Why are so many retail promotions wasteful? Many retailers are asking themselves that question, and with good reason. From 30% to 40% of retail promotions not only are either inefficient or unprofitable, but also risk alienating consumers by overwhelming them with choices that make shopping harder. These inefficiencies have two primary causes:

- Too Many Promotions. It sometimes seems as if everything is on promotion, everywhere, and targeted at everyone. In this saturated landscape, promotions cannibalize each other, while consumers seek simpler and more personalized offerings. In March 2023, we surveyed approximately 1,000 consumers to understand their perspectives on retail promotions—and about 60% of respondents said that they would prefer to receive more relevant promotions instead of just more promotions.

- Too Much Short-Term Focus. Many retailers look at promotions only through a tactical lens. An overemphasis on day-to-day work, coupled with intense pressure to meet sales and share goals, can spur promotion teams to focus on introducing short-term corrections to a system that isn’t optimized for long-term success.

Attempting to reduce promotional intensity, however, presents several challenges. First, retailers face a prisoner’s dilemma. Making unilateral cuts in promotions without adopting offsetting measures is a sure-fire way to lose consumers to other retailers. Second, because many retailers cannot gauge the effects of different promotions precisely, they struggle to decide which ones to cut and which to keep and improve. Without those insights, efforts to optimize promotions could have the opposite effect and leave a retailer in a no-man’s land between heavy promoters and every-day-low-price (EDLP) retailers. Winning in EDLP requires a consistent, loud-and-clear message to consumers, accompanied by intensive cost management to beat out competitors on price. Very few retailers are in a position to do that well.

Well-planned, well-executed promotions can play a critical role in retailers’ overall value strategy by helping them effectively communicate their value proposition and shape consumer perceptions.

But this assumes that the retailer is clear and confident about what that value strategy is before optimizing the promotional strategy to support it.

Retailers generally play what we refer to as the Uniform Game, in which they share value with consumers by offering uniform prices aimed at striking a balance between volume and margin. Thanks to the vast progress in data collection and AI capabilities in recent years, retailers now have opportunities to switch their value-sharing strategy to the Choice Game, which emphasizes balance across the entire portfolio rather than the success of any individual product. The most sophisticated retailers could switch from the Uniform Game to the Dynamic Game, with the goal of sharing value with individual consumers and adjusting prices and promotions in real time.

In line with the game they choose, many retailers would benefit from taking a holistic view of their promotional activities across three dimensions: strategy, measurement, and execution. Superior tools are now available to help them become smarter and more strategic about which promotions to run.

Strategy: Invest Where It Matters to Consumers

The needs of consumers often play only a minor role in retailers’ promotional planning process. Instead, the typical process involves taking the previous year’s promotional plan as a starting point and adjusting it on the basis of what suppliers want to push and co-fund. Facing short-term sales pressures, merchants often try to maximize promotional spending despite poor ROIs.

By redefining their plans from a consumer-centric standpoint, retailers can identify the consumer behaviors they want to drive, understand how consumers perceive different promotions, and determine why one promotion may be likelier than others to induce the desired behavior. This helps retailers set clear objectives for individual promotions as well as for their entire program.

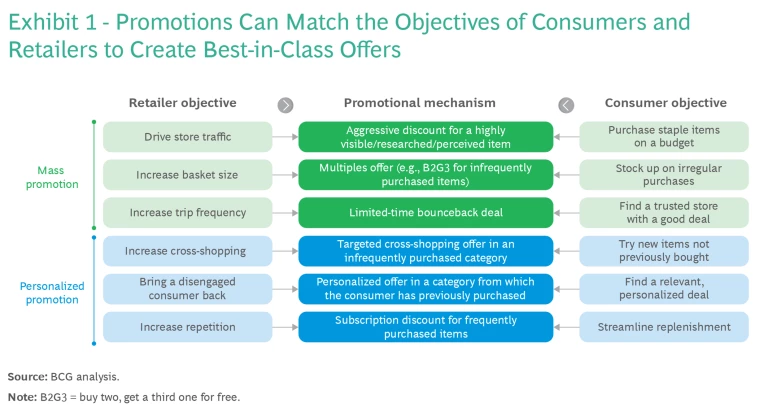

Simplicity is key to influencing behavior. Over half of consumers in our survey preferred promotions that are easy to understand versus more complicated promotions. The design of a promotion—including target consumers, discount intensity, and promotion duration—should reflect critical thinking about the intended change in consumer behavior. (See Exhibit 1.) These strategic goals need to come together in a targeted promotion plan.

The role of promotions, the behaviors companies want to encourage, and consumers’ perceptions can vary considerably by category, brand, and item. For this reason, business and consumer insights play an integral role in the design of a promotion. Ensuring that every promotion has a clear rationale can help drive incremental changes in consumer behavior, rather than reinforcing existing behaviors or subsidizing sales that would have occurred anyway.

Consider items designed to meet an immediate need, such as on-the-go meals or cough medicine, which consumers generally buy only when necessary. Although promotions can motivate consumers to choose a specific brand or item, they exert minimal influence on the fundamental decision to make a purchase. In such situations, it is more critical to have a competitive list price that consumers will remember. In contrast, promotions are much more effective at driving purchases of impulse buys such as snacks or beverages.

Promotional planning can be trickier for bigger-ticket items that consumers purchase less frequently, such as an espresso machine, a television, or an outdoor grill. Faced with greater differences in functionality, price point, and even buying occasion (for example, gift or personal use, primary or secondary unit, first-time purchase or return buy), consumers tend to do more research. Retailers who sell such items may benefit from a move to the Choice Game by restructuring the portfolio on a segment-specific basis that reduces the need for—and the relevance of—blanket promotions. Instead of subsidizing purchases that would have happened anyway, promotions should focus on driving incremental behavior. Because buying circumstances can vary widely from one consumer to another, personalized offers are especially effective in these situations.

Measurement: Data-Driven ROI Measurement and Decision Making

Retailers can make better data-driven decisions once they have defined a clear promotional strategy. Often, however, they have a distorted view of the true impact of promotions, because measuring incremental uplifts is so difficult. Obtaining an accurate reading of ROI entails accounting for factors such as cannibalization, pull-forward, competitors’ actions, and seasonality. But the reward is great: a more accurate picture of promotional effectiveness helps retailers drive greater accountability and make more informed decisions. The more complex a retailer’s environment (reflecting such variables as high competition and more diverse consumers), the more the retailer will benefit from investing in advanced analytics capabilities.

Data quality plays a key role in improving both ROI calculations and the consumer insights that inform decisions. The worst situation for a retailer is to imagine itself to be data-driven when in fact it relies on low-quality data and analytics. A retailer must equip itself with data on past promotions, and it must ensure that it can correct and adjust for factors such as price changes, marketing intensity, and competitor behavior tailored to its specific business context.

Although many retailers have adopted some form of promotion software solution, not all are seeing meaningful value from this effort, for several reasons:

- Process Focus. Many promotion solutions focus on execution, administrative tasks, and workflow efficiency, rather than on impact. Although these tools help buyers save time, they are not designed to create value by enabling smarter and more strategic decision making.

- Inaccurate Predictions. In our experience, from 40% to 60% of promotions that retailers expect to generate high ROI ultimately result in low ROI. It is not at all uncommon for promotional solutions to provide inaccurate forecasts, undermining their value.

- Black Boxes. We have found that retailers may need to customize up to 75% of algorithmic features to maximize results. If retailers cannot access and review algorithm code, they will find it challenging to customize the promotional algorithm and validate that it is working correctly.

- Lack of Change Management. Because promotion decisions are strongly buyer-driven, retailers should not try to make them on the basis of software recommendations alone. The combined effects of changing how buyers plan promotions, how they negotiate with suppliers, how they structure their governance model, and how they interpret pre- and post-event analyses will have at least as much weight, if not more, in delivering sustained value and success in promotional optimization. Delivering sustained value in promotion optimization depends on refining merchants’ ways of working and their governance model. This includes improving how they plan promotions, negotiate with suppliers, and interpret pre- and post-event analyses.

Execution: Implement Promotions as One Unified Organization

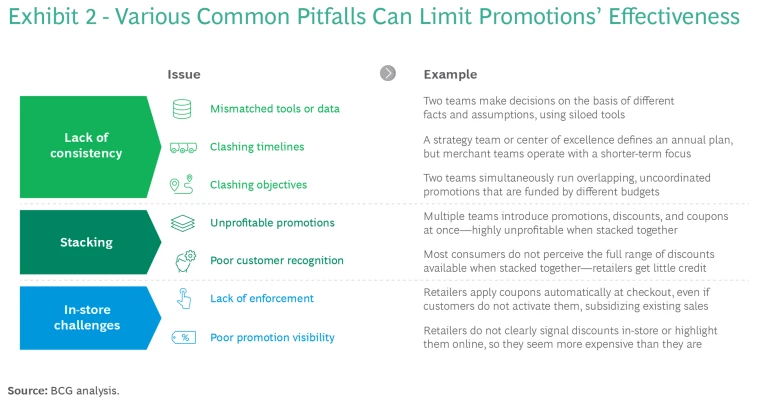

In-market coordination remains a challenge for many retailers. Consumers struggle to form any consistent perception when they encounter an uncoordinated mix of promotions, discounts, coupons, and loyalty rewards piled on top of each other. Some events get lost in the mix, while others fail to tap their full power. This tends to be driven by three core issues (see Exhibit 2):

- Lack of Consistency. Often, retailers silo their promotion, pricing, markdown, and personalization teams and equip them with separate tools. As a result, each part of the organization grounds its decisions on different facts and assumptions, even though their activities overlap in the market. Teams end up with conflicting projects instead of driving a fully integrated, well-orchestrated value proposition for the consumer. Retailers can improve their internal consistency by ensuring that all teams, processes, and tools are integrated and can communicate with each other, with consistent data access and data quality, so that all parts of the organization make decisions on the basis of a single source of truth.

- Stacking. Organizational silos, independent tools, and suboptimal processes can cause multiple events to occur in parallel, leading to undesirable stacking behavior in which promotions, discounts, and loyalty rewards accumulate on top of each other. Many consumers find this situation confusing: more than 70% of the consumers we surveyed said that they prefer a single, clear discount to multiple discounts that they need to combine. Presenting them with multiple offers typically does not generate high incremental volume, because relatively few consumers (“coupon enthusiasts”) take advantage of the full range of discounts available. To optimize spending, retailers should set up governance processes that ensure alignment of short-term merchant decisions with long-term strategy, even if merchants report to different parts of the organization. Retailers should establish frequent, recurring communications across teams to make tradeoffs across levers and to drive more profitable promotions.

- In-Store Challenges. In-store execution can strongly influence how consumers perceive a promotion. Each promotion’s value proposition must have a direct and clear appeal, reflected in the retailer’s choices of media, content, and in-store messaging. Otherwise, consumers may become confused or may ignore the promotion entirely. To ensure that retailers get full credit for their investments, consumers must perceive the offer prior to purchase. In addition, targeted promotions should demand active consumer engagement—for example, applying a coupon code at checkout—to ensure that awareness of the promotion has played a role in the sale.

Communicate a Clear Value Proposition to Consumers

Rigorously addressing the dimensions of strategy, measurement, and execution can help retailers define a consistent value proposition that they can clearly communicate to consumers. By doing so, retailers can build loyalty, enhance brand reputation, and gain access to new revenue opportunities.

To excel in overall promotion management, a retailer should make savings readily visible to consumers (for example, at checkout or on their receipts) and remind consumers of their accumulated savings over time (for example, through in-app messaging or via email). However, this approach will be successful only if the retailer addresses all three dimensions systematically.