Faced with an intensifying climate crisis and growing consumer concerns, many companies in the consumer packaged goods (CPG) industry are prioritizing their climate and sustainability (C&S) initiatives. A few leading players are seeing promising results from their initial investments.

While this is a strong start, consumer companies will need to do more to boost the impact of their sustainability efforts. Three innovation strategies will prove critical for addressing consumer concerns: improving today’s products and making tomorrow’s more sustainable, activating green behaviors in consumers, and deploying advanced digital and artificial intelligence (AI) tools for identifying leads and promoting traceability.

Companies that confront the

net-zero challenge

with an innovation lens can capitalize on the C&S opportunity, expanding markets, new areas of business, supply-chain resilience, and more. Sustainability-boosting initiatives that Nestlé and AB InBev have launched over the past few years suggest how

innovation in CPG

can make a real difference—for the climate, consumers, and companies.

Building a Sustainability Advantage with Consumers in Mind

CPG value chains are massive, touching the lives of practically everyone on the planet. According to a BCG analysis, the agri-food supply chain, in which CPG companies figure prominently, currently accounts for a significant portion—approximately 31%—of annual greenhouse-gas emissions. By the same token, the CPG sector has the potential to make a significant contribution to the decarbonization effort.

Focus and Capabilities

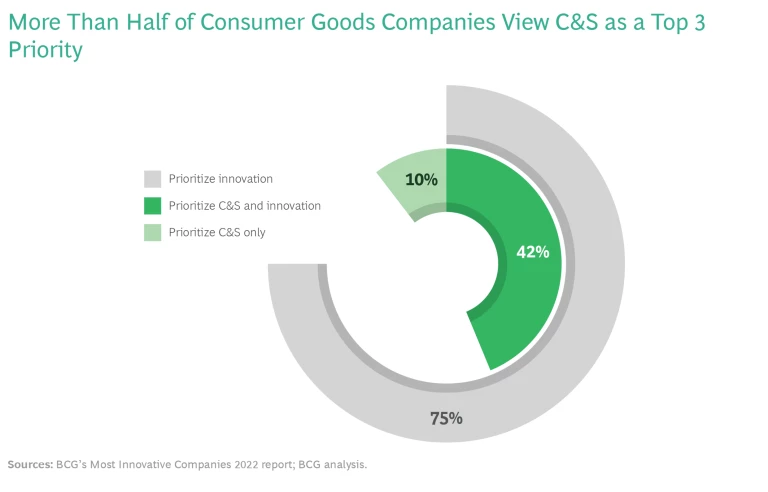

Many CPG companies want to go green. According to BCG’s 2022 Most Innovative Companies (MIC) report , 52% say that sustainability is a top-three priority. (See the exhibit.)

Yet it’s one thing to say C&S is a priority—successful execution is another thing entirely. The CPG sector significantly lags other industries in what BCG calls “ innovation readiness ,” the underlying capabilities or “systems” that organizations deploy to generate new value propositions and profitably solve customer problems. According to our 2020 MIC findings , companies with mature innovation systems generate as much as 20% more innovation output than their peers.

Concerned Consumers

The lack of CPG preparedness is especially significant given consumers’ growing climate concerns—and the shift in their buying habits over the past few years. Approximately 80% of consumers say they think about sustainability in their day-to-day purchasing decisions . Also, according to the NYU Stern Center for Sustainable Business, between 2015 and 2021, sales of products marketed as sustainable grew 2.7 times faster than conventionally marketed products.

However, today, only around 10% of CPG shoppers (8% to 18% across the categories we tested) say they purchase sustainable products or have sustainability in their top drivers of choice. This percentage could increase by up to 30% if CPG companies linked sustainability to other emotional and functional needs, such as quality or health.

Other BCG research determined that 75% of consumers think that large companies must take the lead against climate change . Clearly, CPG companies must use this opportunity to raise the level of their sustainability efforts.

Innovating on Three Levels

Given the sheer size and complexity of the value chain, organizations that wish to achieve game-changing innovation in CPG must execute sustainability well at scale. This journey requires applying an innovation lens to three dimensions: products, customers, and advanced digital and AI tools.

Improve Today’s Products and Invent Tomorrow’s

As a first step toward greater sustainability, organizations should assess their product portfolio to identify the brands that can be made greener as well as those that require marketing to drive awareness and conversion. This is also the time to determine whether any brands should be divested because they don’t align with corporate sustainability ambitions. That move can help fund opportunities in existing brands as well as new categories with greater potential.

Product-development teams can then make existing products greener by replacing unsustainable ingredients with sustainable ones. Yet while this approach can provide some quick wins, it won’t suffice over the long term. Based on our experience, re-engineering of current operations may achieve only about 30% to 40% of 2030 carbon goals; it is necessary to re-imagine the business model to close the gap, which will require both a transformational portfolio and consumer behavior change.

Replacing unsustainable ingredients with sustainable ones won’t suffice over the long term.

To create truly sustainable products in the future, companies need to develop new products based on new formulations. (See the sidebar on Nestlé and AB InBev.) Since the primary source of CPG emissions is Scope 3 (the value chain, especially upstream), organizations need to ensure that their suppliers meet sustainability standards.

How Two Leading CPGs Are Using Innovation to Boost Sustainability across the Value Chain

Nestlé

Nestlé, an acknowledged sustainability leader, is innovating in various ways to meet its dual ambitions of zero environmental impact in operations by 2030 and net-zero greenhouse-gas emissions by 2050. After determining the carbon footprint of its portfolio, the company has put more emphasis on expansion in the plant-based space, an important commercial and environmental opportunity.

To make existing products carbon neutral, Nestlé has substituted ingredients and changed entire formulations. The company’s sustainable R&D accelerator and creative application of new R&D processes inspired the formulation used in brands such as Wunda, a pea-based milk alternative.

Nestlé has also committed to making its product packaging 100% recyclable or reusable by 2025. In addition, it has shifted manufacturing to renewable energy and invested in more energy-efficient processes. And it has optimized routes and used low-emission fuels and rail transport.

Together, these measures are projected to mitigate 14% of greenhouse-gas emissions associated with the projected 44 million tonnes of carbon-dioxide equivalents by 2030.

To fill out its plant-based portfolio, Nestlé has also made some noteworthy acquisitions, including Garden Gourmet and Sweet Earth foods. In parallel, the company has sold its North American bottled-water business, a slow-growing business with a large environmental footprint, to fund investments in higher-growth categories.

This slew of product innovations has been enabled by Nestlé’s leadership team. A top CEO priority, sustainably minded innovation receives sufficient resources and focus. Moreover, teams are encouraged to explore emerging categories and find applications for R&D developments across the Nestlé portfolio. For example, Nestlé is using lessons from Wunda to develop other innovations in the dairy-alternative space.

By embedding sustainability every step of the way, Nestlé is driving both incremental and game-changing innovation—and raising the bar in the process.

ABI

To help address the growing global demand for food and the pressure this is putting on natural resources, ABI is leveraging its brewing expertise to find new ways of sourcing food sustainably. In addition to rolling out many incremental innovations, ABI has launched ventures that develop new-to-world technologies.

One of its startups, EverGrain, is developing a technology that extracts the proteins and fibers from brewing grains to create nutrient-rich ingredients for use in protein shakes, breads, and milk alternatives. Another startup, BioBrew, is using ABI’s fermentation knowledge to scale production of alternative proteins.

ABI’s ventures are expected to help reduce crop- and livestock-related carbon emissions from food production while providing access to new markets .

This is a huge undertaking, requiring bold experimentation with supply-chain and sourcing models. Companies will need to expand their roster of partners. They will also need to change relationships with existing partners to active collaborations where companies share product-development expertise and work with suppliers to develop sustainable practices.

Since CPG companies are positioned to be the steward of the value chain, they need to engage with partners to drive broader impact. Guinness, for example, recently launched a regenerative-agriculture pilot in Ireland to reduce the carbon emissions from producing barley, a key raw material. Working with farmers and other suppliers, Guinness expects to see improvements in soil health and water quality, as well as enhanced biodiversity.

Help Consumers Change Their Behaviors

While these efforts will go a long way, innovation in CPG won’t be able to maximize the impact of decarbonization measures unless consumers take a more active role. Yet while consumers are increasingly concerned about the climate crisis, many have not yet incorporated sustainability into their everyday behaviors, and many are confused about their role (around 20% say that individuals have a role to play in climate change).

Companies, therefore, need to activate consumer behaviors that will stick. One solution is to innovate and commercialize products in a way that resonates deeply with potential buyers, understanding their core needs and barriers to ensure that sustainable products address them.

To maximize the impact of decarbonization measures, companies need to activate consumer behaviors that will stick.

That is exactly what Reckitt Benckiser’s Finish did in 2020, when the maker of dishwashing products launched “Skip the Rinse,” a campaign that aimed to drive growth and also conserve water by encouraging consumers not to pre-rinse their dishes. Reckitt innovated its product, and the key benefit was that busy families could save time and effort while effectively cleaning their dishes, which appealed to a much broader audience than sustainability alone. As an added benefit, for every consumer who pledged to #skiptherinse, Finish agreed to donate $1 to The Nature Conservancy. In less than two years, more than 20 million gallons of water were conserved. In addition, Finish drove share growth and increased marketing ROI.

Subscribe to receive the latest insights on the Consumer Products Industry.

Deploy Next-Generation Digital and AI Tools

Advanced analytics driven by AI provide the transparency that’s necessary for identifying the C&S leads with the greatest likelihood of success. These next-generation tools include machine learning, natural-language processing, and geo-mapping,

Unlike traditional methods, advanced analytics allow an organization to combine multiple data sources to identify potential targets across multiple sectors globally and further upstream. Moreover, they enable the automated scraping of websites and social media to identify business signals (triggers) in areas of the organization’s choosing, such as environmental, social, and governance (ESG). Third, they help to quickly narrow down searches to a short list of the most promising opportunities.

No less important, these tools enable traceability, both for companies that wish to monitor the greenness of their suppliers and for consumers who want to know whether the product they’re thinking of purchasing has green roots.

Advanced analytics can help identify C&S leads and enable traceability.

Given both the immensity of the C&S opportunity and our relative nascency in addressing it, advanced analytics and AI tools (including machine learning, natural-language processing, and geo-mapping) can help drive impact at critical junctures across the innovation value chain. Companies deploying these tools will be better able to surface valuable insights, prioritize the innovation focus, explore the C&S implications of potential product features during the design stage, and identify emerging technologies and partners to add to their innovation ecosystems.

In all likelihood, CPG companies will play a central role in the ultimate success or failure of the C&S effort. Therefore, it’s only fitting that they use this role to bring us closer to a decarbonized future. By applying an innovative lens to the sustainability agenda, companies can create value—for the environment, for consumers, and for themselves. But to create a real sustainability advantage, organizations must act now, before this source of differentiation evaporates.