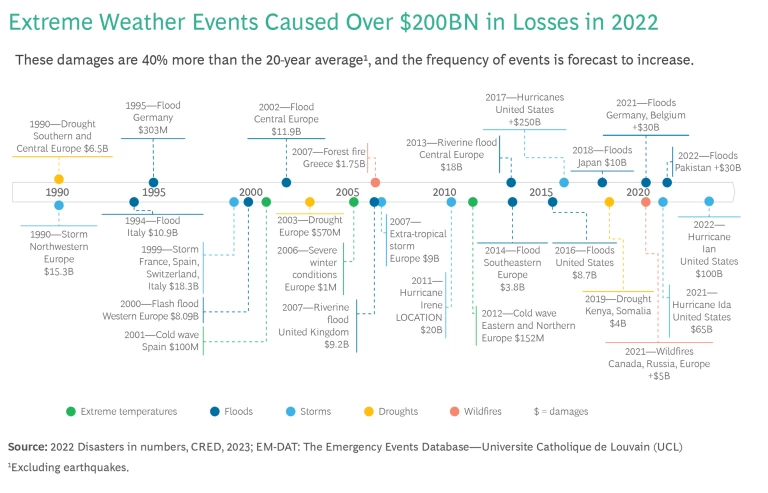

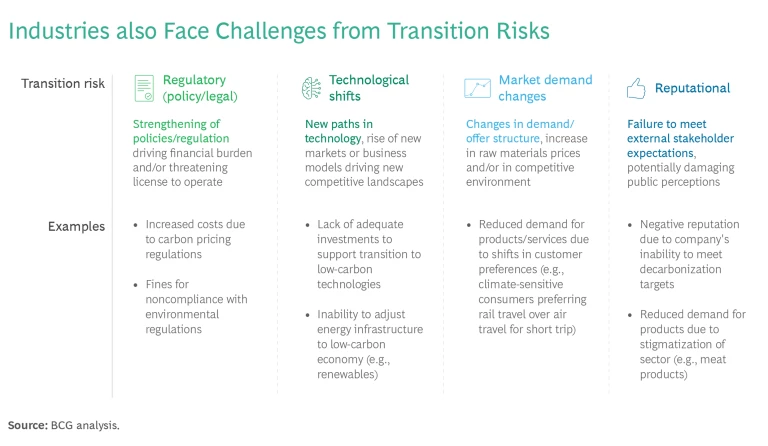

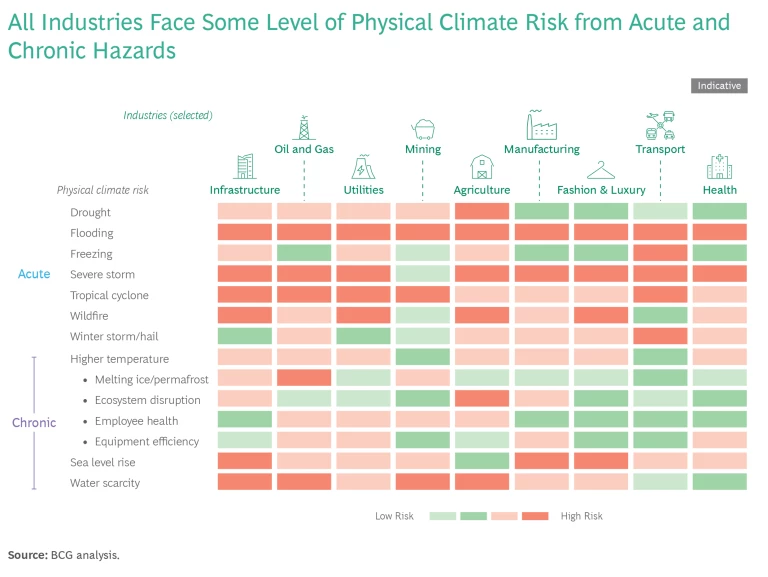

The rising tally of extreme weather events confirms that global warming is well underway. To help slow the process and protect the planet, many companies are working to decarbonize. However, far fewer companies are preparing for the physical risks they face from storms, floods, heat waves, droughts, and fires—or for the transition risks their businesses will encounter as economies respond to climate change with major shifts in regulations, markets, and technology.

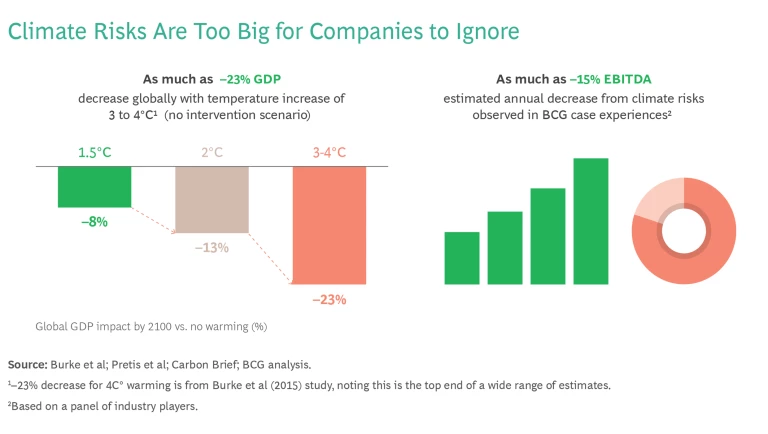

These risks are too big to ignore. The world is not on track to hold temperature rise to 1.5 degrees Celsius by 2050, according to the UN’s first global stocktake report on progress toward the Paris Agreement goals. While noting some headway, the report—which will underpin discussions at COP28—also observes that the window for accelerating decarbonization enough to reach the 1.5°C target is rapidly narrowing.

Falling short would mean enormous hardship, especially for people in the countries most exposed to climate change. In economic terms, missing the temperature target could mean a hit to global GDP of as much as 18% by 2050 and 23% by 2100,

Planning for Adaptation and Resilience

In the public sector, extreme weather events have already made climate risk a major focus. More than 80% of the parties to the United Nations Framework Convention on Climate Change have some level of adaptation plans, strategies, laws, or policies in place. Now private-sector concern is building. Companies increasingly see the need for comprehensive, actionable adaptation and resilience (A&R) plans, both to protect their assets and business value chains and to meet growing demands from regulators and stakeholders to disclose and manage their climate vulnerabilities. The European Union’s Corporate Sustainability Reporting Directive, implemented this year, requires such disclosures, as do the climate rules proposed by the US Securities and Exchange Commission. Both are part of a global push set to accelerate in 2024 as new, consolidated standards from the International Sustainability Standards Board start to take effect.

Companies often find it difficult, however, to look within broad climate and economic trends and translate physical and transition risks into quantifiable business impacts—a prerequisite for taking practical steps to mitigate them. The complexity of potential climate-change impacts across the entire value chain makes it hard to estimate the costs of inaction and include climate in classic corporate planning processes. The result is indecision rather than decisive action. True, many companies identify their most salient climate risks and consider them in isolation, often as part of a traditional risk-management process. But given the far-reaching nature of climate change and the constantly evolving responses to it, this is no longer sufficient.

Instead, companies need to adopt an end-to-end approach and consider climate risks in all business decisions and processes. When evaluating mitigation steps, they also must factor in the potential costs of taking no action. Relating climate scenarios to a specific set of assets and business processes is challenging, but—as a number of leading companies are showing—entirely feasible with the right tools and an effective methodology.

Along with helping companies mitigate climate risks, effective A&R plans can prepare them to compete more effectively in a changing world. Being among the first in an industry to anticipate a shortage of a key ingredient, the significance of a new technology, or the impact of a pending regulation can be a significant advantage.

From High-Level Trends to Actionable Insights

Corporate A&R planners need to connect the biggest of pictures—dramatic, worldwide change in the physical environment and global economy—to the impact of these changes on their specific company, and then devise adaptation steps for those impacts, with a cost/benefit tag for each.

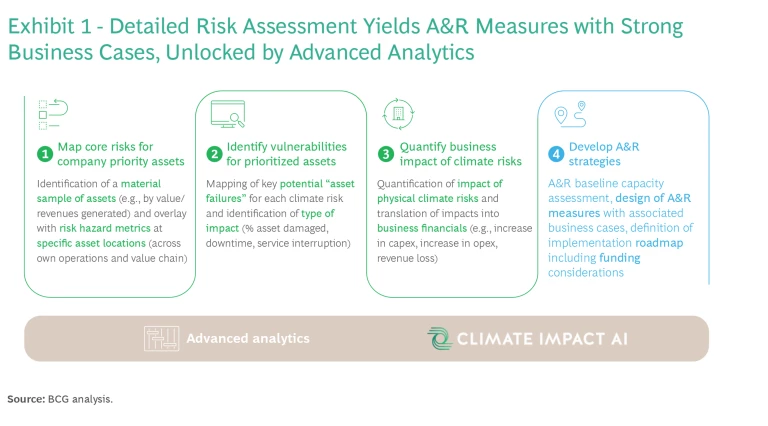

This is best done by starting with a diagnostic phase, where the company assesses and prioritizes its climate risks, followed by a solution-development phase, in which the company’s current readiness is assessed and A&R strategies are developed, based on the business case and resource requirements. Both phases require large data sets, scientific methodologies, and reliable models, especially for climate events and damage functions, which identify associations between hazard intensity and economic damage. All are available on the market, but with some gaps: the data sets can be scattered, while methodologies and models are often isolated and difficult to integrate and implement efficiently.

Complex and integrated modeling—based on the synthesis and elaboration of large amounts of data—is achievable only with advanced analytics and artificial intelligence (AI) tools. Bringing together the best available data sets, methodologies, and models, BCG has developed Climate Impact AI, a proprietary climate analytics platform designed to support companies’ decision-making on A&R in a timely and transparent way.

Assessing climate risks

The diagnostic phase begins with a high-level analysis of the risk exposure of the company’s most important assets and value chains, based on possible climate-change scenarios. The result is a map of the company’s greatest risks. A food and beverage company might be especially concerned about the risk that droughts pose to the supply of a key ingredient. A manufacturer’s worries might include the impact of possible floods on its inbound logistics or manufacturing sites. To assess such risks, BCG uses robust, location-specific climate projections available through our partnerships with leading climate-data providers, such as Jupiter.

Once the risks have been identified, the next step is to define the specific vulnerabilities of key assets. For the manufacturer, if a 200-year flood were to hit its biggest assembly plant, how bad would the damage be, and how long would it take to repair or replace the factory?

The third and final step of the diagnostic phase entails quantifying the business impacts of these vulnerabilities and then translating them into financial terms, such as revenue loss and/or increased capital or operating expenses. (See Exhibit 1.)

Developing A&R strategies

The solutions phase aims to decrease vulnerability and exposure. It starts with a review of the company’s existing A&R measures. The manufacturer’s factory is probably insured, and the food and beverage company may use financial hedges to lock in a price for the at-risk ingredient. For many assets and value-chain segments, however, the existing protections may be inadequate given the more extreme scenarios now possible. By identifying high-value assets with the greatest vulnerabilities and readiness gaps, company planners learn where to focus their attention.

Now the company can design A&R measures that close the readiness gap for these assets, and build business cases that compare the cost of the solutions to their risk-reduction benefits. Here, too, the process is data- and analytics-intensive. Using the Climate Impact AI tool, solutions can be developed on three levels:

- Strategic, meaning they involve changes to the business model, such as increasing the role of service revenue or lowering reliance on owned real estate.

- Operational, with changes such as a backup plan for outbound logistics or a flood-protection barrier for a key asset.

- Financial, via risk transfer through insurance coverage or risk retention through a budget allocation.

Once solutions have been identified, an A&R plan is developed to allocate financing and drive implementation of a portfolio of risk-reduction measures.

Sometimes financing these solutions will be a challenge. When this is the case, companies have several options to consider beyond relying on internal cash flows, banks, or traditional capital markets. They may be able to issue green bonds (used to finance projects meeting the green standards of the European Union or other major certifiers) or resilience bonds (a form of catastrophe bonds focused on climate resilience projects). They may also be able to work with a global, regional, or local entity established to support climate-focused public-private partnerships, such as the UN-backed Green Climate Fund, the European Union LIFE program, or the Italian Green New Deal.

The Role of Climate Analytics and AI

Crafting a comprehensive climate-risk A&R strategy requires an end-to-end view of a complex chain of causes and effects—from climate scenarios; to potential impacts on company employees, processes, and assets; to the value of potential adaptation and resilience measures. To understand the interactions along this chain, planners need to integrate the outputs of predictive models based on large and diverse data sets.

Advanced climate analytics and artificial intelligence tools, such as BCG’s Climate Impact AI—with their ability to interpret large data sets, integrate different kinds of data, and identify patterns that may be missed by humans—are essential for such tasks. We see AI tools being applied to a growing range of climate and sustainability problems in our work with the AI for the Planet alliance (where BCG is a knowledge partner) and proving especially useful in A&R planning.

A&R Plans in Action

Although climate risks are a universal problem, each company faces a highly specific subset of them, depending on its industry sector, geographic locations, and the many facets of its operating business, from supplier and customer relationships to the mix of real estate assets and beyond. Company A&R efforts are therefore also highly individual, as shown by the following case studies.

A highway operator seeks more resilient roads

After extreme weather damaged parts of its network, a European highway operator analyzed its vulnerabilities. The company can now include A&R measures in its multiyear investment decisions.

Risk assessment. The company set out to quantify the physical risks to its highway network, starting with its highest-traffic assets. The analysis showed that extreme precipitation was the greatest threat, posing risks to infrastructure, especially in landslide-prone areas where it can erode embankments and leave debris on the roads.

For each of these high-priority locations, the company ran several 100-year precipitation- and flood-risk scenarios aligned to guidance from the Intergovernmental Panel on Climate Change, estimating damage to the assets in each. It then translated the damages into expected financial impact, based on repair and maintenance costs and revenues lost due to service interruptions.

Result. The company was able to identify assets with the greatest exposure to climate change, quantify the EBITDA at risk, and incorporate the findings in its financial planning. The assessment will inform investment decisions on A&R measures, such as embankment reinforcement, to be integrated into multiyear capex planning.

A PE manager screens its portfolio companies for climate risks

A private equity manager with $140 billion under management and more than 90 companies in its portfolio—including many in energy and transportation infrastructure—needed to gauge its overall exposure to climate risk and understand which companies are most vulnerable.

Risk assessment. The firm began with a top-down, qualitative process, sorting its portfolio companies by industry and identifying the sectors and subsectors most exposed to climate risks. The analysis tracked both physical and transition risks and also noted climate-related opportunities. The results were used to build a heatmap, highlighting the companies most at risk.

Result. As a next step, the fund manager will conduct a bottom-up assessment of three to four high-risk companies. It will work with them on developing A&R plans, and may also consider company sales to manage exposure to particular risks at the portfolio level.

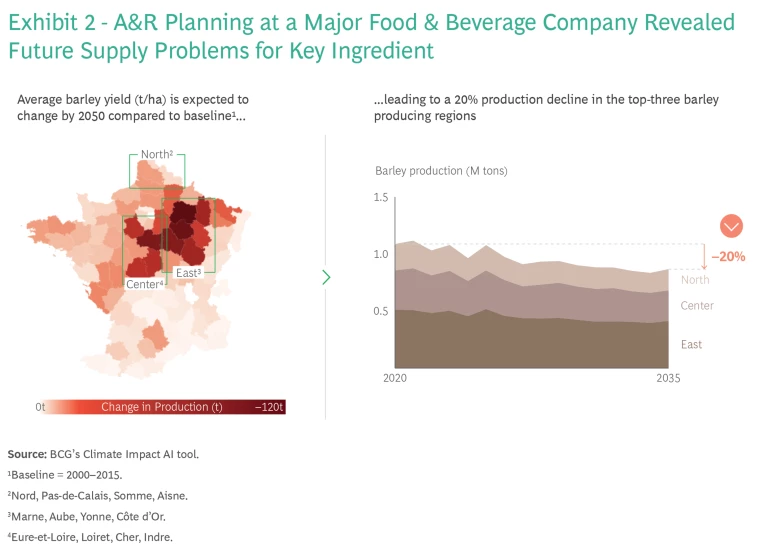

A beverage company diversifies its barley sources

A major beverage company was concerned about future supplies of barley, a key ingredient for its main product. The company wanted to anticipate the impact of climate change on crop yields in the various regions where most of its barley is sourced.

Risk assessment. Using historical agronomy data and different climate change scenarios for the regions, the company identified high temperatures and more frequent droughts as the greatest threats. The analysis pointed to a 20% decline in barley production by 2035 across the target regions. (See Exhibit 2.)

Result. The beverage company has begun broadening its supplier base, expanding geographically and reducing dependence on the regions found to be most at risk.

Thinking Strategically about A&R

The public’s awareness of climate-change risks is rising with every tragic wildfire, damaging drought, and destructive flood the planet suffers. Governments are responding with tighter regulations and standards, pushing adaptation and resilience planning higher on many—but not all—corporate agendas. Companies that have just begun mapping their vulnerabilities need to accelerate their efforts. Otherwise, they could find it difficult to meet the disclosure deadlines being set by regulators.

Ultimately, tackling corporate climate risk is not a regulatory issue but a strategic one, which will persist through a years-long climatic and economic transition that is still in its early stages. For company leaders, the challenge doesn’t end with the task of quantifying how these broad and complex trends might impact their specific assets and activities in the future.

Along with mitigating the risks, leaders must be ready to act on the opportunities the transition will inevitably present. Business hurdles spur innovation. The companies in each industry sector that anticipate problems and successfully innovate to solve them—whether in materials, supplier relations, transportation, or dozens of other realms—stand to outpace their peers. A comprehensive corporate A&R plan can deliver valuable visibility on what’s ahead, helping leaders build a company that’s more sustainable in every sense of the word.

The authors would like to thank the broader managing directors and partners team, including Charmian Caines, Hamid Maher, and Prashant Mehrotra for their contributions. Also, a special thanks to the core project team of consultants Ali Ziat, Roberto Alicino, Maria Vittoria Maranzano, Anna Maggioni, and Alessandra Grimaldi for their support.