformly across the company from the start. This can help to drive immediate action, allowing the entire organization to stand behind the sustainability objective. An immediate full roll-out is best suited to organizations that require less differentiated ICPs, such as for all assets within a single geographic area.

Internal carbon prices have been shown to be an effective way for companies to account for their current carbon footprint, assess their carbon abatement needs, and then fund the decarbonization effort. By putting the process into the hands of the CFO and the finance function, it can be carried out with thoroughness and accuracy, and ensure that it is fully incorporated into the company’s operations and abatement initiatives.

Yet designing and implementing an ICP will take time and should be paired with considerable change management actions. Given the need to begin the decarbonization process soon, if companies are to reach their net zero goals, the time to begin is now.