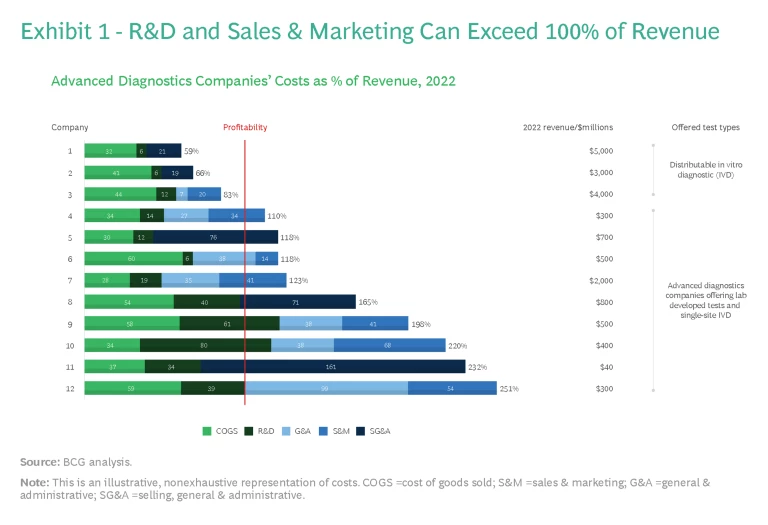

The potential of advanced diagnostic tests to address unmet patient needs is growing rapidly as genomics, proteomics, and other technologies fuel biomarker discovery and deepen understanding of disease pathways. Yet BCG analysis has found that few advanced diagnostics companies turned a profit last year. (See Exhibit 1.)

The success of any advanced diagnostic, of course, depends heavily on the commercialization efforts behind it, with significant sustained investment over many years and often periods of negative profitability. For example, for select companies with on-market products earning more than $100 million in revenue, the combined cost of R&D (including clinical evidence generation) and sales and marketing can surpass 100% of revenue.

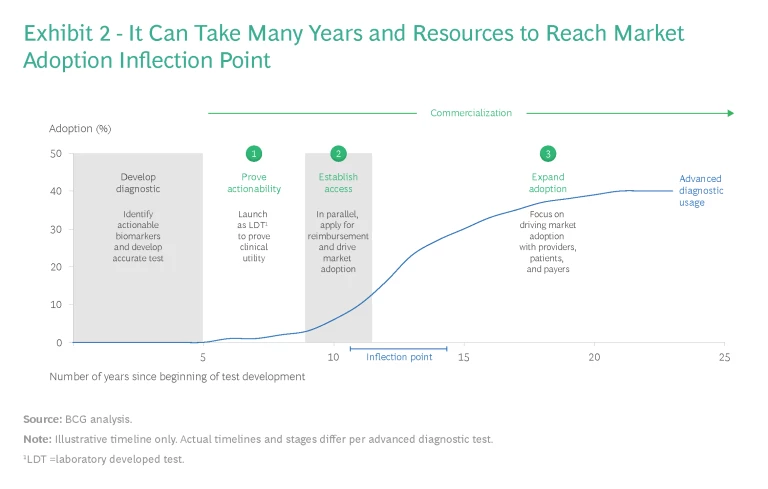

In our experience, when it comes to launching laboratory-developed tests (LDTs) or in vitro diagnostics (IVD) in the US, or IVDR (IVD regulation compliant) tests in Europe, companies should pursue a commercialization strategy focusing on three major imperatives: proving actionability, establishing access, and expanding adoption. Although each requires much in the way of capabilities, resources, and time, together they can set the foundation for successful market adoption and sustained growth.

While the challenges are vast, so are the rewards. Like a biopharmaceutical blockbuster, an advanced diagnostic that is commercialized well can improve the standard of care for millions of patients and bring in substantial revenue. Conversely, a test that is not optimally commercialized could lose tens-to-hundreds of millions for the company that develops it.

Three Major Imperatives

Bringing an advanced diagnostic to market is a daunting prospect. (BCG defines an advanced diagnostic as a test that measures a novel biomarker, has a novel clinical use case, or requires a niche methodology.) That’s because companies must address many different challenges across the commercialization life cycle—from conducting clinical trials to deploying the sales force. These efforts take significant time and funding: companies can spend up to ten years and up to $100 million before their advanced diagnostic reaches the inflection point for market adoption. (See Exhibit 2.)

Proving Actionability

To satisfy the first imperative, actionability, companies need to provide evidence that the use of the diagnostic test influences clinical interventions or improves patient outcomes more than existing tests. Proving actionability takes anywhere from one to six years depending on the therapeutic area. Infectious disease studies typically take months, whereas oncology studies take several years.

This phase of proving actionability entails demonstrating analytical and clinical validity as well as clinical utility.

Analytical and Clinical Validity. When proving actionability, the company needs to demonstrate that the new diagnostic test meets certain analytical and clinical criteria. Analytical validity pertains to how accurate the test’s results are, while clinical validity relates to the test’s ability to accurately predict the patient’s clinical status and is key for pursuing IVD approval.

Clinical Utility. Clinical utility reflects the ability of a test’s results to inform clinical decisions that improve patient outcomes. Clinical utility is critical because it is used to argue for reimbursement as well as guideline inclusion.

In a recent example, after one company demonstrated its test’s clinical utility, the US Preventive Services Task Force decided to include the test in its recommendations for clinical preventive services. Another company, however, failed to prove the clinical utility of its rheumatology diagnostic, which limited its adoption by clinicians.

Demonstrating clinical utility is a more complex—and costly—undertaking than demonstrating analytical or clinical validity. The required clinical studies tend to be very expensive because of the rigor needed to satisfy health care providers (HCPs), regulatory authorities, and payers. Close collaboration with all three groups is critical to avoid the need to redo trials later.

Establishing Access

The second major imperative, the phase in which broad market access is established, entails a number of objectives and can take three to five years, depending on whether the test is an IVD or an LDT, or is complying with IVDR. Investment needs during this phase are moderate and are usually met by venture capital and growth equity firms. Activities during this phase include the following:

Demonstrate value. Companies first need to demonstrate the diagnostic’s clinical and nonclinical value—it’s a key requirement for obtaining regulatory approval, reimbursement from public and private payers, and adoption. In some markets, country-specific health technology assessments are required.

Submit regulatory filings. Companies that are developing an IVD must submit regulatory filings. Although this process takes about two years, it can speed up the reimbursement process later.

Obtain inclusion in guidelines. A company can significantly accelerate access, especially for a novel test, if a medical society includes the company in its guidelines. Qualifying for such endorsements, however, can take up to ten years because it requires strong clinical evidence and purposeful engagement of early HCP adopters.

Qualify for reimbursement. This objective has three components: coding (how the test is identified), coverage (the criteria for determining whether the insurer will pay for the test), and payment (the amount paid for the test). The Centers for Medicare and Medicaid Services (CMS) and private payers have different requirements and processes for establishing reimbursement for a particular test. But all payers require a CPT or PLA code to establish the test’s reimbursement level (the portion of the cost of a covered claim before the deductible is applied) and payment structure.

Develop a flexible pricing strategy. The pricing strategy needs to be flexible enough to cover a large range of the patient population. It should include elements that cater to less-affluent patients, including peer analysis, pricing for uninsured or cash-paying patients, and discounts. And companies should be prepared that cash pay could be the only source of revenue until reimbursement is secured.

The noninvasive prenatal test (NIPT) provides a good example. Initially, this test qualified for reimbursement only when the pregnancy was high-risk; for pregnancies of average risk, the test had to be paid for in cash. After NIPT was on the market for ten years, American Congress of Obstetricians and Gynecologists guidelines recommended that it be reimbursable for average-risk pregnancies as well. Over time, the test came to be covered and reimbursed by a broad swath of commercial payers.

Expanding Adoption

After establishing actionability and access, companies can start expanding adoption. This is when commercial and medical teams develop cost-effective strategies for getting various stakeholder groups and key opinion leaders—health care providers, health systems, payers, and pharma companies—to support the broad adoption of the advance diagnostic by HCPs and patients.

Expanding adoption is a lengthy and costly endeavor. It can take anywhere from five to ten years to reach peak adoption–– and expenditures, which are usually funded by growth equity firms and shareholders, can be significant.

Consequently, it’s critical for advanced diagnostics companies to tailor their commercial strategy at the adoption inflection point. Successful companies customize their value proposition, clinical evidence strategy, segmentation and targeting, and the deployment of their marketing and sales teams for each stakeholder group, including the following:

Companies have found that providing additional support services to HCPs, such as care navigation programs, can increase market adoption.

Patients. The role of the patient in expanding adoption varies with the disease area. For tests such as NIPTs, which have a high proportion of cash-pay revenue, or elective screening diagnostics, direct-to-consumer engagement is critical for building awareness and driving adherence among patients.

Borrowing best practices from the consumer products industry, successful diagnostics develop customized messaging and content for different customer segments and design the end-to-end patient experience with much care. Traditional and digital marketing as well as user experience design are capabilities that these companies build internally or access through partnerships.

Health Care Providers. For HCPs, adoption is as much about the clinical and economic value of the test as the ability to integrate it into their clinical workflow.

Many different types of HCPs may order a test in a particular therapeutic area: broad-access specialties such as family medicine, internal medicine, and ob-gyns, and referral-based specialties, such as oncologists, neurologists, and rheumatologists. As a result, strategic deployment of sales, marketing, and medical affairs resources is critically important. Targeting high priority HCPs (those who are viewed as clinical leaders, and those with high volume and willingness to adopt), use of targeted digital engagement, inside sales models, and partnerships or copromotions with biopharma can all improve returns on sales and marketing spend. Companies have also found that providing additional support services to HCPs, such as care navigation programs, can increase market adoption.

Health Systems. Today, more than 70% of US physicians are now employed by a hospital or corporation. In some situations, health systems may directly pay labs for testing services in a client billing arrangement. Even for tests with no flow of funds between the health system and the test provider, health systems still play a critical role in establishing clinical pathways and providing workflow tools such as electronic ordering and result delivery.

To drive adoption with health systems, advanced diagnostics companies should engage with clinical service-line leads; integrate the test into electronic health records and electronic medical records systems to enable physicians to order them; and partner with the hospital on clinical programs. Each major health system has a unique set of priorities and decision makers, so a one-size-fits all approach is unlikely to be very effective. Key account management for the top 15 to 20 health systems is likely to be more successful.

Biopharma Companies. Advanced diagnostics companies, especially those developing tests in therapeutic areas like oncology, can enhance their adoption efforts by forging clinical development and/or companion diagnostic partnerships with biopharma companies. The direct connection to a therapeutic intervention, in concert with biopharma clinical trials and commercialization efforts, can help broaden and accelerate a test’s adoption.

Five Key Learnings for Diagnostic Commercialization

The required investment, personnel, and time needed to achieve broad adoption of an advance diagnostic can be formidable. Companies starting out on the commercialization journey, therefore, should keep five learnings in mind.

Given the growing importance of profitability, companies that build a high-value commercialization engine should leverage it for multiple tests.

Involve major stakeholders early on. Companies should engage important stakeholders, such as HCP adopters, the Food and Drug Administration, and CMS, at the beginning of the commercialization process. Keeping them engaged through development and adoption can create a network effect that will spur sustained growth in adoption.

Leverage the company’s commercialization engine for multiple tests. Given the growing importance of profitability, companies that build a high-value commercialization engine should leverage it for multiple tests. While establishing access, for example, companies can reuse coding, coverage, and payment capabilities. And while expanding adoption, they can leverage preexisting marketing capabilities; existing sales teams (selling multiple tests to the same physicians or into the same care pathway); and knowledge of customer experience design (including the integration of electronic health records).

Involve the entire organization. Successful commercialization depends on the broader organization understanding the requirements for launching and scaling an advanced diagnostic. Yet often only the chief medical officer and the market access and medical affairs teams possess a nuanced understanding of what’s involved—and are often the ones in the organization who are advocating for investing in these key imperatives.

Sequence investments strategically. Since actionability and market access are prerequisites for market adoption, innovators need to strategically sequence their sales and marketing investments. They should begin with a very focused team that drives market development with early adopters as the test moves through proving actionability and establishing access. Once coding, coverage, and payment structure are in place, companies can embark on a broader campaign.

Prepare for the long term. The commercialization of an advanced diagnostic is a lengthy process, so innovators should be ready with a plan to dedicate significant resources to it for a period of a decade or longer and have the flexibility to adapt the purpose of the test as needed.

Investors, too, should view potential investments with these considerations in mind. Given that many tests in development will have large total addressable markets and promising biomarkers, investors should evaluate the probability of commercial success based on the test’s clinical utility and its path to reimbursement and access.

The journey to commercialize advanced diagnostics is a complex and multifaceted endeavor that demands a long-term commitment from companies and investors. As the industry continues to evolve, the companies that adeptly navigate the complexities of commercialization will not only reap financial rewards. They will contribute to a paradigm shift in health care, moving us closer to a future where medicine is truly personalized.