Tremendous changes are taking place in markets around the world. Global growth is slowing, geopolitical conflicts are intensifying, and the long-term effects of COVID-19 are increasingly apparent, boosting uncertainty and altering insurance customers’ needs and behaviors. In addition, technologies are developing rapidly—including those that are fueling the metaverse and digital assets such as cryptocurrencies. Insurers must respond to these shifts—adjusting their product, customer, and channel strategies in every market.

BCG organized a survey of more than 13,000 insurance customers across 13 markets to gain more insight into the impact of these changes. (See “Our Methodology.”) By combining the results with input from our global network of experts, we identified and analyzed three important shifts in customers’ requirements and behaviors along with some compelling facts about individual markets around the world.

Our Methodology

The purpose of the survey was twofold. First, it was to generate quantifiable customer insights regarding property and casualty, life, and health insurance. Second, it was to identify future growth opportunities for insurers around the world. Our analysis of participants’ responses informed our understanding of their current insurance coverage and needs, as well as the channels they use and the best touch points. We also gained insight into how their insurance choices are shaped by their perspectives on environmental, social, and governance factors; the metaverse; and embedded insurance.

Three Key Trends

Our survey finds that three key trends are occurring worldwide: customers are becoming relatively risk averse, omnichannel journeys are increasingly the norm, and innovative insurance products and channels are gaining in popularity, especially among the younger generations.

Risk Aversion

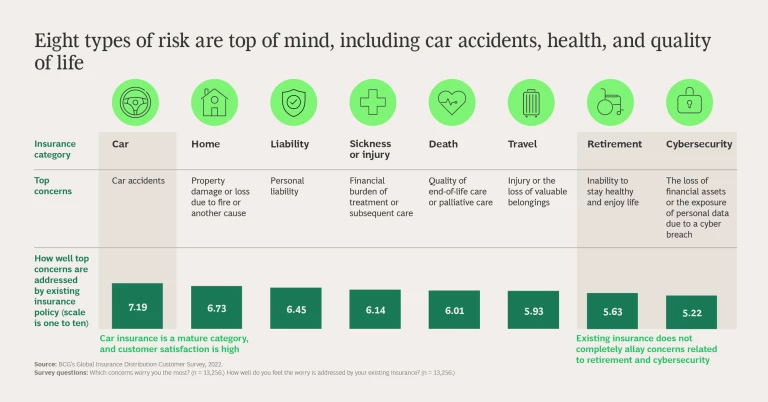

Insurance customers everywhere are avoiding risk more and more, largely owing to concerns about an uncertain future. Top-of-mind risks for respondents are car accidents and property damage, as well as potential health care costs and the quality of end-of-life care. In addition, many respondents expressed concern about retirement risks and cybersecurity, saying that their existing insurance does not fully allay their concern.

Variance by Affluence. We find that the most risk-averse respondents are in the affluent-plus category (those with investable assets of more than $1 million). Their demand for all types of insurance is stronger than that of less-affluent respondents—particularly for life insurance policies. Affluent-plus respondents have, on average, 3.9 insurance contracts per person, compared with 3.2 per mass-affluent respondent (one who has investable assets of $100,000 to $1 million). Mass-market respondents (those with investable assets of less than $100,000) have 2.7 policies, on average, per person.

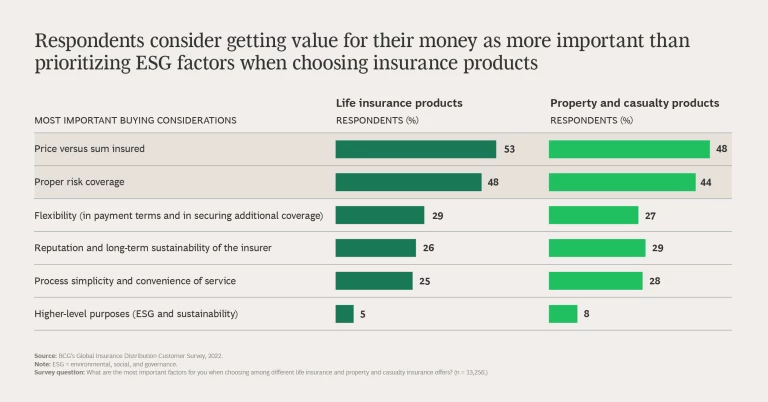

Key Buying Factors. Getting value for their money is essential to many respondents when purchasing insurance, although younger respondents—those in Gen-Z (ages 18 to 25), in particular—are less sensitive to price than older ones when it comes to both life and property and casualty insurance. In general, the customers we surveyed tend to compare prices and products among two or three offers. Meanwhile, younger respondents care more about product flexibility and the customer experience in the sales and claims process than do older ones.

Sustainability, in contrast, does not rank highly among buying factors. Forty-six percent of those surveyed said that environmental, social, and governance (ESG) factors and sustainability are important to them. However, only 5% choose ESG factors as the most important criteria when buying life insurance, and only 8% cite it as an important factor when purchasing property and casualty insurance. Sustainability has a long way to go before truly affecting purchasing decisions.

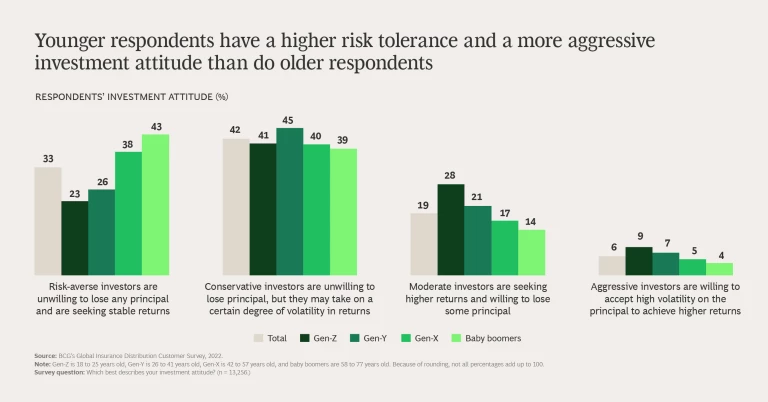

Investment Attitudes. When it comes to investing via insurance products, respondents around the world are fairly risk averse. The Japanese customers we surveyed self-identified at the high end. In fact, 83% of Japanese respondents are risk-averse investors, compared with 68% of those in the US—the country with the least risk-averse respondents.

Younger generations, in turn, have an understandably higher risk tolerance and a more aggressive investment attitude than older generations. (See the slideshow “Risk Aversion.”)

Omnichannel Prevalence

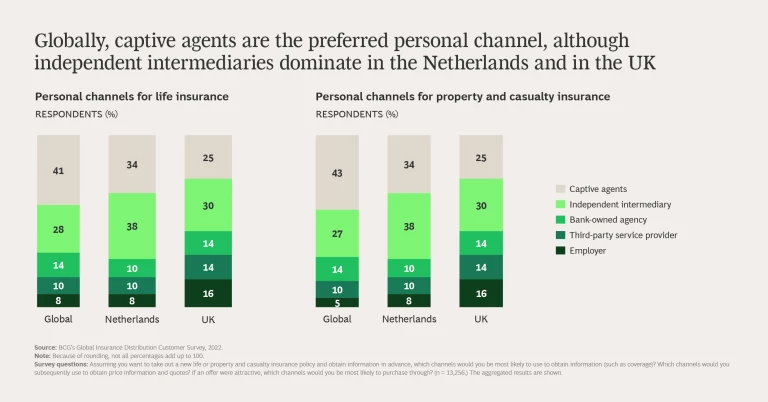

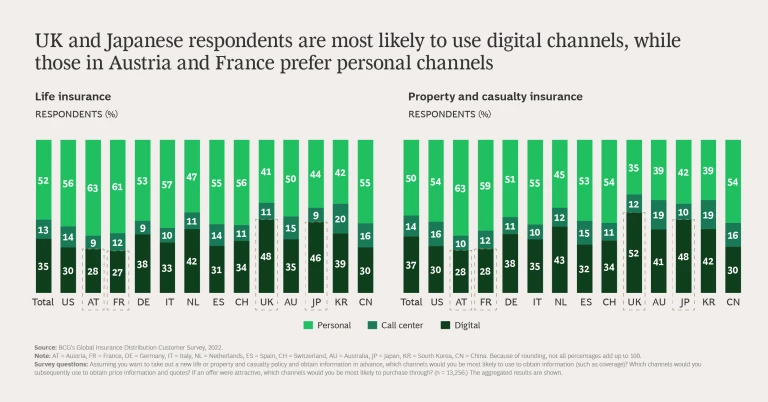

Omnichannel journeys are becoming the norm worldwide; many insurance customers are moving easily between online and offline interactions. Personal channels are still the most popular, especially for purchasing a policy. Captive (or tied) agents tend to dominate that category, although independent intermediaries are gaining traction in many countries. But digital channels are growing in popularity. More than a third of respondents said that they prefer collecting and comparing quotes online, and they would rather perform research digitally than by interacting with an agent in a call center.

The preference for digital channels varies among countries, of course. The UK and Japanese markets lead the way, while Austrian and French respondents currently still tend to prefer personal interactions.

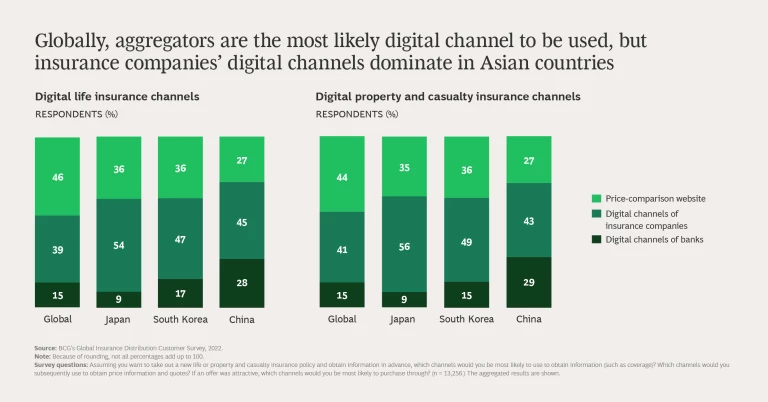

Among digital channels, price-comparison websites, or aggregators, tend to dominate globally for both life and property and casualty insurance, with respondents preferring to use them over the individual digital channels of insurance companies or banks. Respondents in Japan, South Korea, and China, however, tend to prefer the digital channels of insurance companies. (See the slideshow “Omnichannel Prevalence.”)

Innovation Readiness

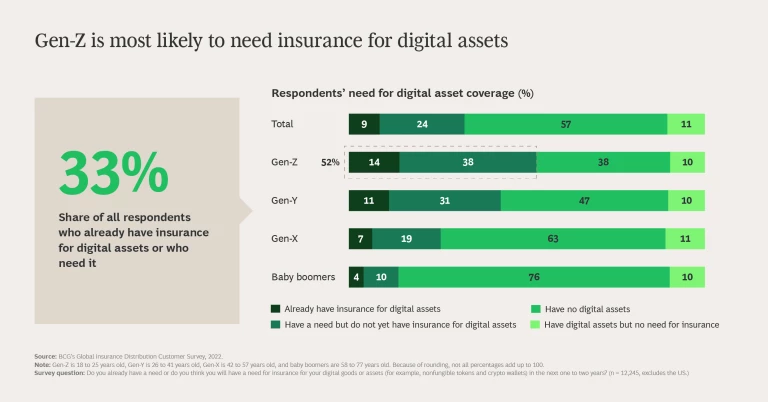

It seems that younger generations—Gen-Z and Gen-Y (ages 18 to 25 and 26 to 41, respectively)—are the most open to innovation in their insurance interactions and products. They are the most likely to purchase insurance from a virtual insurance agency in the metaverse (a virtual reality space) and to buy insurance for digital assets, such as cryptocurrencies. Although just 18% of respondents worldwide said that they can imagine purchasing insurance in the metaverse, 30% of those in Gen-Z and 25% of those in Gen-Y are willing to do so (excluding US respondents). Meanwhile, more than half of Gen-Z respondents said that they need insurance for digital assets, compared with 33% of respondents globally (excluding those in the US).

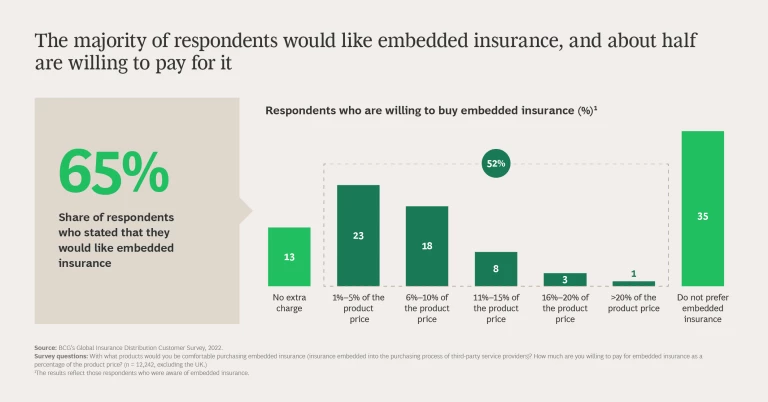

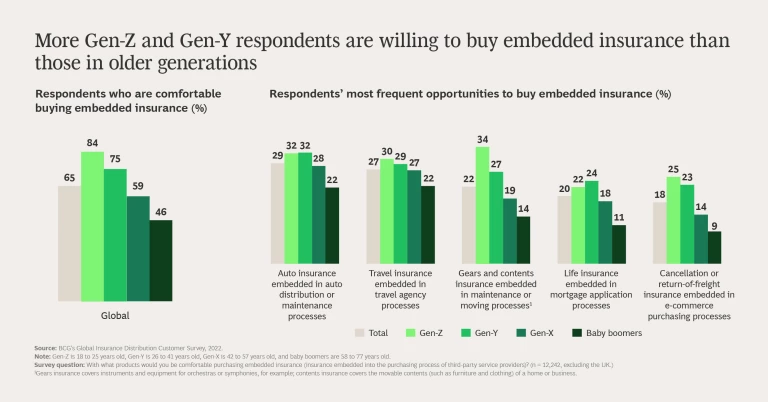

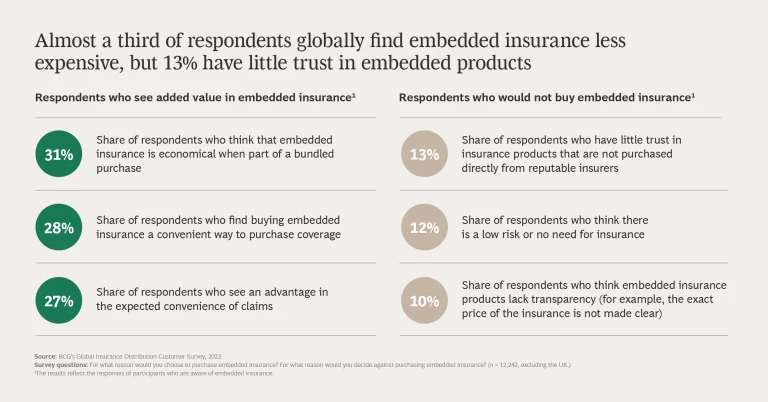

About 65% of respondents globally (excluding the UK) said that they would purchase embedded insurance—policies that are included in or added to the item purchased. For example, airlines often offer customers cancellation insurance when they are purchasing tickets. Younger generations are particularly interested in embedded insurance, with 84% of Gen-Z and 75% of Gen-Y respondents saying that they would buy such a product. And 52% of non-UK respondents who are aware of embedded insurance said that they are willing to pay for it, although the amount they would pay varies from just 1% to more than 20% of a product’s price. At the same time, about 13% of those surveyed said that they have little trust in embedded products, preferring to purchase directly from reputable insurers. (See the slideshow “Innovation Readiness.”)

Market-Specific Trends and Insights

Certain facts stood out when we analyzed the survey results for individual countries, and we highlight just a few of these facts here. Note that we asked some questions only in specific countries; therefore, comparative global numbers are not available.

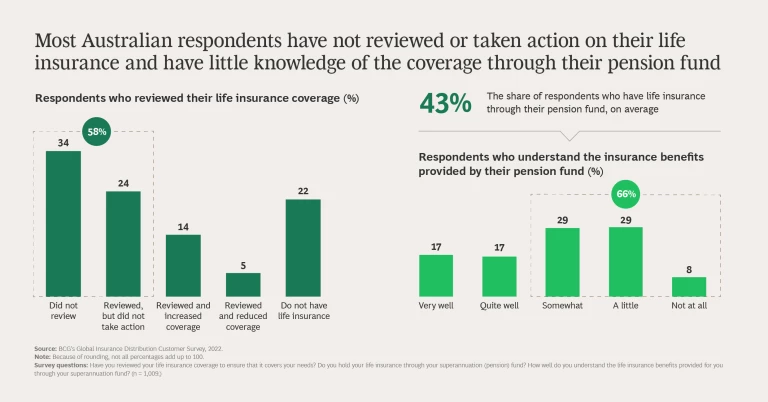

Australia. For 39% of Australian insurance respondents, we find that an offer of loyalty or rewards programs is likely to have a positive impact on purchasing decisions. This is especially true for younger and wealthier buyers. Fifty-six percent of Gen-Z respondents and 71% of affluent-plus respondents are likely to be influenced by such offers. Separately, most respondents in Australia do not review the life insurance bought by their pension fund or take any action on the related coverage—even though nearly half of those surveyed (and 66% of the affluent plus, specifically) have purchased their life insurance through these funds.

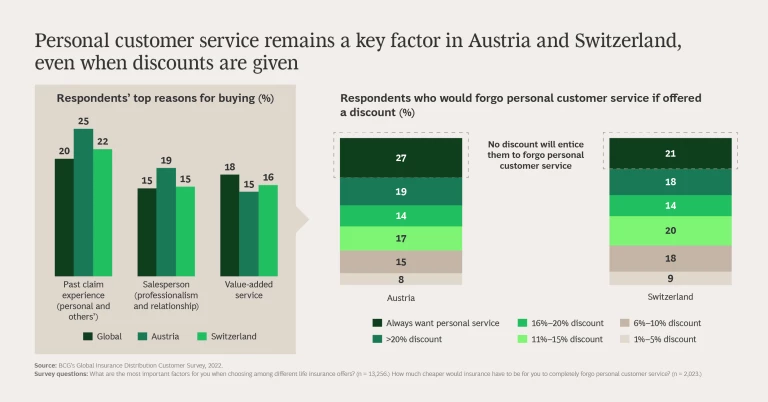

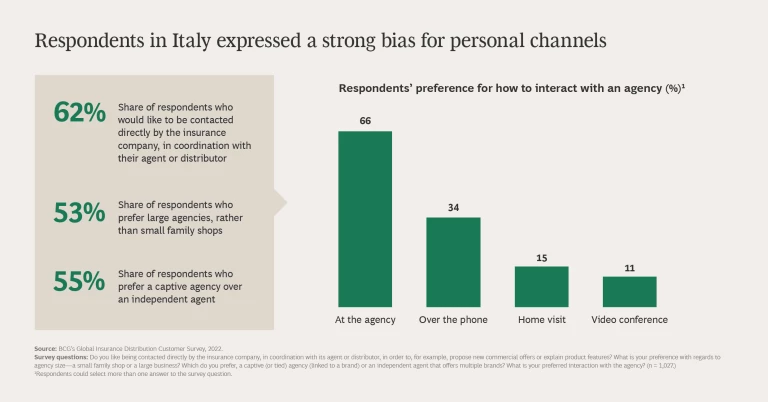

Austria, Switzerland, and Italy. In Austria and Switzerland, we find a strong preference for personal customer service, with more than 20% of respondents stating that no discount would be enough to persuade them to use a different channel. This feeling is especially strong among the baby boomers (42% of the respondents in Austria and 34% in Switzerland). Similarly, Italian respondents have a strong preference for personal interactions, with 66% saying they would prefer to go to an agency than interact over the phone or on video.

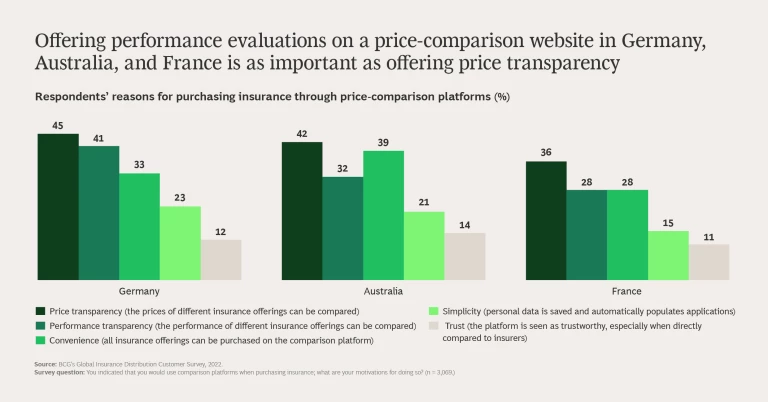

Germany, Australia, and France. In Germany, service calls are particularly effective; in fact, about 50% of Gen-Z respondents in Germany have bought additional insurance products through a service phone call. And we find that German, Australian, and French respondents have something in common: they think that insurers offering performance evaluations on a price-comparison website is just as important as offering transparent pricing.

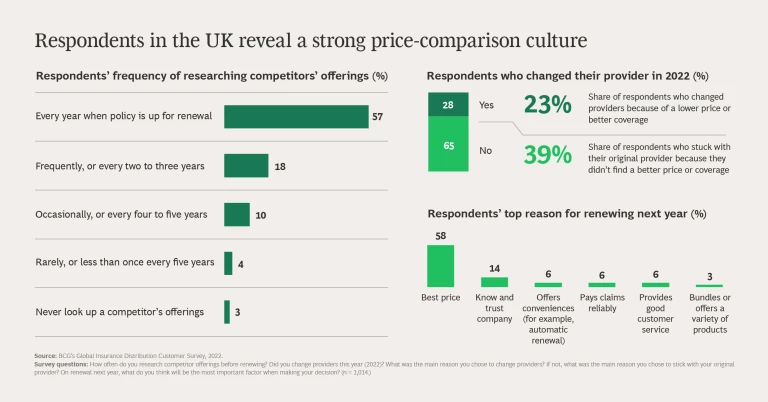

The UK. In the UK, we find a truly powerful price-comparison culture. In fact, the average UK respondent compares three or more offers before buying insurance, and more than half said that the price is the most important factor in their decision to renew their insurance in 2023.

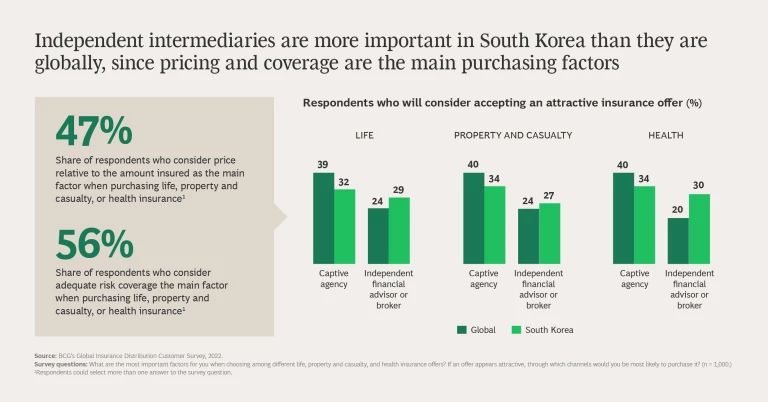

South Korea, China, and the US. In South Korea, we find that the typical respondent prefers using independent intermediary channels (specifically the general agency channel), rather than employing a captive agency. As a result, insurers’ agency channels are struggling with downsizing and with agents leaving for the general agency channel. To gain a foothold in the rapidly growing general agency channel and to retain agents, insurers are entering it directly or indirectly—through acquisition or investing.

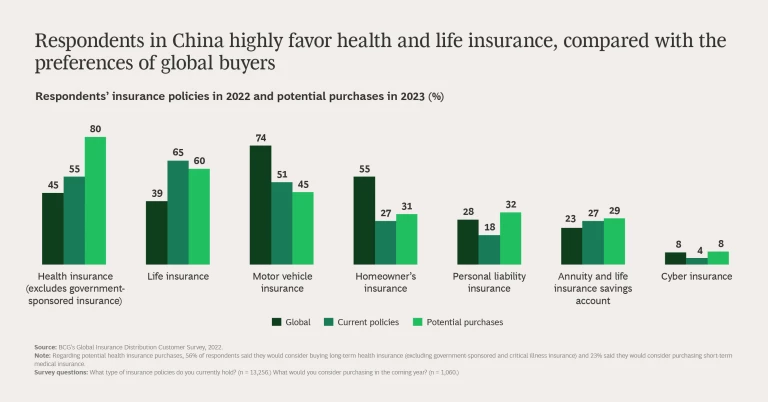

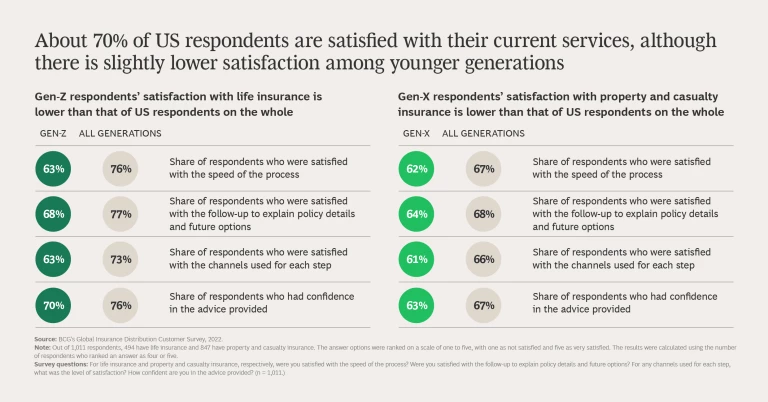

In China, respondents show a strong desire for health and life insurance. And in the US, we find it interesting that about 70% of the insurance customers surveyed are satisfied with their current services, especially among older generations. (See the slideshow “Market Trends.”)

The Implications for Insurers

The changing customer requirements and behaviors revealed by our survey have a number of implications for insurers globally regarding customer approaches, pricing, channel options, and targeted approaches. Here are a few of our leading recommendations.

Customer Behaviors. Given that price comparisons are common among respondents around the world, and getting value for their money is still a key buying factor, insurers should enhance their cost effectiveness and pricing to win over new customers—and retain the ones they have.

Omnichannel Options. As omnichannel journeys become the new reality, insurers should work to offer their products and services as seamlessly as possible across all available channels, connecting and integrating all customer touch points, both digital and personal. Digital channels should not be considered independently, nor should they replace personal channels, which remain important for insurance interactions despite the development of online services.

Segment Differences. Insurers should develop more tailored products and services to satisfy the strong demand of wealthy customers for life, health, and personal liability insurance, as well as for life insurance savings accounts. In addition, given that younger generations have a higher risk tolerance and expect to get higher returns with appropriate risk, insurers could offer these customers unit-linked insurance plans, which provide a combination of insurance coverage and investment exposure via equities or bonds.

Younger generations are less price sensitive and are typically happy to pay more for innovative products (such as digital-asset insurance and embedded insurance), as well as for product flexibility and greater convenience. Insurers should therefore consider these options in product development and in their marketing and sales efforts.

The authors thank their former colleague Charles Xu for his contributions to this article.