In June 2019, two weather-related events occurred in Germany. They were not particularly out of the ordinary. But to energy industry watchers they were a huge warning sign.

First, during the initial days of the month sudden significant reductions in wind speed resulted in insufficient electricity in the grid to meet the demand, causing alarming instability in the distribution network. Second, towards the end of June, a heat wave rolled in, with temperatures exceeding 35 degrees Celsius for nearly a week. This led to a surge in electricity consumption for cooling, resulting in severe supply shortages.

Countries increasingly reliant on renewable energy face new challenges to ensure stability of their power networks.

Together, both incidents—occurring as they did so closely in time—clearly highlighted that electricity grids, which have always struggled to balance supply and demand , were at a new unfamiliar pressure point. As global warming continues to alter weather patterns, making once-extreme events commonplace, countries like Germany that increasingly rely on renewable energy for residential electricity will face new challenges to ensure stability of their power networks. At the same time, homeowners are using more electricity than ever, in part responding to climate change, to charge their electric vehicles and power heat pumps, among other “green” products. The result: both supply and demand are hit by different and countervailing affects from the global climate crisis—and the outcome is increased volatility.

This is not sustainable and is likely to worsen. Increasing renewable energy distribution is not a feasible answer: it is a technically difficult and expensive undertaking requiring massive storage systems near renewable energy sites.

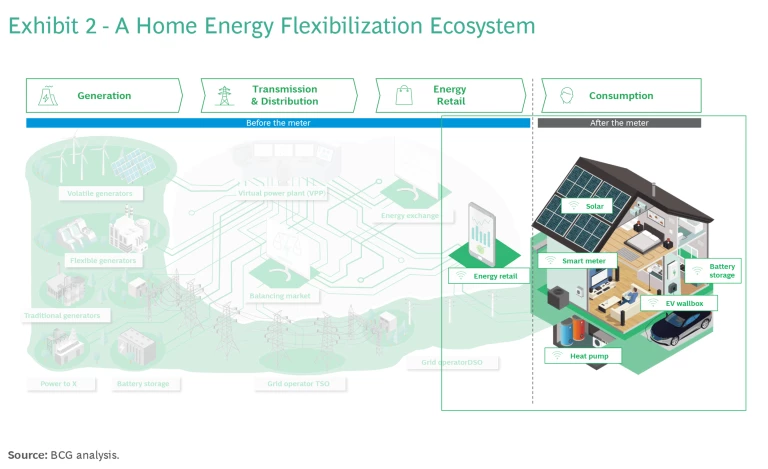

A better and more immediately feasible solution is to concentrate on the downstream side by adopting residential energy flexibilization approaches. Flexible energy is a two-way concept, in which the homeowner uses, generates, stores and ultimately feeds electricity back to the grid. It requires a combination of smart metering, innovative and dynamic energy tariffs, a suitable regulatory setup, and powerful software to effectively automate the critical processes. The residential sector has a significant potential, although often overlooked, to drive greater elasticity in electricity demand, correcting energy imbalances while supporting net zero carbon emissions initiatives.

The Impact of Residential Energy Flexibilization

The real estate sector accounts for over 35% of the world's energy consumption and contributes more than 35% of global CO2 emissions. Between 60% and 80% of these emissions come from on-site activities, such as heating and cooling buildings and homes and electricity usage. Addressing climate change necessitates a shift away from gas and oil as energy and heating sources in residential environments.

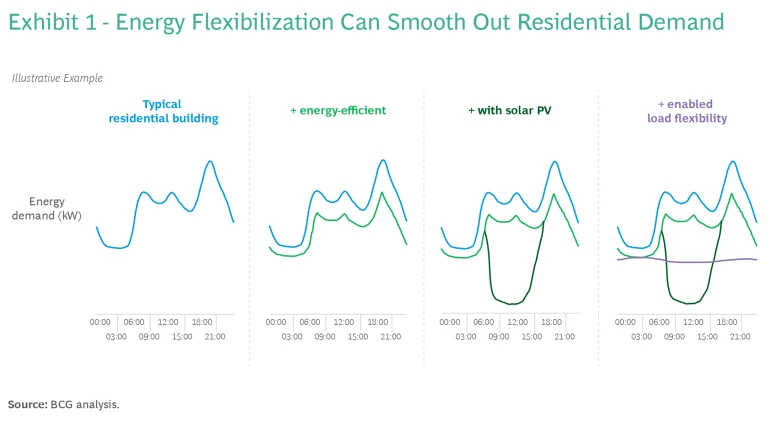

Many countries are addressing this already. Germany has set a goal to increase the share of electricity consumption from renewable sources to 80% by 2030 from about 50% now. Renewable energy generation relies heavily on weather conditions, while energy demand from consumers and industries follows predictable usage patterns. By adopting flexible energy strategies in residential buildings, supply fluctuations can be mitigated, making the use of renewables more viable and contributing to the overall stabilization of the grid (see Exhibit 1).

Residential energy flexibilization can take many shapes. It primarily uses modern home electricity generation and storage technologies—such as photovoltaic (PV) solar systems and panels, batteries and electric vehicles, and modern heating and cooling equipment (primarily heat pumps with water storage)—to stabilize a building’s energy demand. Importantly, stored excess locally generated energy can be fed to the grid when electricity demand is high. At scale, flexible residential energy can evolve into a series of virtual power plants (VPPs)—that is, a consolidated network of decentralized power sources.

“

When flexible loads follow particularly favorable production peaks from wind and solar, the electricity costs for heat pump and EV operations decrease by up to 50% without any limitation for the customer, while simultaneously reducing the CO2 balance of the grid electricity used. Both consumers with PV and those without can benefit from this. The flexibility provided by heat pumps and electric vehicles makes the overall system cheaper and greatly reduces conventional base load requirements.”

—Philipp Schröder, Co-Founder & CEO, 1KOMMA5°, one of the leading integrated installation and emerging VPP platforms

“

Every house will have a solar PV system. It's not a question of if, but only how quickly. The PV system is the gateway product for homeowners to not only consume energy passively, but to actively participate in an even more flexible energy market.”

—Alex Melzer, Co-Founder and CEO, Zolar, one of the leading providers of solar energy equipment

New Policies Drive Adoption

Governments are already playing a role in encouraging energy flexibilization. In Germany, for instance, the proposed Building Energy Act, would ban gas boilers in favor of heat pumps in new construction and some existing buildings. Legislation like this spurs the introduction of heat pumps at scale. In turn, this enables flexibility by increasing the electricity-based energy used in residential buildings (instead of oil and gas). It also motivates homeowners to invest in decentralized electricity generation and storage capacity to optimize their energy costs and carbon footprints.

Policymakers can also mandate the use of smart meters, which track electricity consumption in real time. This allows utilities to quickly adjust supply based on current and historical patterns and encourages consumers to modify their usage according to smart meter recommendations. For instance, if electricity from renewable sources is lagging mid-day because of grey skies since morning, EV charging can be delayed.

Because of government regulations, in some European countries—Spain, Italy, Estonia, Finland, Sweden and Norway, among them—all homes are equipped with smart meters. In the Nordic countries, dynamic fee structures for energy usage based on time of day, grid capacity and availability, and what the electricity is being used for, among other things, are commonplace because of the penetration of smart meters.

Consumers find the current options of energy flexibilization too complicated and too limited.

Consumers must cooperate. Certainly, there are altruistic reasons to do so. A growing number of homeowners are trying to shrink their carbon footprints, anxious to do their part in stemming climate change. Moreover, consumers are always looking for ways to minimize volatile energy costs. Still, despite these sentiments, most consumers find the option of energy flexibilization too complicated and the opportunities too limited—for instance, the smart meter infrastructure may not be robust in their country—to actually explore its possibilities.

“

Buildings [...] are key to achieving net zero emissions by mid-century. But in order to play their role in the transition to net zero, buildings must switch from being passive and inefficient energy consumers into active participants in the energy system.”

—International Energy Agency

A Huge Opening for Businesses

The flexible energy opportunity places the private sector in a uniquely fortuitous position. Governments and consumers are relying on companies—utilities, energy startups, and hardware and software firms—and investors seeking to back energy innovation. If the companies are alert, they can develop solutions for using residential electricity in a more agile and environmentally-safe, less expensive manner. The hope is that businesses can help consumers exploit the value of adaptable energy consumption and production in their homes.

In BCG’s analysis of this new, timely, and potentially lucrative market, the most promising opportunities are:

- Dynamic electricity tariffs that allow consumers to pay less for electricity during periods of high supply of renewables-sourced electricity and low demand. These would be supported by smart meters.

- Home Energy Management Systems (HEMS) that intelligently control high-consumption appliances in households equipped with heat pumps, EVs, photovoltaic systems, and home batteries. This ensures load balancing and optimization (see Exhibit 2).

- Seamless systems that give consumers the ability to sell excess power generated in their homes on the wholesale market. This transforms consumers into prosumers who can financially benefit from the electricity they produce.

“

The move towards more flexible energy usage in the residential sector opens massive opportunities for new and established companies. Energy is one of the biggest cost factors for the average household and companies that build solutions to solve decarbonization while providing benefits to end customers are going to become the energy behemoths of the future. We are particularly excited about products that make energy use and generation more flexible. Examples could be novel IoT solutions or Virtual Power plants.”

—Maximilian Zoller, Principal, HV Capital, which holds a stake in Enpal (among other investments)

“

The energy of the future will be networked. Energy management software will make it possible, for example, to trade surplus solar power on the stock exchange, intelligently shift loads or provide storage as to control energy. For example, storage could be charged from the grid precisely when more wind power is produced than is needed. This makes the power supply from fluctuating renewables more reliable and reduces the need for expensive gas-fired power plants. The next step will be solutions that allow electricity from the battery of the electric car to be used in the home or fed back into the grid.”

—Mario Kohle, Founder and CEO, Enpal, one of the leading providers of solar energy for home owners

Flexible residential energy is a new paradigm.

Where Does Your Company Fit?

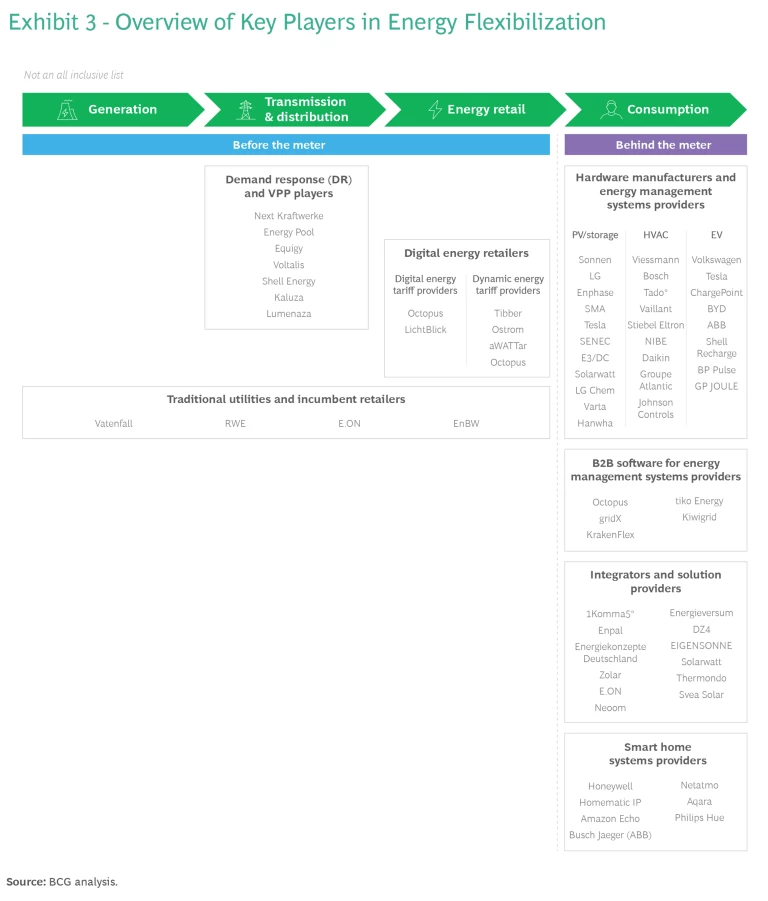

Residential energy flexibilization is a new paradigm in how consumers and businesses view electricity supply and demand—and their own roles in decarbonization . The market is fresh and we think it will develop rapidly in certain segments. Companies must seize the opportunity. In order to map the landscape and areas of opportunity, we have separated the key players in the market into the most prominent categories of flexible residential energy (see Exhibit 3).

Hardware Manufacturers and Energy Management Systems Providers

Historically, hardware manufacturers primarily concentrated on supplying energy-consumption hardware and controls such as heat pumps (HP), photovoltaic systems, batteries, electric vehicle charging infrastructure and enabling devices (such as smart controls and meters). These companies also offered software services, including systems maintenance.

As flexible residential energy evolves, companies in this diverse group must shift their focus to providing home energy management systems. They will be able to orchestrate a comprehensive range of components, including EV wall boxes, heat pumps, and PV inverters. The HEMS becomes a control point for home energy consumers, compensating them for the flexibility they provide to the energy system.

HEMS can be sold as standalone equipment or in a Hardware-as-a-Service (HaaS) offering, which would include hardware, software, maintenance and support. These would help consumers adopt efficient usage patterns to cut spending and minimize their carbon footprint. In addition, with the HaaS model, companies can leverage their expertise in the energy market to cross-finance attractive consumer offers from multiple third-party vendors.

“

Almost every household in Europe has a heating system and these systems are responsible for 79% of residential energy consumption. Hence home heating is the most important pillar when optimizing home energy. A platform which can connect and manage any system from any manufacturer is the key to offer efficiency propositions to every household.”

—Christian Deilmann, Co-Founder and CPO, tado°, one of the leading providers of heating & energy management solutions for home owners

“

Energy flexibilization is the logical next step. Customers want one point of contact for this and not a multitude of specialized providers. We are increasingly seeing a complete integration of the range of products and services offered by providers of decentralized energy services.”

—Peter Bachmann, Vice President Strategy and Customer Solutions, Solarwatt, one of the leading providers of solar energy hardware

Digital Energy Retailers

The majority of new energy businesses consists of young companies with expertise in digital go-to-market strategies and cost efficiency. They aim to enter the energy retailer market and revolutionize its pricing dynamics with flexible pricing based on supply and demand conditions. Additionally, certain players in this category are smartly positioning themselves as energy management platform providers that combine hardware, particularly battery storage, with dynamic pricing, enabling customers to reduce their energy costs. Energy is stored in the battery when prices are low and then drawn from the battery when prices are high.

To overcome the twin obstacles to success in their segment of the market—slim profit margins and limited customer loyalty—digital energy retailers can expand into hardware and HEMS, while also buying and selling energy based on flexible residential strategies. But to thrive here, companies must give customers access to up-to-the-minute usage data and cost efficiency, attract consumers through positive user-experience, and create a robust brand presence in the "new energy world."

“

Energy storage can be a fundamental piece and absolutely necessary for renewable energy to be built at the scale that is needed in order to phase out fossil fuels. That is a true way of dealing with climate change.”

—Edgeir Aksnes, Co-Founder & CEO, Tibber, one of the leading digital energy retailers

Integrators and Solution Providers

In recent years these emerging providers, often starting as PV installers, have expanded by offering other flexible energy equipment, such as heat pumps and EV charging stations. This fed into the increased public awareness of energy self-sufficiency and the desire to easily manage energy in the home. In some cases these businesses also positioned themselves as energy retailers.

Capitalizing on the scarcity of residential energy system installers, these companies offer consumers a one-stop source for a broad-scale residential energy solution. They thus can present themselves as trusted providers, meeting the diverse needs of customers seeking comprehensive energy solutions.

In this new market, being the "first to the customer" can be a competitive advantage.

In this new market, being the "first to the customer" can indeed offer a competitive advantage. This is especially true for new residential construction projects and complete home retrofits, where consumers are more inclined to invest in all-in-one energy solutions from a single provider. However, for integrators the current market is still somewhat limited beyond high-investment photovoltaic (PV) and all-in-one solutions. To grow their soup-to-nuts offerings, the companies can create a lock-in effect through maintenance, the ability to work with any type of hardware and software, add-on services as energy innovation occurs, and perhaps financing options.

B2B Software for Energy Management Systems Providers

A spate of software startups has emerged that develop software-based energy management systems for B2B partners, including energy retailers and home appliance providers. These companies offer seamless integration of various components such as heat pumps, EV charging stations, photovoltaic systems, and energy storage. They play a pivotal role in the residential energy flexibilization ecosystem by, for instance, providing the software for digital energy retailers to do dynamic pricing and to facilitate communication among myriad flexible energy equipment.

Until now, the main challenge for these providers has been the immaturity of flexible energy hardware, exacerbated by the slow deployment of smart meters. However, smart meters that can manage high-performance energy usage among disparate equipment are being installed much more quickly than before. And HEMS providers are more actively emphasizing innovative technologies to attract and retain consumers. To support all this, software companies must develop applications that integrate as many energy systems as possible from original equipment manufacturers and enable fast and convenient onboarding and installation for consumers. Most importantly, software vendors must know how to optimize power consumption.

Traditional Utilities and Incumbent Retailers

A notable trend among traditional power retailers is their increasing focus on adaptive strategic investment. While power generation and trading remain their core business, some are now investing in software solutions that support flexible energy and a more sustainable energy ecosystem. Part of their motivation is to prevent high-value customers from switching to attractive newcomers in energy flexibility and loss of margin from their traditional business lines.

With these investments, incumbent companies have generally avoided developing new approaches in-house. Instead they are taking stakes or partnering with companies that offer energy flexibility equipment and solutions, including services that provide grid balancing and stabilization and photovoltaic storage. In addition, dynamic electricity tariffs based on supply and demand have already become a standard offering among major energy retailers, and many of them are actively developing HEMS solutions.

This strategic shift among traditional power retailers reflects their recognition of the changing energy landscape and consumer demands for flexible and sustainable energy solutions. By investing in energy innovation, they can remain competitive in the renewable energy and consumer-centric market.

“

Incumbent players need to take action and participate in the emerging market opportunity of energy flexibilization. They can successfully do so by leveraging their strong customer base and vast experience in energy retail/trading.”

—Philipp Klenner, Senior Vice President Future Energy Home, EON, a major energy utility

In this picture of the flexible residential energy landscape, we have left out segments of the energy industry that are broader and not focused solely on activities at the residential level. In coming years such companies are more than likely to reach into the homeowner market. In particular, demand response and VPPs are more linked to utilities and power generation and at this point have few interactions with residential players.

Some retail-focused smart home systems providers deal directly with consumers. Apart from offerings that control entertainment or appliances, these companies have solutions that can measure, track, and help manage home energy usage. However, these smart home providers are not yet prepared for energy consumption management because they are either still focused on their profitable hardware business or concentrating on going broad (automate more and more parts of the home) rather than going deep on energy and HEMS. As flexible residential energy becomes more commonplace, we suspect that smart home systems will play a bigger role.

Not A Winner Takes All Market

Because of residential energy flexibilization's multiple dimensions and myriad new innovations, it is not likely to be a one-sided marketplace with a small handful of dominant players poised to lead the industry in the near future. While there is potential to create a consumer lock-in effect through superior products and services and by getting into the game early, these relationships will not be particularly sticky since consumers will have the option to switch from one provider to another relatively easily and inexpensively. Moreover, the residential building technology market is predominantly localized, with distinct preferences, market structures, and regulations providing openings for many new companies to join the fray.

In this market, collaboration among companies is essential to integrate various hardware technologies and to foster innovation.

Rather than winner takes all, the flexible residential energy market should be viewed as an ecosystem. Indeed, collaboration among companies is essential to integrate various hardware technologies—which appeals to consumers—and to foster innovation on top of existing energy systems. Hardware providers need to join with software companies to offer integrated HEMS technology. Software providers should build platforms that achieve broader reach. This diverse ecosystem can synergize the capabilities of manufacturers, suppliers, technology firms, investors, and regulators.

Thus, companies must assume multiple roles. They can actively orchestrate ecosystem development, establish common standards, and determine value distribution among participants. As contributors, they provide value-added services, products, or assets to enhance the effectiveness and efficiency of the market for all participants.

“

As Europe faces an accelerated transition towards a low carbon energy mix, the legacy grid infrastructure is being put under increasing scrutiny and pressure. As residential homes race to electrify, there is significant value to be unlocked by tapping into consumption management and demand response services.”

—Tim He, Partner & Energy Transition Lead, Summa Equity, which holds a stake in Tibber

“

As investors, we are particularly excited about solutions that facilitate faster access to, and efficient participation in, the flexibility markets. We do not see one dominant strategy that will take the entire market of home energy flexibility all at once. Rather we observe a multitude of approaches that pick different starting points ranging from pure software plays to more integrated approaches combining software and assets in their value proposition.”

—Florian Reichert, Partner & Managing Director, Picus Capital, an Enpal investor

What It Takes to Be Successful

Despite the collaboration and co-competition within the ecosystem, intense rivalry for the consumer's attention will persist. In our view three strategic steps should be emphasized to successfully attract and retain customers:

- Be the first to reach the customer. Move quickly to establish a strong presence in the core energy flexibilization segment that you are targeting and then expand by value-added services alone or in collaboration with others in the ecosystem. For instance, electricity providers could offer home energy management systems or hardware with integrated HEMS. Critical for companies with a large consumer base is leveraging these customer relationships to introduce additional solutions and generate new revenue streams.

- Offer consumers maximum savings and convenience. Companies that can provide products or services with substantial cost savings for consumers without sacrificing convenience will have a competitive advantage. For example, optimizing heat pumps or charging electric vehicles in a way that minimizes the consumer's involvement while still achieving energy savings would be extremely attractive. As would be finding the optimal balance to provide cost savings and grid flexibility.

- Provide simple and comprehensive solutions. Offering straightforward and comprehensive products and services is essential to maximize the lock-in effect and customer loyalty. Integrators may have an advantage if they can offer seamless and user-friendly experiences in integrating energy retailing and HEMS. Given the growth potential in flexible residential energy, all types of companies should be able to branch out from their core offerings—often by collaborating with others in their ecosystems—to offer more comprehensive solutions over time.

Often overlooked in discussions about energy flexibility is the vital role that specialists and craftspeople play in installing these new technologies. For every company, ensuring installation capacity by building strong partnerships and positive relationships with installation professionals is essential to satisfy consumer expectations for speed of installation and quality. Accordingly, companies must invest heavily in strengthening either their own installation capabilities or in forming partnerships with installers. And they must adopt training programs that equip craftspeople with the necessary skills and knowledge to efficiently install the technology.

Subscribe to our Industrial Goods E-Alert.

Time for Action

Residential energy flexibilization creates new market opportunities for all players in the building and energy technology sector. No single player can achieve complete dominance. Instead, success lies in the ability of individual providers to combine the right capabilities within an effective ecosystem. The pivotal question becomes: What role does a company play within this ecosystem; is it an orchestrator shaping the ecosystem or a contributor?

To answer this question, all players, including early movers, must carefully observe, analyze, and adapt their own positions, as well as assess the current state, competition, and prospects of the market. The market is evolving rapidly, and no one can afford complacency or resting on past achievements. Ultimately, success in the era of flexible residential energy will hinge on the right strategy, a holistic ecosystem approach, and swift action to strengthen individual positions.