With so many companies investing behind their net-zero commitments—and half of all assets under management held by investors committed to

sustainable investing

—why do so few business leaders feel that investors are giving them credit for their

sustainability investments?

We set out to answer that question and, in fact, found no correlation between the environmental component of a company’s overall ESG score and how much the market rewarded its sustainability efforts. At the same time, we knew that many companies were rewarded by investors for smart sustainability strategies. Maximizing your ESG score is important, but in our experience, the best sustainability strategies go beyond just checking all the boxes. Rather, they check some boxes—those that enhance competitive advantage—more than others. After all, with attractive and growing green profit pools across nearly all sectors, it should be possible to chart a value creation strategy that’s green in more ways than one.

Given that starting point, our hypothesis was that investors favor sustainability moves with a compelling business case over ones with a less clear economic rationale. Using this lens, we evaluated a rich dataset of sustainability-related initiatives announced between 2015 and 2022 by the world’s largest public companies, seeking to identify which elements of a thoughtful, verifiable business case were part of each one. We then looked at the market’s reaction—and confirmed that initiatives with a more robust business case created more value. (For more on our methodology see “About the Research.”)

About the Research

Our approach and hypotheses were derived from earlier BCG global research as well as related findings from country-based or regional studies in Australia, France, and Scandinavia. We took a number of steps to mitigate the effects of confounding drivers of rTSR: using short-term returns (three days following the announcement) as our metric for value creation, merging multiple related announcements on a single day, excluding announcements within three days of earnings calls or investor days, and excluding data from March through December 2020 because of the impact of the COVID-19 pandemic on stock markets. This yielded a data set of about 14,000 announcements. After that, we filtered the sample once again to focus only on the announcements made by the top 20 companies in each sector by market capitalization as of the end of December 2022, yielding a final data set of approximately 6,700 announcements.

We then tagged each announcement in our global data set to indicate which of seven business-case elements identified in earlier global, regional, and country-level research were included. We used natural-language processing to tag the full data set and then ran manual checks on all announcements in three sectors—mining, auto, and consumer products—to verify accuracy.

We also found that greenwashing doesn’t work. Companies that issued a lot of announcements mentioning few business case elements were punished. Investors reward a compelling narrative grounded in a smart sustainability strategy that focuses on the material moves that drive competitive advantage. Companies that are clearer about the intersection of their sustainability and value creation agendas may even help bridge the “great disconnect” highlighted in our previous research between institutional commitments at investment firms and the actual investment criteria used by portfolio managers.

Elements of a Sustainability Business Case

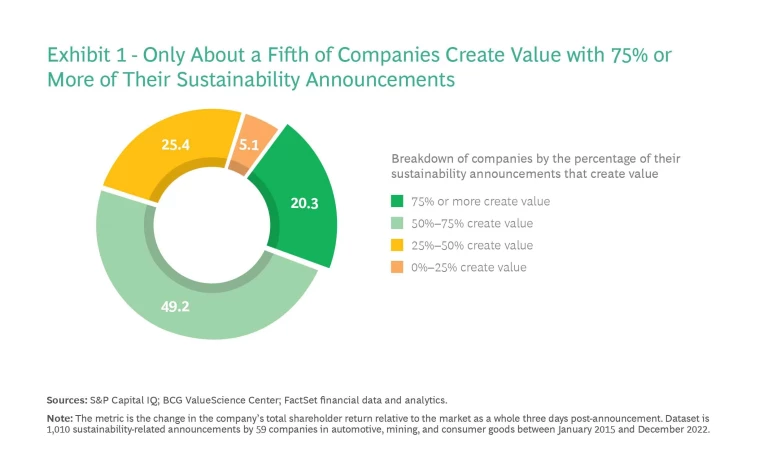

Between 2015 and 2022, only 20% of companies saw a positive market reaction to 75% or more of their sustainability-related announcements—and nearly a third saw half or more of their announcements destroy value. (See Exhibit 1.) Moreover, after three days, the aggregate of announcements we studied didn’t deliver a shareholder return distinct from that of the overall market. But when we applied the business case lens, our hypothesis was confirmed. Those sustainability-related announcements that included some or all of the following seven elements associated with a strong business case did create value:

- Material to the Company. The effort is big enough to make a difference given the scale of the company.

- Material to the Sector. The investment area is seen by the Sustainability Accounting Standards Board as a material environmentally related disclosure topic. For example, in automotive, SASB calls out fuel economy and use phase emissions, material sourcing, and materials recycling as the critical disclosure topics.

- Connected to the Core. The initiative is tied to the company’s core strategy.

- Clear on Funding. The announcement discusses the investment’s magnitude and sources.

- Tangible Goals. The company offers a way for investors to monitor progress, such as a revenue target or deadline.

- Third-Party Verified. Progress will be audited by a trusted external entity such as the Science-Based Targets Initiative, which can attest to member companies’ progress toward their net-zero goals.

- Drives Value Creation. The announcement describes the move’s potential financial upside for the company.

We found that the presence of any of these business case elements on its own in an announcement creates value. (See Exhibit 2.) What’s more, articulating the potential value creation upside of a sustainability move delivers twice the positive impact of any of the other six elements.

It shouldn’t be hard to find sustainability investment opportunities in nearly every sector that are a win-win for both the planet and investors. In auto and mobility, it’s being on the right side of the transition from internal combustion to vehicles powered by electricity or hydrogen. In mining and materials, it’s capturing an advantaged position in critical minerals like the rare earths essential to the battery technology that supports the electrification of everything. (BCG’s 2021 Value Creators Report, “ Value Creation in a Decarbonizing Economy ,” offers additional perspectives.)

Better Business Cases Create More Value

Obviously, no single one of the seven elements on its own constitutes a real business case. But in combination they do. The best companies are saying, We’re doing something sustainability-related that addresses a big issue facing our industry. And not only that: the move is consistent with our strategy, is related to our core business, has the potential to deliver a material financial upside—and here’s how to track our progress. That’s five business case elements that tell a compelling investor story.

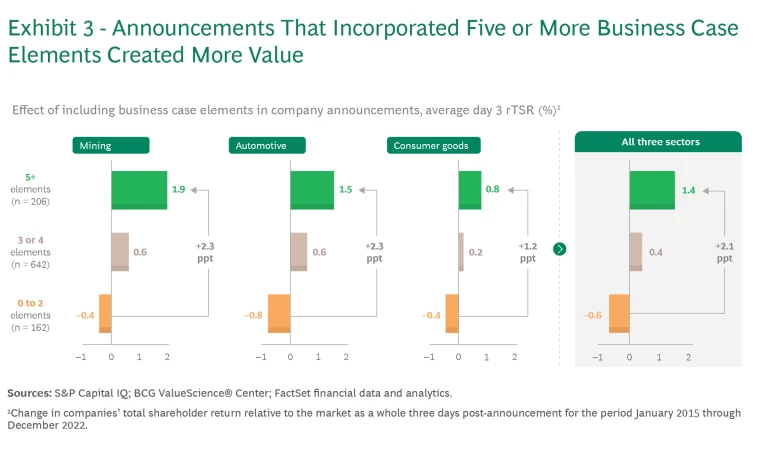

Our deep dive into three sectors—mining, auto, and consumer goods—demonstrated the impact of this approach. We selected mining and auto because their traditional business models are threatened by the climate transition—and both have potentially attractive future profit pools. We selected consumer goods to see if our findings in mining and auto would hold true in a sector less existentially challenged by climate and sustainability megatrends.

For example, the best-performing announcement for Stellantis (formed from the merger of Fiat Chrysler and PSA Group) concerned a $223 million investment in three Indiana-based plants that would support the company’s goal to have low-emission vehicles account for 40% of its US sales by 2030. And that announcement included six out of seven of our essential business case elements.

Across all three sectors, announcements that incorporated five or more of the business case elements outperformed those that included two or fewer by 2.1 percentage points. (See Exhibit 3.) And the outperformance was even greater when one of the elements was a discussion of how the move would drive future value creation.

In consumer goods, the business case effect was less pronounced but still observable, suggesting that all companies can benefit from applying this lens when setting and communicating their sustainability priorities.

Among mining companies, for example, Fortescue stood out with 41% of its announcements citing five or more business case elements. Of those, 86% created value—the sole exception announced a possible $8 billion investment with no mention of its potential value creation impact. The company’s best-performing announcements all related to initiatives driven by Fortescue Future Industries, a new division established in 2018 to produce green hydrogen using energy from 100% renewable sources. One of FFI’s best performers was a 2022 announcement (citing five business case elements) of a partnership with European energy leader E.On to explore the feasibility of shipping 5 million tonnes of green hydrogen to Europe by 2030—enough to replace one-third of the natural gas Germany imported from Russia each year until recently.

Quality and Consistency Are Rewarded

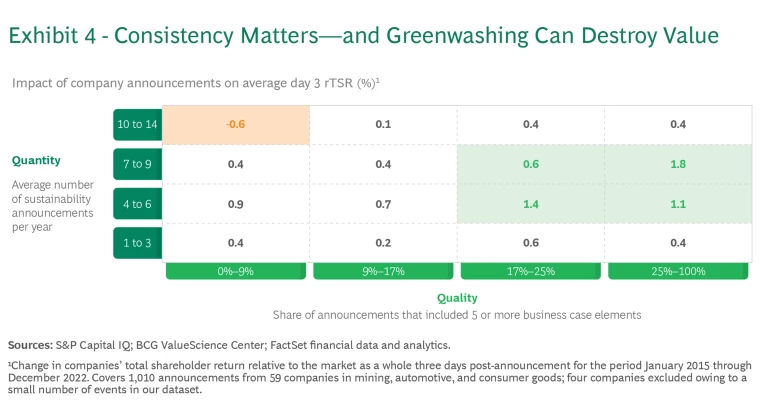

Our research also revealed that companies with a track record of consistently communicating strong sustainability business cases are disproportionately rewarded. Companies generally outperformed when about one-fifth or more of their sustainability announcements included five or more of the seven business case elements. (See Exhibit 4.)

And up to a point, those that issued more best-practice announcements got better results. Our analysis suggests that for sustainability-related announcements featuring a clear business case, the sweet spot is between one and two per quarter (the green area in Exhibit 4); companies issuing more than that saw lower returns. We also found that greenwashing doesn’t pay. Companies that made a lot of low-quality announcements (the orange area in Exhibit 4) actually destroyed value.

Strategy is about making choices. Ultimately, the best way to create value with sustainability is to concentrate on the things that make a difference for both the planet and your competitive advantage. Well-articulated moves that position a company to win in a decarbonized world are rewarded. Our research necessarily focused on what companies announce, but the findings are about more than the words you use. You can’t articulate a compelling business case if you don’t already have a thoughtful sustainability strategy guiding your investment priorities. In the final analysis, that’s what investors want.

The authors would like to thank Eden Cottee-Jones and Luke Tashie for their help with the analysis.