Companies that truly grasp and leverage data create more value for customers, employees, and shareholders—and build stronger resilience. They understand their customers’ needs in more depth, orchestrate their partner ecosystem more skillfully, enjoy superior automation and efficiencies, deftly pivot when necessary, and outperform competitors by wider and wider margins. Yet even leaders at the most advanced companies still struggle with how to best leverage data in nearly every initiative from sustainability, customer experience, and personalization to employee strategy and supply chain transparency.

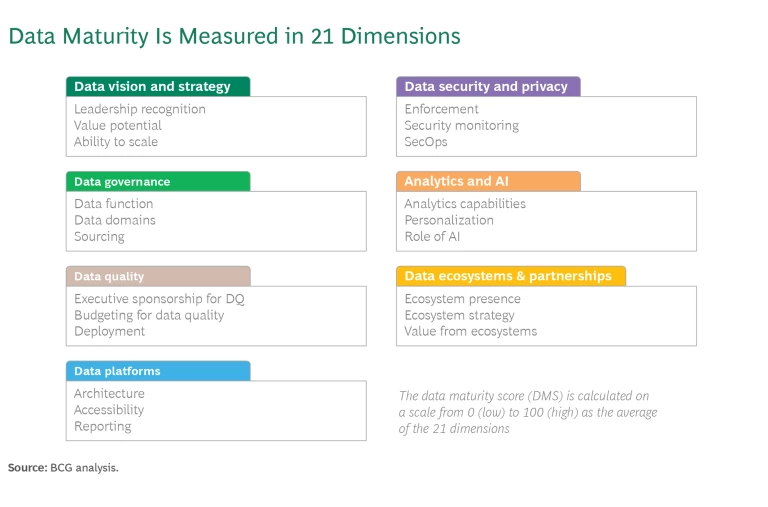

With this in mind, recent BCG research commissioned by Google surveyed business and thought leaders around the world and scored their data maturity. (See “About Our Research.”) More specifically, we compared data “champions” and “laggards,” the key traits necessary to succeed, the common challenges, and the practical steps that leaders of companies at every level of data maturity can take to push their organizations in the right direction.

About Our Research

Our research confirmed that levels of data maturity vary considerably among organizations. Based on the DMS, we split companies to compare the top 25% (data champions) with the bottom 25% (data laggards).

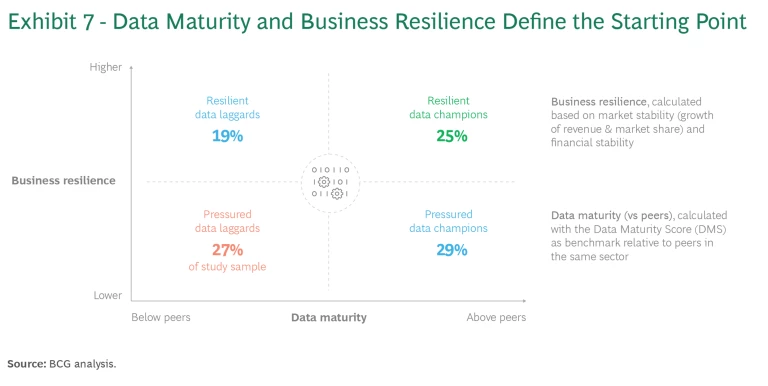

While every company can be a data champion, knowing one’s starting point is important. To that end, we introduce four archetypes in this article based on a company’s level of data maturity and business resilience. Each archetype will chart a distinct path to data maturity.

Data Champions Outperform

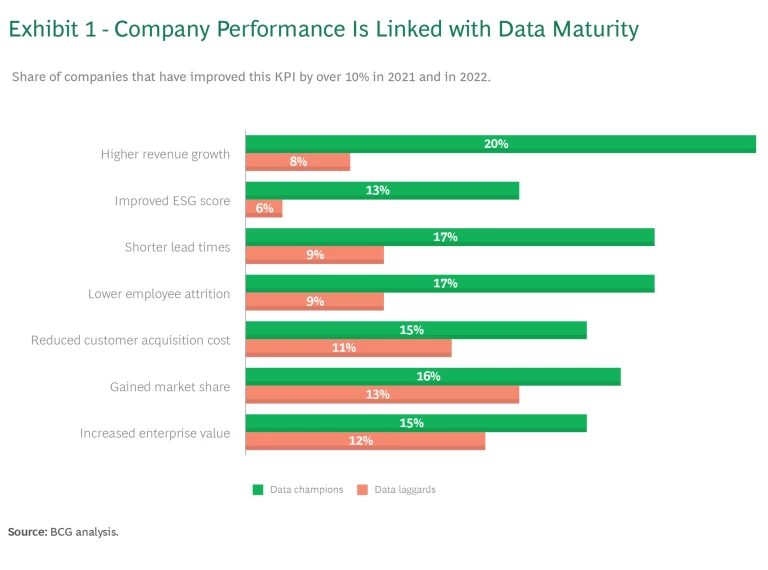

While the road to data maturity is not an easy one, it’s necessary and well worth the effort. We found that data maturity, performance, and resilience are strongly linked. (See Exhibit 1.) Across major indicators such as revenue growth, sustainability (ESG score), lead times, or employee attrition, data champions have outperformed their laggard peers. For example, champions grow their revenue over twice as fast as laggards.

This performance gap will continue to widen. About 30% of champions expect to increase performance in revenue growth by over 10% by the end 2024, compared to 13% of laggards. This gap is much wider than in 2022, when 16% of champions and 11% of laggards expected the same increase. Our findings support BCG and Google’s previous research in March 2022, which revealed significant advantages for digital champions, including 15–20% greater revenue growth and 15–20% higher cost savings.

Five Traits Needed to Boost Performance

Any company can become a data champion. Likewise, any data champion can fall behind without continued investment and innovation. Many incumbent companies that existed before the late 20th century’s push to digital have made a deliberate choice to make data a key strategic priority. Many of these incumbents have reached similar levels of maturity as first-generation digital natives. The parity is so close that they report very similar data challenges.

By looking closely at high-performing companies (top 25% across all performance KPIs), we identified five connected traits that boost performance.

CEOs take the driver’s seat for data transformation.

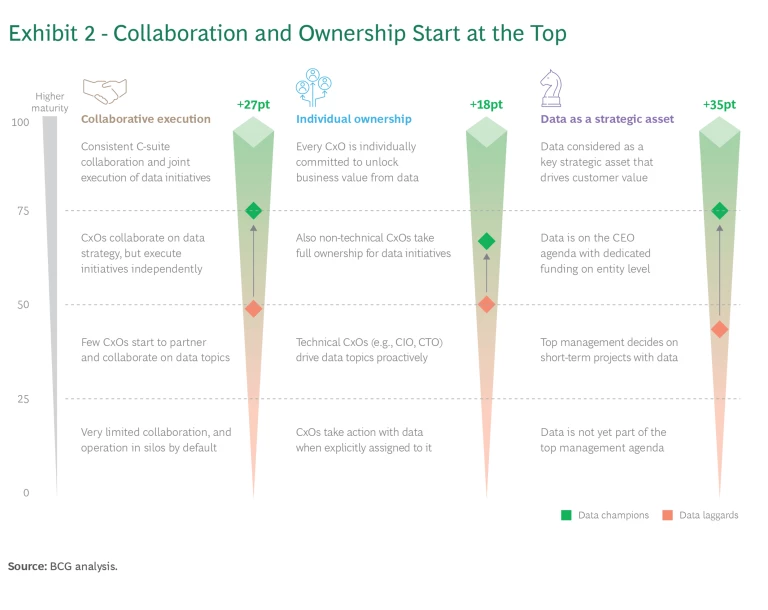

The CEOs of data champions are much more likely to recognize data as a strategic asset than CEOs of laggards. (See Exhibit 2.) These leaders are instrumental in helping translate the complexity of data transformation into a clear action plan and facilitating transformational change to unlock value. They don’t do it alone but in close ally with functional CxOs (e.g., COO, CFO, CIO, CTO). Our 2022 study showed that the CEO’s ability to align the C-suite to a shared agenda is pivotal to executing digital transformations and scaling digital use cases for value.

In our current study, data champions scored 27 points higher than laggards in C-suite collaboration. Members of the C-suite take ownership of their functional and business domains for data-related business outcomes. They put processes and incentives in place that empower people, and they ensure that messaging is consistent from the top of the organization down to frontline employees.

Data champions invest mindfully, with a strict eye on value.

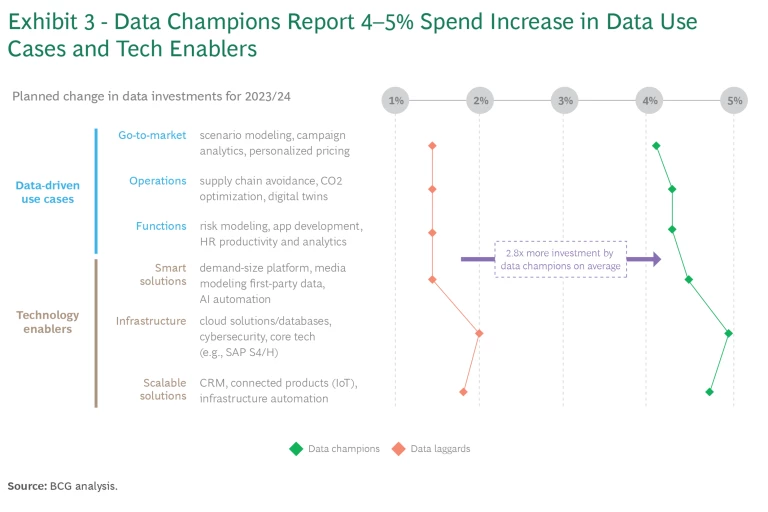

Champions invest in scalable, data-driven use cases with a strict eye on value and business outcomes—knowing when to pull the plug on pilots that are not living up to expectations and when to double-down on those that drive real value. They balance the need for positive short-term ROI with longer-term bets on more innovative initiatives. On average, they plan to invest about 2.8x more than laggards in data-driven use cases across the value chain and technology enablers. (See Exhibit 3.) Also, 76% of champions report having a strategy in place for generating value from data, and they measure value realization regularly. Only 46% of laggards report the same.

Moreover, champions outpace laggards by 15 percentage points in planning initiatives that will reduce IT and tech costs in the short term, particularly by optimizing service levels and sunsetting legacy systems to reduce redundancy. Laggards, on the other hand, are often stalled by multi-year IT and tech transformations that tie up key resources over a long period and don’t promise near-term ROI.

Data is high quality and accessible.

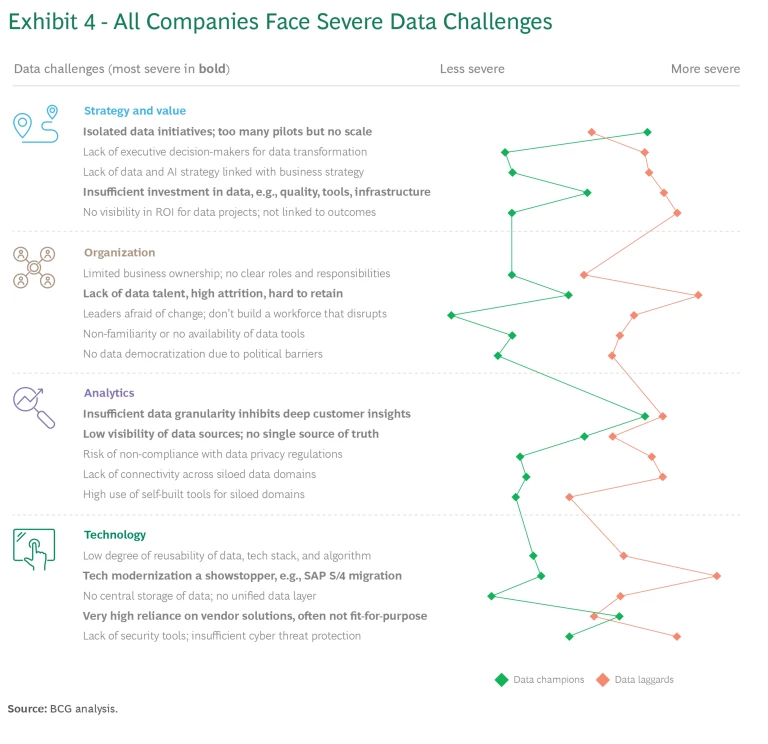

It’s hard to overstate the importance of starting with clean, high-quality data. Yet every company in our study reported struggling with data challenges that span the entire data journey—from sourcing, cleaning, validating, and accessing data to sharing it internally and externally. For a vast majority (70%), the challenges are so severe they pose a threat to the success of their use cases. Unsurprisingly, data champions face significantly fewer challenges than laggards, and their struggles tend to be less severe. (See Exhibit 4.)

Champions have less siloed data domains and, consequently, more consolidated data storage. This improves the reusability of data objects, algorithms, and the data tech stack. Senior executives are assigned and committed to enforcing policies for data accuracy, consistency, reliability, and timeliness. These policies are continuously tracked across the organization and external partners. To back up these efforts, many champions have a dedicated data management and governance function to ensure the organization and the third parties they work with adhere to their data quality standards.

Workforce is empowered and feels trusted.

Champions know they need more talent. Another recent study shows that companies on average have about 1.5% of full-time employees working in roles related to data and AI. But champions assign 2.2% to these roles, while laggards just 0.8%. Laggards seem to realize that they are struggling on the talent front. In our study, we asked respondents to rank the 10 challenges that are top of mind for executives. Laggards ranked “Talent and employee value proposition” as the third highest priority, far ahead of champions, which ranked it second to last.

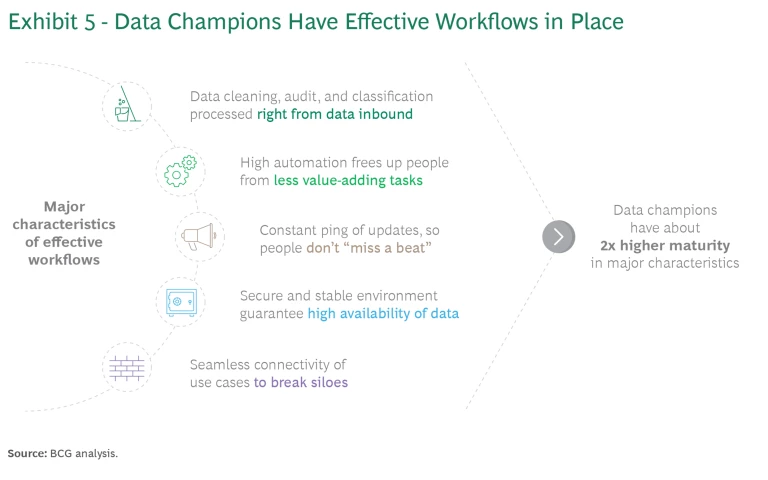

In addition to workforce size, data literacy is key. Literacy requires tools and workflows (see Exhibit 5) that give employees the opportunity to gain experience about how to use data effectively in their daily work. Champions equip their front-line teams with AI and encourage their people to experiment with modern technologies. Not surprisingly, three times more data champions than laggards report that their leadership is not afraid to build a workforce eager to innovate and disrupt. Champions are also committed to responsible AI and AI regulation—which is valued by both employees and customers—to ensure they aren’t building tools that cause harm to individuals or the community.

Partner ecosystems are used to drive scale.

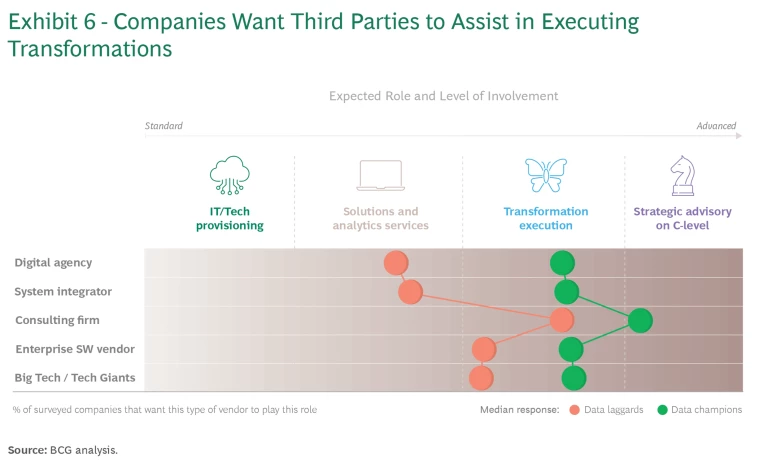

We have studied what companies expect from their partners, such as digital agencies, system integrators, Tier 1 consulting (management and strategy), enterprise software vendors, and tech giants. It’s clear that the role of partners is changing. (See Exhibit 6.) Data champions expect third parties to be much more than providers of IT, analytics, and other technology products and services. They want full transformation partners that can help them discover disruptive solutions and scale data offerings, and they lean heavily into the cloud to achieve these goals. In fact, spending on cloud solutions, including highly responsive databases, is expected to increase the most of any data-enabling technology in 2023 and 2024 (followed by AI, security solutions, and data analytics).

But dealing with third parties comes with complexity and cost risks. To mitigate these risks, successful companies have deliberately built capabilities in “multi-partner orchestration” that help them manage their ecosystem and steer partners toward joint value creation (by ensuring that only fit-for-purpose offerings are advanced, for example). About twice as many champions as laggards align procurement and incentive plans among third parties.

Know Your Archetype

Being a data champion does not mean a company has completely mastered data. Even champions continue to face many challenges on the road to data maturity. All companies should ask: What is our starting point, and how can we accelerate the path toward high data capabilities? The answer to these questions depends on the company’s status in terms of two dimensions: data maturity and business resilience.

Data maturity. Advanced companies leverage a strong data foundation to scale data-driven use cases and disrupt peers. Less advanced companies may still need to build foundational enablers (such as data platforms, quality assurance, security enforcement, and analytical capabilities) to avoid falling further behind. It is critical to understand that a company’s starting point is not only dependent on its absolute data maturity, but also on where it stands relative to peers.

Business resilience. Resilient companies demonstrate persistent financial solvency in stable markets and create advantages in moments of disruption. They can take larger (financial) risks and invest in more use cases to expand their competitiveness. Companies that are pressured by tighter budgets need to focus on cost reduction use cases.

By considering where they fall on both dimensions, leaders can place their companies in one of four archetypes. (See Exhibit 7.) Knowing your archetype helps clarify strengths, weaknesses, where the company lies in the data ecosystem, and how to accelerate data capabilities.

Pressured data laggards have less financial room to maneuver, but still need to improve their low data maturity and build crucial capabilities at the core. They should prioritize a few data use cases that will support cost reduction, such as automation and efficiency, and achieve a short-term ROI.

Resilient data laggards have stable finances and markets but lag peers in data maturity. They need to immediately make data and AI a top C-suite priority. (See “AI Maturity by Industry.”) These companies should prioritize 6 to 10 data/AI use cases that strengthen their data foundation and improve their cyber, risk, and compliance capabilities. Also, they should evaluate possible data solutions beyond the core that could help them outperform peers.

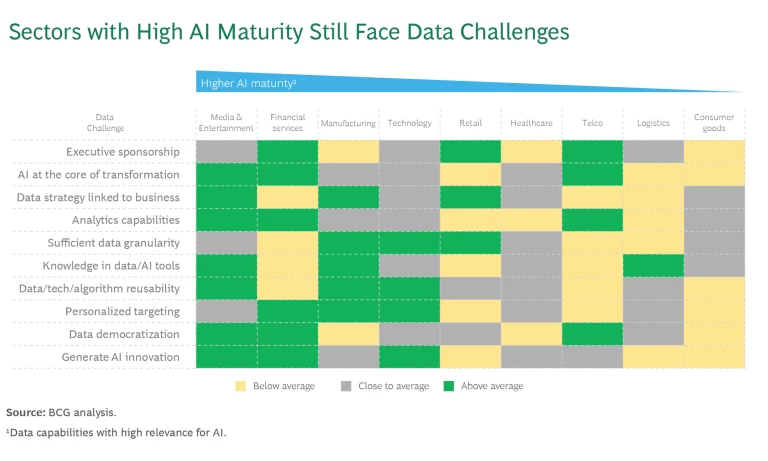

AI Maturity by Industry

While data champions in all industries make AI a priority, the level of data and AI maturity varies by industry. Those that embraced digital transformation early, such as media and entertainment, financial services, and technology, now report above-average maturity in AI capabilities. Even these industries, however, struggle with core capabilities—namely insufficient data granularity, lack of expertise in data tools, and low reusability of data assets. Ironically, companies deeper into the journey might comprehend and report greater data challenges than laggards that have just begun their journeys and might suffer from naïve confidence.

Pressured data champions have built strong data capabilities but are funding constrained. Even so, they must continue innovating to maintain their data advantage. This will require being surgical about short- to mid-term initiatives by prioritizing investments in one or two use cases that support IT and business cost reduction, for example. Also, there may be opportunities to leverage partner ecosystems and scale jointly, sharing the risk.

Resilient data champions are in the strongest position, benefiting from business resilience and world-class data capabilities. They should press their advantage by taking strategic risks to disrupt competitors, prioritizing initiatives that make the business future-proof (such as green tech), orchestrating partner ecosystems to improve scale, and doubling down on scaling use cases. Additionally, they should take the opportunity to break down any data silos and address remaining data challenges.

Three Ways to Jump-Start the Journey

No matter a company’s archetype, leaders can take three actions immediately that will help develop the traits needed to boost performance and move them decisively toward greater data maturity.

Conduct a pulse check. CEOs should assess their organization’s data maturity and digital capability maturity with senior leaders to ensure everyone is aligned on a vision that reflects current economic and strategic realities. Having a clear understanding of how data and AI can advance business success is critical to aligning and prioritizing initiatives and measuring their impact. This pulse check should build enthusiasm among leaders to evangelize the vision across the organization.

Hire talent for data priorities. There is much economic uncertainty and belt-tightening today. Yet even financially pressured corporate leaders should be careful about pausing technology spending, and instead rigorously prioritize tech spend for value. This could quickly erode competitive positioning. Recent layoffs offer an opportunity to snap up tech and digital talent—data scientists, ML engineers, cybersecurity specialists, product managers, and the like. Leaders should review their data priorities and goals, assess where talent gaps exist, and start looking to fill them.

Orchestrate the partner ecosystem. A partner strategy and orchestration capability are critical to building data maturity and resilience. This is true for all companies, but for those organizations with less financial resilience, it’s particularly crucial to have partners that can provide key assets fast. For example, partnerships with services providers are a way to quickly scale solutions such as AI and to optimize sourcing costs.

Macroeconomic circumstances are subject to change and sometimes-sudden pivots, but one thing will remain constant: companies must continue to improve their data maturity to tap into the rich vein of business insights that will elevate performance and ensure the company’s future success. The sooner a company can define its data strategy and begin its journey, the better. The good news is that every company, regardless of its current maturity level or industry, can become a data champion.