In today’s economic climate, marketing leaders in financial institutions are under heavy pressure to cut annual spending by 20% or more. At the same time, they face high expectations to drive new growth through increased marketing effectiveness, including delivering on the long-promised potential of personalization. Achieving both goals simultaneously, on top of navigating a difficult banking landscape, is a major challenge for chief marketing officers.

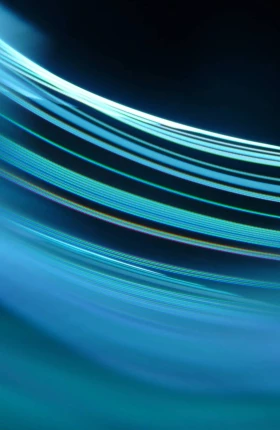

A recent BCG survey of industry CMOs showed that, for more than half of all financial institutions, it takes at least 14 weeks to launch a digital marketing campaign. The survey also revealed that a mere 15% of CMOs rate their organization’s personalization and data-driven marketing capabilities above a “basic” level, although these capabilities are high on the C-suite agenda and have received extensive funding. Such constraints keep marketing operating expenses high and limit the ability to drive growth. (See Exhibit 1.)

Interestingly, our client work has demonstrated that a relentless, laser-like focus on transforming marketing for efficiency can be the elusive key to unlocking effectiveness and growth as well. By optimizing for efficiency, financial institutions can see marketing campaign cycle times drop by as much as 70% and revenues rise substantially—sometimes dramatically—through improved personalization.

With timely action, the challenge created by today’s shifting economic winds can become a catalyst for positive change, creating a large opportunity for CMOs not only to meet the needs of the moment but also to unleash their teams’ full potential for years to come. The size of the opportunity is also significant, with our project experience showing an achievable 20% to 30% revenue lift from addressable marketing through modern, data-driven marketing and personalization capabilities. An initial boost to the business can be realized in just 12 to 16 weeks, with full transformational change across the enterprise achievable within 6 to 12 months.

Three Key Actions for Financial Institutions

Drawing from successful collaboration with retail banks, credit card issuers, payments companies, and fintechs, BCG has identified three critical action steps to capture this opportunity. These initiatives, which involve agile marketing, experimentation, and data integration, represent a shift away from the legacy approaches of many leading financial institutions.

Redefine Efficient Ways of Working with a Purpose-Built, Agile Marketing Model

There are many lessons to be learned from the adoption of agile methodologies, initially within software development and later within marketing organizations. One of the most important is to avoid forcing a one-size-fits-all version of agile onto your teams. Sidestepping this trap begins with an in-depth evaluation of your organization’s current state. Then, design and pilot a target state specifically crafted for your needs and constraints.

For example, when we engaged with a leading North American financial institution on its current ways of working, we were able to pinpoint more than 20 synchronous steps in its marketing-campaign process, including up to 20 different handoffs of work from one team to another. Each handoff represented extra preparation time for the sending team, many hours spent in queues waiting for the work to be picked up, issues with resource availability, and, worst of all, the possibility of rejection back to previous teams to restart the entire process.

The first part of correcting this inefficiency was to design a custom, end-to-end, cross-functional agile model with optimized processes that eliminated all handoffs, minimized total steps, and converted many operations from synchronous to asynchronous. The second part was to ensure that the new way of working natively accommodated the company’s rigorous legal, compliance, and risk requirements—while still enabling a much higher scale of content creation and delivery.

One of the actions needed to achieve this balance included embedding partially or fully dedicated reviewers in the agile team from the start of the campaign process. Their purpose was to provide guidance throughout—including participating in upfront strategy discussions—and to proactively address approval needs in order to minimize iterations and timelines prior to launch. This process also involved a well-defined, tiered review matrix to streamline and expedite approvals based on the level of potential impact for each piece of content. Most important was a heavy focus on reusability, including a governed library of campaign templates and preapproved assets and copy that could be leveraged with little or no additional approvals.

By employing a new, custom-fit agile model that brought together all functions end-to-end, including eliminating handoffs, streamlining approvals, and embedding the use of data and analytics throughout the process, this financial institution saw a 60% to 80% drop in average campaign cycle times from months to a handful of weeks. The massive reduction in time and effort required meant that, at scale, fewer people hours were needed for each campaign and each dollar of revenue driven. While such efficiency demonstrates how existing marketing can be maintained with reduced operating expenses, the real insight comes from reinvesting those saved cycle times to do additional cycles—learning and iterating quickly to optimize personalized campaigns that drive incremental lifts for the business at large.

Elevate the Importance of Experimentation and Measurement

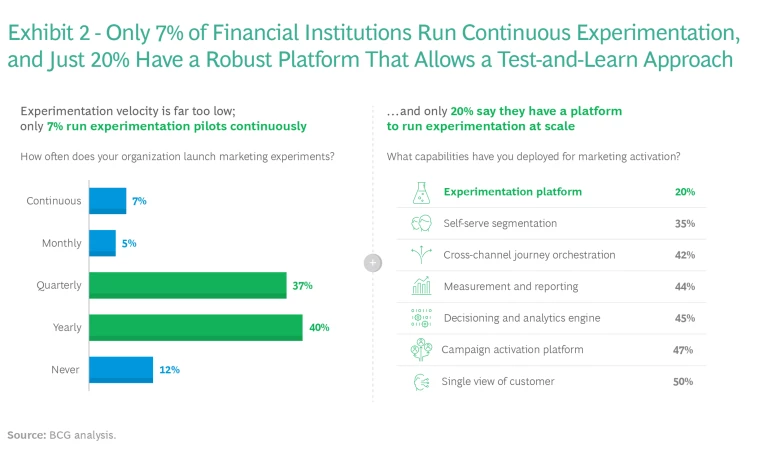

Before investing heavily in machine-learning models and predictive analytics, organizations should enable experimentation and develop true test-and-learn capabilities. The lack of these attributes—both the technical enablers and the way of working required—is the most common shortfall we see across leading financial institutions. For example, our research shows that more than 70% of FI marketing organizations run and complete basic experiments only quarterly or yearly. Shifting the culture toward continuous learning from experimentation, at scale, is a key action step, and the resulting knowledge and data generated are fully proprietary, providing a key ingredient of any modern marketing team’s “secret sauce.”

From a tech perspective, an experimentation engine that supports the design and execution of hundreds of simultaneous experiments across digital channels is required—but not readily available from major marketing-technology suites. In our survey, a mere 20% of FI marketing organizations reported having a robust experimentation platform that allows a cross-channel test-and-learn approach. (See Exhibit 2.) The other side of the same coin is measurement—which enables a high level of confidence in the learning gained from each experiment and the ROI of each pilot. The right experimentation platform enables both required components.

Tech alone, however, cannot unlock the full potential. A test-and-learn culture must be enabled by building up multidisciplinary, agile teams that make experimentation and continuous improvement (based on measurement) native to the new way of working. Segmentation, personalization strategy , frequency, and content optimization should be informed in each iterative campaign cycle by both customer data and collective learning from previous experiments.

In one example, a financial institution’s first attempt at launching a test-and-learn email campaign resulted in a drop in attributed revenue from the test group, leading to concern and distress among company leadership. But as the organization learned to trust the process, it witnessed a 15% revenue lift just a few weeks later from additional experiments. This strong result was then followed by a staggering revenue lift of more than 25% from the same campaign by continuing to pilot, learn, and optimize. The increase in velocity that came with the agile execution process—which was equipped with an experimentation platform—was the catalyst that allowed the financial institution to execute four to five times more tests in the same time frame as just one test previously.

Financial institutions need to equip marketers with the right capabilities to automate and measure experiments at scale.

Financial institutions need to equip marketers with the right capabilities to automate and measure experiments at scale. They also need to redesign how teams work together in order to activate significantly more variations and iterations for each campaign—within the time it used to take for one basic activation. With each iteration, marketers learn from the previous to optimize further. Our experience shows that substantial revenue lifts can be gained even from long-standing, mature campaigns. Overall, the critical first step is to embed rapid test-and-learn experimentation at the heart of the new execution process.

Focus Tech Investments on Data Integration and Templatization

It’s time for FI CMOs to get more benefits from technology than they have to date. Marketing-technology-spend fatigue is real in banks today, especially for those that have undertaken long, costly, and ultimately underperforming platform implementations. To complicate matters, more than 73% of large financial institutions report they have deployed multiple platforms for the same functional capabilities, with fragmented and duplicative use across their businesses.

FI marketing organizations should focus their near-term data and tech spending on targeted integration and automation initiatives.

In our view, FI marketing organizations should focus their near-term data and tech spending not on building additional platforms but on targeted integration and automation initiatives. These can result in increased efficiency and effectiveness, and they can extract significantly more value from investments already made. This approach can work within a multiplicity of different destination architectures, and strong progress can be made without waiting for the perfect data end state.

The overall goal is to facilitate an automated customer data pipeline across the marketing-technology value chain, one that hydrates each existing downstream platform not just with raw data but with insights specifically built to enable marketers. Building atop an existing customer data foundation as a starting point, organizations should allocate teams to automate the handoff of data from each component to the next, wherever gaps exist (for example, from Customer 360 to analytics and intelligence, from intelligence to activation, and so on).

Further, FI marketers need to maximize the value of increased data flow through the templatization of marketing campaigns. The focus should be on enabling campaign variations to be built and launched with minimal manual effort and a high level of repeatability. Rebuilding key campaigns atop a small set of data-driven and parameterized templates not only enables speed and rapid iterations, it reduces the probability of costly human errors.

Finally, in several of the most successful marketing transformations that we have assisted, achieving omnichannel personalization has not necessarily been the primary focus. The holy grail has been the efficiency of execution. However, delivering on the required enablers for efficiency often turns out to be the best way to capture the effectiveness gains that data-driven, personalized marketing can provide.

The Time Is Right for Action

Taking action on all three imperatives will be required to capture the full potential that cost cutting and efficiency can bring to financial institutions’ bottom lines. Given the delays often experienced with addressing tech gaps, a modular personalization engine built to fit into any organization’s existing stack can be extremely useful in accelerating time to market.

FI CMOs should start by prioritizing a set of specific campaign use cases that drive substantial value. They should then mobilize a ring-fenced subset of resources across functional teams into the purpose-built agile marketing operating model—both to adopt its ways of working and to test and refine the model together. They should further integrate their engineering resources or partners into the same model to take an MVP approach to filling any key gaps in data and tech stacks. Such work should be done rapid-fire, with each iteration deployed specifically to unlock the next prioritized use case.

Once an MVP version of required enablers is ready, CMOs should launch pilots of their first use cases to obtain and measure early results from new cycle times, incremental revenue, and learning about how to further improve. When early success is apparent, which is achievable within a few months of kickoff, the outcomes achieved create needed proof points to solidify corporate buy-in and to capture value that helps fund the journey to scale.

With cross-organization alignment and enthusiasm from the successes of the initial pilots, scaling this model requires a robust execution-led approach to change management . True change, initially achieved by incrementally shifting over subsets of the marketing function until a true tipping point is reached, will be driven by realizing benefits for all stakeholders. Like any transformation, achieving full-scale change across the organization is a very difficult challenge, requiring a well-defined north star along with a healthy balance of bottom-up innovation and top-down, target-goal mandates.

Some financial institutions may take an 80/20 approach that deploys this model only to the highest-value subset of their marketing activities, seeking to provide a significant level of near-term value while minimizing change management and disruption risks. Others may choose a no-holds-barred approach and seek sweeping change within the shortest possible time frame.

Whichever path is chosen, one thing is clear: action is needed to capitalize on this timely opportunity—and sooner rather than later.