Here’s the good news on the US property and casualty (P&C) market . Companies in the segment—especially P&C leaders—are doing pretty well. US P&C companies delivered average annual total shareholder return (TSR) of 10% from 2018 through 2022, compared with the disappointing global average annual TSR of 4% for life and health, multiline, P&C, and reinsurance combined over the same period. Top-quartile US P&C companies did even better, notching a five-year average annual TSR of 20%—among the highest in any industry or sector.

US P&C leaders’ resilience throughout the economic turmoil of 2022 was rooted in their focus on underwriting results and in the resulting strong return on tangible equity (RoTE), which correlates highly with TSR. Indeed, it appears that US P&C leaders cracked the insurance value creation code—and BCG’s insurance industry value creators reports have documented the success of the top companies over the past several years. Their principal challenge going forward is to stay the course and continue generating superior results.

But warning signs are flashing. The P&C segment is undergoing a structural shift. Future underwriting excellence will hinge on companies’ ability to foresee and adapt to significant macro-environmental changes, such as geopolitical instability, supply chain disruption, and the expanding effects of climate change. Underwriting excellence will also depend more than ever on carriers’ ability to embrace advances in digital capabilities and AI. If they are going to continue to outperform, top quartile US P&C companies must take a hard look at their portfolios’ strengths and objectively assess what is likely to change over the next five years and by how much.

Although leaders must stay focused on the fundamentals, they must also recognize that doing so may not be enough to guarantee that they remain on top. As our 2023 insurance industry value creators report points out, relative TSR performance across companies fluctuated strongly over the past ten years. Only 16% of insurance leaders maintained their performance, meaning that only one in six top-quartile performers in the period from 2012 to 2017 retained that ranking in the 2018 to 2022 period.

This article looks at the US P&C segment and what companies need to do to continue to outperform their

insurance industry

peers and the market as a whole.

The Fundamentals Matter

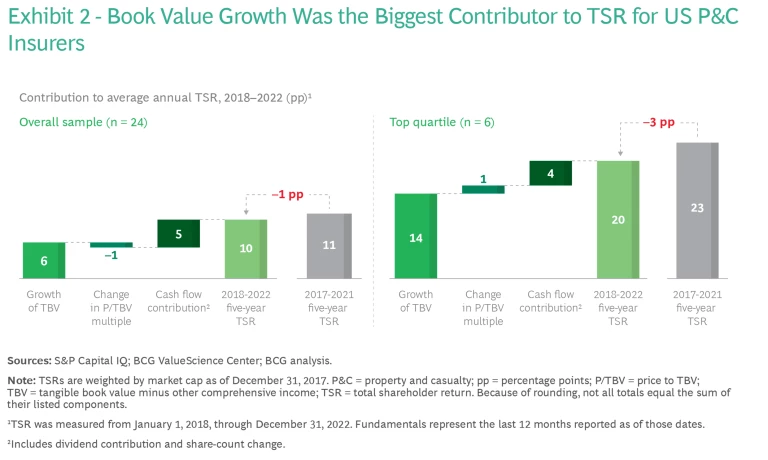

As we have observed many times, TSR for insurance companies has three drivers: growth in tangible book value (TBV), change in the multiple of price to tangible book value (P/TBV), and the contribution from cash flow (dividend yield and share buybacks). In the long term, TBV growth and cash flow are the major contributors to TSR. In the short to medium term, changes in the P/TBV multiple matter more. Improving RoTE is critical to increasing P/TBV multiples.

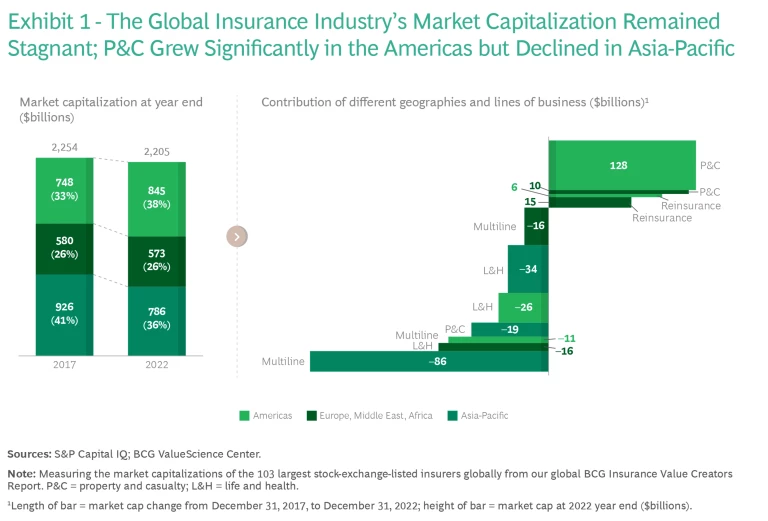

The insurance industry’s global average annual TSR of 4% reflects positive contributions from TBV growth and cash flow and negative contributions from contracting P/TBV multiples. From January 2018 to December 2022, the global insurance industry's market capitalization (which can be calculated as tangible book value multiplied by P/TBV) remained roughly flat at around $2.2 trillion. (See Exhibit 1.) Market caps of Asia-Pacific companies declined by some $126 billion, led by shrinking multiples for multiline and life and health players, while North America market caps increased by a similar $128 billion, driven primarily by P&C insurers. Progressive and Chubb were the main contributors to the expansion, accounting for $43 billion and $24 billion, respectively.

For US P&C insurers, TBV growth was the largest contributor to TSR—and for top-quartile performers, it played an even bigger role. (See Exhibit 2.) Cash flow was a second major contributor.

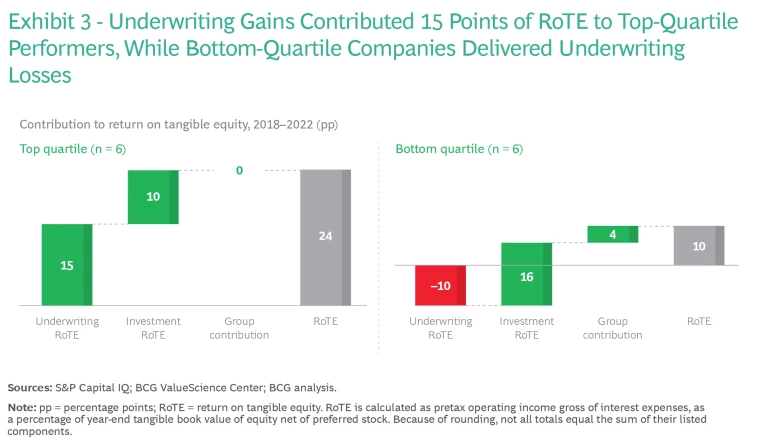

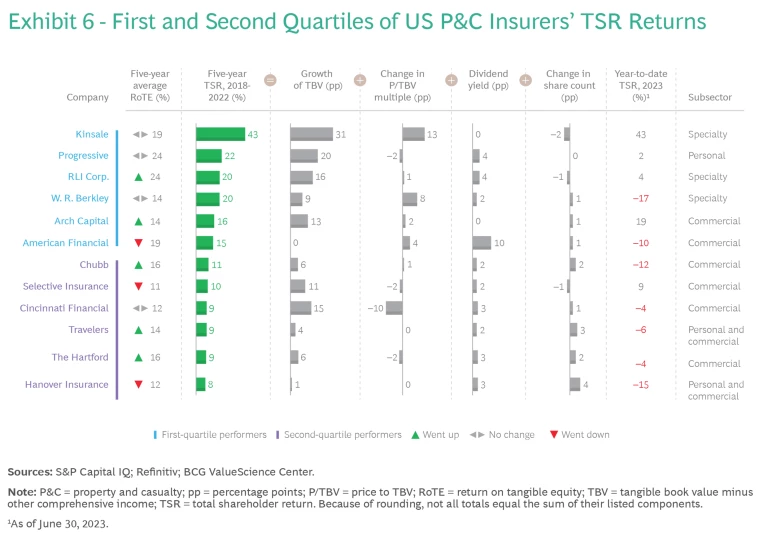

In last year’s insurance value creators report , we emphasized that there is no substitute for profitable growth. The difference in overall RoTE between top-quartile and bottom-quartile P&C companies in this year’s rankings underscores this point. (See Exhibit 3.) Top-quartile insurers tend to stick to their knitting: they focus on specific aspects or areas of the market in which their knowledge and expertise provides a competitive advantage. For example, Kinsale, the top TSR performer in this year’s ranking, is an excess and surplus specialist that focuses on hard-to-place risks for small accounts. Second-ranking Progressive, a consistent top-quartile player over the past ten years, concentrates on auto insurance. Selective and Cincinnati are regional players that delivered strong performance. These companies select, assess, price, and tailor coverage to risk, and they leverage best-in-class expertise, data, and technology to generate long-term value.

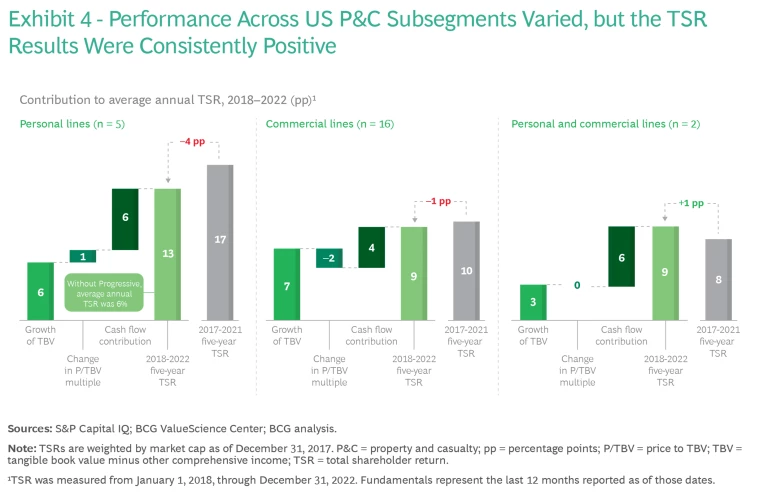

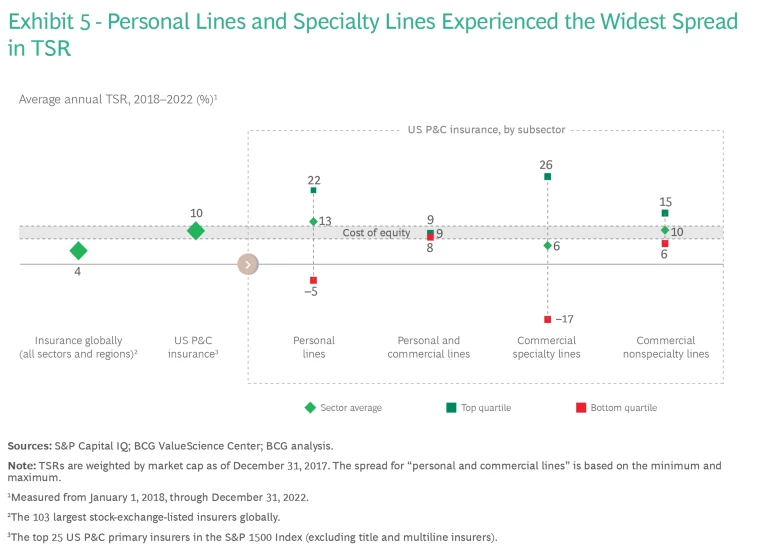

Although performance and its underlying drivers vary across subsegments of the market, the TSR results are uniformly positive. (See Exhibit 4.) Spreads between top-quartile and bottom-quartile companies were widest in specialty lines (ranging from 26% to –17%) and personal lines (22% to –5%). (See Exhibit 5). Two insurers whose business is approximately evenly split between personal and commercial lines (Travelers and Hannover) delivered an annual TSR of about 9% in the period.

Top-performing players applied disciplined expertise to their target segments and leveraged technology as a differentiator, whether by establishing an expense ratio advantage, providing a superior client and broker experience, or assessing risks more accurately. Kinsale leverages proprietary technology and uses analytics to drive profitability and operating efficiency. Progressive, which has long set the industry standard for usage of data and analytics, continues to expand its use of telematics to push the boundaries of how technology and data can inform underwriting, pricing, and claims. Bottom-quartile companies, in contrast, were disproportionally affected by catastrophes and weather-related events or had high exposure to challenging lines of business (such as nonstandard auto and medical malpractice).

Personal lines carriers delivered an average annual TSR of 13%, a 4-percentage-point drop from the prior five-year period. This result primarily reflects stronger market headwinds, including the spike in inflation, supply chain challenges, and continued adverse impact from climate change, which boosted the severity of claims. (If we remove Progressive and its 22% TSR from the calculations, the performance of personal lines drops to 6%). It is an understatement to say that 2022 was a challenging year. US P&C carriers recorded a staggering net underwriting loss of $26.5 billion, compared with a $5 billion underwriting loss in 2021, according to AM Best. From 2021 to 2022, the gap between top- and bottom-quartile performers in the segment widened by 10 percentage points.

Mutual insurers, which we cannot include in our TSR analysis, are big players in the US personal lines market, writing almost two-thirds of the total premiums in our sample and accounting for five of the top ten carriers. Comparing of mutual companies and stock companies poses multiple challenges, one of which is their differing missions. Mutuals tend to pursue longer-term strategies and often emphasize KPIs other than profitability. Mutuals lagged publicly traded insurers by about 65% in total value creation, owing largely to their lower return on surplus (4% versus 13%), which stems from higher combined ratios, lower investment returns, and capital inefficiencies (the inability to buy back shares, for example).

Overall, the challenging environment in 2022 demonstrated that insurers that execute their strategy deliberately and act decisively on risk selection, pricing, and costs can navigate market turmoil successfully, protecting their returns and increasing their competitive advantage. (See Exhibit 6.) The question is, what will it take for them to continue to do so?

The Changes Are Coming Big and Fast

In 2022, US P&C companies faced a combination of changes at the macro and industry levels unlike any other in modern history. We expect these conditions to continue and to generate additional volatility in performance going forward.

Increased Uncertainty. Underwriting and managing aggregations of catastrophe exposure have become more important than ever. Shifting weather patterns, an increase in large weather events, and an ever-growing number of people living in weather-exposed areas present one set of challenges. When combined with loss costs that outpace inflation and a difficult reinsurance market, these concerns are leading some big insurers to pull back and even exit some markets. Both State Farm—the largest P&C insurer in the US—and Allstate have announced that they will no longer issue new homeowners’ policies in California. Several other big carriers had already stopped writing new homeowners’ business in the state in 2022.

Regulation is part of the problem. Regulators in California require insurers to base their home-insurance rates on historical loss experience rather than projections of future losses. But commercial property insurance and homeowners insurance are also becoming harder to secure in other large states, such as Florida and Texas, as companies manage their exposure to risk and regulation.

The constricted appetite of reinsurers is another factor. Last year saw the first full-year decline in reinsurance capital (by almost 16% to $355 billion at year end) since 2008. Together with significantly higher premiums, capital erosion dropped the sector’s solvency margin ratio (capital divided by premiums) below 100. Terms and conditions are more restrictive, too, particularly for less attractive risks.

Stubbornly high inflation in 2022 has added uncertainty to insurers’ ultimate claim costs, affecting not only long-tail lines but also historically less vulnerable short-tail lines, owing to such factors as the labor shortage and rising material costs. Different lines of business—such as workers compensation, directors and officers liability, and property—seem to be at different points in the insurance hard-and-soft cycle, intensifying the need for insurers to rethink their portfolio approach to managing risk and pricing to achieve target returns.

The dramatic moves by big companies such as State Farm, Allstate, Nationwide, and Farmers lead to a big question. What if a significant share of customers can no longer afford to obtain insurance? Although insurance is often either directly or indirectly required by law for everyday items (such as housing and autos), some P&C products could become unaffordable for some customers (as in the case of home insurance in some coastal areas)—not unlike what has occurred in the health insurance market .

Climate Change. The near-term outlook is challenging, but longer-term prospects are even more daunting, as climate change is likely to lead to higher weather-related losses and volatility. Swiss Re Institute estimates that insured losses from natural catastrophes, which have risen at an annual rate of 5% to 7% since 1992, will continue at this pace, driven primarily by the rising severity of individual catastrophe events.

According to the National Oceanic and Atmospheric Administration, the severity and frequency of weather events increased notably from 2020 to 2022 compared with the previous ten years (2010 to 2019). The average number of events increased from 13 to 20 per year (65%), and the average annual loss from these events jumped from $94 billion to $145 billion (55%). Near-record losses of $165 billion occurred in 2022 (only 2017 and 2005 were worse), led by damage from Hurricane Ian. As Thomas Blunk, board member of Munich Re, said about natural disasters, “Climate change is taking an increasing toll. The natural disaster figures for 2022 are dominated by events that, according to the latest research findings, are more intense or are occurring more frequently. In some cases, both trends apply.”

Social Inflation. The growth in attorney representation and enormous jury awards in civil cases are not news. An analysis by the Insurance Information Institute found that the impact of social inflation on commercial auto claims in the US over a ten-year period increased almost threefold, from $1.4 billion in 2012 to $4 billion in 2021. But these big and fast-rising numbers are now attracting new sources of funding. A report by Swiss Re detailed that third-party litigation financing—by hedge funds, family offices, and other investors—totaled some $17 billion in 2021, an increase of 16% over the corresponding figure for 2020. The US accounts for more than half of the global market. Investment is likely to continue to grow at about 9% yearly, and we estimate that it may exceed $30 billion by 2028. Litigation management is more important than ever, and underwriters need to equip themselves with the tools to properly manage this risk.

New Sources of Competition. P&C insurers no longer have the competitive playing field to themselves. Auto manufacturers, for example, are beginning to leverage proprietary advantages to enter the insurance sector. In 2020, General Motors launched OnStar Insurance, aimed at tailoring insurance rates to consumers on the basis of individuals’ driving behavior and use of vehicle safety systems. The service collects data on driving patterns such as hard braking and acceleration. In January 2022, GM filed a trademark application for GM Financial Insurance Company.

Tesla offers real-time driver data insurance in seven states, basing premiums, in part, on a vehicle’s “safety score”—a continuously updated, automated assessment of driver behavior. As the role of software in cars expands and as manufacturers introduce more assisted-driving features and (ultimately) autonomous vehicles into the market, the flow of data to OEMs will increase. Cars may take on smartphone-like roles in their owners’ lives, giving expansion-minded manufacturers the opportunity to offer customers a range of new service options.

After four years of breakneck growth—34% a year on average—funding for insurance technology ( insurtech ) startups decelerated sharply in 2022, falling by 50%, as investors hit the brakes hard throughout the tech sector. Nevertheless, P&C insurtechs remain a factor in the industry. From 2018 through 2022, they attracted the largest share of venture funding, raising $15.8 billion. A recent report by BCG and venture capital firm QED found that P&C remains the most attractive segment for insurtechs, with segment revenues expected to grow at a CAGR of 27%, reaching $200 billion in 2030.

AI Developments. The biggest wildcard for insurance—and every other sector—is the rapidly evolving impact of generative AI (GenAI). We wrote in May 2022 that ignoring AI is risky business for insurers, since the technology is breaking down the industry's historically high barriers to entry and laying bare the imperative for every insurance CEO to build AI-ready organizations. The advent of plain-speaking GenAI, which puts AI capabilities within anyone’s reach, heightens the urgency.

GenAI could transform every aspect of the insurance business, with massive implications for risk pools, distribution, underwriting, claims management, and talent—to name just a few factors. Commercial and personal insurers need to come to grips with the immediate implications and project potential "what if" scenarios. Potential benefits are plentiful—for example, using AI-powered tools and platforms to streamline and augment core process such as underwriting and claims, or improving customer satisfaction through efficient and personalized service. AI’s breadth of applicability and its ability to process and learn from vast amounts of structured and unstructured data mean that slow-moving companies could soon find themselves playing catch-up in the wake of early adopters.

How US P&C Insurers Can Stay on Top

Insurers can learn a lot from their peers and competitors, but they should also pay attention to what companies in other industries are doing, particularly with respect to uses of advanced technology such as GenAI and new initiatives such as sustainability-related programs. US P&C management teams looking to stay in the top TSR quartiles or move up the rankings should pay special attention to four areas.

Stay focused on the fundamentals. It is hard to deliver sustained value creation over time without profitable growth in the core business. In last year’s insurance value creators report, we documented that for top-quartile performers over periods of three, five, and ten years across the full insurance sector, TBV growth accounted for 59%, 65%, and 74% of TSR, respectively.

For P&C companies, profitable growth depends on underwriting excellence. Our April 2023 analysis of results for US P&C commercial lines showed that companies with top-quartile combined ratios generated 13 percentage points higher return on equity and 7 points greater annual premium growth than companies in the bottom quartile. But as we said then, there is no one-size-fits-all way to achieve strong underwriting results, particularly in commercial P&C. Moreover, as underwriting becomes more challenging, the importance of data and technological capabilities increases. Combining expert judgment and other human skills with the power of data and technology is key. Top performers will continue to adopt advanced underwriting tools and platforms that leverage data and technology to improve decisions and streamline workflows. Keeping up with the science (by integrating new data sources and investing in tech systems) will become table stakes, while excelling at the art (by attracting and retaining top specialized talent) may become the differentiator.

Embrace data, advanced analytics, and GenAI. AI and, in particular, GenAI may be a wildcard, but the uncertainty surrounding it involves only the type and nature of the disruption it poses, not the disruption itself. AI has already demonstrated that it is far superior to conventional analytics at combining complex and large data assets, capturing nonlinear patterns, and developing granular insights.

US P&C companies that adopt a wait-and-see approach toward AI are likely to find themselves contending with and losing out to faster, more efficient, more capable competitors. GenAI is poised to transform all core insurance functions, improving operational efficiencies and outcomes in underwriting, claims, and customer service. Likewise, advanced data and analytics will play an ever more important role in revealing advantaged insights and enabling forward-looking approaches to risk assessment and pricing.

There are four prerequisites for harnessing the power of GenAI: establish a data-driven culture within the organization; develop strong data management capabilities; put the necessary talent in place; and ensure that the operating model is fit for the future. Our cross-industry research reveals that the leaders in

scaling and generating value from AI

do three things better than other companies:

- They prioritize the highest-impact use cases and scale them quickly to maximize value.

- They make data and technology accessible across the organization.

- They have aligned leadership that promotes collaboration and agile ways of working.

As GenAI proliferates, the importance of ensuring its responsible use—deploying AI in a way that aligns with a company’s purpose and values while still delivering transformative business impact—rises quickly. Responsible AI helps management teams resolve complicated ethical questions related to AI deployments and investments, catalyze and safeguard innovation, reduce AI failures, and realize more value.

Invest in talent and skills development. BCG’s recent global research into change agendas and corporate performance found that a small number of companies with winning capabilities invested in both smart technology and their people, processes, and culture in ways that enabled them to realize maximum value from their investments. In their AI investments, for example, winners adhere to the 10-20-70 rule: 10% of the effort lies in building an adequate AI model; 20% involves making high-quality data available; and 70% focuses on selecting and training people, developing new business processes, and transforming business functions.

BCG studied three years data on digital transformations and the changing nature of competitive advantage. In doing so, it, identified several specific attributes that enable companies to move into new high-growth markets that lie beyond the reach of less-capable players. Four of these are human capabilities: aligned leadership; a clear ability to attract, retain, and develop world-class talent; an agile and resilient operating model; and an innovation-driven culture.

Insurers should follow suit by investing in training programs and upskilling opportunities for existing employees to equip them with the skill sets needed to adapt to evolving market demands. Companies should also identify and recruit talent with expertise in emerging technologies, such as GenAI, machine learning, and data science. The balance between art and science in insurance will continue to evolve in the years to come. Although technical skills will inevitably take on greater weight, underwriters, claims adjusters, and pricing actuaries will still need to apply the arts of critical thinking, leadership and communication, specialized expertise, and business development skills.

Energize the fight against climate change. We observed last year that the insurance marketplace is in an ideal position to foster cross-industry transformation from old climate-warming assets to low-carbon, clean-tech solutions. Globally, this transition will require up to $150 trillion in investment from the private and public sectors—companies, investors, lenders, builders, operators, owners, and government agencies that are looking to address climate change and build a more sustainable future. Insurance can support the energy transition by providing risk management solutions and financial protection to green energy projects such as wind, solar, and hydrogen, and to sustainable businesses initiatives.

Some commercial insurers are already making bold strategic moves to capitalize on this opportunity, creating dedicated energy transition units, hiring renewable-energy talent, and adjusting their operating models and risk appetites as necessary. They recognize that it will take time to understand the risks, develop the necessary underwriting, risk-engineering, and claims skills, and explore partnerships and collaborations for improved data collection and sharing on new and emerging risks.

There are challenges to overcome, such as the current abundance of insurance capital without strong underwriting discipline, and difficulties in modeling and pricing risks of emerging technologies whose loss history is limited. But inaction is not an option. Several tailwinds are propelling the transition, including policy pushes (such as the Inflation Reduction Act and Infrastructure Investment and Jobs Act), investments by incumbent energy players, and mobilized capital from private investors. Moreover, energy supply is only one part of the equation: ultimately, all sectors must embark on decarbonization journeys. It will not be a winners-take-all market, but insurance sector laggards will struggle to replicate early movers’ broker and customer relationships and developed expertise. Companies cannot build differentiated green capabilities organically overnight, and M&A may be neither available nor affordable in coming years.

In the US as well as globally, economic, social, geopolitical, and climate volatility does not seem to be receding. Simply remaining good at the capabilities that underpinned past success may not be enough to ensure top-ranking TSR performance going forward.