The New Zealand Consumer Sentiment series shares insights from a BCG consumer survey undertaken with our coding and sampling partner, Dynata. The survey aims to uncover how consumer perceptions, attitudes and purchasing behaviours are impacted by the evolving COVID-19 and inflation crisis. This snapshot presents insights from Round 3 of the survey, gathered from 28 August 2023 to 10 September 2023. We have drawn comparisons with research completed in the previous survey rounds (April 2022 and September 2022) and our surveys in other countries. Note that the age ranges used in this analysis are consistent with those used in BCG consumer research around the world. We recognise that other organisations may use different ranges.

As New Zealand’s economy slows and experiences highly inflationary conditions, consumers are increasingly concerned about the country’s economic outlook and their own finances. Consumers are spending more on essentials, have less disposable income and continue to be driven by value. However, sentiment does vary by life stage – with a bright spot in the 52+ age group.

Our analysis found 3 key insights into current consumer sentiment:

- Negative sentiment, caused by high inflation and recessionary conditions, is leading consumers to tighten their belts.

- Young New Zealanders are pessimistic about the future, while New Zealanders aged 52+ remain confident and resilient.

- Value remains the top driver in decision-making across all consumer spending categories.

For local businesses, it will be important to focus on the fundamentals. Pricing, ongoing cost management and personalisation to reflect value for each market segment will be key to resilience in the current economic climate.

This third consumer sentiment report is informed by 1200+ responses from New Zealanders. It aims to support local businesses to understand the latest in consumer sentiment, trends in consumer spending and implications for strategic priorities in the year ahead.

1. Negative Sentiment Is Leading Consumers to Tighten Their Belts

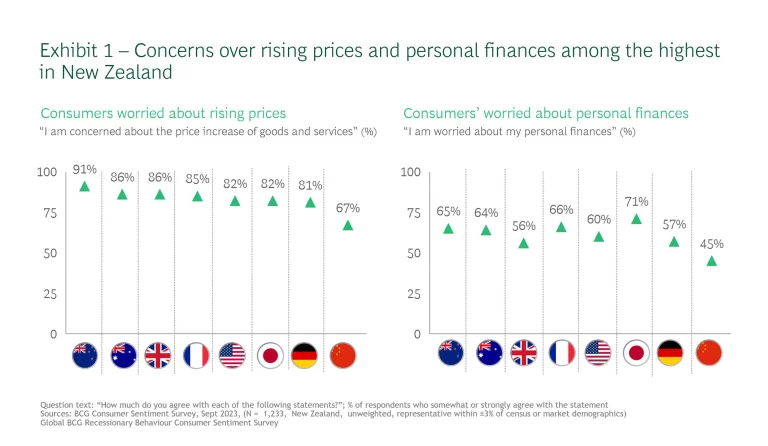

Consumers continue to feel the pinch as inflation remains at elevated levels and the economy balances on the edge of a recession (with Stats NZ restating GDP for the March 2023 quarter to 0% growth). New Zealanders are more concerned about rising prices and their personal finances than many of our global peers. See Exhibit 1.

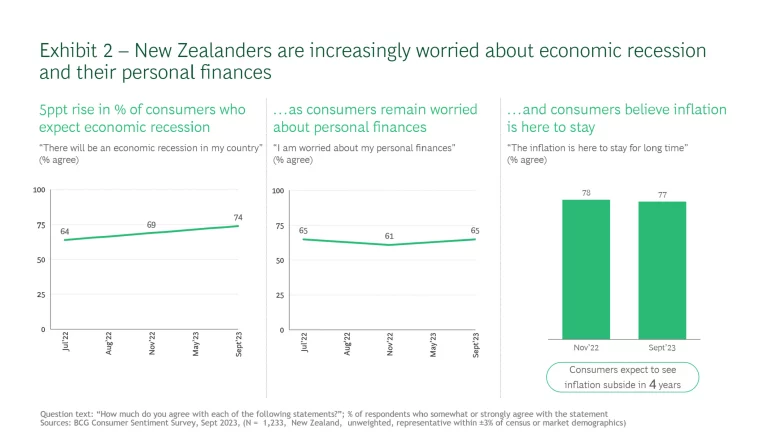

We found 74% of respondents expect a recession in New Zealand, up from 67% a year ago. 65% remain worried about their personal finances and the majority believe inflation is here to stay. See Exhibit 2.

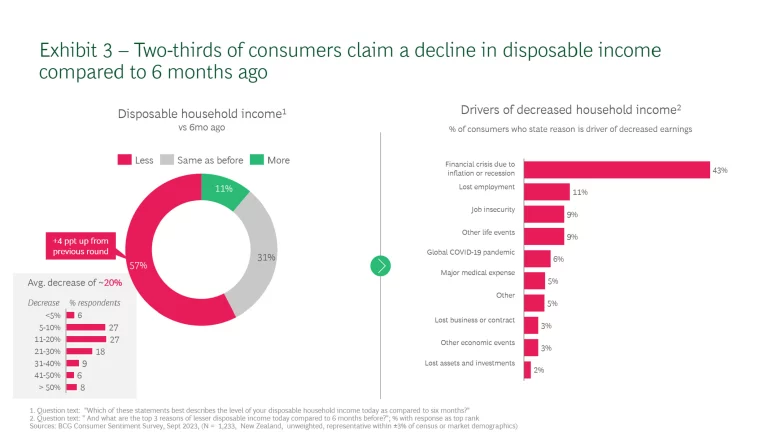

These concerns are not surprising when considering that 60% of respondents said their disposable household income has decreased compared to 6 months ago. The ‘financial crisis due to inflation or recession’ was the most cited driver for this decrease. See Exhibit 3.

As personal finances come under pressure, there has been a 15 percentage point increase in consumers stating they are saving less compared to our survey a year ago. And when asked how their situation has changed in the past 6 months, 63% of respondents state they are now saving less of their household income than they did 6 months ago.

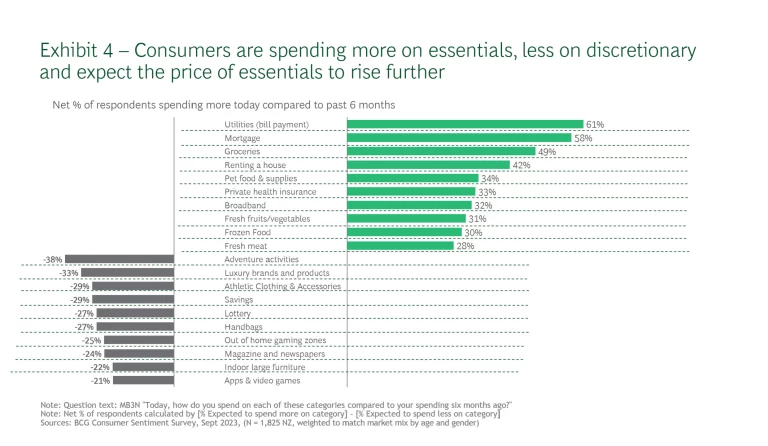

Instead of saving or spending on discretionary goods and services, consumers are spending far more on essentials which are rising in price. When asked to compare current spending with spending 6 months ago, 40%–60% of respondents state they are spending more on utilities, housing (mortgages or rent) and groceries. These figures are up from a year ago, as commodity and labour hikes of the last 24 months are now being passed through to consumers in the form of price increases on goods and services. Over 30% of respondents expect the price of these essential categories to further increase in the next 6 months. See Exhibit 4.

2. Young New Zealanders Are Pessimistic about the Future, While Older New Zealanders Are More Confident and Resilient

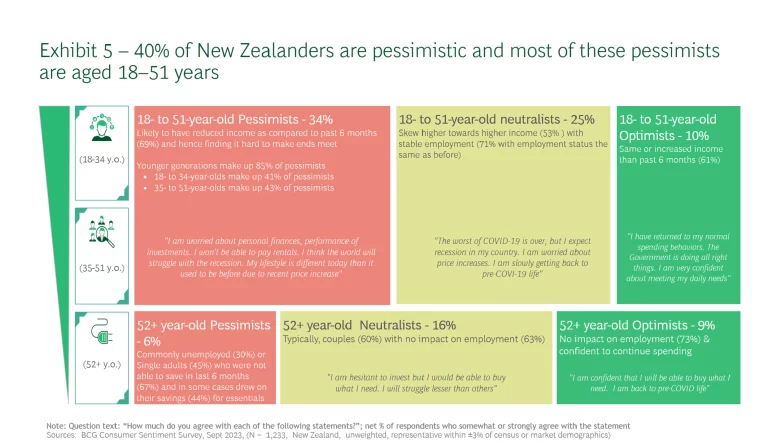

Breaking down the results by demographics, we start to see a divergence between younger and older consumers. Consumers in the 18–34 and 35–51 age groups are generally more pessimistic about New Zealand’s economic outlook and their own personal finances, with 84% of pessimistic respondents coming from these demographics. In contrast, the 52+ age group is more optimistic, making up an outsized portion of positive respondents. See Exhibit 5.

Consumers in the 18–34 and 35–51 age groups are typically facing significant increases in rent or mortgage payments. The pessimistic people in these age groups make up 35% of the broader population. They are highly worried about finances and 87% struggle to meet day-to-day expenses.

The 52+ age group is generally more resilient in its employment and financial position. For business, this group is a bright spot, as it continues to grow its spend on discretionary and health-related goods and services, looks to splurge on travel and in-home leisure and enter new investments. The optimistic 52+ year olds make up 9% of the wider New Zealand population. See Exhibit 6.

3. Value Remains the Top Driver in Decision-Making across All Consumer Spending Categories

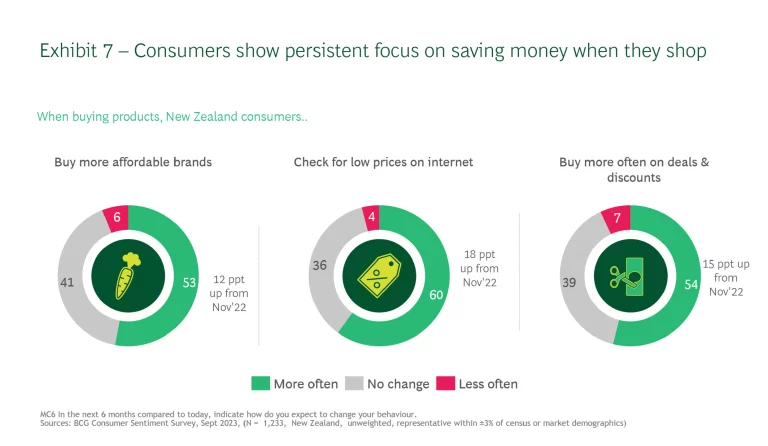

Across all spending categories, ‘value for money’ was the top driver of purchase decisions. New Zealand consumers are increasingly looking to purchase from more affordable brands, check for low prices online and buy on a discount. See Exhibit 7.

For the 18–34 and 35–51 age groups, this focus on value is tied to an increase in the use of digital channels to research prices, purchase goods or arrange services. The 52+ age group is returning to in-person purchasing post-COVID as they search for value linked to quality and reliability, not price alone.

Action for Local Businesses: Focus on the Fundamentals

Even through economic downturns, leading companies can build competitive advantage, grow revenues and increase margins to open a performance gap versus their peers, according to BCG’s global research. We expect this to be true for consumer businesses in New Zealand too; those that focus on the fundamentals to meet the needs of value-seeking consumers or the optimistic and growing silver economy are likely to outperform.

To respond to our current landscape, we recommend 3 key actions for businesses:

- Focus on pricing. Businesses need to consider their pricing strategy and position in the market to win value-seeking consumers. They need to ensure their offer is competitive and accompanied by a well-designed and executed promotional program, and the rationale for any required price increase is clearly communicated to customers. See BCG’s recent articles the Unified Theory of Pricing and Smarter Retailer Promotions for a Saturated Market to learn more.

- Manage costs. Businesses need to react to downward trends in global commodities and freight to mitigate local labour and utility cost increases, and therefore reduce the need to pass on further price increases to consumers. While internal efficiencies should be explored, BCG research found the most effective approach is a holistic and programmatic cost transformation that uses the impetus of immediate saving to address existing structural issues and build long-term resilience.

- Personalise the offer. Businesses must present offers that meet the needs of consumers in the current landscape – delivering low-priced affordability to the 18–34 and 35–51 age groups, and long-term quality value to the 52+ age group. Getting this right relies on 4 elements: a clear personalisation strategy along the customer journey; advanced data and analytics to deliver customer insights; scalable and modular technology investments; and a broader reset of ways of working within the organisation. See BCG’s article on personalisation for more information.

The authors are grateful to a number of colleagues for their support and assistance. They include Julie Nguyen and Paul Sutherland for marketing, Rebecca Diepenheim and Debbie Spears for design and layout, and Charvi Aggarwal for web design and upload.