For the past 100 years, medical technology (MedTech) has been a beehive of innovation, improving patient diagnostics, treatments, and clinical outcomes in a vast array of health categories. This includes everything from MRI scanning, robotic surgery, and knee implants to transcatheter heart valves and COVID tests. But despite this impressive record of scientific advances and breakthroughs, there is one area that MedTech companies have not yet focused on sufficiently: reducing their impact on the environment.

Health care accounts for 5% of total global carbon emissions, and medical devices and technology are responsible for a large portion of that. Much of this comes from the manufacturing operations and supply chains of MedTech companies and their suppliers. At the provider level, MedTech generates tons of unrecycled waste through single-use disposable products and packaging.

MedTech CEOs are increasingly becoming aware that they must take immediate action on decarbonization.

Spurred by the potential impact of climate change on global health and environmental concerns raised by providers, patients, regulators, and investors, MedTech CEOs are increasingly becoming aware that they must take immediate action on decarbonization. Some of the early environmental, social, and governance (ESG) front-runners are already benefitting in unexpected ways. For example, if planned right, abating 20% to 30% of emissions could generate a net cost saving—and cutting emissions by up to 80% could be cost neutral. What’s more, reducing emissions can enable MedTech companies to tap into new revenue streams, such as climate-friendly (energy-efficient and lower-waste) product lines, and lead to improved ESG scores. This can strengthen a company’s reputation and improve talent attraction and retention in the near term.

Four Steps to Emissions Reduction

Given the growing need and desire to take urgent action on decarbonization—and the potential advantages of doing so—BCG has marshaled its experience with multiple MedTech companies to piece together a clear path for shrinking MedTech’s carbon footprint. We have identified four essential steps that can lead to rapid progress on carbon emission reductions: create a baseline, set a target, identify abatement levers, and operationalize improvements.

Step 1: Create a Baseline

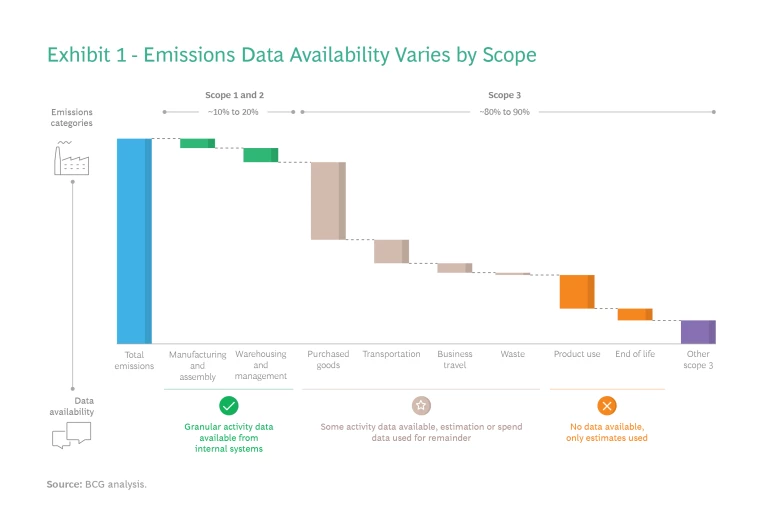

A company can only reduce what it can measure, so comprehensive and transparent emissions measurement is imperative. This means assessing the organization’s own scope 1 and 2 emissions (company activities and energy use, respectively), as well as emissions generated in the supply chain (upstream scope 3) and by customers using the product (downstream scope 3).

For scope 1 and 2, granular emissions data is relatively easy to obtain internally. (See Exhibit 1.) However, scope 3 output from suppliers and customers, which typically accounts for 70% to 90% of MedTech companies’ emissions, is the hardest to measure because specific emissions data (which would form the core of an activity-based analysis) is often lacking. As a result, to estimate scope 3 emissions, companies will choose a spend-based approach when data is available to do so. This involves multiplying the cost of a product or service by an industry average emissions factor per dollar. But this approach can lead to inaccurate outcomes because the same emissions factor may be applied to, for instance, plastic used for MedTech products or consumer products as well as recycled and unrecycled plastics. Spend-based data is often unavailable and companies are forced to estimate their emissions.

Based on our experience, incorrect assumptions about emissions and poor data quality can result in significant swings in baseline measurements in both directions. We have seen activity-based emissions results for MedTech equipment and components that can be up to 80% lower than emissions calculated using a spend-based approach. Therefore, it is essential for MedTech companies to collaborate with suppliers and customers to improve the reliability of emissions data, drilling down into more activity-based greenhouse gases from sources such as upstream transportation, purchased goods and product use, product weight, material type, and even manufacturing locations.

To improve the baseline, companies should adopt business processes (such as supplier and customer outreach and data sharing) that can provide deeper insight. Still, a baseline calculation is essential before moving on to the next steps in decarbonization, so companies should not be afraid to use what they can find out initially. Waiting for perfect data is not an option, and MedTech companies need to get comfortable with continuously improving the quality of their baseline over time.

Step 2: Set a Target

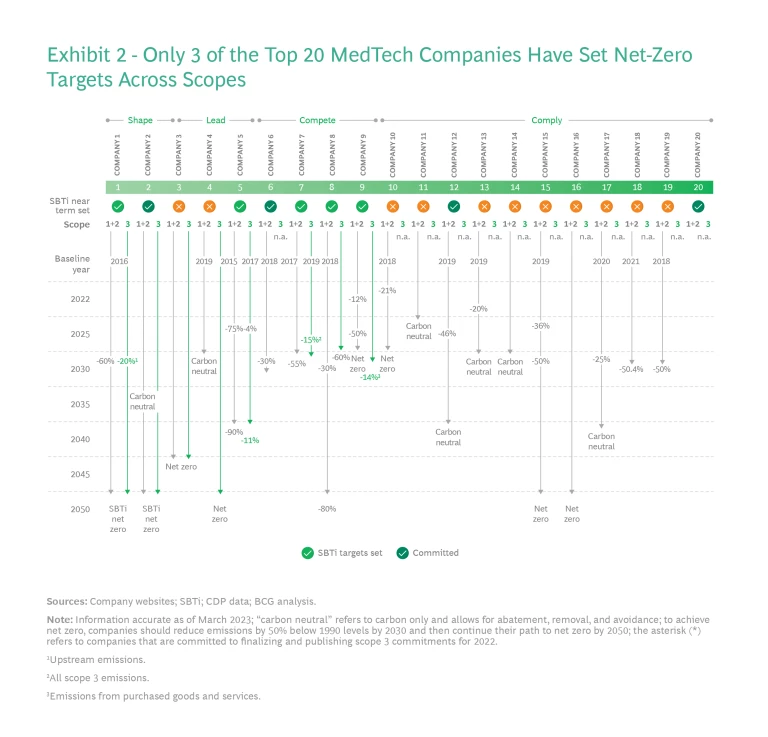

To reduce global warming to 1.5 degrees Celsius above preindustrial levels—the goal set in the Paris Climate Agreement—companies should at a minimum aim for net zero across scope 1, 2, and 3. Based on pledges made as of March 2023, MedTech players have some catching up to do. (See Exhibit 2.) Nineteen of the top 20 MedTech companies have set emissions reduction targets. But only eight, or 40%, included scope 3 emissions (which are emissions outside of the companies’ own control, such as carbon generated by suppliers and end users). And only three have net-zero targets that encompass all three scopes. By contrast, nine of the top ten pharmaceutical companies have established full-scope reduction targets, and seven have published full-scope net-zero goals.

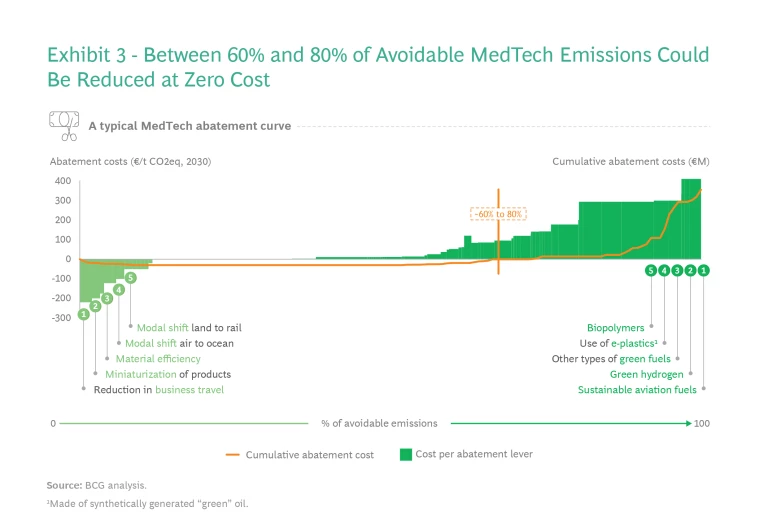

Some of the resistance to setting ambitious targets is based on the perception that a large-scale carbon emissions reduction initiative would be expensive. But many of the activities that would lead to emissions cuts, like factory efficiency, product miniaturization, less packaging, and reducing business travel would save money or break even. (See Exhibit 3.) In fact, 60% to 80% of avoidable emissions can be eliminated at zero cost.

There are other economic benefits of a strong sustainability agenda for MedTech firms as well. Recyclable and climate-friendly products and packaging can help a company differentiate itself from competitors whose green strategies are lagging and, in turn, attract new customers. And business resilience can be improved by moving sourcing closer to manufacturing, which reduces both emissions and the risk of supply chain disruptions.

Subscribe to our Health Care Industry E-Alert.

Of course, setting ambitious targets is easier than delivering on them. In the coming years, there are going to be increasing calls and mandates for companies to embrace carbon reduction targets and to back up their promises with demonstrable progress. A great deal of this pressure is going to come from regulators in all regions of the world who are establishing rules for companies to report their ESG performance measured against their commitments. In the next three to five years, some of these new regulations could be as rigorous as financial reporting standards.

Step 3: Identify Abatement Levers

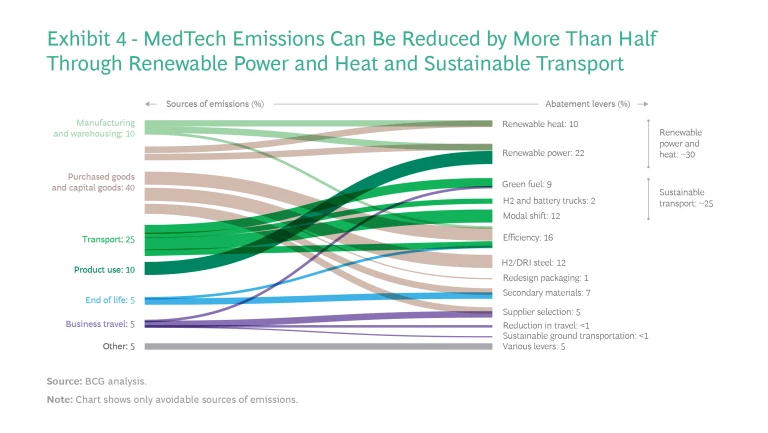

After calculating baseline emissions and setting targets, MedTech companies must explore reduction tactics. We have found that firms can cut their carbon emissions in half by using renewable power and heat in manufacturing, switching to greener fuels in transportation across their activities, and urging their suppliers and customers to do the same. (See Exhibit 4.)

Reducing emissions is also important when it comes to responding to customers’ own increasingly ambitious decarbonization targets. A growing number of health care providers, such as the National Health Service in the UK, are adopting supplier carbon standards to meet their own scope 3 net-zero goals. Others are focusing on waste reduction and recycling. For instance, the US managed-care consortium Kaiser Permanente is aiming to reuse or compost 100% of non-hazardous waste by 2025. MedTech companies that can meet such rigorous standards will have a leg up among these customers and be able to decarbonize along the way.

Some MedTech companies have already made moves to expand their environmental offerings to customers while shrinking their own carbon footprint. They’re often able to do this by, say, providing more circular products that are recyclable from start to finish. For instance, Swedish MedTech company Mölnlycke, which specializes in wound care and surgical supplies, has launched a set of surgical drapes with bio-based raw materials instead of plastic, reducing the overall environmental footprint of its single-use products. More broadly, Philips has made sustainability an essential element of product development with its EcoDesign line, which focuses on improvements in energy efficiency and recyclability. Philips hopes that 100% of its new products will meet EcoDesign standards by 2025. Meanwhile, glucose-monitoring device manufacturer Dexcom’s latest product, the G7, contains 20% less plastic and its packaging uses 56% less plastic and paper than the previous version. And Siemens Healthineers’ ecoline offers refurbished diagnostic-imaging equipment with hardware and software that has been upgraded to meet the latest standards. These used products are offered at a less expensive price, so health care providers in poorer parts of the world can afford them, thereby expanding the pool of patients with access to sophisticated diagnostic devices.

The investment required by MedTech companies in setting and meeting ESG goals is minimal and can even be cost neutral for years to come.

Step 4: Operationalize Improvements

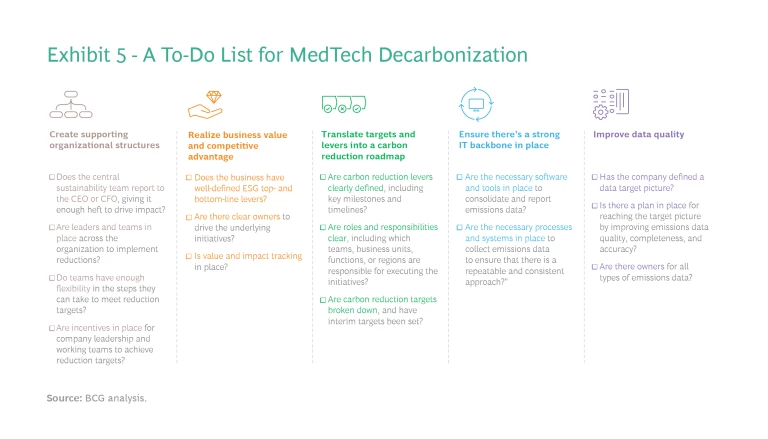

To put decarbonization strategies into motion, MedTech CEOs must lead in ensuring that the sustainability agenda is a priority across the organization—and that decisions about ongoing company strategy, business activities, and programs are made through the lens of decarbonization. Multiple operational dimensions must be involved in this effort, including translating sustainability targets into a carbon reduction roadmap, adopting an organizational structure and incentives to drive implementation, developing an appropriate and effective data governance and IT backbone, and setting up ways to realize business value and competitive advantage.

To facilitate this, we have a created a checklist that CEOs can use to ensure progress on the decarbonization journey. (See Exhibit 5.)

There is no doubt that MedTech companies have their work cut out for them in setting and meeting ESG goals. Commitment to persevere through the effort is essential. And the investment required is minimal and can even be cost neutral for years to come. Meanwhile, the benefits of reducing emissions can be felt in some impressive ways. These include new revenue streams, an improved reputation built upon a green message (distinct from competitors and more attractive to customers), favorable valuations from investors, gains in employee retention, better supply chain resilience, and the ability to stay ahead of regulations. All while playing a significant role in fighting climate change and its impact on global health.