Product marketing and sales decisions have always been unique challenges for biopharma companies. But recent changes in the marketing landscape have made the hurdles more difficult to overcome—and the need to effectively allocate marketing resources more pressing.

Despite this increased urgency, many biopharma firms are stuck. They continue to rely on siloed measurement approaches that only partially capture the business impact of marketing and sales (or commercial) strategies and that, more often than not, result in unprofitable investments.

The biggest shift in biopharma product marketing is the increase in the number and the evolution of the type of customer and patient touch points. These touch points have seeded new but fragmented pathways to reach subsets of patients seeking information about diagnoses, treatments, pharmaceuticals, and health care providers. And the existence of these new pathways has only exacerbated the already complex challenge of driving revenues from marketing across the first three stages of the product life cycle, from product launch through maturity.

To respond to this changing environment, companies should adopt a holistic marketing and sales measurement approach—one that can effectively align a top-down business strategy with deep bottom-up analytics. The strategy should allocate marketing investments to the opportunities with the highest returns. The analytics should measure the impact of these investments on business outcomes.

To implement this approach and achieve this optimal state, biopharma companies need to use multiple dovetailed measurement methods and shift their organizational operating models spanning governance, talent, and processes.

Standing in the Way

Some of the commercial obstacles that biopharma companies face are tied directly to the nature of product development. Biopharma products are complex, they take years to design, and they are expensive to develop. In addition, marketing these products requires regional delineation across cultural distinctions, social preferences, regulatory requirements, and biopharma business models.

To recoup development costs quicker than their competitors do, companies have historically prioritized execution and speed to market over measuring marketing and sales outcomes. That strategy translates into hiring large sales forces and conducting media blitzes using various media touch points—including TV, print, internet search, social media, and telehealth and concierge medicine services—without building the capabilities and tools needed to determine the effectiveness and efficiency of each touch point and maximize the overall business impact.

Organizational design makes matters more challenging. Biopharma companies are too often siloed by function, hindering them from implementing a marketing and sales measurement approach that is best suited to their broad product portfolios. For example, separate marketing and sales functions likely have different KPIs, leading to market insights being segregated and not shared. Further, silos across finance, analytics, and consumer insights impede implementing a common marketing measurement toolkit.

Other issues only amplify the difficulties of spending commercial dollars wisely. There is constant and significant pricing pressure from regulators, politicians, insurers, the media, and the public, in addition to competition from generic drug makers. There are also unknowns about new, accelerated drug development modalities, especially those linked to molecular and genetic engineering. And as the time to market shortens, competition for patient recruitment is intensifying, slowing trials and raising their cost.

Current Approaches to Measurement

Biopharma companies are aware of the commercial challenges, and they are cognizant that their attempts to overcome the hurdles with various marketing measurement methods have met with only mixed success. For example, biopharma companies have relied particularly on an approach known as marketing mix modeling (MMM), which uses historical data to determine the most effective and efficient sales and marketing tactics for new and old products. This approach has value to assess the synergy among marketing channels, and it provides a foundation for marketing scenario planning. However, in a biopharma context, the number of prescriptions attributed to marketing for a drug early in its life cycle may not be indicative of future performance patterns. Consequently, conclusions drawn using MMM may not apply, particularly for freshly minted drugs with a limited track record.

Marketing assessments drawn from consumer insights and brand analytics provide additional guidance, especially about the potential impact of untested tactics and touch point recall on priority brand metrics. However, this research is typically not synchronized with MMM to inform the allocation of marketing investments and is rarely tightly integrated into key marketing budgeting and planning processes.

A few biopharma companies have tried to connect real-world clinical data with ad impression data at the physician and patient levels (the so-called patient-based sales lift measurement). The intent has been to determine if ad campaigns increased the number of new patients using the drug as well as adherence to prescriptions for existing patients. However, although measuring sales lift quantifies incremental sales and the value of marketing campaigns, it is increasingly problematic to do so at the physician and patient levels, given health care privacy concerns and regulations. Besides, leading digital advertising platforms are wholly eschewing collecting or using physician- or patient-level data for targeting or measurement purposes.

The significant gaps between widespread industry challenges and the limited and fragmented measurement approaches often used today by biopharma companies make clear that a more robust and holistic approach is needed.

The Holistic Answer

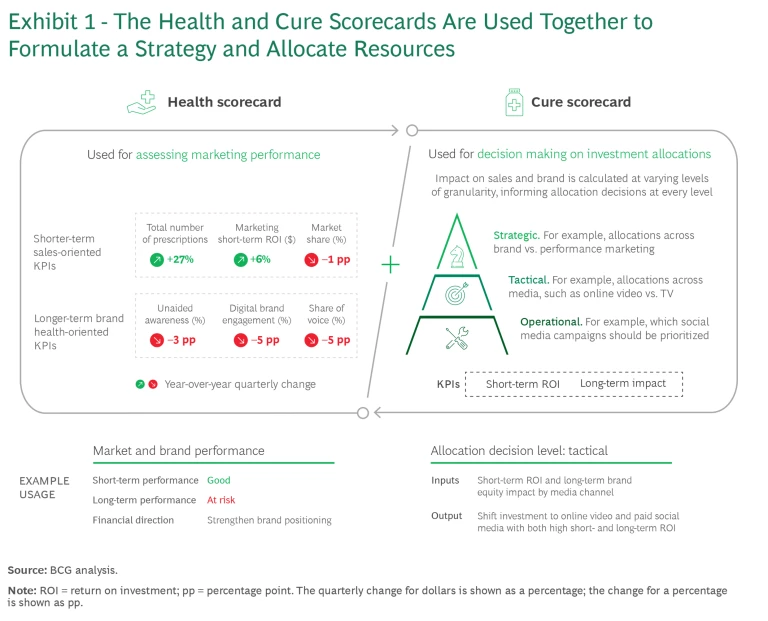

Biopharma marketing analyses must become more collaborative and holistic; they must be freed from silos and use shared data to generate answers relevant to the organization’s strategic path. To help companies achieve this optimal state, BCG has designed a framework with two scorecards. (See Exhibit 1.)

The health scorecard assesses the efficacy and strength of the company’s commercial performance. The cure scorecard focuses on ways to improve, enabling organizations to make data-driven investment-allocation decisions for marketing and sales at the strategic, tactical, and operational levels.

Strategic, top-down decisions tend to involve the reallocation of marketing budgets at the highest level and take place as part of the annual fiscal budgeting cycle. Tactical, bottom-up decisions typically occur many times throughout the year and include course corrections for campaign spending levels, mix, timing, and messaging. And operational decisions, such as those concerning particular media or channels, can occur weekly—or even daily in today’s increasingly digital context.

Instead of making isolated marketing measurements, this scorecard framework helps organizations aggregate data and synthesize insights across three measurement methods: modeling, consumer insights, and test and learn. When the data is paired with the appropriate KPIs, analyses can generate relevant, predictive conclusions that the organization can use to inform critical strategic, tactical, and operational marketing choices.

To best use this holistic measurement approach, an organization needs to be “rewired”—its ways of working and skill sets must be aligned with the new, more rigorous and nimble measurement methods.

Diving into the Health and Cure Scorecards

The health and cure scorecards are designed to help companies decipher and improve the performance of their product and brand marketing campaigns.

Health Scorecard

The health scorecard is designed to determine how short-term sales and long-term brand performance are faring. This analysis typically involves standard sales and marketing data. The following are among the most important short-term indicators of current sales and marketing success:

- The number of new prescriptions fulfilled by patients are especially important to monitor in the brand launch phase.

- Refill levels, or the number of continued prescriptions, could provide hints about brand maturity and whether a shift in marketing is necessary to maintain adherence among patients.

- Prescription sales and profitability uses a combination of new prescription sales and refills to determine overall prescriptions volume and, in turn, profits.

- Market share compares the percentage of prescriptions written for a particular medication to the total number of prescriptions written within a specific therapeutic category.

- Marketing short-term return on investment (ROI) covers the financial return generated from marketing efforts within a relatively short period, typically within one year.

The KPIs for taking a longer view of brand performance and marketing effectiveness include, for example, share of voice or marketing presence, and brand metrics, such as unaided awareness and ad recall. Biopharma companies also actively monitor online engagement and conduct sentiment analyses, often using advanced machine-learning approaches, to determine the strength of word of mouth in the digital realm for specific products.

Cure Scorecard

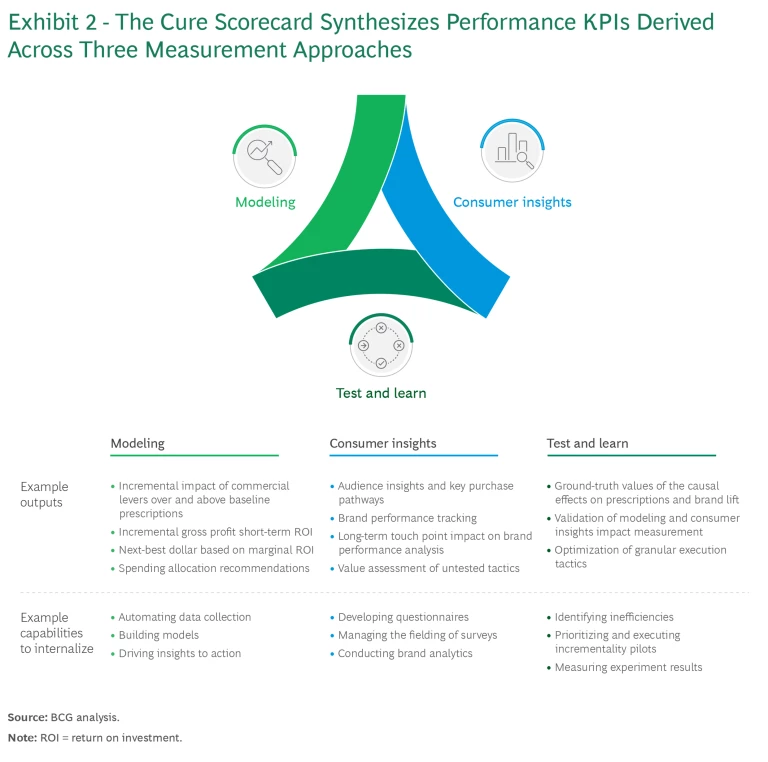

The cure scorecard is designed to assess what a company can do to increase short-term sales or long-term brand performance. The data used for this assessment is the output from three measurement methods: modeling, consumer insights, and test and learn. (See Exhibit 2.) Essentially, the data provides marketers with information on how to make measurement-informed decisions that align prioritized business outcomes with commercial investments. The primary short-term KPIs used are aggregated business outcome gains (for example, incremental improvements in prescription numbers) and return on marketing investments. For long-term metrics, the influence or impact of marketing efforts on brand equity broken down by investment type and channel are valuable.

The KPIs that are used in the cure scorecard stem from three complementary measurement methods.

Modeling. This method is predominantly commercial mix modeling (CMM), which provides significant information about marketing impact from a relatively high perch. The primary goal of CMM is to determine potential marketing outcomes through the lens of historic growth drivers while controlling for external factors, such as economic conditions, seasonality, and so on. It goes beyond MMM in that it measures and accounts for other commercial levers such as in-market sales force activity, breaking out assessments of incremental sales improvements from all media, marketing, and commercial channels. These channels may include offline marketing (such as TV and radio), online marketing (including internet search, social media, Web display ads, and video), and pricing and promotions (such as samples and discounts) and sales activity.

CMM conclusions are based primarily on historical data and assumed causality. (For example, was the sales improvement for a particular drug the result of a social media post or because of more branded search activity.) Therefore, the results provide a clear but incomplete window into marketing efficacy. CMM needs to be paired with other measurement methods to be credibly viewed as a final and accurate source for marketing performance and the primary driver for investment allocation decisions.

Consumer Insights. Every large biopharma organization has a consumer insights function and typically invests heavily in brand-tracking research and other ad hoc quantitative research efforts. However, consumer insights are rarely formally integrated into a measurement capability, and businesses are thereby leaving growth opportunities on the table by not identifying actions to pursue—such as, perhaps, expanding the business into unpenetrated market segments—from the valuable information that this method provides. Employed creatively, consumer insights can answer crucial questions around:

- Core business metrics, such as brand perception, consumer preferences, and performance relative to the competition

- The long-term impact of marketing on sales and brand momentum

- The effect of untested and speculative commercial tactics

Leading measurement practitioners understand that different patient segments will follow distinct journeys to purchase. Consumer insight research can reveal these pathways and should be used to measure the specific touch points along the path to purchase that most influence purchasing decisions. Consumer insight differs from the modeling and test-and-learn methods in that it can bring to light new, untapped touch points—for instance, an emerging social media format that is popular with a specific demographic—and show how they match up against more traditional channels. Armed with this insight, marketing teams can prioritize key touch point investments on the basis of what they seek to deliver, use the test-and-learn method to verify the insights’ value, and measure the marketing potential of the new investments using CMM.

Test and Learn. The test-and-learn method brings the insights gleaned from the modeling and consumer insights methods to life through incrementality testing and causal experiments. It is the method that leading companies today invest in the most to build up world-class measurement capabilities. Further, the test-and-learn method affords companies a competitive advantage. Companies can increase the speed and frequency of testing by carefully establishing control groups against which to compare improvements.

The test-and-learn method does not necessitate much historical data to execute, but building the capabilities and organizational culture to implement it appropriately requires:

- Tools to be able to design tests efficiently

- A clearly defined and rigorously followed process

- A change in operations to include a cross-functional group of stakeholders that presides over the tests

Unlike the other two methods, test and learn has the potential to establish, with a high degree of confidence, the causality or root cause for an increase in prescription sales. Leading marketers earmark at least 10% of their traditional and digital media budgets to the test-and-learn method. The most effective test-and-learn method uses a fail-fast, fail-cheap framework:

- Conducting frequent, small, real-time tests of marketing tactics

- Scaling up tests and lessons that show promise and backing off tactics that don’t before wasting significant resources

- Iterating on new marketing efforts and tactics to achieve greater effectiveness and efficiency in new and existing media channels alike

While a few biopharma companies have employed physician- or patient-level prescription data for their test-and-learn programs, this approach is not sufficient to examine all marketing efforts. For instance, linear TV cannot be measured this way because viewers who were exposed (or not exposed) to marketing content cannot be identified. And for the channels that can be measured, privacy regulations and private-sector privacy initiatives will increasingly discourage and ultimately stymie tracking and using physician- or patient-level data. Therefore, biopharma marketers should instead consider aggregated data (such as geo-based or market-level data) for test-and-learn measurement.

The greatest impact from using the test-and-learn method often comes from having a sufficient budget to quickly implement what is gleaned from successful experiments, not from merely conducting them. For instance, if it is discovered that an online video ad generates twice the ROI of a TV commercial, being able to immediately double down on an investment in the video ad could change the company’s results in the short term and potentially over the next few years.

Bringing Them All Together. Combining and synthesizing insights across all three measurement approaches can bring significant benefits to biopharma companies. Commercial mix modeling and consumer insights complement each other by, respectively, measuring the short-term impact of commercial investments and the long-term impact. Having the ability to gauge the full weight of commercial efforts across time allows for more effective allocation of commercial investments.

Additionally, test and learn is uniquely positioned to validate the findings delivered by modeling and research through in-market consumer-response experiments and exercises. Test and learn and CMM are especially complementary in that CMM can take a more comprehensive view of marketing performance across investments (that is, all commercial activities are assessed in one model), whereas test and learn is required to calibrate and improve the accuracy of CMM. The synergy of the three measurement approaches creates a robust foundation for informed commercial-mix decisions. However, it is important to continuously upgrade the methods and even alter them as marketing and sales conditions change, making the necessary investments to advance the sophistication of the analytics.

Drug Life Cycle Marketing Measurement

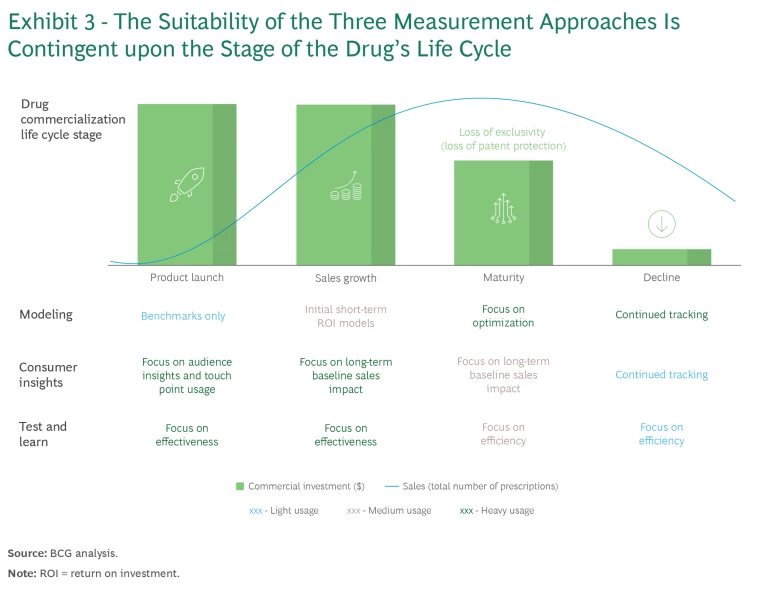

During the first three stages of a product’s life cycle, biopharma companies should rely on each of the three measurement methods to different degrees. (See Exhibit 3.)

Product Launch. In this initial stage, educating patients and health care professionals about the product is crucial. Historical commercial data from other brands and products can help estimate marketing ROI and guide planning, but there is only a tenuous link between historic sales patterns for old brands and prospects for new brands. As a result, CMM lacks sufficient data to produce trustworthy conclusions about future commercial activity. The consumer insights method—which draws information from brand tracking through surveys and focus groups, social media, and community engagements—should be used to understand the target audience’s interests and media response. Test-and-learn techniques can allow for quick and nimble experimentation and snapshots of performance to optimize the launch campaign while it is unfolding.

Sales Growth. During this stage, the product has garnered a modicum of visibility and is protected by one or more patents. Consequently, marketing effectiveness and efficiency in patient and health care professional channels to drive sales growth is critical. Modeling can be used to analyze historical data to understand the opportunities to maximize revenue and market share based on short-term ROI KPIs. The consumer insight method should be used to understand consumers’ paths to purchase and to discern the impact of different media channels on brand equity. The test-and-learn method should assess the impact of marketing on short-term sales and long-term brand equity.

Maturity. This stage is when the product is losing or has lost its patent protection and maintaining the interest of patients and health care professionals is the primary concern. Sales will likely grow marginally in this phase. Consequently, optimizing profit potential is paramount. Modeling plays a large role because of high-fidelity historical data, from the product launch through the present, that can help drive sophisticated decisions about the most effective and profitable channels. The consumer insights method is less useful than it is in other stages because the cost of making significant strategic shifts may outpace potential future returns from the product. New patient segments, pathways, and touch points should have already been sufficiently explored. Still, the consumer insights method can be used to continue to track the evolution in brand performance. Finally, the test-and-learn method can be employed to unearth efficiency improvements, which can unlock value, while focusing less on effectiveness levers to drive sales growth.

Rewiring the Organization

The scorecard framework is an innovative, process-driven approach built atop data and technology infrastructure. It requires a structural reboot, cultural refresh, and the adoption of new skill sets and capabilities to run smoothly. Often, an organization has to realign and change its priorities to embed this framework and a new culture in the organization.

Additionally, silos will need to be broken down across marketing, sales, commercial analytics, and finance to facilitate broad data availability and flexibility, as well as to include the variety of expertise necessary to measure marketing outcomes. Cross-functional teams are best able to keenly understand these results and turn insights into action as they interpret lessons and drive decision making. Clearly defined roles and responsibilities for teams involved in the modeling, consumer insights, or test-and-learn methods are key. Often, these teams are hybrid units—a mixture of in-house and third-party specialists—and biopharma companies should exercise oversight in the formulation and execution of measurement.

Subscribe to our Marketing and Sales E-Alert.

An Achievable Ambition for High-Value Results

Biopharma marketing is a complex activity. There are regulatory and privacy considerations, unique market pressures and dynamics, and a relatively well-circumscribed marketing window for extracting efficient returns on investments. But executing marketing well can generate outsized returns for a company.

To navigate the challenges, biopharma marketers need to identify—through actionable measurement techniques—which marketing and sales efforts can best contribute to an optimum business outcome. Biopharma companies must break down the silos that have isolated marketing measurements in the past, rendering them inadequate as a tool for broad and timely decision making about commercial investments.

Marketing measurement has somehow maintained many of its traditional conventions even as biopharma marketing and sales themselves are transforming on the heels of new technologies, media channels, platforms, granular data accessibility, and interactive channels that have altered the way people live and communicate. Considering the high marks that biopharma companies earn for innovation in designing and developing their products, it should not be an insurmountable challenge to remake marketing measurement in the same creatively modern guise.

About Meta

Meta builds technologies that help people connect, find communities, and grow businesses. When Facebook launched in 2004, it changed the way people connect. Apps like Messenger, Instagram and WhatsApp further empowered billions around the world. Now, Meta is moving beyond 2D screens toward immersive experiences like augmented and virtual reality to help build the next evolution in social technology.