As pricing, cost, and economic headwinds continue to exert pressure on biopharma budgets, an effective commercial model is more critical than ever. But companies both large and small have found that the conventional approach—deploying many sales representatives to drive sales across a wide swath of health care providers —can be both inefficient and ineffective.

Today’s pharma companies need to be able to provide a targeted sales experience that is personalized to each HCP to help them best care for their patients. Part of the solution is deploying a new mix of in-person and virtual channels, as we’ve discussed recently . But to drive optimal HCP engagement, pharma companies also need to use digital and analytics to coordinate and personalize these channels.

BCG’s model has the potential to drive better HCP education and patient care, unlocking tremendous shareholder value in the process.

Over the past few years, we’ve helped multiple clients deploy a new, data-driven, high-efficiency commercial model with three key elements: a dynamic field-decision platform that drives next-best-action sales and optimizes engagement with HCPs; an omnichannel marketing engine that enables marketing

personalization

; and most important, hands-on

change management

.

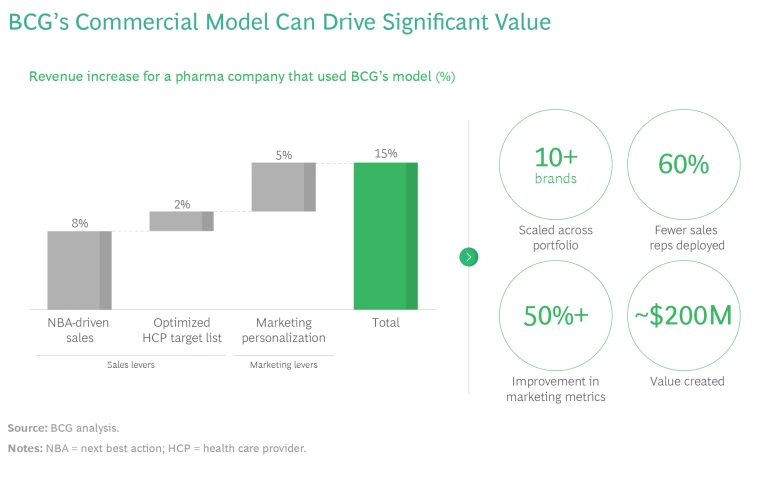

BCG’s model has the potential to drive better HCP education and patient care, unlocking tremendous shareholder value in the process. One private-equity-owned pharma company that scaled our model across its portfolio saw a sales lift of 15% and a step change in marketing effectiveness—all while deploying 60% fewer sales representatives. (See the exhibit.)

Dynamic Field-Decision Platform

In the conventional sales model, target lists and call plans are fairly static: once set, they remain more or less fixed throughout the year. Sales representatives then take the “one size fits all” call plan and do with it as they see fit.

Our new model differs in three important ways. First, it is powered by an advanced decision-support platform controlled directly by the sales rep. As a result, the target list is dynamic: it self-adjusts in response to signals in the market, including the changing needs of patients treated by each HCP. Say, for example, a patient’s current treatment exhibits signs of failure or an HCP is showing a rapid change in prescribing behavior. In such situations, the sales rep would receive suggestions to intervene and provide targeted messages customized for the situation at hand.

The model is powered by an advanced decision-support platform controlled directly by the sales rep; as a result, the target list self-adjusts in response to signals in the market.

The platform provides pharma reps with recommendations on how best to engage with their HCPs. For instance, after a sales call, the platform may suggest sending a follow-up email within a week—and to send it in the morning, since that’s when this particular HCP has historically engaged with sales reps best. The platform may also suggest which channel to use—for example, it may recommend a virtual call because the doctor, who is located far away, is open to virtual interactions. The sales rep can provide negative feedback if so inclined, which is then used to further train the system.

While the suggestion logic is customized to the unique disease and brand context, it also incorporates cross-portfolio business objectives to help sales reps optimize their time across the portfolio. For example, the logic of a mature brand might aim to maximize sales-rep reach and sample delivery to maintain sales at a low cost, whereas a new brand’s logic may focus on maximizing engagement with a more targeted group of HCPs or identifying patients for whom the new drug may provide substantial value.

Omnichannel Marketing Engine

Sales and marketing functions in biopharma companies have enormous amounts of valuable data that, if combined, can unlock more effective personalization. But since these functions frequently operate in silos, with marketing activities (such as e-mail, search, and display) outsourced to third parties, personalization capability is limited.

Our approach solves this challenge by tightly integrating sales and marketing data. First, we work with marketing teams to develop advanced capabilities across channels—email marketing, paid search, social, and so on—each of which generates its own data. Marketing data is then integrated with the sales-decision support data and fed back into the marketing engine, which then makes channel and personalization recommendations in real time. This integrated, closed-loop system enables continuous testing and learning to provide successively better recommendations over time.

All these tools combine to provide better recommendations on who to target, and through what channel, while sales management also receives robust reporting tools and insights on the market’s prescribing dynamics and on sales reps’ adherence to recommendations. Leading companies are exploring how to incorporate

generative AI

approaches to take these personalization capabilities to the next level.

Hands-On Change Management

While companies can build a better sales model, it will fail if their marketing teams and their reps in the field don’t adopt it. This makes it critical to have sales leadership and field teams involved throughout the process. Their feedback will ensure that the insights from the analytics are rounded out with real-world experience.

Four practices are key for driving adoption:

- Ensure not only that senior sales leadership is bought in from the start, but also that individual field reps are involved in the design process.

- Build in both formal and informal mechanisms for training and feedback.

- Create a test-and-learn mentality—nothing is perfect at the start, and enormous value is created through continuous experimentation.

- Make KPIs transparent so that field reps and the broader team can see the link between adoption of the model and sales performance.

In our experience, the first three practices are critical in the beginning, but the fourth ultimately drives adherence over the long term. When measuring adherence, companies should confirm that the pharma rep actually carried out the recommended actions—not just that they used the platform or acknowledged the suggestion. We’ve often seen adherence hover in the 30% to 50% range at launch and rise to 80% once sales reps see how adherence boosts sales performance.

By evolving their commercial model, biopharmas have the opportunity to make significant improvements in effectiveness and efficiency. Companies that are able to provide a more personalized sales experience at a lower cost will create tremendous value for their HCPs, their patients, and their own business.