The conversation around sustainability in the private markets has intensified considerably in the past year. Even as some critics accuse the industry of greenwashing, others express concerns about whether private equity firms are prioritizing sustainability objectives over financial returns.

In hopes of shedding light on the real status of sustainability in the industry—and perhaps reconciling these two opposing points of view—we offer BCG’s first annual “Sustainability in Private Equity” report. Following up on last year’s initial analysis of early data from the ESG Data Convergence Initiative (EDCI), this year’s report offers a considerably more detailed picture of the PE industry’s current performance on social, energy, and sustainability metrics. Deep dives into decarbonization, renewable energy use, and social considerations offer insights into the importance of these key metrics as indicators of business excellence, how performance is changing over time, and how it is connected to financial outcomes.

Read the “Sustainability in Private Equity” report's deep-dive chapters:

Private Equity’s Pivotal Role in the Climate Battle

Private Equity Is Making Gains in Renewable Energy Use

Launched in 2021, the EDCI is a coalition of 350 major PE general partners (GPs) and limited partners (LPs), led by a steering committee chaired by The Carlyle Group and CPP Investments. The initiative’s mission: to drive convergence around meaningful metrics for the private markets and generate useful, comparable, performance-based data.

The EDCI has made strong progress in this regard. With more than 62,000 data points collected from around 4,300 PE-backed companies, we now have a broad understanding of how the private markets currently compare with the public markets across a variety of topics. (See the appendix, “About Our Research.”)

The results show that, to date, the performance of privately owned companies on sustainability topics relative to their public peers is mixed, outperforming in some areas and lagging in others. And while it continues to be early days for this analysis, we are beginning to see evidence of effective links between sustainability performance and financial outcomes.

Meanwhile, there is now strong evidence that the PE investment model—which can effectively transform financially underperforming, unloved companies—can work to improve sustainability outcomes as well. As we noted in a 2022 article in the Harvard Business Review, PE firms’ high degree of control and long-term perspective can have a powerful impact on portfolio companies’ sustainability and create stronger business outcomes. This year’s EDCI results support this view: we see significant improvement in several metrics over the lifetime of companies’ ownership by PE firms.

The PE industry is uniquely positioned to drive change on sustainability issues—creating value for investors and stakeholders alike.

We believe this report makes clear that PE firms are uniquely positioned to drive change on a variety of sustainability topics. But there is much work to be done. As the global economy transitions in the coming years to become more sustainable and inclusive, PE investors have a unique opportunity to effectively deliver sustainability performance gains that drive positive business outcomes, for investors and other stakeholders alike.

Appendix: About Our Research

Appendix: About Our Research

In our inaugural analysis, the EDCI data set included data from 105 private equity funds and nearly 2,000 portfolio companies. Building on last year’s momentum, the 2023 data set nearly doubled that response rate, with about 185 GPs and 4,300 portfolio companies contributing more than 62,000 individual data points.

The increased participation this year has resulted in an even more diverse benchmark data set of companies in the private markets—across regions, sectors, and company size—allowing for a closer comparison with the universe of publicly traded companies. While coverage of the US and Europe remained strong, there was also significant growth in responses from other regions, notably Asia-Pacific: triple the number of portfolio companies in that region submitted data compared with last year.

The diversity of industries within sectors also increased, especially in the financial services, renewables, and extractive and minerals processing sectors, and now reflects the makeup of the overall universe of private companies with reasonable accuracy. In addition, the proportion of companies contributing multiple years of data more than doubled this year, to 46% from 22% last year, allowing for a more detailed analysis of ESG trends over time.

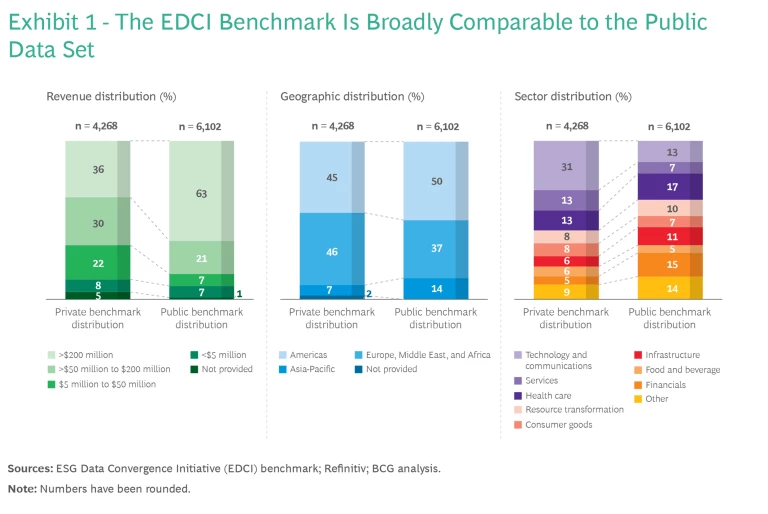

The data set for the public markets was drawn from over 6,000 comparable public companies across major stock exchanges, sourced from Refinitiv. Companies with market caps above $2 billion were excluded to allow for a more accurate comparison with the EDCI benchmark; still, the two data sets are not entirely equivalent, as Exhibit 1 shows. The average private company in our data set is somewhat smaller, and more likely to be in the technology and services industries, than the average public company.

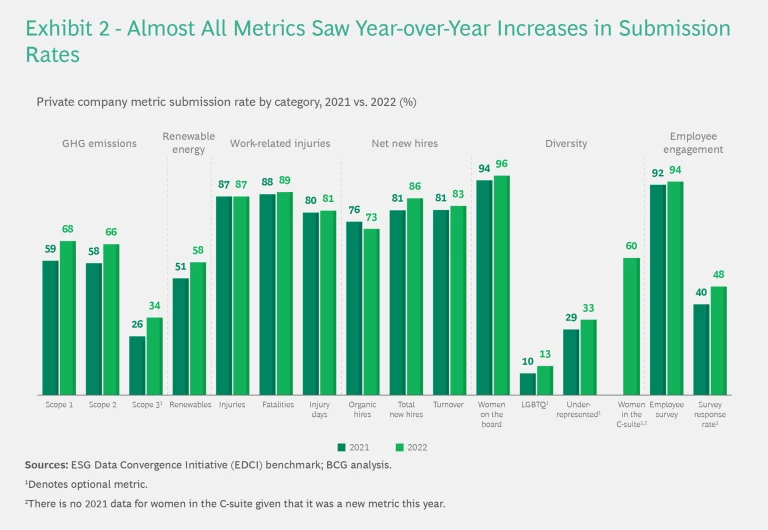

In the EDCI’s first year, more than 80% of portfolio companies submitted data for the majority of the EDCI’s mandatory metrics—which companies were required to submit if they had them. This year has seen continued progress; the number of companies submitting mandatory data increased by an average of 3 percentage points. This suggests that, in its second year, the EDCI continues to be instrumental in encouraging the collection and tracking of consistent ESG metrics.

While response rates on environmental metrics continued to trail those regarding social issues this year—likely because of the difficulty and complexity involved in collecting this data—they improved considerably. Rates for both Scope 1 and 2 emissions metrics, for example, rose by nearly 10 percentage points. And 60% of portfolio companies submitted data for women in the C-suite, a new metric for 2023. (See Exhibit 2.)

The EDCI benchmark has been shared with all participating GPs and LPs for their internal use through an online platform, with firms able to conduct their own customized analysis of the benchmark. For 2023, a number of additional useful functions (including the ability to cut the benchmark at more granular subsector levels and visualize it on third-party platforms) have been introduced.

As more GPs and LPs join the EDCI, the data will become even more useful and the insights even stronger. If you are interested in learning more:

- Visit this

website for more information about the initiative, including how to participate. - Contact the EDCI with any questions at

info@esgdc.org .

Sustainability in Private Equity, 2023

Hundreds of PE firms have reported data detailing the progress that their portfolio companies are making on social and climate-related issues. The results are encouraging.