Technological breakthroughs in new modalities will be a key driver of growth for the biopharma industry over the next decade . This opportunity has not escaped the notice of global biopharmaceutical, biotech, venture capital, and life science investment companies, which are racing to invest in the most promising platforms.

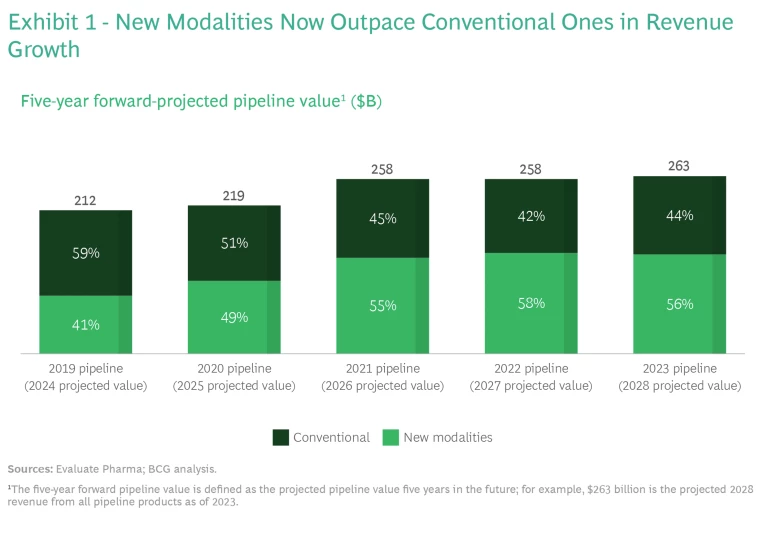

And the promise is already becoming a reality, as the enormous success of the COVID-19 mRNA-based vaccines has demonstrated. Notably, 2021 was the first year that new modalities, rather than conventional small molecules, were responsible for more than half of future projected biopharma revenues. (See Exhibit 1.) According to our analysis, over the past few years, revenues from new-modality products increased by $60 billion, while revenues from conventional products declined by $10 billion.

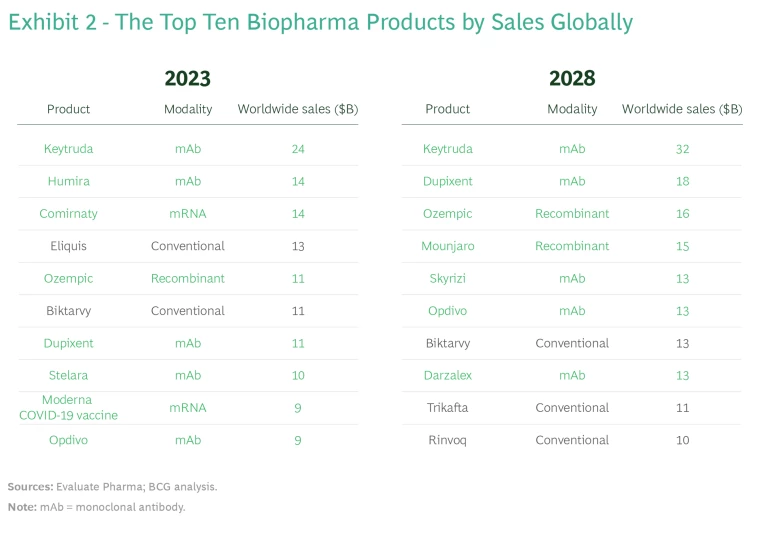

We expect that new modalities will continue to be a big driver of revenue growth. In 2023, four of the six top-selling biopharma products are based on new modalities—in 2028, that will be true of all top six products. (See Exhibit 2.)

Yet it isn’t easy to evaluate and compare the evolution of different modalities, with each advancing through development at its own pace. To our knowledge, there has been no standardized way of tracking the progress and potential of different modalities to date.

BCG’s first annual New Drug Modalities report aims to fill this gap by tracking the evolution of 18 modalities over time. Our analysis takes a cross-modality approach to determine which modalities are progressing most rapidly, which hold the greatest promise, which diseases they are expected to treat, and what these findings imply for patient outcomes and revenues.

Six Categories of Modalities

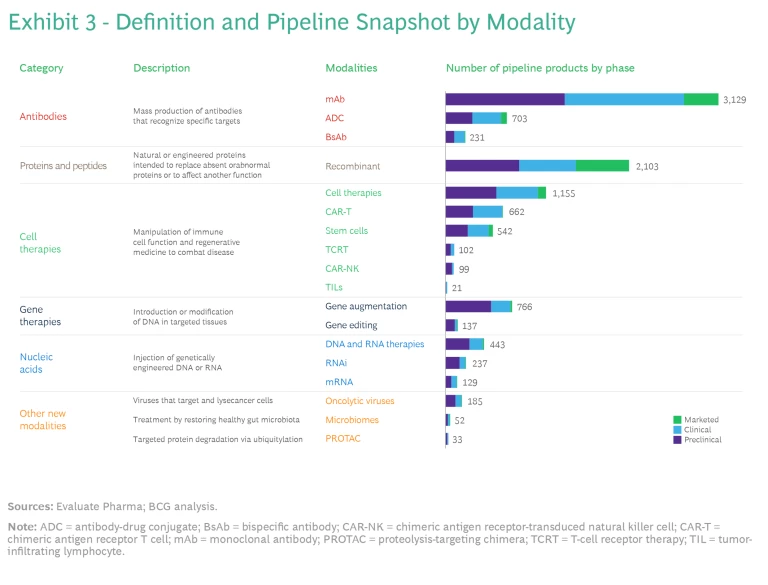

Companies are developing new biopharma modalities for a diverse array of molecular targets. The 18 modalities developed so far fall into six categories, which comprise proven modalities such as antibodies as well as nascent modalities, including oncolytic viruses, microbiomes, and proteolysis-targeting chimera (PROTAC). (See Exhibit 3.)

Antibodies. The oldest of the new modalities, antibody technologies, have been in use since 1986, when the FDA approved the first monoclonal antibody (mAb) product. After revolutionizing treatment in immunology and oncology, these products are now considered a mainstay. There are more than 100 mAbs on the market today. They include some of the most commercially successful products of all time, such as Humira. Five of the top ten products by projected 2028 revenue are also mAbs: Keytruda, Dupixent, Skyrizi, Opdivo, and Darzalex. Merck’s pending $10.8 billion acquisition of Prometheus, whose lead candidate is a mAb, suggests that interest in this modality will remain strong.

Companies are also using antibodies as platforms for other kinds of drugs, including antibody-drug conjugates (ADCs), which enable the targeted delivery of small-molecule chemotherapy drugs, and bispecific antibodies (BsAbs), which can target two antigens. This space is receiving significant investment attention, such as Pfizer’s pending $43 billion acquisition of Seagen for its ADC.

Proteins and Peptides. Like antibodies, these modalities are highly mature. They consist of proteins with enzymatic, regulatory, or targeting activity, as well as vaccines, and target a broad array of therapeutic areas (TAs), including endocrine, immunology, and hematology. One fast-growing class of medications in the protein and peptide category is glucagon-like peptide-1 agonists, which target incretin hormone action. These drugs, which include Trulicity and Mounjaro as well as Ozempic and Wegovy, have rapidly become blockbuster treatments for type 2 diabetes and obesity.

After revolutionizing treatment in immunology and oncology, monoclonal antibodies are now considered a mainstay.

Cell Therapies. Immune cell therapies have been used for treating various cancers since the FDA approved the first chimeric antigen receptor T cell (CAR-T) therapy in 2017. Today, cell therapies are also under development for endocrine, musculoskeletal, and dermatological conditions. The newer modalities aim to improve upon the limitations of earlier cell therapies. For example, T-cell receptor therapy (TCR-T), unlike CAR-T, can recognize intracellular as well as cell surface antigens, so it may have more success in treating solid tumors.

Gene Therapies. This category of modalities has the potential to be curative because it treats disease by modifying the genetic material of the relevant cells. The therapy is introduced either directly into the patient (in vivo) or into cells harvested from the patient, which are modified and transplanted back into the patient’s body (in vitro). Key modalities include gene augmentation, which delivers a functional version of the mutated gene, and gene editing, which uses CRISPR/Cas9 machinery to modify the genetic material of the cells. So far, the only approved gene therapies treat rare diseases, particularly in hematology and central nervous system TAs.

Subscribe to our Health Care Industry E-Alert.

Nucleic Acids. The first nucleic acid–based products received FDA approval only seven years ago. mRNA is especially well known because of its prominent role in two highly efficacious COVID-19 vaccines. This category includes two other important modalities: antisense RNA for rare diseases and RNAi for liver, kidney, and heart conditions.

Other New Modalities. A few other modalities are relatively new but have already shown signs of potential:

- Oncolytic Viruses. These viruses selectively target and infect cancer cells, releasing antigens and stimulating an immune response. In 2015, Amgen’s Imlygic, a herpesvirus used for treating metastatic melanoma, became the first oncolytic virus to receive FDA approval.

- Microbiomes. Therapeutic microbiomes engineer gut microbiota to regulate the microbiome and treat dysbiosis, the imbalance of bacterial composition. While most microbiome therapies are still in the clinical stage of development, the modality has attracted attention from biotechs and large pharma companies interested in potential applications beyond gastrointestinal diseases, including in oncology and immunomodulation.

- PROTACs. The PROTAC modality uses existing cellular machinery to target and destroy proteins related to a particular disease. Unlike traditional small-molecule inhibitors, the PROTAC degrades the protein continuously. It is also far more potent and can be used to treat more-severe diseases. Most of the PROTAC drugs currently in clinical trials target some form of cancer, but in the future, they may be capable of treating immune-mediated inflammatory and neurological diseases.

Evolving Potential over Time

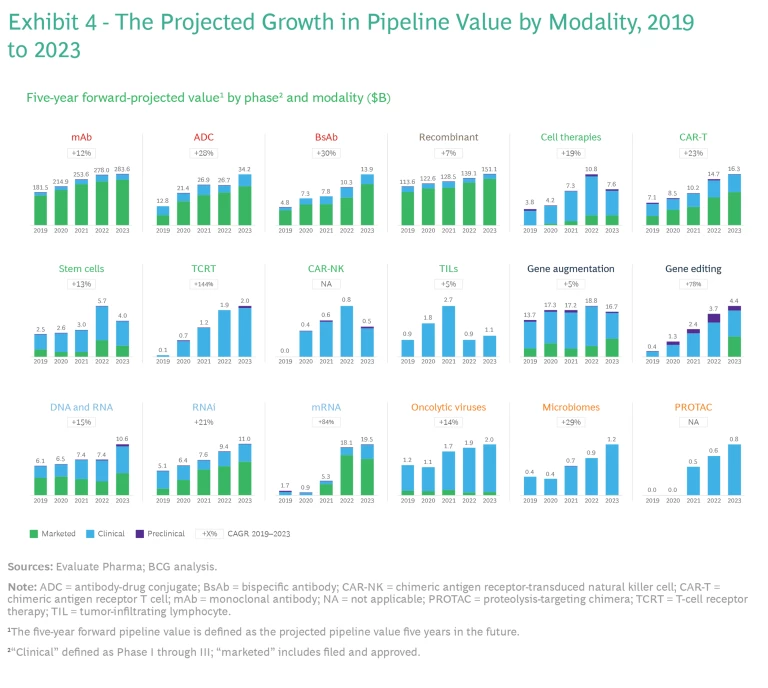

To better understand how each modality’s potential has evolved, we longitudinally tracked the year-over-year progression of projected pipeline revenue. For each year, we look at the projected revenue for pipeline products five years into the future; for example, “2023 five-year forward-projected value” is the revenue projected for 2028 for all the products in industry pipelines across that particular modality as of 2023. This growth in value is therefore driven by the product’s ability to progress through the pipeline and an underlying belief in the modality’s economic potential.

Growing Value. All modalities have demonstrated growth over the past four years. (See Exhibit 4.)

mRNA assets have shown an 84% spike in projected value—significantly more than other modalities. This growth has been driven primarily by COVID-19 vaccines, which account for $13 billion of the roughly $20 billion in forecasted revenues, though vaccines for other pathogens, including influenza and respiratory syncytial virus (RSV), also play a role. The next-largest group, immuno-oncology, includes mRNAs that encode tumor antigens and proteins that stimulate immune responses.

Gene editing, which so far has seen a 78% increase in projected value, is still in its infancy: clinical data for the most advanced gene therapy assets emerged only recently. It will be interesting to see if this trajectory continues as standards of care begin to improve.

Antibodies have seen a 15% rise in projected value over the past four years. mAbs have experienced growth of 12% owing to a jump in forecasted revenue of more than $100 billion. ADCs and BsAbs have increased even faster—28% and 30%, respectively—with revenue estimates rising by $21 billion and $9 billion, respectively. Antibodies constitute the most mature category, with a majority of their expansion coming from marketed products rather than clinical development.

Recombinant proteins and peptides have also maintained a robust revenue forecast, with sales expectations soaring by nearly $40 billion from 2019 to 2023.

Some technologies that were leaders in 2019 have experienced slower growth in forecasted revenue. For example, gene therapy, the third-largest category in 2019 after mAbs and recombinants, has increased by only $3 billion and its projected value has now been surpassed by ADCs and mRNA.

The projected value of many of the nascent modalities, including newer cell therapies as well as oncolytic viruses, microbiomes, and PROTACs, is each concentrated in several large clinical-stage products. These modalities have not yet experienced the breakthroughs seen in other categories, such as nucleic acids.

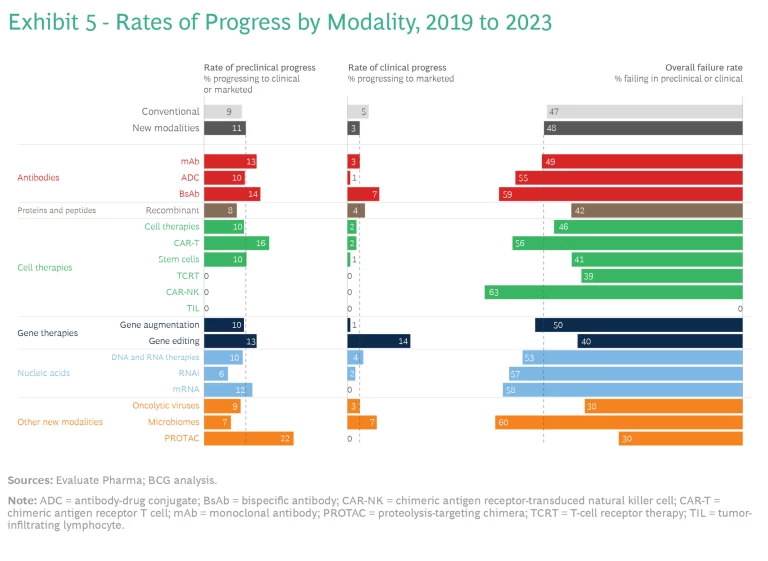

Rates of Progress. Interestingly, new and conventional modalities have experienced similar rates of progress across clinical phases over the five-year period from 2019 to 2023. So, as a cohort, newer modalities have not yet proved to be riskier propositions that the broader industry. To ascertain which, if any, technologies stand out, we determined the percentage of preclinical assets in the new- and conventional-modality pipelines in 2019 that progressed to clinical or marketed status by 2023. We also evaluated the clinical assets that advanced to marketed status over the same time.

On average, new modalities have progressed slightly faster than conventional assets in earlier phases of development, but a smaller portion of new-modality clinical assets has reached the market. Among the new-modality agents, mAbs, BsAbs, and CAR-T therapies have seen higher than average rates of progress, particularly at the preclinical stage.

New and conventional products have also experienced similar failure rates; however, there is a wide distribution of failure rates among modalities. PROTACs, oncolytic viruses, and TCRT have some of the lowest failure rates, although this is due, to some extent, to the relatively small number of those assets in the pipeline in 2019. (See Exhibit 5.)

Looking Ahead

The future of new modalities is bright. Although the broader investment environment is down, the biotech sector remains strong as investors perceive innovative health care to be less vulnerable to a potential recession. In addition, the 2022 Inflation Reduction Act (IRA), which aims to curb drug pricing, will likely benefit many of the newer modalities relative to small-molecule products. The law completely exempts Medicare Part A products, which are administered in hospitals, from all three drug pricing provisions, and thus will likely incentivize development in areas like cell and gene therapies. It also grants biologic drugs longer periods of patent protection than traditional products, regardless of channel.

At the same time, once the biopharma industry exhibits interest in a particular target or modality, it’s common for many other companies to want to get in on the act. So it is increasingly important for players with strong clinical development capabilities to move quickly on scientifically differentiated assets. The sweet spot is early in Phase II, when preliminary data on effectiveness becomes clearer. We expect that deal activity will increase as more assets move through Phase II.

In the longer term, the potential of each new modality will depend on its individual value proposition and ability to drive improvements in the standard of care. When the level of investment is high, the improvement in outcomes needs to be commensurate. But that has rarely been the case. For example, while oncology is the TA that has seen the greatest investment activity, the significant therapeutic advances of PD-1s like Keytruda have yet to be matched by other new modalities. As more assets move through trials, it will be important to monitor their clinical benefits.