There’s no denying the appeal of e-commerce to today’s consumers. The rapid uptake of this radically new form of shopping over the past couple of decades has been nothing short of extraordinary. But for all of e-commerce’s advantages—convenience; variety; the ability to compare sellers, products, and prices; endless cyber shelves to explore—it still has fallen somewhat short when it comes to brands’ ability to build personal relationships with shoppers.

Until recently, that is. The emergence of social commerce—an increasingly popular offshoot of e-commerce propelled by a powerful mixture of community and communication—is making online shopping a much more interactive and intimate experience.

Social commerce is a relatively new idea, one that has caught on quickly in China while making substantial inroads in Western markets. It can be described as a shopping experience built around social interactions among people with shared likes, habits, hobbies, and behaviors. As such, it’s a perfect commercial complement to the discussions, chatter, and sharing that takes place on social media. If done right, social commerce ultimately benefits consumers, tech platforms, and brands (see Exhibit 1):

- For consumers, social commerce opens up more seamless, convenient, and novel shopping formats and experiences.

- For technology platforms, social commerce provides increased revenue opportunities by allowing brands to leverage multiple partnerships and implement new shopping features that are natural extensions of their social media offerings—thus enabling a more authentic and valuable commercial relationship with consumers. Tech platforms can also benefit from opportunities to collect data about consumer behaviors and preferences (from users who give their approval) as well as from heightened consumer engagement and stickiness on their sites as a result of brand memberships and loyalty programs.

- For brands, social commerce offers new channels and formats to connect with consumers and gain a better understanding of their needs and how to fulfill them. With social commerce, consumers can be reached where they already want to be—which, in turn, makes them more receptive to product recommendations and purchasing ideas.

Social commerce comes in many forms. It could be an influencer on social media waxing enthusiastic about a particular brand of clothing he is wearing or raving about a new album, with a link to a shoppable ad for seamless one-click purchase. Or it could be community-based—a hobby group or a neighborhood chat board discussing a particular product that can be purchased instantly, with members offering their reviews and expertise about how to best use it. It might take place on Instagram, Facebook, TikTok, or any social media site. And it could be as short as a 30-second video or as long as an ongoing series of how-to sessions about a particular product category.

Lizanne, a 28-year-old living in Berlin, is a typical social-commerce early adopter. When she wakes up, the first thing she checks is her phone. Scrolling through her feed, she sees friends and influencers she follows posing in clothing and jewelry, some of which dovetail with her personal tastes. Before social commerce, Lizanne would have to scroll through the comments section to see if someone named the product or designer—and even if someone did, she would then have to do a web search to find out how to buy it. Often, she just moved on to another online activity. But now, tags on the photos lead her directly to the brand’s Instagram page, which has all the products she saw lined up in its Instagram shop. Just a couple of “taps” lead her to checkout, and she’s made her purchase.

As Lizanne’s story shows, social commerce moves the selling model from the buyer finding the product to the product finding the buyer—leveraging personalization as the social-media algorithm learns from browsing behavior. Companies, however, have to find their own sweet spot and determine the best social-commerce models for their businesses, brands, products, and operational capabilities. Later in this report we will look at four possible social-commerce archetypes for companies to consider.

Social Commerce Is Taking Off

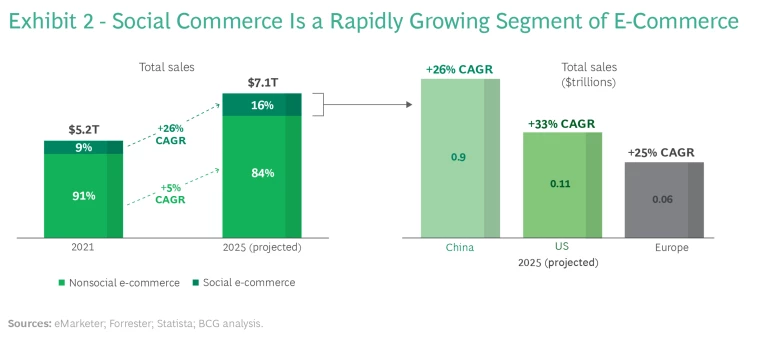

As early as 2016, social commerce began to be a popular shopping option in China. By 2021, the volume of social-commerce transactions had grown by 52% to more than $350 billion, or about 13% of Chinese e-commerce sales, from $43 billion five years earlier. According to a Nielsen China survey, 80% of impulse purchases in China were based on social recommendations.

Social commerce has been a more recent phenomenon in the West; even so, between 2021 and 2025, transaction volumes in the US and Europe are expected to grow by 33% and 25%,

There are four primary reasons why social commerce is headed for accelerated growth in Western markets, and they closely parallel the dynamics behind its popularity in China. (See Exhibit 3.) First, purchasing power is expanding for social-network users from ages 18 to 24, who are most inclined to engage in social shopping experiences. Second, technology providers are investing heavily to integrate commercial and social features, blurring the line between the two. Moreover, tech firms are abandoning the “walled garden” approach—in which they mainly provide proprietary, closed platforms for commercial activities—and are joining forces with specialized service providers to reach wider audiences. For instance, YouTube has introduced live shopping programs and an “explore” tab with shoppable content in partnership with the e-commerce platform Shopify.

Third, leading brands are developing social-commerce strategies to convert users of social media into paying customers. For instance, Cluse, a UK-based jewelry an watch company, increased its overall conversion rate of people browsing to actual sales by 19% when it attached relevant shoppable-product photos to its Instagram lookbook.

Fourth, money is pouring in. Investments in social commerce are gaining traction as private equity firms bet on a strong future for the technology. In 2021, there were 109 deals involving social commerce companies, representing some $8 billion in capital—compared to 49 in 2016, involving less than $1 billion.

Those prospects for growth come with a few caveats. Policies and regulations around social media are evolving as the debates over its power and perils continue. Access to social-media platforms is also subject to geopolitical forces—TikTok is under regulatory scrutiny in the US, for example, and is banned in certain jurisdictions there, while Meta and its products cannot be downloaded in China. As marketing leaders consider various social-commerce opportunities, it is imperative that they keep track of ongoing developments that may affect the accessibility of certain platforms.

How to Get Started in Social Commerce

Companies should view a social-commerce effort as a new approach to their existing e-commerce programs—a way of increasing the effectiveness of those programs by directly addressing, in an entertaining fashion, how their products meet customers’ needs. Indeed, as a launching point, brands and retailers must first focus on upgrading their core e-commerce capabilities. This includes boosting their social-media marketing proficiency and driving e-commerce and marketing integration by initiating small, focused pilots on chosen social platforms.

Testing the waters with target consumers is crucial. These first campaigns could include shoppable links on, say, Instagram or Pinterest as well as reward programs that offer discounts (or award points) if a customer’s friend or family member makes a purchase based on their recommendations.

In this phase, companies should plant the seeds for their more advanced social-commerce efforts by addressing three potential obstacles:

- Regulatory Constraints. To offset existing and emerging data-privacy regulations, brands have to be creative in offering rewards to consumers (such as discounts on future purchases or access to full functionality of the social-commerce site) in return for permission to collect data about their online activities.

- Technical Boundaries. Antitracking measures can impede the personalization of product recommendations and prevent a seamless social-commerce experience. To drive user engagement, brands therefore need to be creative—exploring strategic partnerships with tech giants and expanding their data capabilities to create comprehensive customer profiles that enhance recommendations and simplify shopping.

- Consumer Sentiment. Sketchy behavior by an influencer—taking a noxious social stance, for example, or engaging in untoward public activities—can trigger negative attitudes towards a social-commerce site. To avoid that, companies must make agreements with influencers and other channel partners carefully, focusing on those partners’ suitability to the company’s brand image. And companies should review these arrangements frequently to make sure that they remain appropriate.

Next Step: Advancing the Social-Commerce Program

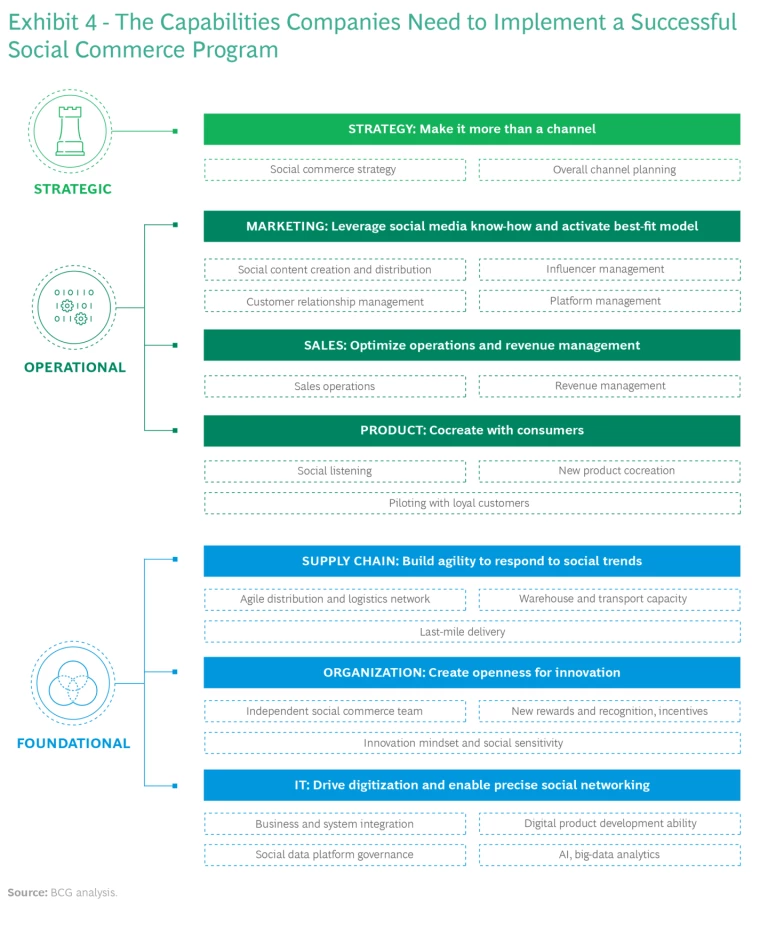

If the first phase was about establishing the basic parameters of the social-commerce initiative and dipping toes into the water, this advanced phase involves developing the internal teams, processes, skills, and structure that will be responsible for maintaining and expanding the social-commerce effort. Three categories of capabilities should be addressed: foundational, operational, and strategic. (See Exhibit 4.)

Foundational capabilities cover the core engine that drives the social-commerce program. These include an agile supply chain that can respond instantly to changing social trends, an organizational culture that supports bold initiatives and cross-functional collaboration, and a modern IT organization that can turn digitization and data management into a competitive advantage.

Operational capabilities should be focused on successfully implementing social-commerce activities on a daily basis. To do that, the marketing team must have strong social-media know-how and content-creation skills—and the ability to rapidly identify and act on online opportunities based on changing trends and altered consumer preferences and behaviors. To understand customer sentiment and promote products that consumers want, marketers must listen closely to comments and reactions on the platform and even collaborate with loyal customers in making social commerce marketing decisions. The sales team must see beyond short-term sales targets to collaborate with marketing in using social commerce to capitalize on sudden, unanticipated market shifts.

Strategic capabilities safeguard the long-term vision of the company and make sure the organization aligns the social-commerce strategy with the overall channel strategy. Social commerce is more than another sales channel—it is a shift in how a business operates, offering a more unified approach that brings together supply chain, marketing, sales, and customer interaction.

Four Social-Commerce Archetypes

Once the basic underpinnings of a social commerce program are built, companies need to determine the essential features and characteristics of their social-commerce presence. They need to answer the question: Based on our product line, market lane, and customer base, what is the best social-commerce model to drive sales and expand our reach? We found that there are four archetypes for companies to choose

Archetype 1: Influencer Social Commerce

Influencers reach followers through numerous online formats and platforms—and can promote products and brands by posting pictures, stories, and holding livestream sessions, touting how they use or wear these items in their daily lives. Influencer recommendations are a powerful lure for many consumers; according to a number of studies of the “electronic word of mouth” effect, consumers are more likely to trust influencers than a commercial advertiser. Influencer social commerce is particularly impactful for companies marketing luxury, fashion, and beauty products—items people often associate with rich and glamorous celebrities, athletes, and hip music stars.

Some companies pay influencers to promote their products; others wine and dine them and offer freebies. But whichever approach is used, disciplined influencer management is crucial—including helping the influencer formulate unique and targeted interactive content, presentations, and posts that have the greatest likelihood of being shared among the most valuable groups of potential customers. And companies must be especially careful to monitor the influencer’s public persona and social media comments, making sure they represent the company’s core values.

When working with influencers, businesses should also be aware of “push” and “pull” strategies. Push involves influencers with a massive following spooning out content to their networks—an approach that favors creators over the content they produce. By contrast, a pull strategy would be centered on influencers with a smaller following, who nonetheless offer the type of viral, creative, and crowd-pleasing content that a social-media algorithm would pick up, distribute, and promote due to its quality and stickiness. Companies’ investments in content creation should support both “precious but few” and “short lived but abundant” content while making sure to avoid brand dilution as content volume and the number of creators and influencers increase.

Revolve, a fashion e-tailer, uses a network of more than 3,500 influencers, who receive free clothing and invitations to exclusive social events in exchange for sharing their love of Revolve products online. With links on their pages that take consumers directly to Revolve’s Instagram page and purchasing channels, influencers drive some 70% of Revolve company sales.

The online furniture retailer Made.com takes a more low-key approach to social commerce. It uses so-called microinfluencing, which consists of customer-generated content showing how Made’s products fit into their home décor. In 2020, Made added automatic bidding on products on its Pinterest site—and increased revenue by 250%.

Archetype 2: Peer-to-Peer Social Commerce

People are four times more likely to purchase a product when someone they know tells them about it, according to Nielsen surveys. Thus, networks of friends, family, or coworkers are excellent centerpieces for social-commerce campaigns. Since word of mouth already exists in many markets, companies need to commercially scale it and encourage it online.

In practice, that means extending consumers’ online engagement with the product and brand by offering them appealing loyalty programs and rewards for convincing their peers to consider the items as well. In addition, companies could involve their customers in product cocreation. And they must have effective customer relationship management (CRM) systems that constantly reach out to product purchasers, collect feedback, ensure high satisfaction, and take note of what products and features their best customers would want to see.

All of these steps can propel product recommendations within circles of friends and families. Generally, sellers of more personal items, such as baby or beauty products or household appliances, could do well adopting the peer-to-peer social-commerce archetype, essentially piggybacking on the relationships customers already have.

US beauty brand Glossier, which targets women aged 18 to 35, uses “real models”—its customers—to post its products on Instagram, using digital word of mouth to convince friends and family members to purchase Glossier products, often at a discount. In return, these customer-models, whose referrals drive as much as 70% of Glossier’s online traffic, earn points toward future orders.

For companies that have a limited number of repeat customers, such as US furniture retailer Burrow, the peer-to-peer model can still be incentivized. Instead of discounts on future purchases, Burrow, which primarily sells couches that feature tool-free assembly, gives supporters third-party gift cards if they attract new customers with photos and descriptions of the company’s products.

Stay ahead with BCG insights on marketing and sales

Archetype 3: Occasion Verticals

This type of social commerce is rooted in solving a consumer need. An occasion—for instance, a holiday, becoming a first-time parent, or getting married—triggers individuals to search for advice, community, products, and services that can help them navigate an often busy and potentially overwhelming moment in their lives. Social-commerce sites can offer perfect one-stop solutions for such occasions. Fully 40% of all purchases are occasion related, and spending on these items is 33% higher, on average, than spending on more routine, everyday shopping.

To capture this opportunity, companies must be smart and flexible about which products they offer on their occasion sites. And they should be prepared for large swings in demand as trends change for, say, what newborns wear or which birthday gifts are most popular. Also, it’s important to note that different occasions interest different types of consumers; choosing a social-media platform for an occasion site that attracts the target audience is therefore essential. For instance, when marketing dresses for a Sweet 16 party, it makes more sense to set up shop on a teen-magnet social platform like TikTok than, say, Facebook, where participants skew older.

One recent, successful occasion vertical was launched by US-based Jane, the boutique-fashion and home-décor marketplace, which in 2021 conducted a customer-profile analysis to determine which of its products were likely to be most popular during the holiday season. Based on these results, Jane curated a series of product collections to promote in a holiday-themed online site using search engine optimization and live shopping events—and attracted 675,000 visitors between November and December, generating $365,000 in sales.

Beyond occasions, life stages are also excellent choices for social commerce. Kyte Baby, which sells baby clothing made from bamboo, gives customers that use the “#GrowWithMe” hashtag on TikTok and Instagram points for rewards and discounts. On these and other social media platforms, parents can find Kyte Baby’s shop, parental advice, exclusive offers, and sneak peeks at new collections as well as monthly calendars linking to live shopping events and upcoming specials.

Archetype 4: Interest-Based Social Commerce

This archetype is similar to peer to peer—it involves family and friends recommending ideas for purchases—but it is much more niche or hobby-and-lifestyle oriented. Nature lovers or football fans, dog fanciers or automobile enthusiasts, online game players and people who can’t get enough of chess—all of these interests have targeted communities and are perfect for social commerce. A hiking site could be a place where hikers exchange tips on trails, good places to legally camp, and types of equipment needed; it can also be a place where they share experiences about recent purchases and what they would recommend. The retailer running the site would make sure that shoppable links to appropriate products are included in these discussions.

For brands and retailers, demonstrating credible knowledge and interest about a particular lifestyle or activity creates a bond with consumers—and consumers are more partial to brands with which they have a kinship. A survey of more than 1,000 US shoppers by Sprout Social found that 76% would more readily buy products from a brand they feel connected to, while 57% said they are more likely to spend more on that brand.

To drive these connections, companies must upgrade their social-content-creation capabilities to produce material that meets the needs of interest-based consumers. This means closely following the channels and activities of people who are deeply involved in niche hobbies and activities and then emulating, in a social commerce setting, the kinds of material and opportunities for interaction that appear to engage those people the most.

One interest-based social commerce site was created by online grocery retailer Instacart, which introduced shoppable recipes on several social-media platforms, including TikTok, Tasty, and Delish. Home chefs could choose a recipe and the ingredients they need would be automatically ordered from Instacart and delivered within hours.

Another example involved Petco, the pet-products retailer, which in 2021 partnered with Facebook to launch its first live-shopping event, called “The Perfect Fit.” In this show, rescue dogs displayed pet products on a runway while a celebrity host prompted viewers to buy the items— or, ideally, adopt the dogs—by clicking a link.

For companies that want a deep online sales presence—and which companies don’t these days?—social commerce offers a huge opportunity for growth and for outpacing the competition in three critical facets of their businesses:

- Customers. Companies can enjoy more loyal and engaged customer bases as well as more personal and real-time relationships with consumers across their shopping journeys. From this, rich consumer insights can emerge as well as new channels to cocreate, test, and promote products and services.

- Operations. Social commerce creates additional routes to market and new influence pathways that shorten the time from customer interest to purchase, while lowering the cost of sales acquisition.

- Data. The customer profile is enriched, incorporating social traits and enabling more precise targeting and personalization; this allows brand, product development, marketing, sales, and CRM to come together to advance the company’s digital capability across channels and functions.

Social commerce can be a difference maker in a consumer market that increasingly demands speed, convenience, community, and communication. This is a perfect time—just when social commerce is about to take off in Western markets—for companies to establish leadership in this new outlet for online shopping.