For chemical and materials companies, it’s time to ask a $3.5 trillion question: Are we in the early stages of a transformation from emissions-intensive petrochemicals to a new, green production paradigm in which CO2, hydrogen, and renewable energy are used in place of fossil fuels?

Carbon transformation, or CO2 to X as we call it, is rapidly emerging as an economically viable alternative to fossil fuel-based chemical production. Covestro’s CO2-based chemical precursor, Cardyon, and Econic’s CO2-based production method for polyols are being used to make sustainable polyurethane foams. Evonik, in collaboration with multiple partners, has launched the PlasCO2 project, which aims to use CO2 as a raw material in the production of C4 chemicals. Twelve, a startup working with Daimler and Procter & Gamble to produce CO2-based products, recently announced a $130 million Series B funding round. Air Company, another startup, has been selling CO2-based vodka and fragrances, among other products; it raised $30 million in Series A funding. All told, venture capital firms invested some $700 million in CO2 transformation and utilization startups in 2022, according to PitchBook. Investment has been rising at an annual rate of 47% since 2018.

As the drumbeat of innovation and funding in CO2-based chemicals grows louder, big companies (especially those with carbon reduction or net zero commitments) need to engage with alternative production inputs and processes.

CO2 to X

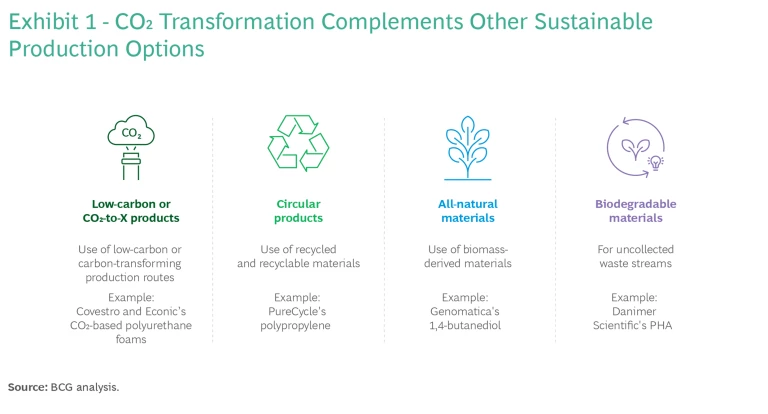

Recent analysis by BCG indicates that CO2 to X is a compelling, and underappreciated, endgame for the decarbonization of the chemicals sector—an industry that produced approximately 2.5% of global carbon emissions in 2022. CO2 to X can be viewed as one of four complementary approaches that augment carbon capture and storage (CCS) and reduce the carbon intensity of chemical production processes. (See Exhibit 1.) And as the economies of scale for CCS improve, the rewards will accrue to those best prepared to act.

Almost all petrochemicals used today can be produced using CO2, low-carbon hydrogen, and renewables in place of fossil fuels and heat. Such CO2-based pathways can unlock new greenhouse gas-reducing options that are highly desirable for downstream users. For example, the carbon footprint of ethylene produced using low-carbon hydrogen and CO2 (from biogenic sources or direct air capture) as feedstocks could be negative compared with the 1.3 to 1.8 tonnes of CO2 per tonne of ethylene generated by today’s gas-cracking process.

Developed at scale and reasonable cost, CO2-based production processes can be an important contributor to a low- or no-carbon chemical industry in which:

- The majority of process heat is provided by hydrogen and green electricity.

- Large shares of petrochemical building blocks based on syngas are produced through CO2-to-X methods in place of steam methane reforming.

- The remaining process emissions are captured and the carbon reused.

- Sustainable CO2 sources (such as biogenic or direct air capture) or recycled materials provide feedstock carbon.

The catalysts for these improvements will be technology developments that are both incremental (such as process optimization) and step change (such as the discovery of new catalytic materials), as well as evolving regulation and widespread green-electricity generation and hydrogen production. Renewables and storage technologies are rapidly advancing, and electricity for industry could be further enhanced by technologies such as small modular nuclear reactors, which Dow, among others, is pursuing. The supply of green hydrogen also needs to increase; BCG estimates that the demand for low-carbon hydrogen could soar to 350 million to 530 million tons per year by 2050.

Big Bet, Bigger Payoff

To be sure, being a pioneer in green markets is still a bet, but it’s one that could pay off big. Upstream players in industries such as chemicals have long operated in commoditized markets, competing mainly on cost and price. A January 2023 white paper prepared by the World Economic Forum and BCG reported that demand in this decade for some green materials, including chemicals and plastics, could outpace supply. Early movers that are addressing applications for which the customer demand for green alternatives is high (such as low-carbon olefins derived from pyrolysis oil or biobased monomers for polyethylene terephthalate) are already capturing price premiums. Those that wait for demand to materialize before investing may be too late.

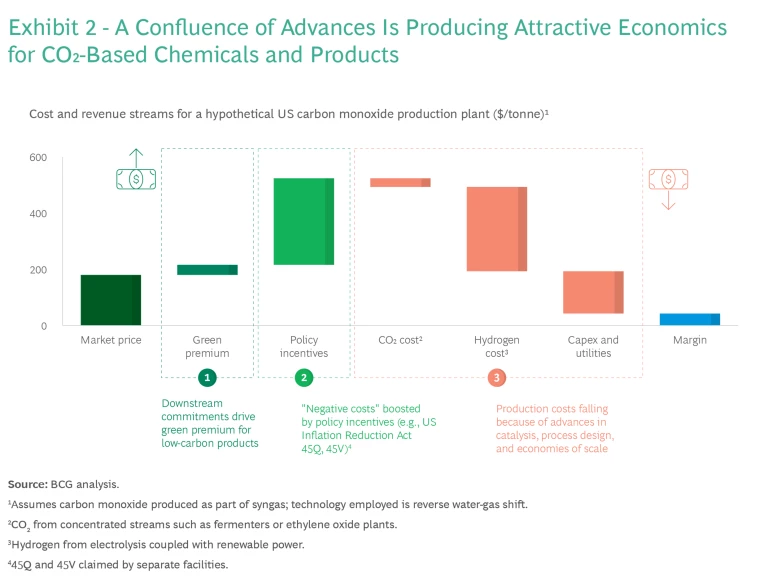

CO2 is an attractive feedstock because it is both industrially abundant and a problematic greenhouse gas. The big challenge is that CO2-to-X processes are still expensive and typically use large amounts of energy to create platform chemicals such as carbon monoxide (a key ingredient in a variety of industrial chemicals) and ethylene glycol (an antifreeze agent as well as the precursor for polyester fibers). Yet the economics of CO2 utilization are improving, with various pathways on the cusp of economic attractiveness. (See Exhibit 2.) BCG has shown that CO2-based processes may have lower Scope 2 and 3 emissions than biobased methods, and their costs are becoming competitive with gas cracking (net of subsidies). Pending EU regulatory shifts (such as the Emissions Trading System and Carbon Border Adjustment Mechanism) could erode the profitability of established high-carbon-emission production processes, creating additional incentives for change.

Many companies have committed to CCS as a key pillar of their sustainability programs. CO2 to X is a complementary approach: the infrastructure for capturing and transporting CO2 will create economies of scale for CO2 as a feedstock. For example, ExxonMobil and Mitsubishi Heavy Industries are partnering to use Mitsubishi’s CO2 capture technology as part of Exxon’s industrial end-to-end CCS solutions. Air Liquide, Fluxys Belgium, and the Port of Antwerp-Bruges have been awarded €145 million from the EU for the Antwerp@C CO2 Export Hub, which will collect and transport CO2 via an intraport, open-access pipeline network.

All that said, plenty of questions remain. Given the variety of technologies in development, as well as the number of potential products that could be targeted, assessing the technical, economic, and commercial risks is no simple matter. Crossover points for economics and greenhouse gas mitigation depend on the molecule of interest, the relative availability of circular or biobased options and electricity, and regulatory incentives. Companies need to determine how the various CO2 transformation routes compare with other sustainability pathways, such as biodegradability and circularity, from a cost and carbon footprint perspective. The decisions are rarely straightforward. Aliphatic and aromatic value chains require careful consideration based on process economics and maturity.

Many companies have committed to CCS as a key pillar of their sustainability programs. CO2 to X is a complementary approach.

Companies need to ask three key questions about when, how, and where to deploy the new technologies:

- Which molecules do we choose to try first?

- How should we (and others) assess technology developments and market and energy demands?

- How will the market develop? Given capital-intensive scaleup requirements and a lack of clarity on customers’ willingness to pay a premium, is there a go-to-market strategy that minimizes risks and accelerates timelines?

Which Molecules?

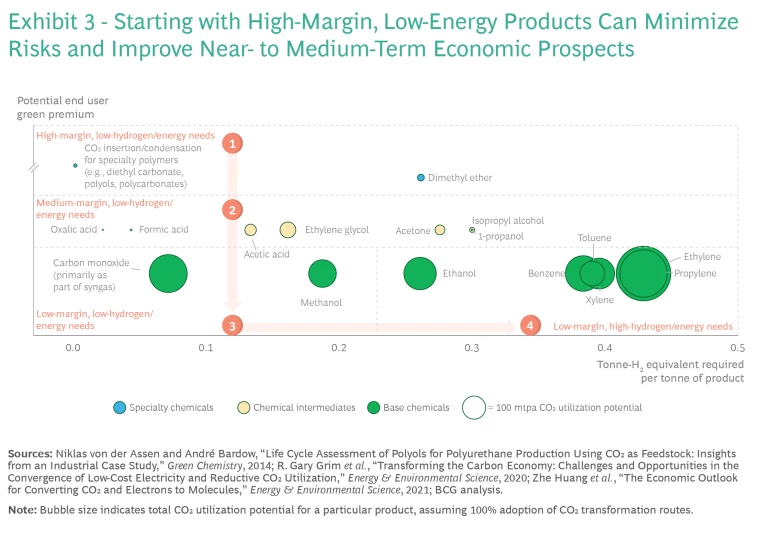

CO2 transformation is in the early stages of building scale by moving from premium to lower-cost products. Players should decide where and how to play based on their position in the value chain and their net zero aspirations.

We expect adoption by the chemical industry to follow an L-shaped curve, starting with high-margin products with low energy needs and spreading to more widely used molecules as costs come down. (See Exhibit 3.) Today, we are seeing the deployment of minimum viable products in high-margin, lower-volume specialty materials with low renewable-energy or hydrogen requirements, such as polycarbonates, polyols, and diethyl carbonates (used for batteries). These use cases minimize competition for scarce renewables while absorbing the extra costs associated with new products. Twelve’s collaborations with Daimler and Procter & Gamble, as well as Covestro and Econic’s entry into the CO2-based polyurethane foam market, are examples of this strategy already being tested.

Expanding availability of green energy and hydrogen should lead to scaled-up production and diversification into medium-margin specialty chemicals, followed by moves into lower-margin and more energy-intensive base chemicals (such as syngas and methanol). The ultimate displacement of low-margin, high-energy base chemicals will be the last phase, as CO2 transformation technologies move up the scale curve.

Technology Developments and Market and Energy Demands

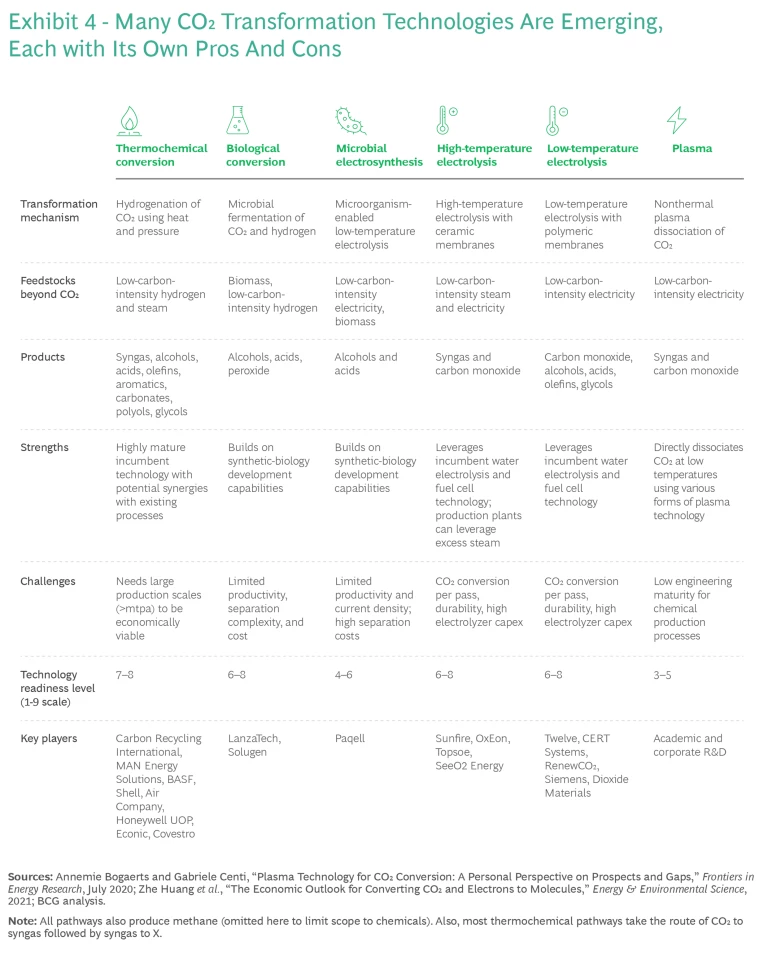

At least six technical pathways to CO2 transformation provide multiple options with potential for market development and carbon reduction. They are at different stages of maturity, and each has its own advantages and disadvantages and is useful for particular groups of products. (See Exhibit 4.)

Understanding which markets are likely to convert more quickly involves assessing factors such as production costs, customer willingness to pay, downstream sustainability commitments , and downstream options for addressing Scope 2 and 3 emissions. LanzaTech, for example, has focused on monoethylene glycol, a precursor for polyesters used across numerous consumer product value chains, where commitments are strong, willingness to pay is high, and Scope 2 and 3 reduction options are lacking for downstream companies.

Determining fit-for-purpose options involves assessing several factors, such as market, value proposition, and net zero commitments. Companies need to analyze what’s attractive about a particular technology (bioroutes are good for alcohols and acids, for example, electrochemical routes for C2 olefins, and thermal routes for most other products), its technology maturity, the feedstocks needed, and their (potential) availability in the required locations.

New models and priorities may be necessary. Sustainable-chemicals “unicorn” Solugen determined plant locations based on proximity to downstream customers and suitability for smaller-scale facilities. LanzaTech looks to capture CO2 from existing processes and facilities. Evonik and Siemens have located a major facility where they have ready access to low-cost renewable power and hydrogen incentives.

How We Expect the CO2-to-X Economy to Develop

CO2 transformation technologies that are viable at scale now will only partially meet net zero ambitions. A mix of near- and longer-term technologies will be necessary to achieve significant and lasting impact.

Near Term. As the CO2-to-X economy gains traction, two types of players with natural synergies could be the first large-scale adopters. Some large-scale syngas users with aggressive sustainability goals are already pursuing CO2 to syngas as a way to reduce embedded carbon, achieve price premiums, and leverage existing downstream production capacity and market access. CO2 to X also provides a potential solution for large-scale producers with concentrated CO2 streams that do not have access to CO2 pipelines or geologic storage and could face big carbon emission liabilities. Rather than investing in avoiding those liabilities, such companies could invest in turning them into a product stream.

A mix of near- and longer-term technologies will be necessary to achieve significant and lasting impact.

Medium Term. Collaborations and alliances along the value chain provide opportunities to align incentives, collectively lower emissions, and expedite scaleup for lower-value, higher-energy molecules. For example, Total is working with Axens on bioethylene and with Stanford University and startup CERT Systems on transforming CO2 into ethylene. CO2 transformation could complement and be integrated with bio to X, waste to X, and oil to chemicals, minimizing the risks associated with investments in feed-flexible refinery alternatives. As carbon dioxide evolves from a waste product that needs to be buried to an economically viable feedstock, process economics will change, rewarding strategic bets on the right processes and feedstocks for the right molecule.

Longer Term. Venture capital and government investment will push potentially disruptive new technologies (such as plasma and electrocatalysis) toward maturity. These could provide the opportunity to leapfrog existing technologies and ultimately meet carbon reduction or net zero goals. By 2040, cost advantage may no longer be about access to low-cost natural gas but rather access to low-cost, low-carbon electricity, hydrogen, and a concentrated CO2 stream. This would have massive implications for traditional petrochemical geopolitics, trade flows, and claims to profit pools.

Guidance for the C-Suite

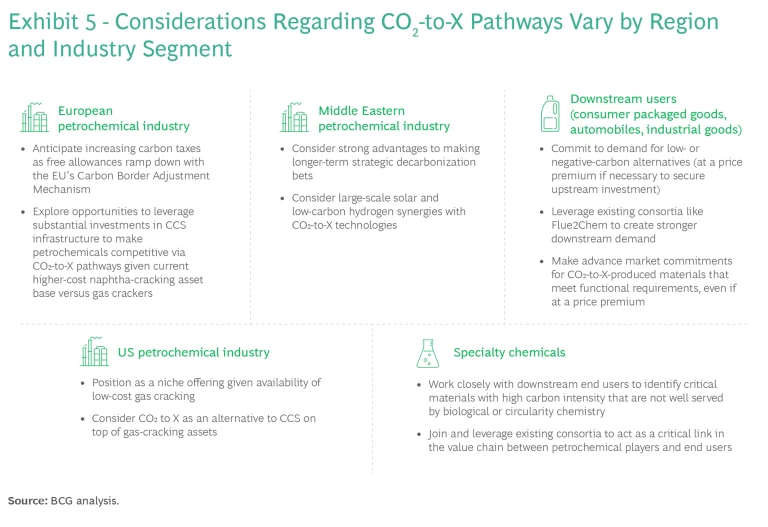

The pathways to environmentally and financially sustainable CO2-to-X models vary by region and industry segment. (See Exhibit 5.)

But as CO2-to-X costs fall, leaders at all large chemical producers, as well as at other companies, should address the following questions to determine if the technology has a place on their decarbonization agendas:

- How could CO2-to-X technology change competitive positions and profit pools in our core products and geographies?

- Does our R&D organization possess the capabilities to take advantage of the new technology?

- Where do our assets or value chains create natural partnership options that we can explore?

Chemical manufacturing appears to be stuck with a choice between profitability and sustainability. But we are at the leading edge of a technological and commercial revolution in how to turn CO2 into a net contributor to a net zero chemical industry. Chemical companies can be among the biggest winners—if they get to work on the transformation now.