The road ahead could be challenging for automotive dealerships as traditional original equipment manufacturers (OEMs) sell more and more cars directly to consumers online. While the new automotive direct-sales model offers numerous benefits for the OEM, its impact on dealerships is not as clear-cut.

To better understand dealers’ perspectives on the paradigm change, BCG interviewed more than 400 executives in Germany in 2022 from authorized car dealerships representing a broad array of premium and volume brands.

Understanding Dealers’ Perspectives

Over the past few years, incumbent OEMs, both premium brands like Mercedes-Benz and volume brands like Volkswagen, have adopted an automotive direct-sales model for some of their markets and product lines. The customer can buy new cars from a dealership or online straight from the OEM. No matter where the purchase takes place, there is only one price: the manufacturer-set retail price (MSRP) — negotiations with the individual dealer are no longer permitted.

The shift to direct-to-consumer sales allows OEMs to realize higher price points since dealerships must adhere to the MSRP and can no longer undercut one another. Additionally, sales costs are lower in online channels than through dealerships. And, thanks to digital technologies, OEMs can capture, own, and use the data critical to building strong customer relationships.

The direct-sales model is changing the game for both OEMs and dealers.

From the dealers’ perspectives, the advantages of the new model are less clear-cut. Traditionally, the dealer acted as an independent entrepreneur, buying inventory from OEMs and selling it to customers. In the new paradigm, by contrast, the dealer adopts an agency model: the dealer follows up on leads, provides customers with information relevant to their purchase decision, and takes care of after-sales services. In return, the dealer receives a commission for every new car sold and, depending on the agency contract, for additional services rendered to the customer or to the OEM. This also implies that the dealer no longer carries the risk and costs of financing and managing stock.

The Automotive Direct-Sales Model Gets Mixed Reviews

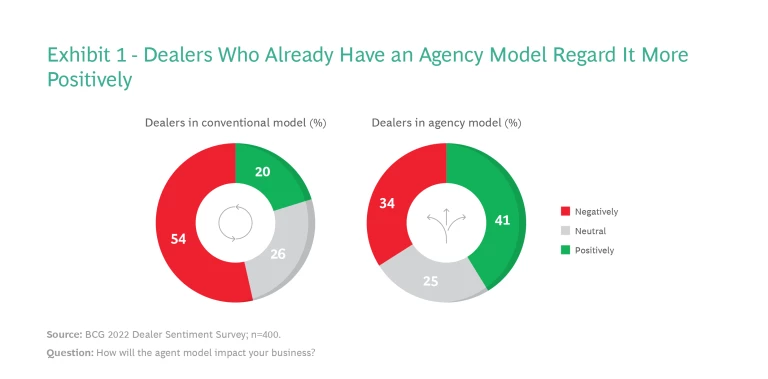

So far, nearly 60% of the 400 dealers we spoke with have not adopted an agency model. Eighty percent of these conventional dealers believe that it would negatively impact their business.

Specifically, 75% think that OEMs have provided insufficient detail on what the new model, roles, and transition period would look like. And 66% believe that agency compensation is unfair and that pricing is unlikely to be demand-oriented and dynamic.

Conventional dealers also expressed reservations about the shift in pricing and commissions. For many, sales of used and demo cars, after-sales service, and financing are more profitable than new-car sales: selling new cars is simply a way to get customers into the dealership for servicing. Not knowing more about how the economics of the automotive direct-sales model will affect their bottom line, dealers are concerned that the agency model could put their whole business on the line.

Dealers who have already adopted the agency model seem to have a more favorable view of it. (See Exhibit 1.) More than half of conventional dealers dislike it, compared with one-third of early adopters. Similarly, only 20% of conventional dealers like the agency model, while double the percentage of early adopters do. This finding suggests that dealers’ opposition to the agency model will fade as they get firsthand experience and as implementation issues are resolved.

Intra-Brand Competition Is Strong

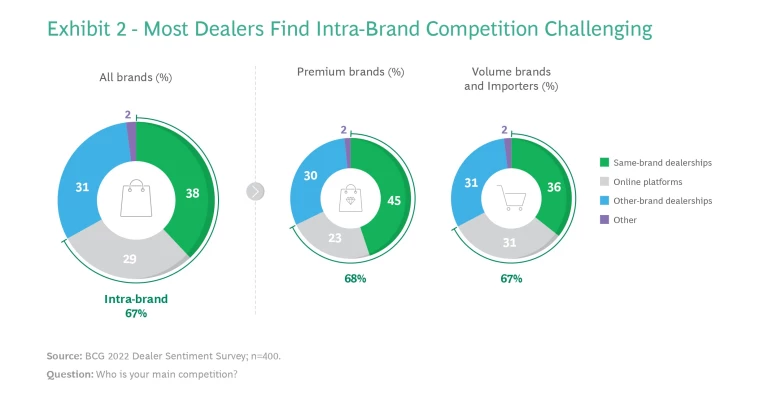

But it would be a mistake to assume that conventional dealers are completely content with the status quo. Two-thirds of respondents said that intra-brand (same-brand) dealers are their fiercest competition. (See Exhibit 2.) So a Brand A dealer would regard another Brand A dealer on the other side of the city as a greater threat than a Brand B dealer located right next door.

Clearly, in the conventional model, same-brand dealerships are underpricing each other to win the customer who is already loyal to this brand of car. Consequently, dealerships cannot capitalize on their customers’ brand loyalty — instead, they destroy each other’s profit margins. This has led dealerships to run on razor-thin margins and focus primarily on reducing costs by, for example, moving to rural locations rather than stepping up their customer-service game.

We also found that independent platforms pose a significantly greater threat for volume and importer brands than for premium-brand dealerships (31% versus 23%). Most likely, that’s because volume consumers are more price sensitive.

OEM-Determined Pricing Has Support

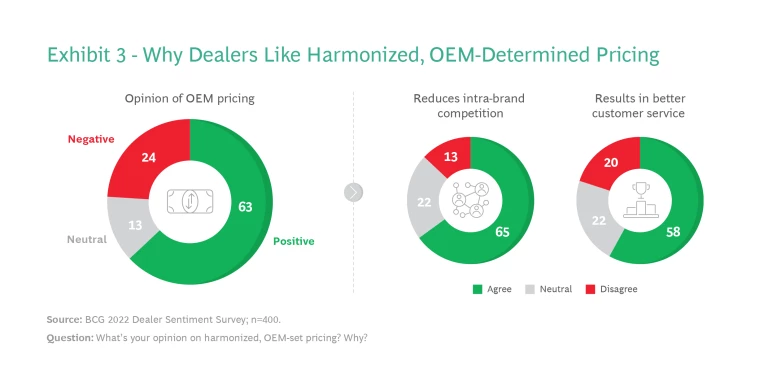

Nearly two-thirds of respondents expect that same-brand competition will decline if dealers must adhere to prices that OEMs have set and harmonized across channels. (See Exhibit 3.)

Respondents indicated that eliminating price negotiations could save about 25% of their sales time. And 58% said that it would lead to a greater focus on customer needs since dealers would no longer be able to compete on price, and the level of customer service will become the new differentiator. This change would also register positively with customers, who according to a recent BCG survey view comparing and negotiating prices as the most frustrating part of the car-purchase process.

Although dealers favor prices that are harmonized, two-thirds of our survey participants are not convinced that OEMs can set them effectively. Dealers believe they know their customers better than an OEM because they see them face to face on a regular basis. Although a data-based and digitally enabled price-setting mechanism could help, dealers are skeptical that OEMs have the digital capabilities to build such a tool.

Although many dealers see benefits in manufacturer-set prices, some doubt OEMs’ abilities on pricing.

Preparing for the New Landscape

Like it or not, the automotive direct-sales model is coming. To make the best of this massive shift, OEMs and dealers must start preparing for it now.

OEMS

Both premium- and volume-brand carmakers have important strategic and operational issues to address.

Strategic Planning is Key. OEMs need to ask themselves several strategic questions, including which product categories to sell directly, which sales channels to use for each, what role dealerships should play, and what outcomes could result for themselves and their dealership partners. To answer these and other questions, OEMS will need to consider the competitive context, the online ambition, the geographic footprint, the existing dealer networks, and the internal resource and capability base.

Understand the Business You’re Getting Into. Most OEMs have little hands-on experience in interacting with the end-customer. Therefore, to succeed, they must take the time to understand the complexities of their dealers’ sales operations. That’s true whether the OEM decides to conduct the sales activities themselves or cover their costs for the agent. Either way, a solid business case requires OEMs to quantify the costs accurately. Often simple things, such as estimating the operating costs of a demo car, turn out to be more complicated (and the costs higher) than initially thought.

Price with a Steady Hand. Premium-brand OEMs need to implement pricing in a way that befits a top brand. This means being consistent and persistent: OEMs should use price changes as a measure of last resort, first exploring other sales levers, such as marketing campaigns or reallocation of volumes. To ensure consistency, prices for former demo and service replacement vehicles with low mileage need to be consistent and should not undercut the price points of brand-new cars.

Volume-brand OEMs, which face higher selling pressures, greater demand elasticity, and thinner margins, may need to act more opportunistically, adjusting prices to meet their sales targets. In such cases, they should restrict price discounts to less transparent channels like fleets, rentals, or subscriptions.

Subscribe to our Automotive Industry E-Alert.

Dealers

To succeed with an agency model, dealers will need to revisit many aspects of their businesses and understand the key issues that will have to be resolved with OEMs.

Rethink the Business Case. It will be important for dealers to have a deep understanding of the sources of value in their existing business case. The ability to quantify the profitability contribution of their various business segments will be key to understanding how the business case will change in a direct-sales world.

The shift from selling new cars to earning commissions on them will affect more than revenues. For example, dealers will benefit from lower financing costs because their inventory is no longer on their books but on the OEM’s. They will also be able to reduce overhead because they will no longer have to manage ordering and payment toward the OEM or invoicing toward the customer. This gives dealers the chance to become more profitable than in the old model and to improve their firm’s credit rating as a result. At the same time, maintaining an excellent customer relationship will become more important than ever.

Transform Operations. The shift in competitive focus will require dealers to build out their capabilities in sales-related services. More than ever, employees’ skill sets, marketing communications, internal processes, and dealership facilities will need to be geared toward excellent customer service rather than selling vehicles fast and at (almost) any price. To secure a sales commission and the ensuing after-sales business, agents will compete not on price but on offering customers a shopping experience of the highest quality — enjoyable, informed, and simple.

To succeed, dealers will have to devote more attention to providing outstanding customer service.

To realize these goals, dealers will also need to reconsider their performance incentives. Sales personnel were typically incentivized on the number of deals they closed and the amount of revenue they generated. In the future, incentive structures as well as sales-training curricula will need to focus increasingly on customer satisfaction.

Prepare for Negotiations. New-car sales commissions have garnered much attention, but many other important issues pertaining to the new setup will probably also need to be resolved. For example, OEMs and dealers need to agree on how demo vehicles are ordered, managed, repaired, and paid for. These negotiations will have a significant impact on dealers’ future profitability, so adequate preparation is essential.

Both Sides

While OEMs and dealers each have various issues to address, there are some issues that they will need to address together.

Redefine the Customer Journey. Direct sales offer OEMs and dealers a unique chance to fundamentally redefine the customer journey, from presales to after-sales services. But every opportunity to improve customer experience comes with a risk: if OEMs and dealers focus on fighting over their share of the pie instead of on enlarging its overall size, everyone will be worse off, customers included.

Build Trusted Relationships. The size of that pie ultimately depends on a rock-solid partnership that enables both sides to perform to the best of their ability. So OEMs should make sure that dealers take an active role in developing the agency model and redefining the customer journey. Dealers should focus on building an agency model that will enable them to prioritize the customer segments where their unique value proposition gives them an edge while enabling OEMs to meet sales and customer acquisition targets.

Ensure a Smooth Transition. Many major transformations are not as successful as they could be because problems arise during the transition. The challenges are as varied as they are numerous: legal hurdles, integrating data and IT, restructuring the OEM and dealership organizations, training employees, communicating the new setup to customers, and more. To ensure a smooth transition, OEMs and dealers need to make the transformation a top priority.

The transition to an automotive direct-sales model is likely to be full of challenges. To compete successfully in the new landscape, OEMs and dealerships must start preparing now. Their future could well depend on it.