Finance functions in all industries face a talent crisis. In today’s increasingly dynamic business environment, the mandate for finance is evolving from simple tracking and reporting of business performance to actively shaping it. This is triggering a shift in the type of talent that’s required. Going forward, finance functions will need a workforce that can partner with business units more proactively, apply data and digital solutions to take on problems in new ways, and address emerging trends like the focus on environmental, social, and governance (ESG) goals—all skills that are in growing demand across industries and markets.

To build these capabilities, CFOs should act swiftly to develop their current workforce and recruit talent from new sources. It’s a big challenge, but with the right approach, finance functions can put in place the talent they need to thrive in a more challenging environment.

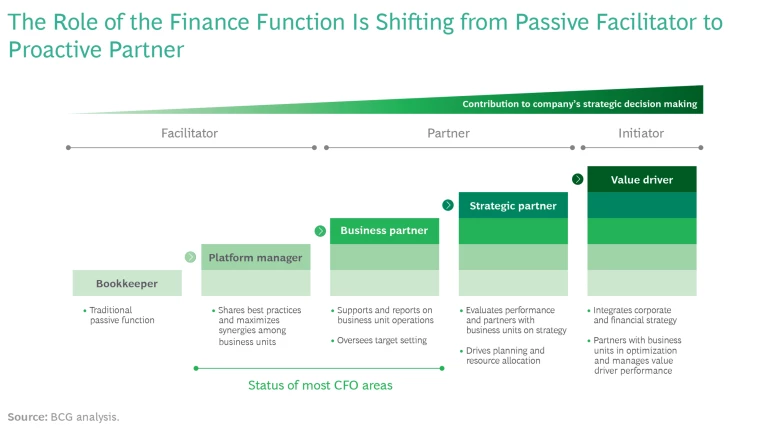

From Bookkeeper to Business Partner

In the past, finance functions spent most of their efforts on transactional work, including high-quality bookkeeping and operations conducted in shared service centers. But over the past several years, most have become more of a trusted partner to business units, empowered to take proactive measures and create more value. (See the exhibit.) The volatility of the business environment—and the increasing availability of data and digital tools—has only accelerated this trend. To become a true value driver, finance functions must cultivate additional skills through partnerships with other functions, new digital and data capabilities, and an emphasis on ESG goals.

Strategic Partnerships with Business Units and Other Functions. The finance organization must apply a business-oriented mindset, strategically partnering with operational units and functions and communicating more directly with business leaders. For example, a US retailer was recently evaluating whether or not to build a new distribution center to support business growth. To inform the decision and address risks, the finance team was engaged to run multiple scenarios: steady state, a boom in demand, a recession, and spikes in inflation or fuel prices. Based on this analysis, the team confirmed that the move made sense, and the company went ahead with the plan. To conduct such a robust and thoughtful analysis, the finance team had to possess a deep understanding of the business and the skills needed to collaborate with partners across the organization.

Data and Digital Capabilities. Dynamic scenario modeling, management reporting, and other types of advanced, data-driven analysis require finance functions to leverage scalable, cost-effective automation capabilities and analytics solutions, including process mining and AI tools. These greatly accelerate critical finance processes and automate simple rules-based tasks, freeing up staff in finance functions and shared service centers to focus on higher-value, more complex work.

In some cases, these digital tools may require the creation of new roles, such as data scientists, AI and machine-learning translators, and modelers of simulation and planning tools. At the same time, those in existing roles, such as financial planning and analysis employees, will need to acquire new skills and become proficient at using additional tools and solutions.

For example, the finance function at an automotive leasing company recently partnered with the data science team to develop AI/machine-learning algorithms to forecast the key KPIs that the company would need to run its business. These forecasts eventually replaced a large part of the company’s planning process, and the finance analysts who oversaw planning took on new roles providing advice and guidance to operational units.

Data-driven analysis requires finance functions to leverage scalable, cost-effective automation capabilities and analytics solutions, including process mining and AI tools.

Environmental, Social, and Governance Goals. Tackling ESG goals—particularly sustainability—is not something that can be done in a silo or by a small team. It requires fundamentally rethinking processes across the entire organization, with companies equipping themselves to capture different types of data, report on new dimensions of performance, and interact with a wider group of stakeholders. As ESG considerations become a baseline requirement among investors, regulators, consumers, and other stakeholders, companies can differentiate themselves by making it an integral part of their strategy—and treating it as a means of value creation rather than a net cost. This requires that everyone in the organization understand the challenges, embrace ESG goals in their everyday work, and learn the new skills and capabilities needed to execute.

For finance, the mandate is even greater; the function can (and must) play a critical role in integrating ESG criteria into all management practices and decision-making processes. When ESG activities are led by the finance function, they generate better results. CFOs therefore need to be sustainability leaders within the organization.

Growing Competition for Talent

The evolution in finance comes during a unique moment in the talent landscape, and it’s creating a significant challenge for companies that want to improve their finance function. The skills most needed by CFOs are needed by virtually all organizations—across industries and geographic markets. The pool of people with expertise in finance and in the required capabilities is small, making a competitive talent market that much more so. In a 2022 survey conducted by BCG and The Network, 74% of finance professionals said they had been approached with a job offer multiple times per year—and nearly 40% had been approached monthly. Recognizing their increased clout, many finance professionals routinely change jobs for better pay, flexibility, or mobility.

If there’s a bright spot, it’s that the shift to hybrid work expands the potential talent pool. Nearly 40% of finance employees worldwide now work in a hybrid setting, and 5% work completely remotely. Work-life balance is a key consideration when people look for a job, and finance talent—like most workers, especially young ones—increasingly want to work for a company whose values and purpose they find meaningful. Companies that understand these needs can position themselves to recruit and retain finance talent more effectively.

Seven Imperatives to Improve Finance Talent

Given the growing demand for new skills in finance, how can CFOs put these capabilities in place? Our experience working with clients across all industries suggests that CFOs must focus on seven imperatives.

Anticipate future talent needs. Traditionally, CFOs have planned their talent needs by looking out over the coming 12 to 18 months. But that relatively short timeline can limit their options for developing internally, requiring them to go outside for digital, data-savvy, and business-focused talent. Now CFOs must shift their workforce planning to look three or more years ahead. This will give the finance function more options for talent development—including the reskilling and upskilling of current employees—and make its talent strategy far more sustainable.

Redesign the finance organization and create new roles. The traditional structure of the finance function is no longer fit for purpose. Just as the function’s needs have evolved, so must its structure and roles evolve as well. Because finance practitioners will have to work across business units and functions, CFOs need an organizational model that is more agile and cross-functional, with fewer silos and more collaboration across disciplines. Finance should also consider new and emerging roles, such as data scientists, crypto specialists, and ESG specialists. As roles get redesigned, functions will need to determine where they belong within the organization—for example, in a center of excellence, embedded within IT, or someplace else.

Make career paths less linear. In finance, career paths have typically been highly linear and predetermined: employees need sufficient tenure in a given role before they can be considered for a more senior role. That approach can push some finance employees to look elsewhere. One survey found that 50% of finance employees move to a new job in order to find more interesting work or a more senior role, while only 23% leave for higher pay. This highlights the importance of giving employees the right role, which does not necessarily mean a promotion.

The new environment requires far more flexible, skills-based career paths. These allow talent to be drawn from a wider range of backgrounds, with career trajectories based on skills rather than time accrued in a given role. Employees are not only encouraged but required to build up a breadth of experience by taking jobs and stints in different operational units, rather than spending their entire tenure within the finance department. Skills-based career paths also create more opportunities to gain seniority, as roles are defined not by an org chart but by the value that an employee can create for the company. Careers paths look less like a ladder and more like a jungle gym.

The new environment requires far more flexible, skills-based career paths.

To support this shift, finance functions should encourage employees to gain new experiences and skills. For example, short-term rotations and job transfers can provide opportunities to develop functional and digital skills across finance. Special projects, with a fraction of an employee’s time spent on an initiative unrelated to his or her core role, can have a similar impact. One company even invented a “get out of the office day” to encourage employees to look beyond the company and do things like attend conferences.

A large health care company recently changed its focus from the traditional requirements for promotion (such as number of years in a given role) to the acquisition of skills and experience via job rotations, side projects, and transfers to different teams within and outside of finance, including other operational units. This approach has enabled finance employees to build skills more quickly and dynamically, increasing their career satisfaction and improving finance’s ability to respond to business needs.

Ensure that performance reviews reflect the new requirements. Performance reviews can be a powerful lever for enabling and sustaining changes such as skills-based career paths. Good review programs typically involve supervisors acting as coaches rather than evaluators. They occur more than once a year and provide continuous, 360-degree feedback—from multiple people, including internal customers—and they emphasize team over individual performance. Functions also need to revise how employees are assessed regarding data and digital skills, including which metrics to use. It’s important that metrics be forward-looking, reflecting not only current requirements but capabilities that the organization will need in the future.

Expand the scope of training and support. To equip the finance workforce to succeed, functions should provide enhanced opportunities for employees to develop their skills and equip them with the necessary tools and structure. These offerings should be tailored to specific roles, at the same time making them as broadly accessible as possible. For example, most finance professionals don’t need to be data scientists to do their jobs, but they may require a working understanding of key data science tools (such as machine learning) in order to call on the right experts when needed. And those who want to learn more than the baseline should be given that opportunity.

Agile methodologies are another potential area of focus. New organizational models should enable flexibility, with agile tools and coaches accessible to all finance professionals. Leaders should have experts embedded in the finance function to help them apply agile. On-the-job training should be bespoke and readily available. Virtual training sessions and classroom instruction should be tailored to each role and be directly applicable to employees’ jobs. A central training hub is ideal for individualized learning and should include a variety of self-serve offerings, some covering functional topics—such as finance processes, agile, and digital skills—and others covering industry- and company-specific topics. Training programs should also emphasize the roles that are potentially available based on employees’ current skills.

To equip the finance workforce to succeed, functions should provide enhanced opportunities for employees to develop their skills and equip them with the necessary tools and structure.

Critical to this training approach is “learning how to learn”—developing the right organizational muscles to provide ongoing training, so that finance can continue to evolve in response to changing requirements and market conditions.

Recruit talent from beyond the usual sources. In addition to building up skills among the current finance workforce, companies need to improve their ability to identify and attract external talent. They should look beyond traditional sources (such as college graduates with accounting degrees or finance employees at other organizations) and consider people with complementary skills, such as expertise in a particular business, product, or technology.

Stay ahead with BCG insights on corporate finance and strategy

In addition, companies must change the way finance evaluates candidates’ fit with the desired competencies (for example, by revising interview guides to identify digital and data skills). And they should bear in mind that in a competitive job market, candidates evaluate companies just as much as companies evaluate them. A recent survey found that 55% of finance workers would refuse an otherwise attractive job offer if they had just one negative experience during recruitment, such as bad chemistry with an interviewer, discriminatory questions, or failure to receive a timely response.

Cultivate—and communicate—a sense of purpose. A company’s clear vision and sense of purpose can appeal to the entire organization, and especially to younger workers. A recent BCG survey found that 67% of millennials want their employer’s purpose to be compatible with their own values and their jobs to have a positive impact on society. In the context of finance, purpose is about driving value for the broader enterprise, customers, and the world—in other words, making and supporting decisions that contribute to the company’s overall direction and performance.

For years, finance has sought a seat at the table—a chance to partner with business units and drive performance for the organization. Today, that is not just an ambition, it’s a requirement. But CFOs can’t fulfill this expanded mandate without the right talent in place. By taking the measures described above, finance functions can acquire and develop the capabilities needed to succeed in the current environment and into the future.