Running a business in Europe over the past several years has been no easy task. First came the COVID-19 pandemic, dramatically disrupting supply chains and distorting customer demand. Then Russia invaded Ukraine, and energy prices rose to near-record levels. Since then, both inflation and interest rates have soared while labor shortages continue to be an issue. As a result, the outlook for Europe’s economy in 2023 and the companies operating there has darkened.

But how bad is it, really? To find out, we developed the BCG Transform Index. The goal of this first edition of the index is to understand better how European companies have maneuvered through the challenges of the past several years, and how well prepared they are to face the future. To that end, we conducted a financial review of more than 1,000 companies in ten primary sectors across 33 European countries, covering public data from 2018 through the third quarter of 2022.

The good news is that most industries have seen a strong recovery following the COVID-19 dip, with operating performance reaching record heights across several sectors. And so far, we have not yet seen a drastic decline as a result of the Russian invasion of Ukraine and the resulting economic challenges.

The bad news is that there are clear warning signs on the horizon. Overall, cash balances are declining for the first time since 2018, while net debt continues to grow to record highs. With an increasing number of companies with negative free cash flow, the quality of net debt is deteriorating—an especially concerning issue given the current high interest rate environment.

Some sectors, especially basic upstream industries, such as Metals and Mining and Chemicals, have been more resilient in the face of past shocks. This makes them better positioned for upcoming challenges than others, notably Leisure & Tourism and Technology. Still, companies in every sector can thrive by devising resilient strategies to anticipate future challenges and withstand new shocks, while setting themselves up for long-term profitable growth.

Status Report

There’s no getting around the fact that the COVID-19 pandemic and the war in Ukraine has adversely affected the macroeconomic environment in Europe. Key economic indicators, including inflation, energy prices, and interest rates, are all above their long-term averages. And while annual GDP growth across Europe has been strong in the past couple of years, it is expected to decline in 2023 to just 0.4% in the Eurozone, and even less in Southern Europe and the UK. Only the Nordic countries and Eastern Europe are predicted to see better growth.

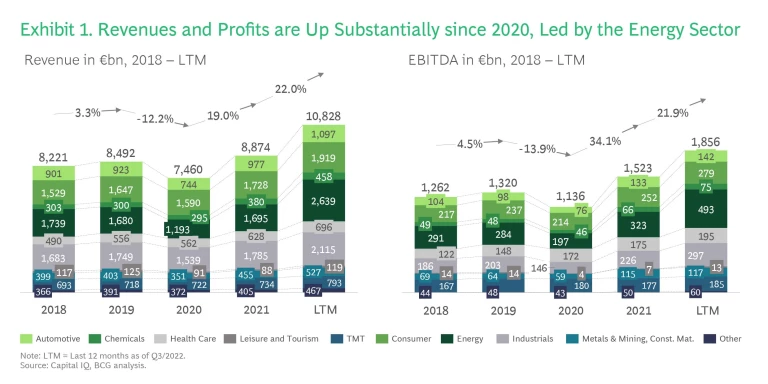

Yet the situation on the business front is not as bleak as this data may imply. While company revenues and profits dipped considerably during the pandemic, they have mostly recovered to well above pre-pandemic levels in the following years. And they continued to grow through the third quarter of 2022 across almost every industry—although the growth rate has slowed somewhat more recently (see Exhibit 1). Equity ratios are currently above historical levels, and cash accounts grew significantly during the pandemic, supported by government programs and company efforts to conserve cash and reduce costs. Taken together, our analysis shows that the number of companies in crisis based on their financial status has declined since 2021.

On the other hand, clear warning signs have appeared on the horizon, possibly indicating that the recent deterioration in economic indicators may gradually affect the business climate. In fact, companies’ cash balances have been declining since the beginning of 2022, while net debt levels have increased to record highs. The quality of that net debt is still significantly above 2020 levels, but below the level of 2018-19, and it has deteriorated recently. Most ominously, fully a quarter of European companies had negative free cash flow in the 12 months through the third quarter of 2022, up from just 17% in 2021.

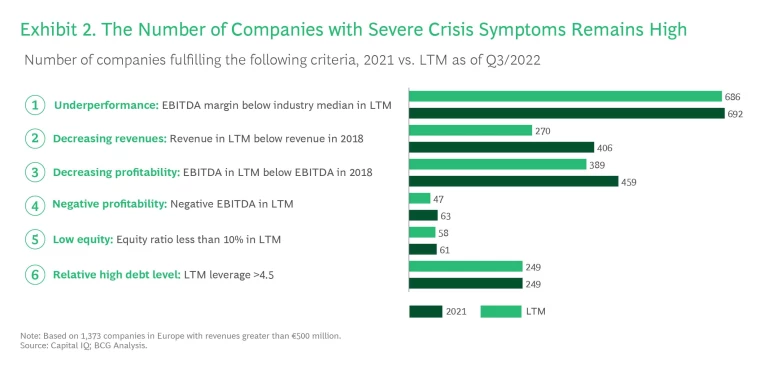

As a result, 12% of the companies studied exhibited three or more crisis symptoms in the 12 months through the third quarter of 2022, such as lower revenues or lower profitability compared to 2018, and EBITDA margins below the industry median. That's down from 2021, when 18% of companies exhibited such symptoms, but still disturbingly high. Of particular concern is the high number of companies that are underperforming compared to their industry median, and those with low equity ratios and high leverage. (See Exhibit 2.)

Ups and Downs

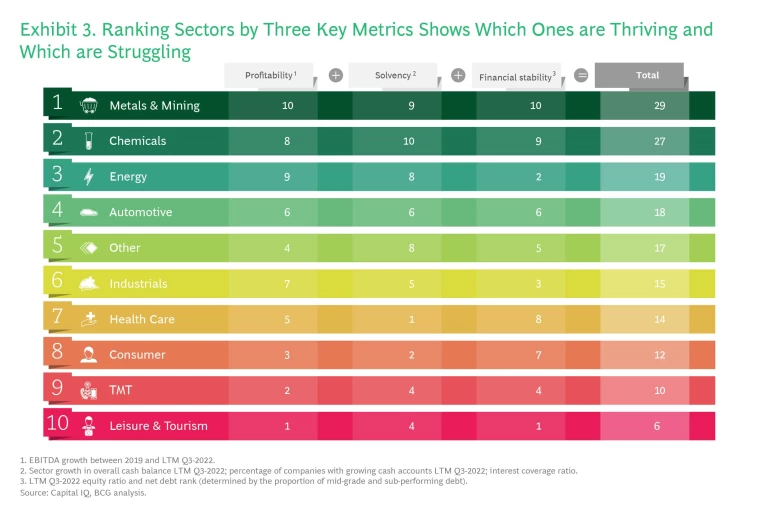

To understand in greater detail the challenges European companies are facing, we ranked nine key sectors by three vital financial metrics: profitability; solvency and financial stability (see Exhibit 3). (The analysis does not include Financial Services because the sectors’ key performance metrics are not comparable to those in non-financial sectors.) The results make clear which sectors have been more successful than others in overcoming the past challenges facing businesses throughout Europe. And they suggest how well prepared they are to prosper in future.

Overall, those sectors providing fundamental inputs for industrial production proved to be the most successful in withstanding the economic challenges during and since the COVID-19 pandemic:

- Metals & Mining. Capitalizing on the surging demand for metals and minerals and price increases from constrained supply in the recent past, this sector scored highly across all dimensions.

- Chemicals. This sector achieved the second-highest score across all metrics, due in part to the widespread demand for its products. Rising energy costs, however, may make the coming years more challenging.

- Energy. Thanks to recent supply constraint and rising prices, this sector’s producers have high profitability and solvency, but financial stability remains a challenge.

Several industries, however, are likely to continue to struggle, for a variety of reasons:

- Consumer. This sector scores decently in financial health but ranks in the lower tier in profitability, primarily as a consequence of strong competition. An economic downturn could prove a challenge if consumers become more price-sensitive.

- Technology, Media and Telecom (TMT). Financial stability is the chief concern of companies in this sector, which is likely to worsen given increasing macroeconomic challenges.

- Leisure & Tourism. This sector has not yet recovered from the effects of the pandemic, despite recent signs of recovery in profitability. And ongoing economic challenges, most notably rising interest rates, remain a concern.

Looking Forward

This ranking of European sectors provides a clear picture of their current status. But the European economy is dynamic, and past performance, as they say, is no guarantee of future results.

While Metals & Mining and Chemicals, for example, have performed well over the past few years, their ongoing success depends strongly on economic developments. A looming recession and rising energy cost could create major challenges if demand declines significantly. Automotive, too, is in a good starting position. But automakers need to master the transition to electric vehicles. Production costs are rising due to inflation, which is affecting all players in the sector, especially suppliers.

Surprisingly, Health Care is not among the strongest sectors, despite the pandemic’s positive impact on its growth. This is due to its comparatively week solvency, with key metrics showing that most of the companies in the sector have seen a recent decline in cash. Leisure & Tourism, despite its recent rebound, is also in a difficult starting position, given the threat of an economic downturn, and companies’ weak operating performance may make refinancing options especially challenging.

In the past, high net debt levels could be maintained, due to very low interest rates and improving operating performance. As interest rates rise, and financing parties growing more risk averse, however, poor financial stability and comparatively weak profitability may make refinancing difficult for some sectors, especially Leisure and Tourism and TMT.

Stay ahead with BCG insights on business resilience

The Resilience Imperative

No matter where they stand now, no sector of the European economy is entirely safe from the vicissitudes of the future. Even as the impact of the pandemic decreases, the Ukraine war shows no sign of ending, inflation remains high, economic growth is slowing, and no one knows what new crisis may arise.

In this light, every company, in every sector, needs to prepare for a highly uncertain future. It’s time to shift from firefighting mode to a mindset focused on maintaining resilience—the ability both to roll with the economic punches and to capture growth opportunities as they become available. To that end, companies should take three key steps:

- Keep cost structure lean. Monitor inflation and adapt cost structure accordingly, reassess the product portfolio, and implement cost-saving programs in the face of a looming recession.

- Secure financial stability. Focus on cash flow management and balance sheet optimization to ensure short-term liquidity and financial stability in the current high interest-rate environment.

- Harvest upcoming opportunities. Ensure topline resilience, review the existing business model and be ready to invest in new opportunities to secure future growth. Shift from a reactive to a proactive strategy that can weather shocks and sustain profitable growth even in turbulent times.

No sector is entirely free from Europe’s currently challenging economic environment. Every company can benefit from a concerted and carefully designed effort to keep the cost structure lean and prepare to capture growth opportunities. To that end, solvent companies should actively look for opportunities, while others should rebuild their financial positions. In both cases, the key is resilience.

The authors would like to thank Idil Alptüzün, Paul Catchlove, Mateo Decormis, Constantin Huesker and Livia Morscher for their contributions to this article.

BCG Transform Index: The European Economy and the Resilience Imperative

Overall, European companies have done well in the past couple of years. High inflation and interest rates remain a challenge, but resilience is the key to further growth.

Explore the BCG Transform Index Country Deep Dives: