As the supply of renewable energy rises and the price drops, companies are increasingly looking to renewables for cleaner sources of power. That’s because clean energy isn’t just a major component of the fight against climate change—it’s also an important competitive advantage, reducing energy costs, boosting reliability, and improving strategic positioning.

Clean energy isn’t just a major component of the fight against climate change—it’s also an important competitive advantage.

Judging from our analysis of this year’s ESG Data Convergence Initiative (EDCI) data, the private equity model is effective at driving growth in renewables adoption. Still, PE firms can do more to help their portfolio companies capitalize on the opportunities associated with increased use of renewable energy.

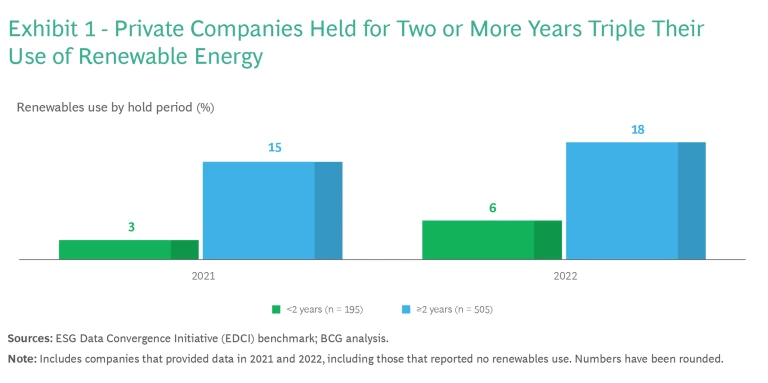

Consistent with last year’s EDCI findings, private companies continue to trail public ones in terms of overall renewable energy use. But while portfolio companies early in a PE hold period had low levels of renewable energy uptake, companies held for more than two years had an average of three times that level. And even though companies in the Americas continue to trail those in the EMEA (Europe, the Middle East, and Africa) in their overall renewables use and growth rate, recent legislation in the US (notably, the Inflation Reduction Act) is likely to provide significant incentives for businesses to increase their adoption of renewable energy.

Detailed analysis of these findings illustrates the important role that PE firms can play in helping companies make the transition to renewable energy —and the value of doing so.

Adopting Renewables

Where do private companies held by PE firms stand with regard to their renewable energy use? The story told in the results of the second year of EDCI data is mixed. On one hand, private players continue to lag their public peers overall: the median private company that used at least some renewable energy derived 27% of its energy from renewable sources, compared with 36% for public companies. This reflects public organizations’ greater sophistication and experience in renewable energy procurement as well as their advantage in negotiating renewable energy contracts, owing to their generally larger size. On the other hand, this year’s data further supports the idea that private equity is well positioned to be a driver of clean energy adoption—and here, the news is considerably more encouraging.

The results show that companies early in a PE fund’s hold period do indeed continue to have very low levels of renewable energy use—just 6% on average, much less than their public peers. But companies that have been held for two years or more include an average of 18% renewables in their energy mix. (See Exhibit 1.) Clearly, PE firms are beginning to see the commercial value of increased renewable energy use and are driving change over the course of their investment period.

When considering the PE investment class’s performance on this topic, what matters should not necessarily be a portfolio company’s performance at the time of a firm’s investment, but rather the level of progress that a company makes over the lifetime of the PE hold period. This data shows just how powerful the PE investment model can be in increasing renewable energy use.

Making Progress

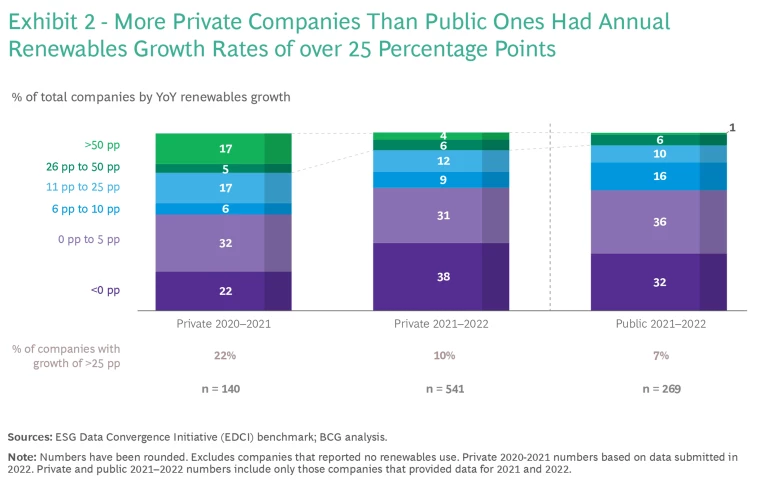

Private companies are moving forward in their uptake of renewable energy. Use of renewables by private companies didn’t grow as quickly as it did in 2021, likely because many early adopters that increased their renewables use at a particularly rapid rate in 2021 were unable to replicate that feat, having already transitioned a substantial portion of their energy use to renewable sources. In addition, there were significant imbalances in the renewable energy market in 2022, with overall demand exceeding supply. This means that, although 22% of private companies improved their renewable energy use by more than 25 percentage points from 2020 to 2021, only 10% did so from 2021 to 2022. But even this lower proportion exceeded that of companies in the public markets. (See Exhibit 2.)

Still, it’s clear that when boosting renewable energy use is a strategic focus, private companies can drive remarkable change. And while almost 90% of the businesses experiencing this level of renewables growth are based in Europe, they span a wide array of sizes and sectors. Indeed, rapidly increasing renewables use is an opportunity available to all companies, no matter how big they are or which sector they operate in.

Regional Differences

Last year’s results showed that private companies in Europe had achieved significantly higher levels of renewable energy adoption than their peers in the Americas. This year’s results reinforced that trend, with European companies increasing their renewables use by 3 percentage points, on average, during the last year, while those in the Americas remained flat. This is likely the result of the greater availability of renewable energy in Europe—and the greater regulatory pressure and incentives to use it. Moreover, the war in Ukraine has created additional pressures on European nations to boost their renewable energy supply.

This trend may change, however, as the US Inflation Reduction Act (IRA) and Infrastructure Investment & Jobs Act (IIJA) unlock new supplies of renewable energy and create more opportunities to reduce energy costs for privately owned businesses in the US. The increase in the supply of renewables is particularly important given that demand has outstripped supply in recent years. Taken together, the IRA and IIJA allocate more than $169 billion for renewable energy technologies alone.

Much of the renewable energy cost benefit produced by these acts stems from the extension of tax credits, specifically the investment tax credit, which lowers the expected long-term cost of renewables relative to other energy sources. The legislation also has the potential to bring significantly more renewable electricity generation onto the grid, providing companies with greater opportunities to source clean energy. According to BCG analysis, the combined effect of the IRA and IIJA could drive up the share of renewables—not including nuclear energy—consumed in the US from 20% in 2020 to 60% to 70% in 2030. PE funds can gain an advantage by rapidly increasing their portfolio companies’ renewable energy use, thus helping them close the gap with their European counterparts.

Commercial Potential

No matter what region they operate in, PE funds have a unique opportunity to support their portfolio companies in leading the transition to renewable energy. Doing so can allow them to deliver environmental impact and build competitive advantage for their businesses, in three ways:

Lower and More Stable Energy Costs. We have reached the tipping point at which many renewable energy sources now have a lower expected long-term cost relative to other energy sources, while benefiting from relatively stable long-term pricing. For example, Invest industrial worked with PortAventura World, a destination resort and amusement park company, to set its sustainability strategy and help it increase its use of low-carbon energy sources. As part of the effort, the company developed a 7.5 MW solar plant at the resort, which allowed it to avoid 4,000 tonnes of carbon dioxide equivalent (tCO2-e) every year and enable energy savings equivalent to a return on capital employed of 20%.

It is important to note, however, that achieving such savings depends on a variety of factors, including a company’s current level of renewables use and geographical location. As companies reach high levels of renewables use, it becomes increasingly difficult to generate cost savings for on-demand energy needs.

- Greater Reliability. Given the recent disruptions in traditional fuel markets—the result of several factors, including the pandemic, more frequent extreme weather, and the war in Ukraine—companies’ ability to ensure the reliability and resilience of their energy sources will likely only grow in importance. Renewable energy has an important role to play in this regard. For individual companies, effective deployment of renewables onsite, such as solar and storage, can provide a consistent supply of clean energy in the event of a grid disruption. For grid operators, the addition of renewables and energy storage further diversifies the grid and makes it more reliable, which in turn benefits all businesses that use it. An analysis by PJM Interconnection, a major US regional grid operator, showed that including wind energy in its natural gas–driven grid makes it more reliable and resilient to extreme weather than portfolios with gas-only generation.

As more and more large companies make robust Scope 3 decarbonization commitments, sustainability has become an increasingly important factor in their purchasing decisions.

- Improved Competitive Positioning. As more and more large companies, in a wide range of B2B and B2C markets, make robust Scope 3 decarbonization commitments, sustainability has become an increasingly important factor in their purchasing decisions. Businesses that form part of their supply chains, which are often owned by PE firms, and that can boost their renewables use will gain real competitive advantage. For example, as part of a broader decarbonization push, Apple has set a 2030 goal of ensuring that its suppliers use 100% renewable energy to produce its products. The company has also stated that “progress toward these goals will be a crucial part of the criteria [Apple] consider[s] when awarding future business” and that renewable energy use would be on par with product quality and cost.

While the commercial rationale for increasing renewable energy use is compelling, doing so can be complex, considering the many competing priorities for CEOs in 2023. Companies face numerous challenges when making the decision to switch from traditional to renewable forms of energy. These include whether to use onsite or offsite generation options, regional market variations in policies and availability, which partners to contract with, and how to allocate capital expenditures.

In making renewable energy procurement decisions, companies should balance their energy demands with their sources of supply to optimize emission levels, supply consistency, and cost. Executing this effectively requires businesses to navigate a complex procurement process. They need to determine what their options are given their location (the availability of renewable energy, for example) and understand how much electricity can come from onsite sources compared with offsite ones. They also need to optimize their load profile—the amount of electricity used in their operations—to minimize both costs and emissions. Contracting considerations are also a factor, including how to contract for onsite generation versus using physical or virtual power purchase agreements (PPAs). Furthermore, there are execution concerns such as whether to procure the energy through a utility, broker, or developer. As companies make these decisions, they need to consider the amount of capital they can allocate and how they can deploy it most effectively.

To successfully drive change on renewables use, businesses should first develop an understanding of their current and future electricity needs. Then they can optimize their energy mix using onsite, offsite, and virtual options to reach their emissions targets. Finally, they need to identify the most appropriate and relevant partners to help them execute on their goals.

Evidence from the second year of the EDCI shows that PE firms continue to harness their long-term mindset and operational control to generate significant improvements in renewable energy use among their portfolio companies. But there is considerable room for improvement. With favorable public policies increasing the availability of renewables and lowering their cost, PE firms and their portfolio companies that act quickly can take advantage of this opportunity and become leaders in renewable energy use. By supporting their portfolio companies in making the transition to renewable energy, PE firms can deliver outsize environmental impact while ensuring that their companies gain a real competitive advantage.

Sustainability in Private Equity, 2023

Hundreds of PE firms have reported data detailing the progress that their portfolio companies are making on social and climate-related issues. The results are encouraging.