As economic and geopolitical uncertainty continues to cloud the business landscape, keeping costs under control is at the top of the 2023 agenda in C-suites across the world. But new Boston Consulting Group research suggests that anxiety over the near term is not weakening most CEOs’ resolve to strengthen their companies’ competitiveness.

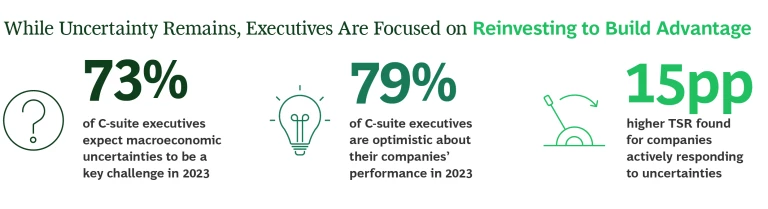

Even though nearly three-quarters of CEOs and other top executives we surveyed indicated that inflation, rising interest rates, and potential recession are top of mind, a surprising 79% expressed confidence in their own companies’ prospects in 2023. And while cost cutting is clearly their priority, most companies are doing so in ways aimed at resetting their organizations for growth and enhancing resilience.

This nuanced CEO outlook holds true even in sectors where big layoffs have recently dominated the news. For instance, top technology company executives in our survey cited retaining and developing talent and boosting innovation in the year ahead as equally important—if not higher—priorities than shedding workers, particularly in North America.

Our study also found that companies that have devoted the most energy to improving resilience are outperforming their industry peers in total shareholder returns and are more prone to reinvest their cost savings in areas that could give them a strategic advantage.

Cutting Costs to Improve Efficiency

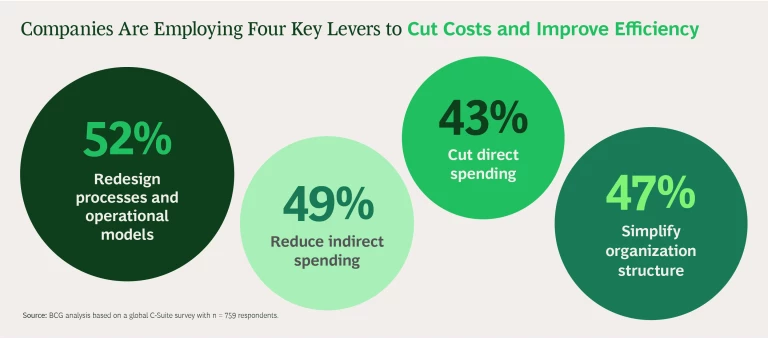

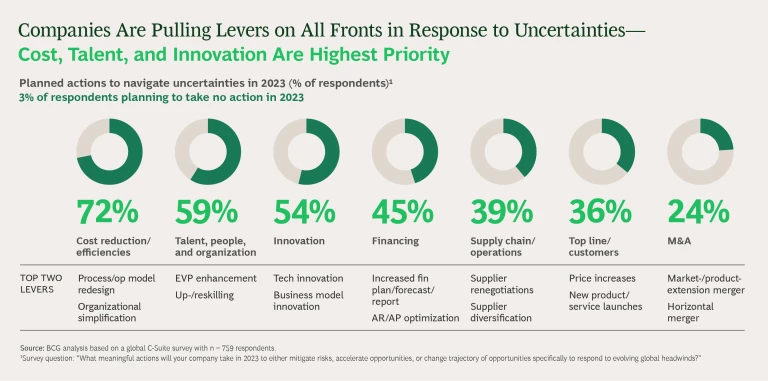

Companies are deploying a combination of strategies to both control costs and create the ability to navigate uncertainty. While 72% of executives globally said they are acting to decrease costs, they are being thoughtful about how they do it. They are placing the highest priority on achieving cost reductions through efficiency improvements, rather than radically slashing direct costs.

Investing in Growth to Outpace the Competition

Recognizing the importance of future competitiveness, most companies are determined not to sacrifice longer-term growth as they control costs. A majority of executives, particularly in North America, included talent in their 2023 action plans, with an emphasis on improving their employee value propositions and upskilling their workforces. This indicates that they recognize they are in an intensely competitive market for talent and will need the right skills to adapt to new technologies and growing trends, such as the emphasis on climate and sustainability. More than half also plan to invest in innovation, focusing on technology and their business models.

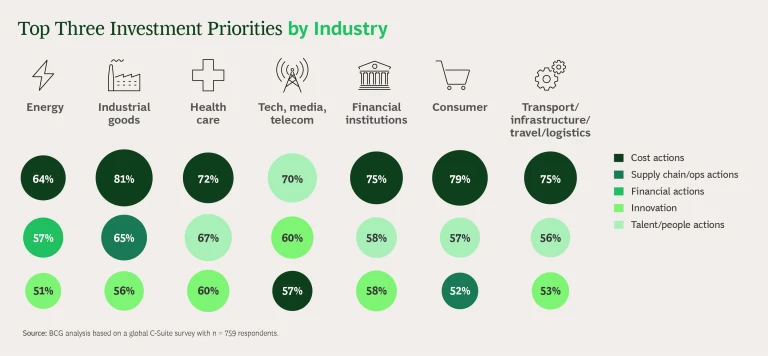

Top priorities vary by sector, however. C-suite executives in industrial goods, consumer, financial, transportation, and health care companies, for example, place the heaviest emphasis on cost actions. Interestingly, that’s less of a priority for technology, media, and telecom (TMT) companies, despite the headlines over the past few months about large layoffs by leading players in this sector. In our survey, TMT executives were more focused on talent development, with 70% citing it as their top action item, while 60% specified innovation.

The emphasis on growth became clearer when we asked how global executives plan to invest for the mid to long term. Talent retention and development, product and service innovation, and cybersecurity were all listed as investment priorities by around three-quarters of global executives.

Other top investment priorities varied by region: in North America, 63% of respondents said they’re planning to invest in hiring, while in Asia 66% cited investments in digital technologies and AI, and 55% in Europe listed climate and sustainability.

Resilience Leaders Are Creating Competitive Advantage

Our research shows that a balanced approach that both reduces costs and builds capabilities that can provide a competitive edge pays off. To get a sense of how well prepared executives are to navigate the challenges ahead, we asked them to assess their companies’ resilience capabilities across 19 key dimensions. According to this self-assessment, 12% of respondents believe their companies have built strong resilience capabilities.

We found that resilience leaders generated total shareholder returns over the previous 12 months that were 15 percentage points higher than the average for their industries. These leaders are also significantly more optimistic about their companies’ outlook.

What distinguishes resilience leaders is their focus on investing resources freed up through cost cutting to support growth. Sixty-eight percent of leaders reported they are investing in product and process innovation, compared with just 44% of the other executives surveyed in their industry. A significantly larger portion also plan to invest in hiring, retention, upskilling, business model innovation, and climate and sustainability initiatives.

Cost consciousness is clearly top of mind for corporate C-suites as they prepare for what looks to be another year of macroeconomic uncertainty and disruptions. But our research also shows that, even in this challenging environment, corporate leaders know that they must continue to invest to compete and strengthen their resilience. How they choose to deploy their savings in 2023 could well determine which companies emerge as winners when the storm clouds finally pass.

CEO Outlook 2023: What Moves Industries

While most executives recognize inflation as a key risk in 2023, each industry faces its own mix of challenges. This edition of BCG Executive Perspectives, based on a survey of C-suite leaders, reveals how companies in different industries are responding to current uncertainties and setting priorities.