Many B2B businesses have reacted to persistent high inflation by raising prices, adjusting their packaging and portfolios, improving analytics, and accelerating their decision-making with tighter pricing governance . But in 2023, uncertainty around demand patterns and cost trends will test the limits of such reactive pricing moves.

As price increases face customer resistance and reach their practical limits, companies will need to find other ways to manage uncertainties and keep their revenues, volume, and margins in balance. They will need to move away from reactive pricing and prepare themselves for what we call resilient pricing.

Resilience is a company’s capacity to absorb the stresses caused by disruptions—such as inflation, the COVID pandemic, and supply chain volatility—and then recover critical functionality and ultimately thrive in altered circumstances.

Resilient pricing entails more targeted actions that can help companies address and remove constraints, meet internal challenges, and explore opportunities to grow amidst uncertainty— rather than merely survive or play defense. It not only expands a company’s range of options, but also establishes the processes and technology infrastructure that enable companies to treat uncertainty as an opportunity which warrants a balance of offensive and defensive strategies.

Implementing resilient pricing will be more of a transition for some companies than an abrupt shift. While most companies have reacted to inflation with tried-and-true tactics, primarily with price increases, some of the most successful companies have begun to adopt practices that will lay a solid foundation for resilient pricing.

Nonetheless, the majority of companies we analyzed in our recent survey still lack a clear plan for managing future volatility. Only 40% have defined plans for holistic, structural pricing actions needed to address the key challenges they face in improving their sales and pricing capabilities.

The Aftermath of Reactive Pricing

In our recent survey of around 1,400 pricing decision-makers across 10 sectors, over 70% of respondents reported experiencing annual inflation rates in excess of 8% in the preceding 6 to 12 months. For each of the sectors and geographies, we sorted companies by the margin increases they achieved and compared the top 20% to the bottom 50% to understand what made those best-in-class companies successful.

Resilience is a company’s capacity to absorb stresses caused by disruptions and then recover critical functionality—and ultimately thrive—in altered circumstances.

The outperformers were twice as likely than their peers to have passed through price increases larger than their cost increases, and twice as likely to have captured 90% or more of their planned price increases. They also enjoyed additional benefits beyond narrow price implementation. The outperformers were 60% more likely to have customers increase their basket sizes, and likewise were 60% more likely to have greater customer trust that they were doing the right things. Their price increases succeeded because these companies did the following:

- Acted quickly. Outperformers have the right systems, processes, and people in place to be nimble and react quickly to cost changes or competitor moves. On average, they were 40% more likely to have performed more pricing rounds in the preceding 12 months compared to their peers and were 20% more likely to have responded to a cost increase within a month. Best-in-class companies built forward-looking margin and cost tools that enabled them to link procurement insights more closely with commercial actions. This reduced the time lag between input cost changes and updates to their own pricing.

- Gained a deep, clear understanding of their customers’ economics. Investments in data collection helped these companies understand not only their customers’ needs and expectations, but also the challenges they face. Best-in-class companies have an in-depth understanding of their customers’ ability and negotiating leverage to pass along cost increases and realize value further up the value chain. They were 2.1 times more likely to have a clear understanding of the financials of their customers and their customers’ customers. This helped some companies adjust price increases in terms of timing and magnitude and also make selective proactive price changes.

- Communicated better. The successful companies in our survey emphasized value more than cost when they explained the rationale for price increases to their customers. They were 55% more likely to claim that price increases were necessary to provide or ensure better product quality, improve service levels, or switch to more sustainable products. They also expanded the scope of pricing discussions to include opportunities for partnerships and optimal risk sharing. This type of communication translated to increased trust. The best-in-class companies were 15% more likely to have their price increases perceived as fair.

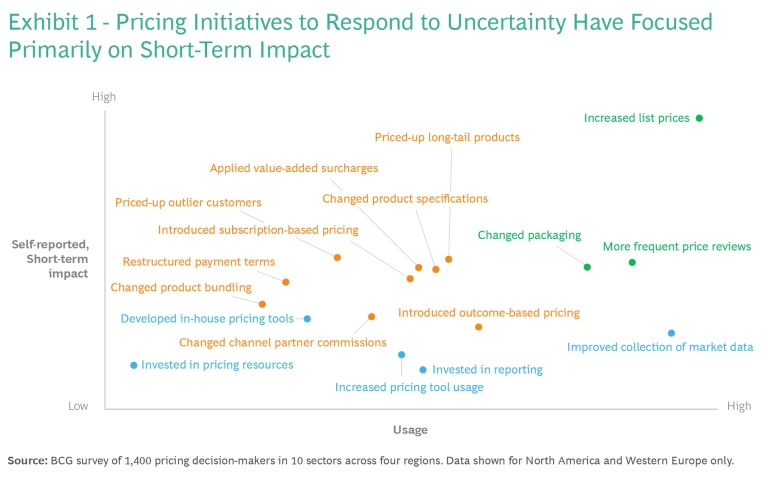

Yet no matter how successful some companies have been with reactive pricing, most have neglected or underinvested in other approaches that will provide the basis for resilient pricing: the tools and capabilities that will give them the medium- and long-term flexibility to anticipate future uncertainty and capitalize on it. An overemphasis on tried-and-true short-term measures (see green text in Exhibit 1)—despite their positive impact—and a lack of emphasis on pricing resources (blue text in Exhibit 1) may leave companies at greater risk in times of uncertainty, because the impact of short-term measures diminishes over time and with repeated use.

Resilient pricing, in contrast, will depend on companies’ use of a wider range of measures and greater investments in pricing resources. These include measures in orange text in Exhibit 1, and especially increased investments in pricing tools and resources (blue text).

The Need for Resilient Pricing

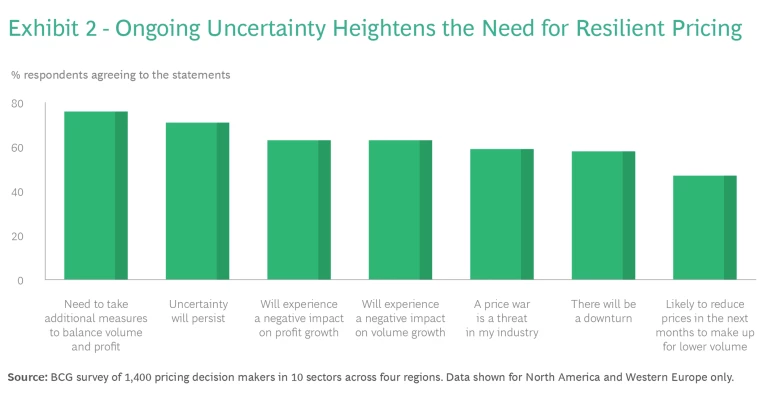

Some 70% of the respondents in our survey felt that some form of uncertainty—inflation, recession, market volatility—will continue in the medium term, and 63% are concerned about lower growth in profits and volume. More than 65% of companies expect near-term inflation levels to remain challenging, which reinforces the widespread pessimism. (See Exhibit 2.)

Over three quarters of respondents therefore said they expect to take additional measures to balance volume and profitability. But they may find their leeway and upside far more limited than a year ago. A strong performance over the last year does not necessarily mean that the same actions will succeed now, because there are practical limits to the simpler table stakes moves such as list price increases.

At the same time, companies see other factors that will impose constraints on their latitude for pricing responses. They cannot overcome the challenges and complexity of today’s sales environment with similar price increases based on inflation arguments. Companies now need to build the confidence of sales teams by providing them not only with more coaching and support, but also with stronger selling arguments that blend procurement insights and value stories. Relying too much on a “cost inflation” argument could boomerang if certain input costs (e.g., energy in Europe) go down from their peaks.

Many companies will also need to re-evaluate existing contracts and make tough decisions on which ones to renegotiate and which to drop to preserve margins. Finally, too many companies lack rapid and granular visibility into their forward-looking costs. This will warrant a redesign of cumbersome internal processes as well as investments that enhance capabilities to monitor cost changes in a timely manner. Our survey showed that in 2022 only 11% of organizations invested in pricing capabilities—such as analytical tools, quoting tools, dashboards, and trainings—in part because they perceive “easy” short-term solutions to have a more rapid payback. One misconception is that this would involve a large investment with time-consuming implementation. Business leaders actually have a large viable range of beneficial approaches to support planning and decision-making—from small incremental investments in new or upgraded pricing tools to comprehensive programs that include AI and machine learning capabilities.

Implementing Resilient Pricing

We recommend that companies undertake a range of actions to make themselves future-ready. That means implementing a much broader range of the measures shown in Exhibit 1, rather than overemphasizing reactive measures such as price increases. The shorter-term approaches (orange text) focus on more targeted and differentiated pricing actions and on an improved strategy for partnerships and contracting. The medium-term actions (blue text) involve more intensive monitoring, enhanced training, and deeper deployment of advanced analytics and AI .

Resilient pricing means B2B companies focus on improving their ability and agility to do the following:

Sense shifts in demand earlier.

Companies can anticipate demand shifts and respond to them quickly by tracking market movements, price changes, and changes in their own volumes. Many shifts occur at a sub-segment level and may remain undetected unless the company is tracking sales and root causes at a much more granular level. This market-sensing feeds into a regular and structured cadence to review a previous period’s performance and plan future pricing moves.

This also goes hand-in-hand with sharper price differentiation, rather than blanket price changes. Companies can “de-average” their prices by making selective price changes differentiated by customer segments or product categories, e.g., hero products vs. long-tail products. These price changes help capture different levels of willingness to pay that reflect competition, availability of substitutes across products, customer switching costs, and other factors.

Improve partnership and contracting.

Companies can also balance volume and profitability by seeking ways to share the burdens and rewards of market volatility with their customers, with a view toward building long-term relationships instead of implementing a series of short-term actions. Table stakes involve having an easy-to-use contract database to give decision-makers a holistic view of terms, conditions, special considerations, and expiration dates. This will help companies refine their negotiation guidelines, set balanced targets for volume and profitability, and when feasible, design contracts to include provisions (hardship clauses, price revision terms) that share risks.

Move toward dynamic pricing.

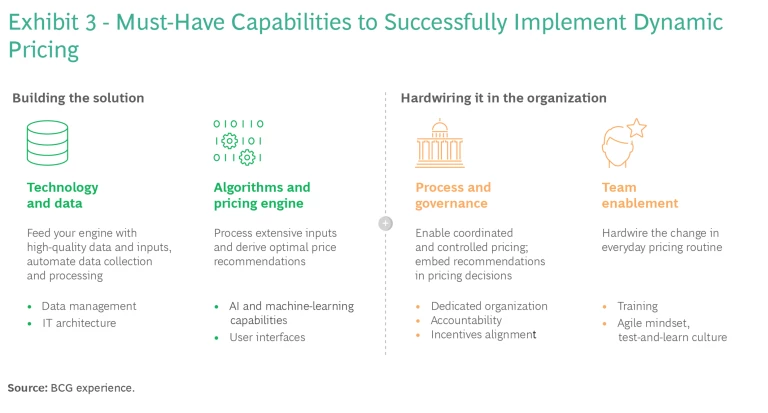

Changing prices dynamically doesn’t require that a B2B company take years to implement black boxes and gather the immense pools of real-time data that airlines, logistics firms, and hotels rely on. Many B2B players face different challenges, because they sell complex solutions to a fragmented market landscape with varying sales cycles. In its simplest form, dynamic pricing in B2B markets is the ability to trigger an automatic pricing review if any input factors change—and then to support targeted pricing decisions, derived with confidence from the right mix of human judgment and technology. (See Exhibit 3.)

An example of this is identifying low-stock items and quickly limiting discretionary discounts for them. This is a lower bar in terms of investment, but still enables the company to respond at the pace of change in its market.

De-escalate price war risks.

Price wars can easily turn into wars of attrition in which everyone loses. Economic uncertainty or crisis heightens the risk. Companies can reduce the risks of a price war—or mitigate the effects—by simulating the immediate and medium-term implications of pricing actions, either one’s own or those of competitors. Focus on value communication rather than a direct price-vs-price comparison in the market. This leads to our next recommendation.

Change the pricing game.

Times of uncertainty are opportunities for companies to go on offense. This means exploring innovative monetization strategies, including outcome-based pricing and recurring monetization models versus one-off transactional approaches. These models can become points of differentiation in times when many customers are more cautious about investment. Such models allow companies to align value in ways that conventional models, such as per-unit pricing and time and materials for service, often cannot—and thus can help build a lasting competitive advantage for the rebound.

The longer market uncertainty endures, the stronger the case becomes for companies to stop emphasizing reactive pricing decisions and start practicing resilient pricing. This will require establishing and nurturing the medium- and long-term capabilities and flexibility to anticipate future uncertainty and capitalize on it. The basic adjustments include pricing process optimization and better use of existing data and analyses. Enhanced resilience comes from viewing pricing as an ongoing, longer-term strategic challenge and using advanced analytical capabilities to expand their range of proactive and reactive pricing options.

About the Survey

In September 2022, BCG surveyed over 1,400 pricing decision-makers in 10 sectors (automotive, building materials, chemicals, consumer packaged goods, fashion and luxury, machinery and industrial automation, medical technologies, restaurants, retail technology, and software) and four regions (North America, Europe, India, and China). The survey asked questions about recent company performance to understand which strategies are proving successful in an inflationary environment. The survey also explored companies’ future expectations across sectors.