As change accelerates across the industry, most commercial insurers should be rethinking their future business needs and building the capabilities required to meet them. Competition is intensifying and blurring the lines between brokers and carriers. Customers are increasingly seeking tailored solutions for new and emerging risks. Digitization is spreading—albeit unevenly—as customers, brokers, and carriers boost investments in data and analytics and build digital interfaces to improve decision making and drive efficiency. And demand for new types of talent is outpacing supply in key regions.

While many players have been slow to adapt to these trends, forward-thinking insurers have broken away from the pack. They have done this by taking a comprehensive, front-to-back (F2B) approach to digital transformation—one that breaks down silos; successfully reconfigures a complex commercial insurance business to meet the changing needs of the market, customers, and employees; and sets the basis to thrive in the future. Such a holistic transformation is not trivial. It represents a major cultural shift for commercial insurers that are typically focused on their lines of business, and it requires a material build-up of data and technology capabilities to reap the full benefits.

Bold Aspirations and a Holistic Approach

Launching an F2B digital transformation is about taking a leap forward. It calls for an organization to set bold aspirations, reimagine the business around customer-centric value streams, and build new capabilities.

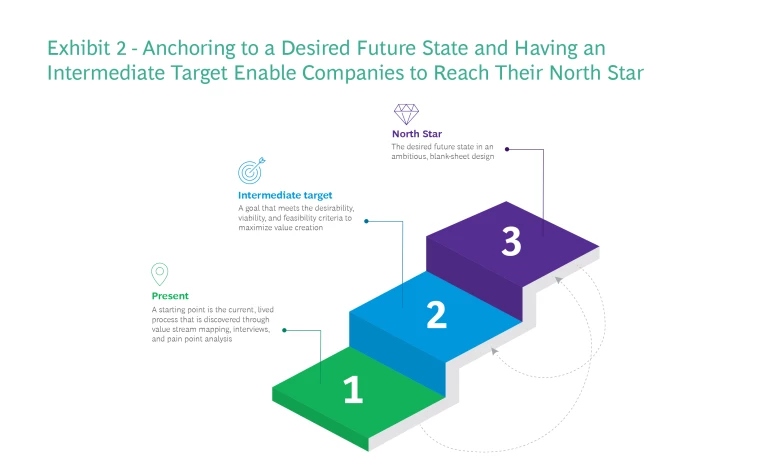

F2B digitization starts with a company developing a North Star to guide its transformation and create alignment at the top. A North Star is a vision of the company’s desired future state that reflects its strategy but is based on best practices in its own industry as well as innovations in adjacent ones.

Commercial insurers can’t achieve transformation on this scale by thinking narrowly. Typical siloed approaches—and their drawbacks—include:

- Lines of Business. Managers of a line of business will typically claim that its processes and issues are unlike those of other lines and resist common approaches.

- Front-End Portals. Investments are limited to portals and other tools that only automate intake forms.

- The Back Office. The automation of middle- and back-office work tends to enshrine legacy processes.

- Tech Systems. Like-for-like replacements of legacy systems often fail to add business value.

True digital transformation requires a more holistic approach that is guided by the company’s North Star. Global commercial insurers serve a multitude of specialized niches, so finding the synergies across them and prioritizing for value is especially beneficial. By applying a holistic approach across lines of business, regions, and key stakeholders, companies can eliminate thousands of uncoordinated digital initiatives and break the cycle of inside-out incrementalism.

The Value of Value Streams

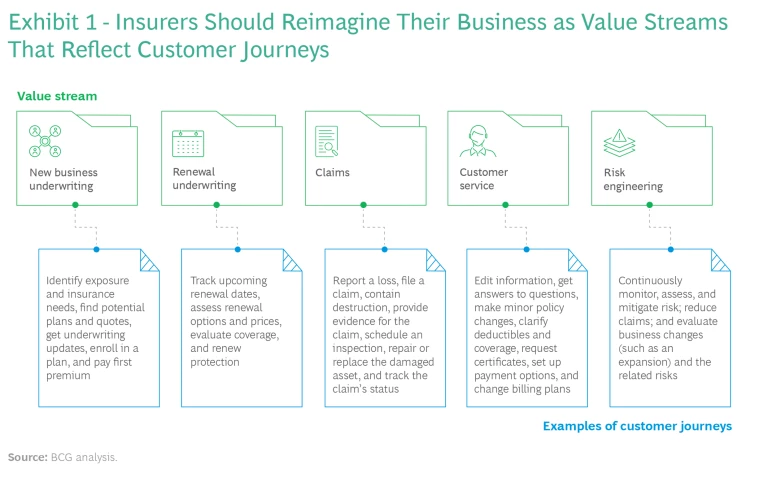

F2B digitization helps commercial insurers begin their transformation by looking beyond their company’s silos and reimagining the business as a small number of outcome- and customer-oriented value streams. (See Exhibit 1.)

An insurer’s value streams should reflect the journeys of customers, brokers, and employees—those who participate significantly in the outcomes—from the first to the last touch point. In addition, the value streams should be mapped across lines of business and regions. This process identifies the value-adding actions of internal functions from the front of the organization to the back—including distribution, underwriting, operations, claims, technology, legal, risk, marketing, and compliance. Value streams are anchored in clear metrics that measure business outcomes, such as changes in the customer experience, costs, or revenue.

Steering by the North Star

A company’s North Star is its vision of the desired future state. Its purpose is not only to guide but also to inspire and generate buy-in from skilled professionals who will be making significant changes in the way they work as they embark on a journey of digitization and collaboration across silos. Because the North Star is tailored to the organization and incorporates industry best practices, it can build employee confidence in the benefits to be gained from the journey ahead and empower them to deliver.

The North Star is organized by value stream and informed by what the value streams must deliver to customers, brokers, and employees so that the company can compete more effectively. It accelerates F2B digitization and allows the organization to set an intermediate target, giving priority to areas where near-term, high-impact wins can help build momentum. (See Exhibit 2.)

Although each insurer’s North Star is unique, we find that the most effective ones are grounded in measurable business outcomes for customers, brokers, and employees across customer segments, from large to small companies. While large corporate customers often require higher-touch, tailored products and services, insurance needs grow more standardized as company size decreases. Mapping value streams across customer segments enables insurers to unlock synergies in their overall operating model where feasible, while fulfilling segment-specific needs. This is especially true for multiline insurers that underwrite policies in many regions.

Building Capabilities for the Future

An F2B transformation helps commercial insurers improve their current capabilities and build new ones.

The strategic importance of a given capability depends on an insurer’s business and customer mix. For example, a player with a customer portfolio largely made up of midsize companies (which have more standardized insurance needs) can benefit from better data intake, automated processes, and use cases powered by artificial intelligence (AI) tools.

Commercial carriers typically build eight capabilities to achieve tangible business outcomes.

Improved Customer Interaction. Insurers can improve employees’ interactions with customers and brokers by modernizing their portal as well as by upgrading their customer relationship management solution. Taking these steps can enable better, more individualized communication and increase transparency on process status. In addition, in certain segments, insurers can offer self-service options through secure and user-friendly data and document exchange platforms. Brokers or customers, in turn, can view, edit, and upload submissions, for example, or claims requests. Such platforms can be made available to a variety of parties on multiple devices and in multiple languages.

Better Data Intake. Carriers can improve data quality and reduce the time spent manually reentering data by collecting data through application programming interfaces, which enable applications to talk to each other, as well as by integrating unstructured data into the workflow using natural-language processing tools. Data intake has been a major challenge in commercial insurance. It has largely been a manual process because formats and contracts vary so much across lines of business and market participants. Carriers that digitize data collection can drive internal efficiency while laying the foundation for data analytics use cases.

Automated Processes. Insurers can also boost internal efficiency by automating the triage of simple requests and claims, as well as by partially automating more complex processes. Implementing straight-through and low-touch processing methods can improve customer response times and free up highly qualified underwriters and claims handlers for higher-value tasks.

Optimized Processes. Beyond automation, companies can optimize processes by eradicating low-value steps and standardizing more data, documents, and process steps. By redefining ways of working (such as referral rules) and the roles and responsibilities of claims handlers, underwriters, and shared services staff, companies can also boost morale and productivity.

Digital Collaboration. Insurers can reap significant benefits when they integrate workflows into a single workbench interface. Such tools enable smoother collaboration among colleagues, better data consistency, and easier tracking of workflows and cycle times. Considerable efficiencies result when employees use the same interface to create and price offers, access underwriting guidelines and policy wording, and administer policies, eliminating the need to manually reenter data into multiple systems.

Analytics-Powered Use Cases. Companies can create value across key steps of the underwriting and claims processes by using machine learning (ML) and AI. Examples include triaging renewals into low-, medium-, and high-touch process lanes and efficiently prioritizing submissions. ML and AI can also support underwriters and claim handlers by providing historic decisions on similar cases, for example, and recommendations for the next-best action. Given the larger ticket sizes, ML- and AI-enabled decision-making tools are even more important in commercial insurance than in personal lines.

Innovative Value Propositions. Carriers can remain competitive by offering customers new insurance solutions that are enabled by technology, data, and analytics. Parametric insurance is such a solution, as is nonphysical damage business-interruption insurance. Carriers can also gain advantage by offering data- and tech-enabled value propositions—for example, new solutions that support remote risk assessment or tools with proprietary models built in.

Stronger Controls. Insurers can improve the strength of their internal controls, compliance, and audit functions by digitizing workflows. Having this capability can improve data consistency and analysis (including what-if scenarios), promote standardization, and make decisions and reporting traceable.

The Benefits of F2B Digitization

Leading commercial insurers have successfully implemented F2B value streams and maximized outcomes in three ways:

- They have captured cost efficiencies by minimizing manual tasks, reducing operating expenses by up to 30%. Successful players have achieved the highest degree of standardization possible. They aimed to design global solutions that can be adapted to local markets, while keeping the number of manual interventions to a minimum. The global scope provided sufficient scale for investment in ML- and AI-driven automation that onboarded business more quickly (cutting quote-to-bind time in half) and reduced the cost of servicing a contract by 15% to 30%.

- They have advanced technical excellence, improving their loss ratio by about 3 percentage points. Better risk assessment and mitigation—using data and algorithms to support better decisions across a larger set of customers and regions—drove a significant improvement in the loss ratio.

- They have significantly enhanced customer value propositions, lifting gross written premiums by 5% to 10%. More comprehensive coverage for current and new clients—the result of digitization, offering new services, and reducing cycle time by 30%—brought in business and increased customer loyalty scores by 40.

It’s Time to Act

In uncertain macroeconomic climates with volatile market conditions, leading insurers invest to build a competitive edge and prepare for the future. Although digitization investments have often been allocated to specific initiatives or functions, and the projects were only partially completed, leaders in the industry have recently delivered truly transformational outcomes using a F2B digitization approach.

There is a new level of clarity on what digital transformation looks like for commercial insurers and how to deliver it. Commercial insurers should review their digital investment portfolio now and tap a proven team to guide the effort by following the F2B North Star.

The authors thank Suavi Erdem Altay, Marc Charissé, Andreas Keller, Raphael Troitzsch, and Kris van der Merwe for their contributions to this article.