By their own account, many digital and technology leaders in the health care industry do not feel prepared to adopt traditional AI, advanced data analytics, and GenAI technologies. The same holds true for deploying applications that address challenges such as reducing operating costs and improving the patient or member experience. And yet, implementing innovative technologies and operating solutions are critical for health care organizations to remain competitive.

To better understand the challenges that senior digital and technology leaders face, we surveyed more than 100 at traditional payers, providers, health care systems (including integrated delivery networks), and service organizations. We supplemented the responses with one-on-one interviews to gain further insights. Overall, we sought to answer four questions:

- What is shaping organizations’ digital and technology agendas?

- How prepared are organizations to act on their agenda?

- What barriers may prevent organizations from acting?

- How can organizations strengthen their digital and technology agenda to win?

We found that a critical first step is for business as well as digital and technology leaders to agree on the organization’s goals and the capabilities required to achieve them. Then they will have the foundation necessary to create a digital and technology agenda to build advantage for future growth.

What Is Shaping Organizations’ Digital and Technology Agendas?

Two forces are influencing the digital and technology agendas of payers, providers, health care systems, and services. External trends are holding significant sway; at the same time, these organizations’ internal strategic priorities are playing an equally important role.

External Trends

Organizations throughout the health care industry are responding to three external trends—the results of innovative technology, new partnerships, and staffing challenges.

Evolving Care Models. The rise of virtual health care, the move to value-based care, and the emergence of new care models are driving the most important industry trend. More than 90% of survey respondents cited one as a top trend. Care models are advancing in part because service organizations are launching innovative solutions and services.

Breakthroughs in AI and Advanced Data Analytics. Payers, providers, health care systems, and service organizations have been investing in traditional AI and analytics for some time. Still, more than 50% of the survey’s respondents pointed to breakthroughs as a second, key industry trend.

Advances will continue to emerge because natural language processing, speech recognition, and machine vision technologies are enabling traditional AI and analytics systems to continually improve. These systems are not only continuing to process data more quickly and with greater accuracy but also becoming increasingly sophisticated. Currently, they are assisting with diagnostics, on-demand personal care, predictive health assessments, medical coding and billing, and automated discharge summaries. This ongoing evolution means that AI and analytics applications will become more prevalent in and fundamental to all segments of health care, even treatment. As we heard from a digital and technology leader, “AI won’t replace doctors, but doctors who don’t use AI will be replaced.”

As advancements in traditional AI continually force organizations to adapt, GenAI, another powerful and disruptive technology, is also gaining traction. The capabilities of GenAI systems go beyond those of traditional AI systems and use one or more types of data input to create text, images, videos, 3D models, and various other types of output. More than 500 companies are already providing GenAI solutions, and the technology has considerable potential to impact the health care industry. GenAI is expected to be a $22 billion market in health care by 2027 and presents the opportunity to create more than $80 billion in savings across the patient journey.

Deploying GenAI solutions without strong risk management is not prudent. But organizations should not take a wait-and-see approach either. In fact, some organizations have already put GenAI to use in care models, gaining advantages and capturing efficiencies. Leaders should therefore consider a two-pronged plan of risk management and experimentation.

Organizations should begin to address the many risks, including bias in their data, data privacy, and hallucinations, which are confident but incorrect AI responses to user queries. At the same time, organizations should assess how to use GenAI in their care models and be ready to move forward.

As organizations look at potential use cases, they should be deliberate about how and where to play. They should also build their own ethical and legal guardrails to ensure the responsible use of GenAI. A regulatory framework for GenAI has yet to take form, leaving businesses without guidance and protections from the technology’s many risks.

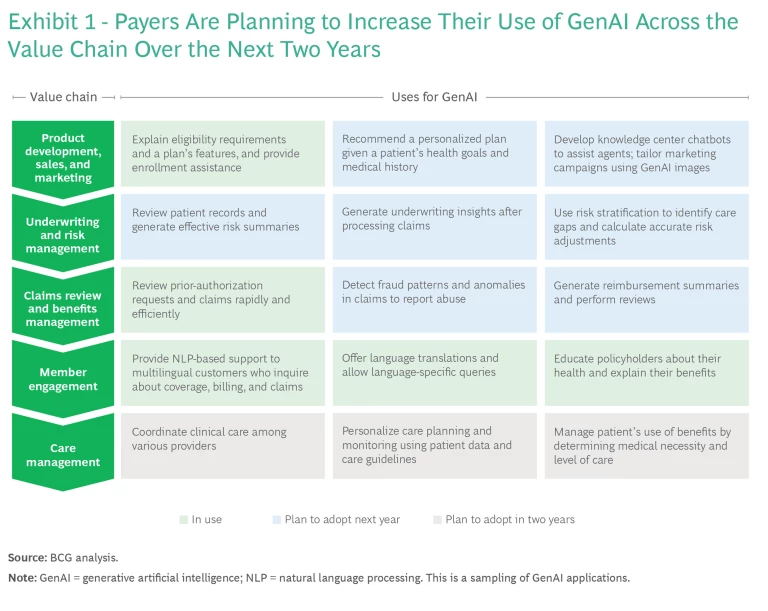

Generally, payers are planning to adopt GenAI in care management solutions in two years. However, some have already started using GenAI technology in their member-engagement applications, and others are deploying GenAI solutions to rapidly review prior-authorization requests and claims.

In the next year, payers expect to begin using GenAI solutions to further support sales and marketing, as well as in underwriting and risk management. (See Exhibit 1.)

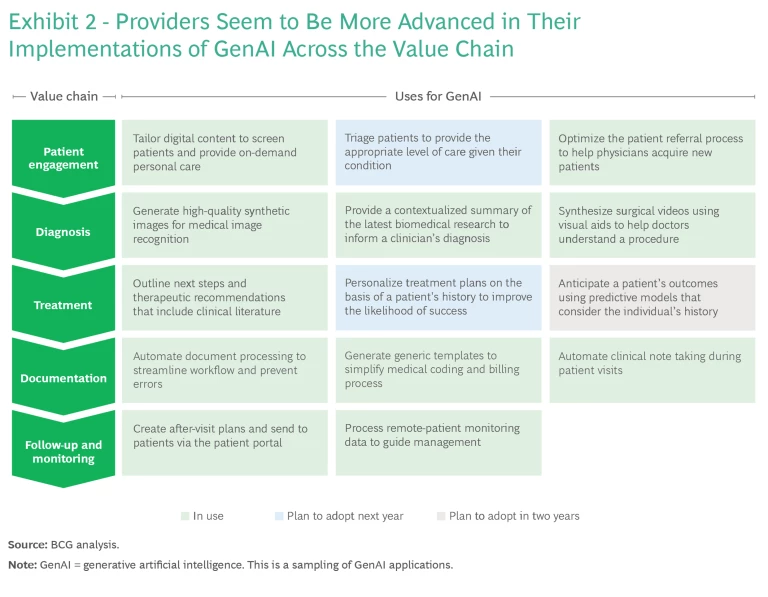

Providers appear to be more advanced in their use of GenAI throughout their value chain, even adopting solutions for medical image recognition and automated clinical note taking. (See Exhibit 2.) Over the next year or two, providers anticipate adopting GenAI solutions to personalize treatment plans and predict patients’ outcomes on the basis of their medical history.

Developments in Health Care Segments. The digital and technology agendas of payers, providers, health care systems, and service organizations are also influenced by developments in their specific health care segment.

For example, many payers are making sizable investments to build up their automation capabilities. These include implementing robotic process-automation solutions to reduce the cost and time required to manage claims processing and other administrative tasks. Other payers are taking notice and making it part of their digital and technology agenda.

Providers are particularly challenged by the high rate of employee burnout. Roughly 38% of physicians are experiencing burnout, compared with about 28% of the general population. About 15% of health care workers quit their jobs from May 2022 through September 2022. Providers are placing outsized importance on addressing talent and staffing challenges.

Internal Strategic Priorities

Along with external trends, internal strategic priorities are influencing the digital and technology agendas of payers, providers, health care systems and service organizations. Our research shows that improving health outcomes and the patient or member experience are two priorities carrying particular weight, perhaps because improvements in these areas are driving revenue. Better outcomes are helping sustain profitable growth by reducing the number of patients and clinical expenses, and better experiences are boosting customer conversion and retention rates.

Many organizations also want to focus on reducing the overall cost of care by improving workforce efficiency and cutting operational costs. They are therefore searching out and implementing digital self-care tools to reduce face-to-face physician-patient visits. For example, Kaiser Permanente has partnered with Calm, Ginger, and myStrength to offer members these wellness apps. Many organizations are also deploying workflow optimization tools, such as IKS Health, EmOpti, and Aiforia. These solutions make clinical processes, such as patient flow and staffing, more efficient.

How Prepared Are Organizations to Act on Their Agenda?

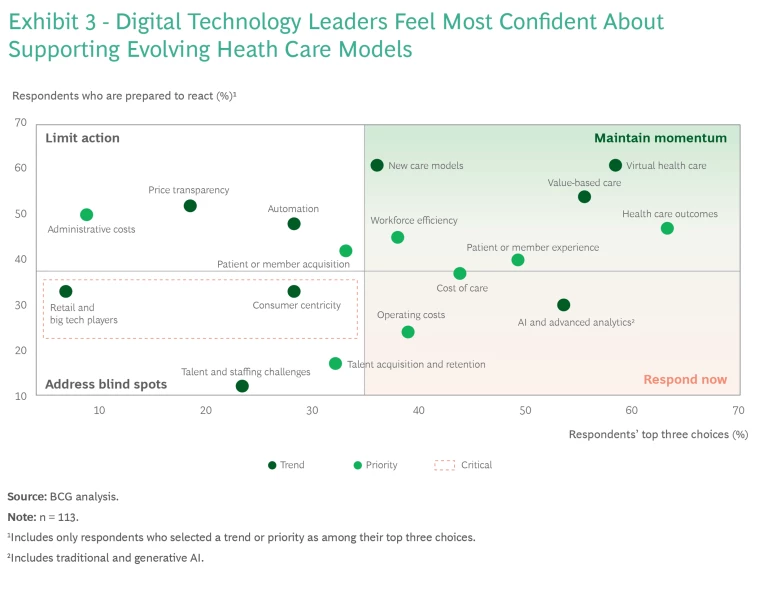

We asked senior digital and technology leaders about their level of preparedness to address external trends and internal priorities. On average, only about 40% of respondents feel prepared or very prepared to react. In general, respondents feel the most confident about supporting the changes in virtual health care, value-based care, and new care models. (See Exhibit 3.)

Respondents feel the least prepared to adopt AI (traditional AI and GenAI) and advanced analytics; to deploy applications that improve talent acquisition, retention, and staffing processes; and to implement solutions that reduce operating costs. Less than 30% of respondents feel well prepared to undertake most of these tasks.

Somewhat surprising is that respondents aren’t prepared for consumer centricity or for retail and big tech players to enter in the space.

Leaders should choose a course of action that suits their organization’s preparedness.

Respond now. More than 70% of the digital and technology leaders surveyed think that several trends and priorities, such as reducing operating costs, are important, but they do not feel well prepared to address them. Organizations need to take action in the important areas if they are not prepared. They should reallocate funds and organically develop the needed capabilities, or they should form strategic partnerships and make acquisitions to strengthen their capabilities and bring them to market quickly. It is particularly critical to move fast to identify use cases for GenAI and deploy solutions.

Maintain momentum. Changes in the way care is delivered significantly impact an organization’s digital and technology agenda, and about 60% of leaders think that their organization is prepared to address these changes. Going forward, these organizations must maintain their momentum to either develop or sustain capabilities that support virtual health care and value-based care and ensure workforce efficiency. To maintain momentum, leaders should periodically reassess the time and money they have invested to determine if they need to recalibrate or shift from building to sustaining these capabilities.

Address blind spots. Blind spots are trends that most leaders do not see as shaping their agenda but that could significantly impact the industry. We have identified two trends as particularly critical. The first is consumer centricity. Increasingly, patients are expecting higher service levels and personalized engagement, similar to the enhanced digital-shopping experiences that are provided by consumer services industries.

The second blind spot is the entrance of retail and high-tech players into the health care industry. These companies are introducing advanced capabilities, such as monitoring medication adherence and transcribing physician-patient conversations, for personalized, proactive follow-ups. Incumbent organizations should take steps to address these critical blind spots in the near term.

What Barriers May Prevent Organizations from Acting?

As organizations prepare to address external trends and internal priorities in their digital and technology agenda, they are mindful of two potential barriers to execution.

Resource constraints were highlighted as a significant barrier by about 50% of the leaders surveyed. Securing timely and adequate funding for investments can be particularly difficult. A leader at an integrated delivery network stated, “A key challenge is demonstrating the fiscal impact of any changes recommended to free up the budget for investing in additional digital and technology capabilities.” An insufficient pool of skilled talent and legacy technology that’s incapable of driving a tech transformation quickly were also cited as constraints.

Misalignment between the strategic business goals and the digital and technology agenda poses another barrier. “There’s a clear disconnect between the IT and health care sides of the company; the IT team isn’t aligned with the larger business,” noted a digital and technology leader. The result is a lack of leadership support, which exacerbates the resource constraints as the digital and technology function struggles to demonstrate the fiscal impact and return on investment in digital capabilities. Organizations need to be clear about their long-term goals and how the digital and technology agenda can best support them.

How Can Organizations Strengthen Their Digital and Technology Agenda to Win?

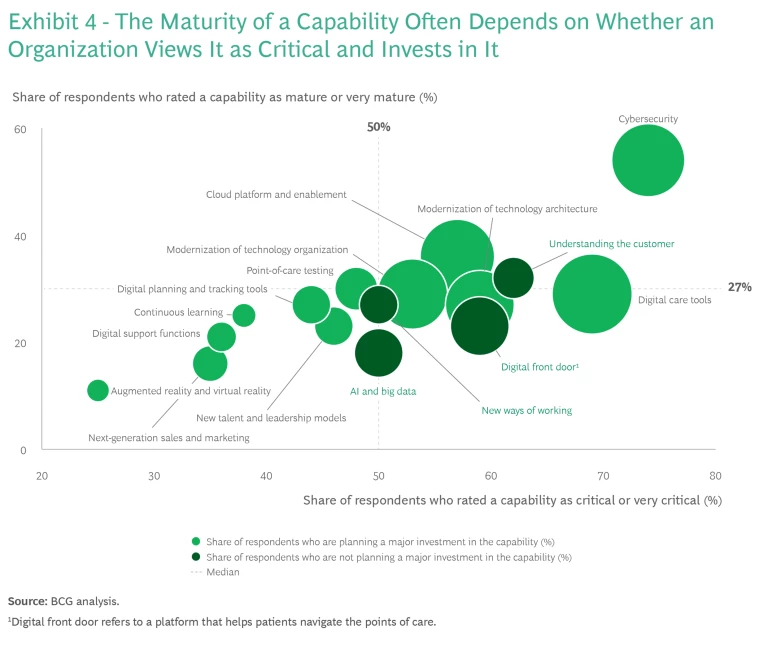

It is crucial that payers, providers, health care systems, and services invest in the right digital capabilities either to stay ahead of competitors or to close the gap with them. To understand what it will take for organizations to keep up with external trends and achieve their strategic priorities, we evaluated a set of capabilities through the lenses of criticality, maturity, and planned investments. What we found suggests that organizations often invest in areas that are less critical to their success. (See Exhibit 4.)

Many survey respondents think that their organization prioritizes investing in capabilities that it finds critical, such as cybersecurity and digital care tools. Respondents also tend to perceive their organization’s capabilities as more mature, on average, when those capabilities are deemed most critical. Roughly 75% of respondents rated cybersecurity as a critical capability, and about 50% ranked their organization as mature or very mature on the topic. By contrast, less than 30% of respondents rated augmented reality and virtual reality or next-generation sales and marketing as critical, and less than 20% ranked their organization as mature in these areas.

However, more than 60% of digital and technology leaders surveyed do not think that their organization is mature in critical capabilities. Within this group, less than roughly 45% of respondents said that their organization is planning major investments in AI and big data, new ways of working, a digital front door (a platform that helps patients navigate the points of care), and understanding the customer.

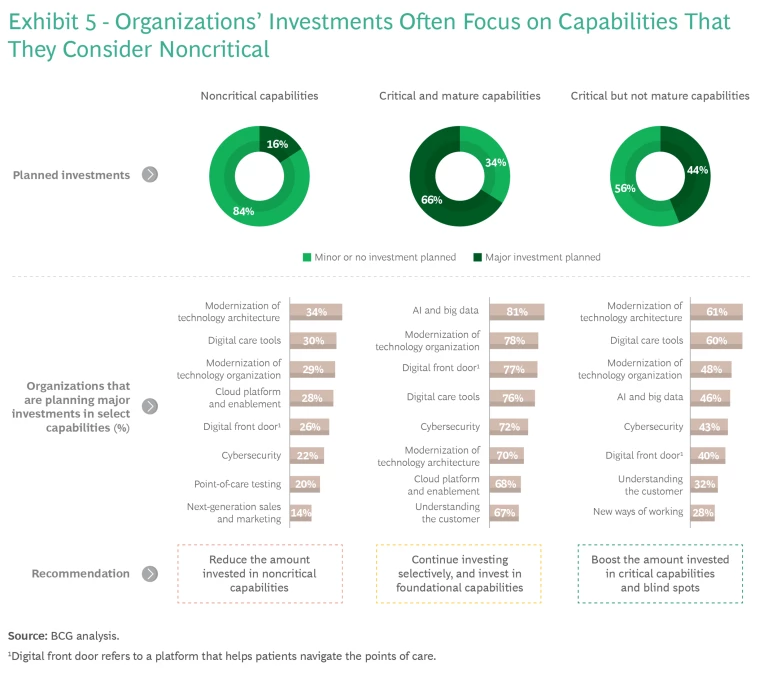

Organizations can strengthen their digital and technology agenda in three ways and find advantage in the future. (See Exhibit 5.)

Reduce the amount invested in noncritical capabilities. While organizations primarily invest in critical capabilities, we still see some planning major investments in capabilities that they consider noncritical. Funding the modernization of the technology architecture, digital care tools, and the modernization of the technology organization stand out, with roughly 30%, on average, planning to continue investing. Organizations need to make a baseline investment to ensure that their infrastructure continues to mature. However, if an organization is investing more than that, it may have the opportunity to reallocate funds toward emerging technologies.

Continue investing selectively in critical and mature capabilities and foundational capabilities. On average, two-thirds of the leaders we surveyed plan to make major investments in critical capabilities that are already mature. Among this group, roughly 78%, on average, are investing heavily in AI and big data, the modernization of the technology organization, a digital front door, and digital care tools. Overall, organizations with more-mature capabilities can respond faster to changing demands and trends than those with less-mature capabilities. Modernization of the technology organization has an outsized impact on preparedness, compared with the advancement of other capabilities.

Boost the amount invested in critical capabilities that are not mature and in blind spots. Typically, an organization’s biggest capability gaps involve skills that leaders consider critical for the business but that are not mature. Yet, on average, less than half of the leaders we surveyed plan to invest in capability gaps. Only 28% are considering investing in new ways of working, 32% in understanding the customer, and 40% in a digital front door. Perhaps most noticeably, only 46% are investing in AI and big data.

These results underscore the need for organizations to rebalance their investments, direct resources to these areas, and place selective bets on AI while navigating the ethical and legal considerations. In light of mounting cost pressures, the increasing rates of burnout and turnover among health care workers, and growing patient expectations for higher levels of service, leaders need to advance critical capabilities and avoid blind spots.

The speed of technology’s evolution carries promise and challenges for payers, providers, health care systems, and service organizations. Yet many aren’t ready to gain advantage or address the issues. To move forward, business and digital and technology leaders should jointly consider external trends and agree on their organization’s goals, identify the needed capabilities to achieve them, and allocate investments. In short, leaders need to develop a digital and technology agenda that responds to the pace of change. Then, their organization will be positioned to deliver competitive care and services.