For hospitals across Europe, digital capabilities are not a goal or even a means to an end. They are the only way health care providers can achieve their strategic objectives.

In an increasingly resource-scarce environment, hospitals’ priorities range from providing the best quality of care to controlling costs and limiting unnecessary waste to fostering research and innovation. Adding to the pressures: patient satisfaction (as well as that of hospital staff) has become pivotal to hospitals’ survival and success. The future of health care will be centered on the patient and enabled through data. And all provider activities will be centered around the patient journey.

Digitization is the essential enabler for achieving hospitals’ objectives. A use case-based approach can help overcome the sometimes formidable barriers to digitizing care and the other aspects of hospital operations.

The Digital Imperative

Hospitals are complex machines. Multiple functions, both frontline and back-office, need to work synchronously to deliver care to patients, and they all rely heavily on information: patient data, hospital data, and information from other health care players. Lots of roles are intertwined along the patient journey; to provide care, hospitals must interact with other stakeholders, which are often motivated by different incentives.

Digitization both streamlines day-to-day operations and helps achieve key hospital objectives as key trends shape the health care landscape:

- More and more health care players connect into a patient-centered ecosystem, with individual players orchestrating specific steps of the patient journey and improving outcomes.

- Digitization of the operating model flattens rising costs. Internal processes become more efficient and scalable, freeing clinicians to focus on value-added activities. The head of digital transformation at a French hospital put it this way: “Digital initiatives come from a push by the hospital staff; our priority is to give back time to caregivers.”

- Digital brings care closer to patients’ homes, giving hospitals more time and resources to handle complex and high-acuity cases. Telemedicine is becoming an important part of the overall patient journey, facilitating access to care, proximity to specialized services, and personalization of services to individual needs.

- Hospitals lag other industries in addressing environmental, social, and governance requirements, and they need to catch up in the coming years. Digital technologies can help. For example, hospitals can reduce unnecessary transfers of doctors, patients, and caregivers by using televisits and home treatments. A study by Italian business school ALTEMS of 831 televisits at six hospitals in three regions identified 10 tons of CO2 saved. Early movers will gain competitive advantage and unlock sources of value creation through higher retention, lower regulatory risks, higher revenues, and higher valuations, among other factors.

Why Now?

Digital is gaining attention in hospital C-suites for two reasons. First, Europe lags other regions in digitization of health care, and the increasing demand for care, paired with the urgency of cost reduction, makes the status quo untenable. Furthermore, no hospital can look at the push toward value-based care as something to be addressed tomorrow.

Digitization both streamlines day-to-day operations and helps achieve key hospital objectives.

Second, the time is right. The pandemic fast-forwarded patients’ readiness, increasing both their digital proficiency and their acceptance of alternative modes of care delivery. As in-person volumes declined, clinicians experimented with creative means of remote care delivery, progressively overcoming patients’ aversion to change. Investment and investor interest in the health care sector are at an all-time high: according a 2021 report from Market Research Future, the global digital health market is expected to grow at an annual rate of 23%, from $160 billion in 2021 to $1.3 trillion in 2030, driving continual progress in the use of such innovative technologies as predictive analytics, virtual and augmented reality, and image and natural-language processing.

Success and Its Barriers

Moving from a siloed to a networked organization by encouraging providers and departments to work together can help reduce the need for investment; facilitate engagement, efficiency, and implementation through economies of scale; and support data exchange. For example, one hospital network achieved a six-fold reduction in implementation time for its electronic medical records system once it standardized procedures across the group.

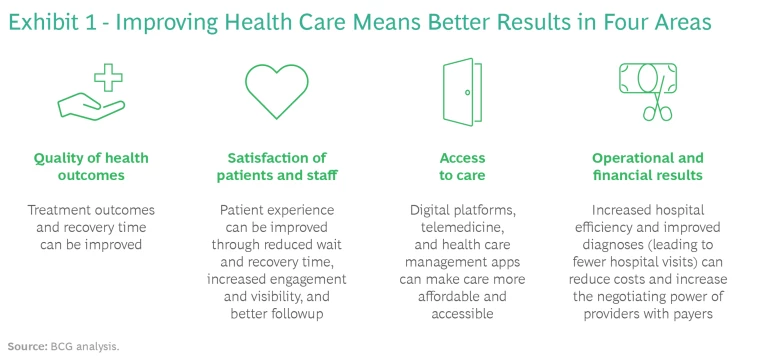

We interviewed senior executives at major hospitals across Europe and the Middle East. They are clear-eyed on the need for digital transformation, but they also have big concerns about the extent and difficulty of the challenge. Success means improving the quality of health outcomes, the satisfaction of patients and staff, access to care, and the hospital’s own operational and financial results. (See Exhibit 1.)

BCG research has shown that 70% of digital transformations fail to achieve their objectives unless six key success factors are in place, only some of which are technological. Hospitals have their own critical enablers. Regulation, particularly with respect to the collection and use of data, needs to put patient benefits at the center. Leadership must be committed to digital implementation. Health care providers at all levels should be involved in the design of digital solutions to ensure that they address actual needs and achieve buy-in. Patients need support in becoming familiar with digital solutions. Identifying the right talent can be a challenge. “We struggle to attract the right talent to implement digitalization in-house,” said the CEO of an Italian outpatient group.

Hospitals need a modern and efficient IT system that enables operations to run fast enough and that can sustain subsequent cycles of digitization. As the CEO of a French hospital told BCG, “Most digital initiatives require building on or replacing existing legacy systems, making the integration complex and costly.”

Transformations cost money, and funding is a big concern. “Hospital margins are increasingly squeezed; we need to maximize every investment,” said the IT director of a UK hospital. Hospitals need to rethink their investment strategies, which will likely include a shift in focus from capital expenditures to operating costs as tech costs become more dependent on cloud-based services than on capital-intensive on-premises computing. Stimulating digitization may require rethinking the tariff systems in place in many European countries as well as European funding.

The time required to make the transition is an additional concern. “We are transforming the internal operations of our hospitals, but I expect the transformation to take at least two to three years,” the CIO of a UK hospital group told us.

The Use Case Solution

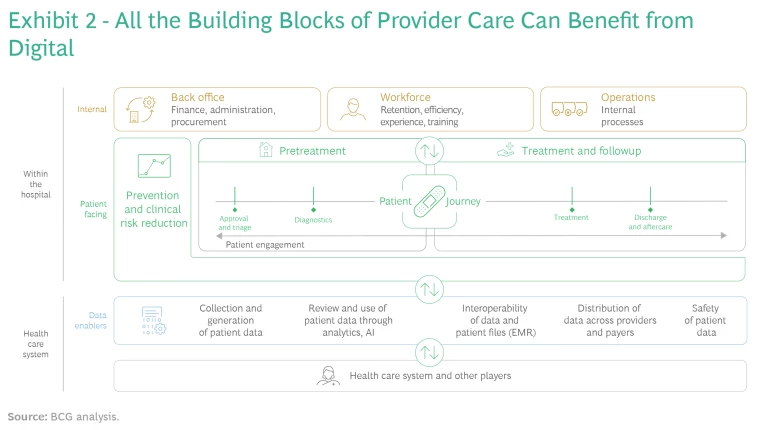

Here’s the good news and the bad news. All the building blocks of provider care can benefit from digital, and hospitals have lots of ways to improve the four key success factors. (See Exhibit 2.) But this makes prioritization hard. The general manager of an Italian hospital group put it this way: “Digitalization could be implemented at every hospital level, but it's impossible to do everything at the same time.”

In our experience, a use case-based approach can break this logjam and start to generate results quickly. The results help build momentum for further change, especially if management sequences the selection of use cases for early payback. Consider a handful of examples:

- A provider network that is part of the UK National Health Service has implemented an innovative system that allows for the early detection of pressure ulcers, which affect 8% to 12% of inpatients and can extend hospital stays by 6.5 days on average. A scanner measures changes in subepidermal moisture from localized edema or accumulated interstitial fluid, reducing the prevalence of pressure ulcers by 27%.

- A digital remote-monitoring app developed by cancer research hospital Gustave Roussy in France has improved quality of care for oncological patients undergoing oral treatments. The app enables patients to record data, upload documents, and contact a dedicated nurse, who can access patients’ dashboards and receive alerts whose priority is determined by a clinical decision support tool. Gustave Roussy has reduced the number of readmissions due to toxicity events from 32% to 23% and the average hospital stay from ten to eight days. There has also been a reduction in treatment-related grade 3 and higher toxicity events, from 36.9% to 27.6%. The app has improved patients’ compliance, which has independently been associated with cost reduction and better survival rates.

- A digital platform developed in Scandinavia allows patients to book appointments online and covers symptom checks, wearables, personal health records, telemedicine, and administrative support. Physicians can use chat services, scheduling software, and patient pathway templates. The platform handles more than 1.5 million online appointments a year while increasing doctors’ productivity from 4 to as many as 10 to 20 appointments an hour, with up to a 7.5% reduction in administrative costs.

- The Italian startup WelMed has been working since 2017 to improve the experience of both patients and doctors through a telemedicine platform that covers the full patient journey, from specialty visits to pre- and post-op care to continuity of care. Since 2020, a partnership with Ospedale San Raffaele has reached 100,000 patients, covering 40,000 bookings and some 450 professionals spanning 40 specialties. Patients appreciate the simple interface, the ability to share medical images, and data security, while clinicians value better communications and the multidisciplinary approach.

- In Spain, hospital groups Quirónsalud and Viamed Salud have streamlined dermatologic triage by involving nurses and pharmacists before patients see a clinician. An initial first assessment is done in person with one of these professionals, which ensures access within 48 hours. Images are sent to a specialist through a dedicated digital channel to ensure a prompt response. Access to care has improved, as has allocation of resources. For example, 75% to 80% of cases are managed at the initial consultation. The ROI for the hospital has been immediate, but much more important, nearly 100% of patients with serious skin injuries go to surgery in less than 14 days.

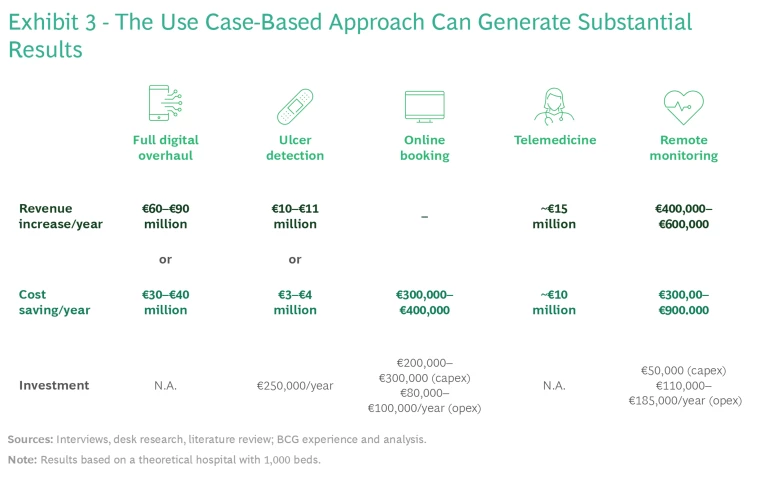

The use case-based approach has shown that it can generate substantial results while blazing a trail toward full digital transformation. (See Exhibit 3.) The key is effective prioritization.

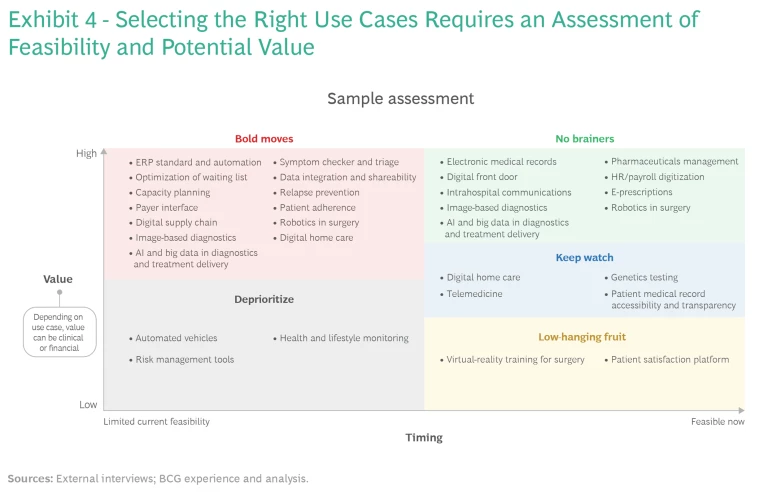

Selecting the right use cases requires assessing the feasibility and potential value of each one. (See Exhibit 4.) This analysis should segment the candidates into higher- and lower-value initiatives and those that are relatively easy to implement and those that are more ambitious. While the actual implementation plan will depend on each provider’s strategic priorities and the results it wants to achieve, the assessment results in a clear roadmap that maximizes impact and limits complexity.

How One Health Care Provider Pulled It All Together

Centro Medico Santagostino (CMS), a network of 31 medical centers in Italy with about €50 million in 2022 revenues, was founded in 2009 with a start-up mentality and limited resources. Its journey to digital was first aimed at containing costs, and its initial goal was to digitize any process that could be handled by an algorithm. From 2009 to 2019, CMS focused on functions that did not require clinician support. It was the first hospital system in Italy to make all calendars available online, offer fast check-in to patients, and allow online payment.

CMS uses an externally sourced software system that management believes enables the highest level of personalization. Customer satisfaction has been measured digitally from day one, first through analysis of complaints and responses to questions regarding experience with the department, overall experience, and value for money and later through a net promoter score tool. CMS has made tens of thousands of survey answers available online to promote the brand’s transparency.

The company’s service center uses WhatsApp to encourage the move from phone calls to chats, with positive impact on effectiveness and efficiency. Invoices are created automatically every month, eliminating the need to manually collect and input information from doctors.

Since 2019, CMS has focused on digitization of clinical processes starting with the easiest use cases. One example of a quick win: requiring that all diagnostic equipment (from individual machines to entire labs) be the best available on the market in order to boost staff and customer satisfaction.

CMS is now tackling its electronic medical records system. Management started by focusing on reporting, which is the most important feature for both clinicians and patients. It then went specialty by specialty to understand specific needs, such as the inclusion of dedicated fields in forms and algorithms relevant to each specialty (such as anthropometric measurements in obstetrics and gynecology).

Initially, to limit physician pushback, this effort included a lot of fields that could be freely filled in, but these have gradually been replaced with closed fields that can be more readily analyzed. The data collected, such as the share of doctors referring patients to physical therapists within the network, is used to gain process insights for more effective management. CMS has started using AI both in clinical settings (supporting doctors in pattern recognition) and in customer relationships (chatbots).

CMS’s journey to digital was first aimed at containing costs, and its initial goal was to digitize any process that could be handled by an algorithm.

In recent years, CMS has moved from relying on external vendors to a fully in-house model, developing its own technology (apart from cloud-sourced services). The initial push was the desire to differentiate itself from competitors and protect intellectual property, in addition to the fact that third-party vendors were not always able to fulfill their requirements. Moving in-house was also consistent with the company’s scale-up model. It took CMS two years to develop the same products as its competitors and then to add the desired functionalities. Management believes its technology is now faster, more flexible, and more cost effective than that of competitors.

The company’s objectives going forward are to become part of the “platform economy,” offering high-value services from third parties (such as Fitbit’s validated algorithm on sleep monitoring), developing opportunities for shared revenues, and accessing noncore expertise (such as research). CMS plans to collect data from all wearables to create a pool of information for clinicians (both prospective and retrospective) over long periods of time.

Food for Thought

Digitization is no longer something to be tackled down the road. Here are six questions hospital leaders should consider right now to get started:

- What is your ambition as an organization over the next five years?

- What are the most effective use cases for your organization that can address your challenges and deliver the biggest value?

- How much operational or clinical benefit can these use cases deliver?

- What is required to implement the use cases?

- How can your organization ensure that potential constraints are not barriers?

- What people and partnerships are required to deliver?

The sooner you start, the quicker you will be on the road to delivering results.