Phillip Benedetti, Fergie Romero, and Katrina Bigelow

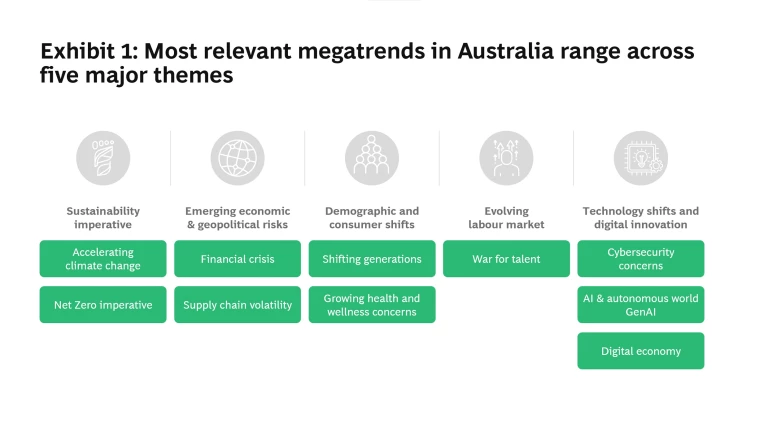

Our world is constantly changing, shaped by megatrends – high-impact, quantifiable shifts that have a profound impact on the way we live and do business over several decade(s). You might ask, "So what? Hasn't this always been the case?". While the answer is yes, we now see that:

- The sources of uncertainty have evolved to include environmental, biological, geo-political and cyber risks, on top of traditional economic, competitive and technology risk

- The speed of change has accelerated with the new technologies, climate change, high levels of debt, social media and more

- The stakes are higher than ever, with stakeholders expecting organisations to better detect megatrends, respond to them decisively, and more proactively build resilience

Megatrends are inherently global and don't typically exist in isolation – spanning shifts in technology, the environment, the economy, geo-politics, consumer trends and more. However, some manifest uniquely in Australia’s context or impact Australia more than other countries. This article is the first in a series on the most prominent megatrends in Australia. It introduces the ways they're manifesting on our shores, some of their implications for organisations and governments, and what can be done to mitigate them.

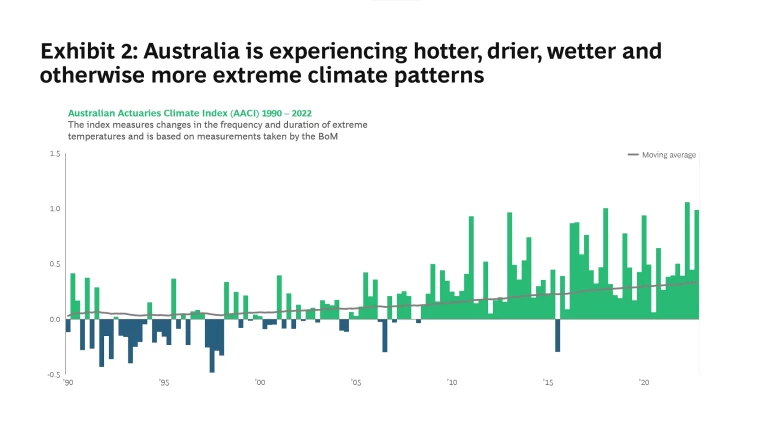

Accelerating climate change. While Australia is no stranger to extreme weather, the severity, frequency and unpredictability of severe storms, droughts, bushfires and flooding is only poised to grow. Australia is already experiencing hotter, drier and wetter climate patterns.

Federal and state governments need robust adaptability and resilience models to support impacted communities and stakeholders through disasters, and to avoid or mitigate their impact. Sectors need to work with each other and government to develop innovative and data-informed solutions to minimise the direct cost of natural disasters to consumers and insurers; insurance losses are trending upward, with a record high in 2022.

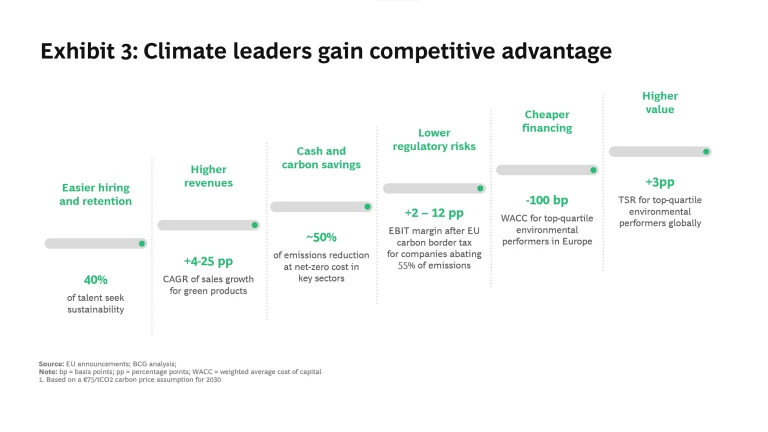

The net-zero imperative. Achieving net-zero by 2050 is not just an environmental imperative – it's a business imperative that requires bold action and across all sectors and nations. Australia has committed to reducing greenhouse gas emissions by 43% below 2005 levels by 2030 and meeting net-zero by 2050 – an ambition expected to require $2.5 trillion investment in the next 3 decades.

Developing and implementing a net-zero transition strategy requires companies to collaborate with government and acquire skills to support new businesses and technology. And for those with the greatest contributions to make – such as the automotive, food, retail, energy sectors – it requires significant investment in decarbonising operations and strengthening resilience.

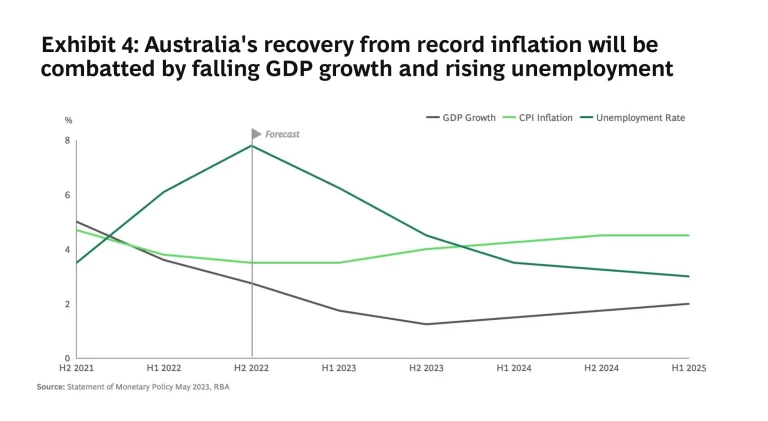

Financial crisis. Australia is positioned for a turbulent recovery from record inflation as the RBA forecasts slowing GDP growth and rising unemployment (see Exhibit 4).

Australian companies need to prepare for rising costs, reduced consumer spending and changing customer behavior. They need to develop robust scenario plans, adapt to arising opportunities and focus on maintaining their bottom line. For banks, this means reinforcing existing responsible lending practices and re-evaluating product constructs as mortgages roll over to variable rates and the housing market strengthens in a high interest rate environment.

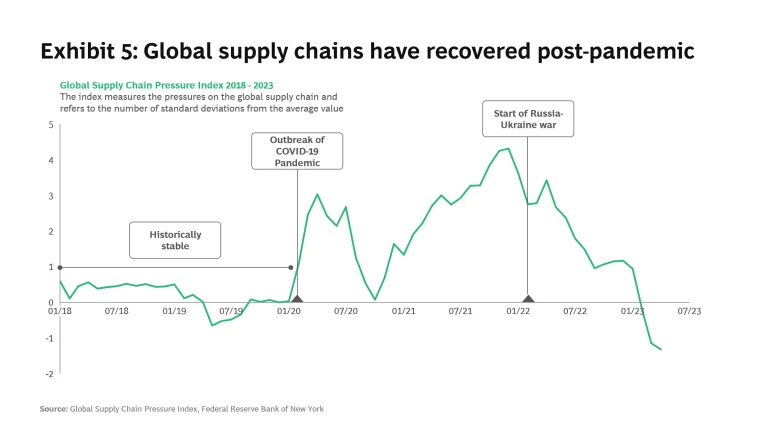

Supply chain volatility. Global supply chain shocks have subsided, pressures have recovered to pre-pandemic levels and Australian companies are experiencing fewer disruptions (see Exhibit 5). However, geopolitical tensions and evolving international relations will continue to shape global trade and supply chains, positioning Australian companies to capitalise on existing opportunities.

Globally, only 10% of companies have resilient and responsive supply chains. These companies recover faster from disruption and benefit financially.

- Identifying and assessing risks and establishing visibility across the supply chain

- Implementing measures to predict and identify supply chain shocks and conducting scenario planning to outline a clear decision-making process

- Evaluating and redesigning supply chain operations including supply chain network design, sourcing strategies and planning and inventory management

- Developing wide-ranging enablers for supply chain resilience, such as digital tools, processes, governance and culture

Shifting generations. Changing demographics, particularly the preferences of Gen Z and Millennials, are reshaping how companies operate, with Millennials now Australia's largest generational cohort.

With Baby Boomers accounting for ~50% of Australia’s wealth while representing ~21% of the population, it is expected that they will pass on $225 billion in inheritances each year to Millennials and Gen Z by 2050.

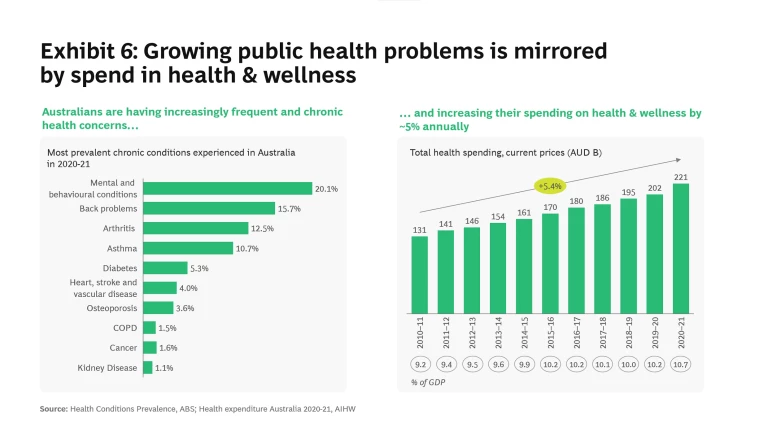

Growing health and wellness concerns. Australia is experiencing rising public health concerns. The prevalence of chronic health conditions such as mental health problems, back problems and arthritis are increasing; 78.6% of Australians had at least one long-term health condition in 2021. Nearly 46.6% (or 11.6 million) had at least one chronic condition.

This increasing health and wellness awareness has been mirrored by consumer health spending, which has risen by 5.4% each year over the past decade (see Exhibit 6). Though total health spending has steadily increased, private health insurance participation is decreasing among younger demographics who increasingly feel that it is unaffordable and fails to provide value. Insurers and government should partner to create an ecosystem in which younger and healthier individuals see the value in participating in health insurance, if they are to maintain affordability of health insurance across demographics.

War for talent. In a post-COVID world, companies must adapt their workforce strategies to meet changing employee expectations.

Companies are responding to these changing expectations. The percentage of remote positions has tripled since 2020.

Cybersecurity concerns. With recent cyber-attacks on Optus, Medibank and Latitude impacting almost 20 million customers, awareness of cyber security and the risks associated with data breaches has increased. Beyond these major public attacks, it's estimated that there's over 750 cyber-attacks every day in Australia – and this is expected to double in the next 5 years.

To counter these escalating threats, companies are being more proactive to prevent or minimise the impact of potential attacks. Given the substantial costs associated with cyber-attacks, investment is expected to increase – it is crucial for companies to allocate sufficient resources to protect their systems and sensitive customer information. Adequate spending on cybersecurity is not only a strategic imperative but also necessary to mitigate risks and ensure the long-term resilience of organisations in today's evolving cyber landscape.

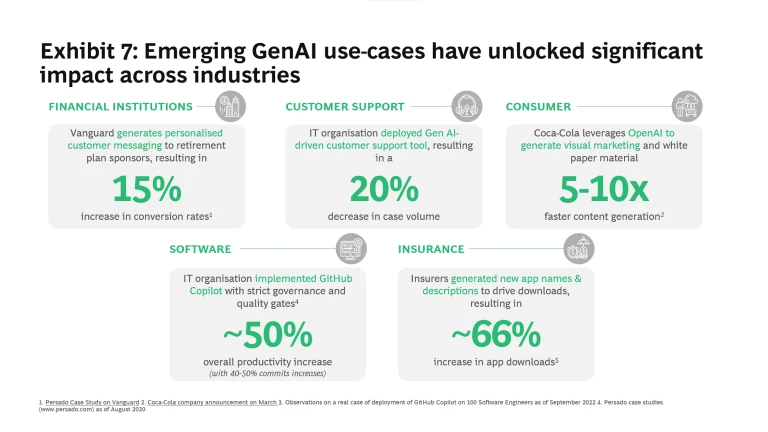

AI and the autonomous world. Artificial Intelligence (AI) is widely used in Australia – from self-driving vehicles in mining, compliance management in finance, to supporting clinical decisions in health care. AI could contribute more than $20 trillion to the global economy by 2030 and has already proven transformative in many industries with many emerging use-cases.

Generative AI (GenAI) is developing at unprecedented rates and the total addressable market globally is expected to reach $180 billion by 2027 ($121 billion USD), from ~$27 billion in 2023 ($18 billion USD).

However, GenAI comes with business risks that are hard to mitigate. These risks need to be carefully managed by organisations that seek to leverage its capability to drive operational efficiencies and better customer outcomes (see Exhibit 8).

Digital Economy. The digital economy has grown and expanded into a multi-trillion-dollar sector, driving the growth of organisations and the broader economy. Companies have a narrow opportunity to capitalise and adapt to the ever-changing digital economy; and those that cannot adapt are left behind. The average lifespan of a company has shrunk from 61 years to 18 years over the past 50 years and the technology adoption curve is 7 times what it was 20 years ago.

Digital activity accounted for 6.1% of the total economy value added in 2020-2021 and the Australian Government has taken on significant and ambitious targets to bring the digital economy to the forefront.

Megatrends provide leaders with a vision and agenda, highlighting how Australia’s competitive structure and landscape will change in the coming years. Organisations need to shift their focus to megatrends so they can adapt and thrive.

This is the first of a new thought-leadership series by BCG focused on megatrends in Australia. Stay tuned for further articles that will explore these megatrends in detail over the coming months.

The authors are grateful to a number of colleagues for their support and assistance. They include Jan Loubal and Paul Sutherland for marketing, Rebecca Diepenheim for design and layout and Esteban Zapiola and Ray Fung for video production.