The global agriculture system is in crisis. It contributes to over 20% of the greenhouse gas emissions causing climate change, according to the Intergovernmental Panel on Climate Change (IPCC), and it is largely responsible for biodiversity loss around the world. Taken together, the environmental, health, and socioeconomic costs associated with today’s food and land use system total nearly $12 trillion per year.

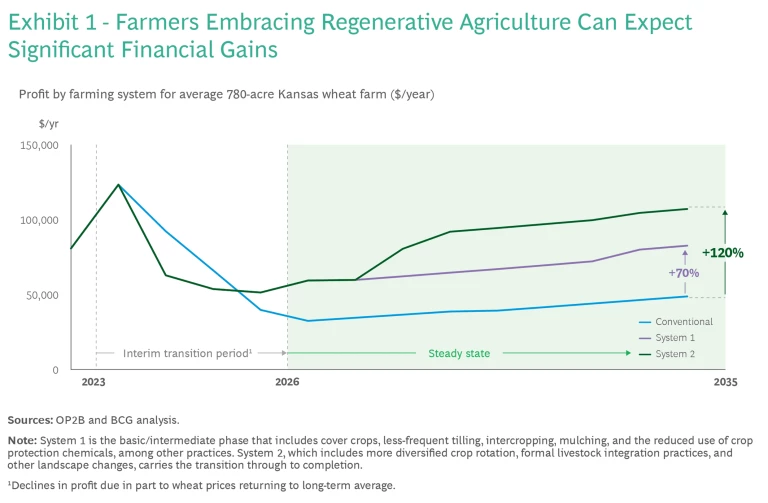

There’s a potential 15%–25% return on investment for farmers once they have shifted from conventional agriculture to incorporating more regenerative practices at scale.

Enter regenerative agriculture, a collection of farming practices intended to improve soil health and biodiversity, conserve water resources, and promote the well-being of farmers and their communities. And as we argue in our recent report, produced in conjunction with OP2B, an international organization that promotes biodiversity through agricultural reform, regenerative agriculture also offers real economic benefits to farmers. There’s a potential 15%–25% return on investment for farmers once they have shifted from conventional agriculture to incorporating more regenerative practices at scale.

These findings are based on insights into the economics of wheat farming in Kansas; another BCG report on the impact of regenerative agriculture in Germany, conducted in conjunction with NABU (Nature and Biodiversity Conservation Union), found similar conclusions.

However, many farmers remain wary of regenerative agriculture due to initial costs and other risks associated with these practice changes. We detail a financing approach that can help farmers address these obstacles and make the crucial transition to regenerative agriculture.

Farmers’ Concerns

To understand what farmers think about regenerative agriculture, we surveyed over 100 growers in the United States and conducted additional interviews. The results show that farmers are not averse to regenerative agriculture, but they do have concerns. Among them:

- Costs and Risks. Farmers worry about a drop in yield during the transition period, the upfront costs, and the lack of adequate crop protection inputs and resulting potential losses. The current crop insurance and subsidy system is more tailored to conventional farming, so they must bear most of the risks inherent in the transition to regenerative agriculture.

- Technical Assistance. They lack the technical assistance and resources needed to make a successful transition.

- Peer Pressure. Farmers face considerable pressure from their peers to maintain their conventional farming practices.

Stay ahead with BCG insights on climate change and sustainability

Making the Transition

Yet the case for regenerative agriculture is strong. Focusing the analysis on farmers of winter wheat in Kansas, our report shows that over time, farmers will likely benefit financially, as their input and labor costs decrease and improved soil health enables revenues from additional crop rotations. Shifting to regenerative agriculture does indeed create risks for farmers, primarily in the early stages of the transition. We break the transition down into two phases:

- System 1, the basic/intermediate phase, includes cover crops, less-frequent tilling, intercropping, mulching, and the reduced use of crop protection chemicals, among other practices.

- System 2, which includes more diversified crop rotation, formal livestock integration practices, and other landscape changes, carries the transition through to completion.

Exhibit 1 illustrates the likely impact of the shift to regenerative agriculture on the typical Kansas wheat farmer, beginning in 2023, during which prices for wheat have been especially high.

In the first couple of years, as farmers turn to intercropping of soybeans with their wheat, our analysis found that farmers are likely see a decline in profits of up to 60% or more, due to lower crop yields and the added cost of seeds and new machinery. Over time, however, and once farmers reach a relatively steady state of regenerative practices, our analysis indicates a positive long-term business case for farmers, resulting in between 70% and 120% higher profitability and a return on investment of 15% to 25% over 10 years.

“With our use of no-till, cover crops, and other soil health building practices, we’ve decreased our fertilizer use by 50% and our pesticides by up to 75% while increasing our yields,” says Mitchell Hora, a seventh-generation Iowa farmer. “We had hiccups early on but overcame the logistic and economic risks and have found success.”

Financing the Transition

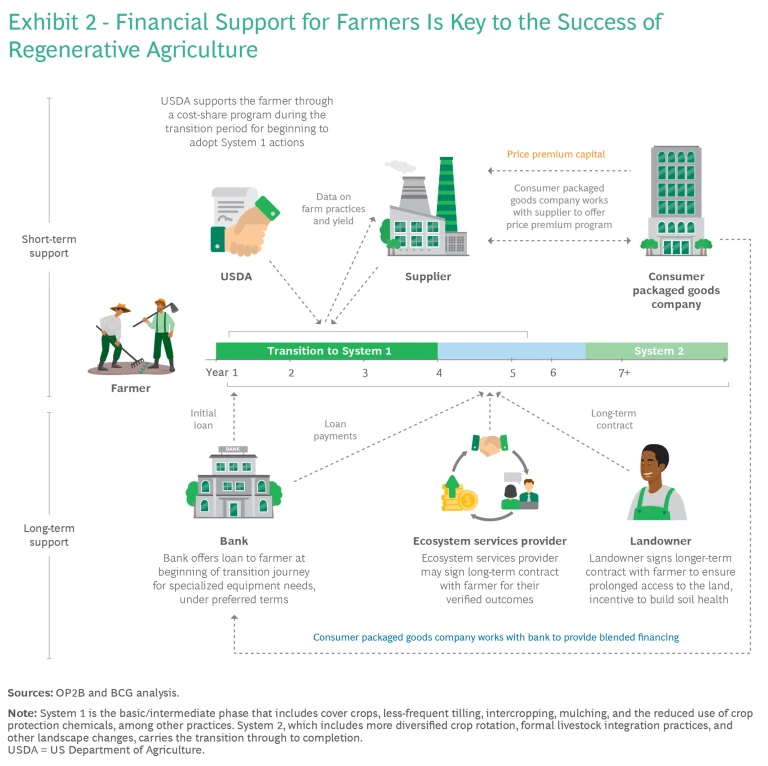

The challenge, of course, is how to encourage and support farmers during the early years and protect against the risks inherent in making this meaningful shift from conventional practices. The solution is two-fold:

- Develop the financing mechanisms needed to support farmers through the transition.

- Provide the technical and educational assistance needed to make a successful transition.

Several financing tools are already available today, including cost-share agreements with consumer goods companies, lending programs, and government subsidies. Each of the mechanisms available, however, varies widely in terms of maturity and longevity of intended support. At present, there is no financing option available at the scale required to support the broad adoption of regenerative agriculture across the food system.

To fully de-risk the transition to regenerative agriculture, the agriculture financing ecosystem must evolve to include an integrated financing approach that can accommodate the needs of farmers making the transition while distributing the costs and risks of the transition throughout the agri-food value chain.

Exhibit 2 illustrates what this financing approach, which we call the transition financing stack, might look like. It includes essential offerings from a wide variety of stakeholders, including banks, insurance companies, government agencies, and both upstream suppliers and downstream buyers of farm products. The goal of the stack is to reduce the risk and uncertainty of the transition to regenerative agriculture by sharing it across the value chain, and thus reduce the overall cost of the transition. Each farmer will likely require an individually customized financing stack, but in every case the stack must offer variety, flexibility, simplicity, and security.

Supporting the Transition

Helping farmers financially is certainly a necessary condition for the transition to regenerative agriculture, but it isn’t sufficient. The pressure on farmers to conform to conventional practices can be considerable. Supporting them will require strong, long-term relationships and a high level of trust among all the players across the value chain. This will take time to develop, but it is critical.

They must also have access to the education, knowledge, and training needed if they are to successfully adapt their farming practices. Stakeholders across the agri-food value chain can help in this regard, including government agencies and university extension services, as well as the private sector. Without collaboration and action along the entire value chain, real change will not happen.

To learn more about our research and findings, read the Cultivating Farmer Prosperity: Investing in Regenerative Agriculture report.