Ferdinand Harries

This is a modal window.

Ferdinand Harries

In a groundbreaking shift, leading car manufacturers are exploring the transition to fixed, non-negotiable prices through direct sales. A BCG study, involving over 500 consumers, reveals that a majority of car buyers are inclined to pay a markup to avoid the traditional price negotiating at dealerships. These compelling findings, published in the esteemed Marketing Review St. Gallen and conducted in collaboration with the University of Tübingen, indicate that consumers might welcome fixed pricing, slightly below current offers, potentially marking the beginning of a new era in automotive retailing.

Contrary to the long-standing tradition of price negotiations with dealerships, our research uncovers a notable trend: a majority of customers are ready to pay higher prices for the simplicity and transparency that come with fixed, non-negotiable pricing. The study, involving detailed consumer feedback, shows that two-thirds of customers, while accustomed to negotiations and substantial price discounts, are actually willing to pay an average of €900 more on a fixed transaction price to avoid the often-unwelcome process of negotiating.

Key insights from the study highlight consumer attitudes:

- Two out of three customers know that they should negotiate the price of a car and that it’s still common practice in the new-car market.

- Customers have substantial discount expectations and expect an average discount of 6% to 7% from negotiating the price with dealerships.

- Customers are on average willing to pay €900 more on a fixed transaction price to avoid negotiating the price and for more simplicity and transparency.

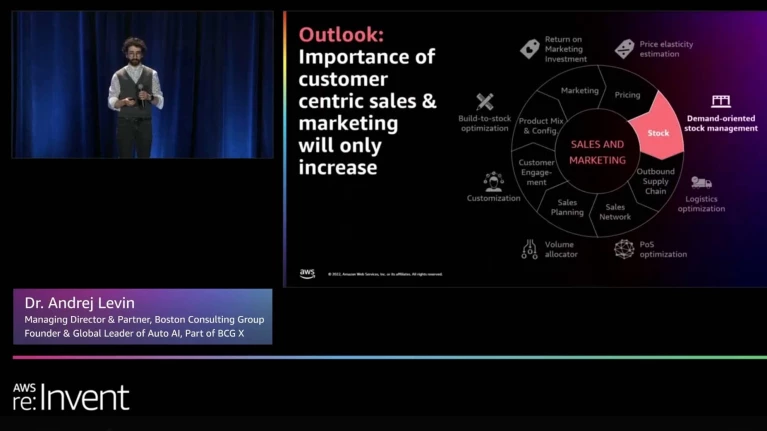

From these customer insights, several key strategies emerge for OEMs to navigate this shift successfully:

- Enforce price consistency. Aim to standardize pricing and phase out the negotiation culture.

- Embrace customer centricity. Leverage AI to rapidly and effectively respond to customer needs.

- Manage the transition. Thoughtfully adjust wholesale to retail prices while keeping customers informed.

- Rethink pricing strategy. Consider customers’ additional willingness to pay for fixed prices.

These findings not only shed light on current consumer preferences but also guide the future of automotive retail.

To explore these groundbreaking insights and their implications for the automotive industry, download the full article featured in the Marketing Review St. Gallen.