Destination: net zero. That’s a goal for companies across consumer categories, including travel and tourism—which is responsible for some 10% of global emissions, a greater share than many other categories. Without intervention, travel and tourism emissions will grow by 5% annually, to 8.4 gigatons of CO2 emissions in 2030.

Those numbers signal an urgent need to reduce the industry’s carbon footprint, and travel and tourism companies are under pressure to achieve results. They have set their own sustainability goals and communicated them publicly; meanwhile, they face increased regulatory demands from governments to reach particular emissions-reduction targets, not to mention rising costs on many fronts.

To date, travel and tourism companies have focused on internal changes—tackling, for instance, the significant role that travel-related transportation and fuel play in generating emissions.

But those efforts alone won’t be enough to fulfill emissions reduction pledges. To achieve net zero, travel and tourism companies need to establish an additional route to sustainability: persuading consumers to make more sustainable travel choices.

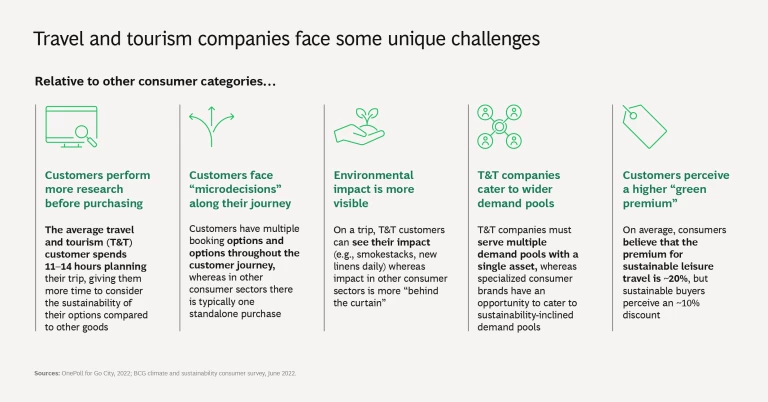

That’s a daunting task. Relative to other categories, the number of macrochoices (a green class of service, for example) and microchoices (choosing local products) that travel and tourism consumers face is vast, and these choices often come with unique nuances.

This presents travel and tourism companies with a complicated web of considerations—but also a wide variety of opportunities. It’s all about understanding consumers and how they make choices, and then creating and communicating sustainable alternatives.

How Consumers Are Making Choices About Travel and Tourism

A consumer-focused approach promises to make a significant dent in the industry’s emissions. More than 40% of those emissions are driven by consumer choices, and 80% of consumers we surveyed say that they are concerned about the environment and that they considered aspects of sustainability when they last traveled. (See the sidebar, “Methodology,” for details on our survey of consumer perceptions of sustainability related to travel and tourism as well as other categories.)

Methodology

- Consumer packaged goods, specifically beverages, snacks, skin care, and home care

- Retail, specifically grocery retail and dining

- Leisure travel

- Apparel

- Streaming media services

- Electronic devices

- Building materials

- Luxury products

- Electric utilities

- Cars

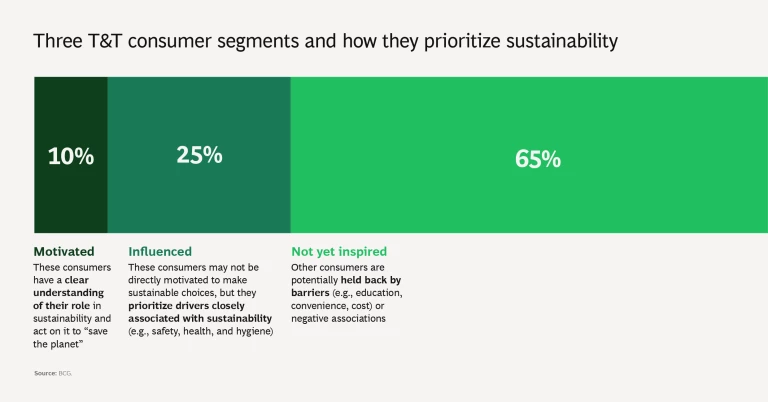

Even so, just 10% of consumers prioritize sustainability as a top driver of choice when making purchasing decisions about their travel and tourism. More specifically, these consumers chose certain options on their most recent journeys because those options were sustainable. Travel and tourism companies need to address not just this small percentage of sustainability-boosting consumers but the majority of consumers, who are not yet prioritizing sustainability.

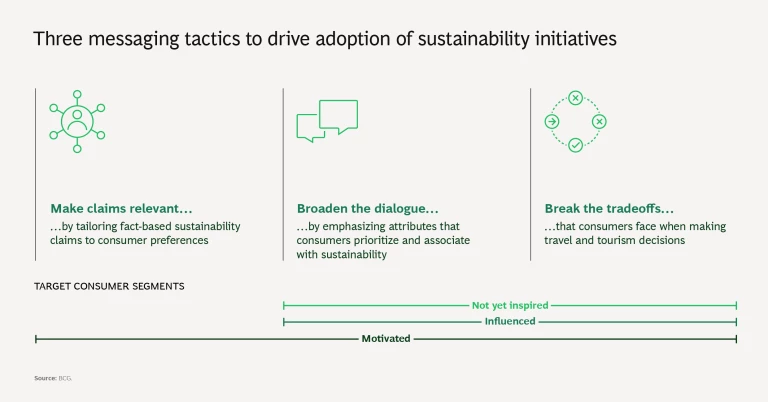

Looking through that lens, we see three broad travel and tourism consumer segments. These are not discrete groups but averaged characterizations that capture the varied consumer behaviors that travel and tourism companies must address:

- Those who are motivated by sustainability considerations. They have a clear understanding of their role and consistently prioritize sustainability as a top purchase driver.

- Those who can be influenced by sustainability considerations. They may not be directly motivated to make sustainable choices, but they prioritize attributes associated with sustainability.

- Those who are not yet inspired by sustainability. They prioritize other drivers of choice over sustainability and other attributes that are associated with sustainability.

To meet their sustainability commitments, companies must act quickly to drive adoption of sustainable choices across all three consumer segments.

Three Steps to Change Consumer Choices in the Future

A three-step approach can foster greater uptake of sustainable travel products and services:

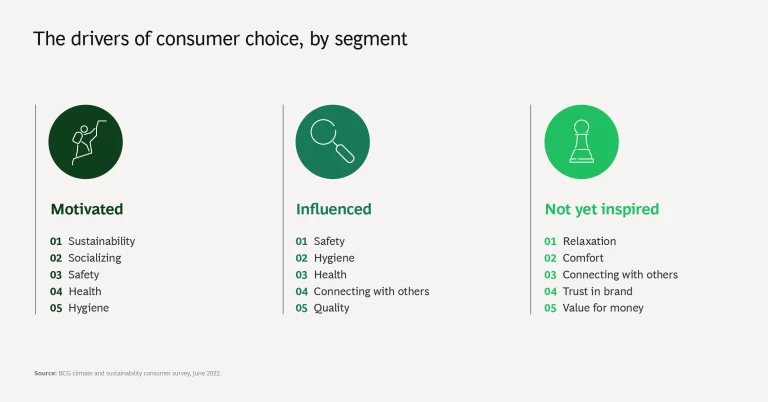

- Understand the drivers of choice. Identify the wide variety of needs that drive consumer choices across the three segments.

- Innovate to create sustainable offerings. Shape products and services that will meet consumers’ needs and encourage sustainable choices.

- Promote sustainable choices. Message consumers in relevant ways that help them adopt sustainable choices.

Step 1: Understand the Drivers of Choice

Nudging consumers toward sustainable choices in travel and tourism presents challenges. Like consumers in other industries, few leisure travel consumers prioritize sustainability when making purchase decisions. Some make choices on the basis of characteristics that are positively correlated with sustainability, like safety and health. But the majority of consumers make choices based on characteristics that are negatively correlated, such as value for money.

Further, many of our survey respondents say they are confused about the role they can play or that they’re disillusioned by what they perceive to be the motivations of companies pledging to become more sustainable. Consumers are alert to “greenwashing,” so companies must ensure that the claims they make and the offerings they provide are authentic and grounded in fact.

Step 2: Create Sustainable Offerings

Travel and tourism companies can push sustainable choices through offerings that are based on an understanding of what consumers really want.

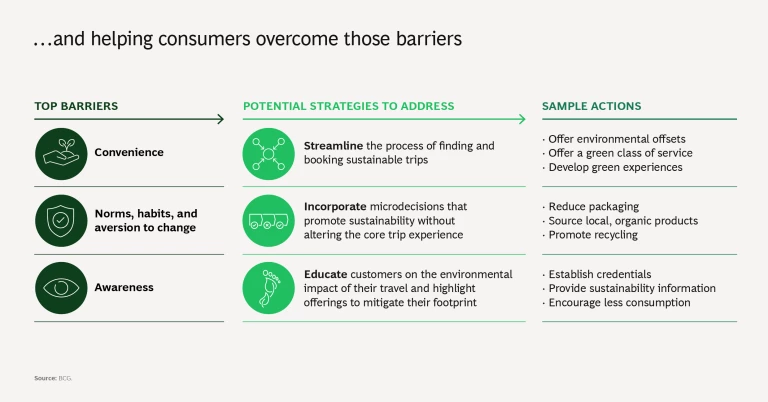

“Table stakes” offerings—for example, encouraging consumers to minimize their consumption without sacrificing the experience and amenities they have come to expect—are a starting point for travel and tourism companies. Some 30% of companies are using such levers to drive sustainability across all consumer groups. And moves made to increase sustainability could benefit consumers in other ways. Hotel guests, for instance, might find that having their rooms cleaned less frequently not only saves resources but also minimizes disruption.

Offerings that are more differentiated will appeal to those who are motivated or influenced by sustainability. For example:

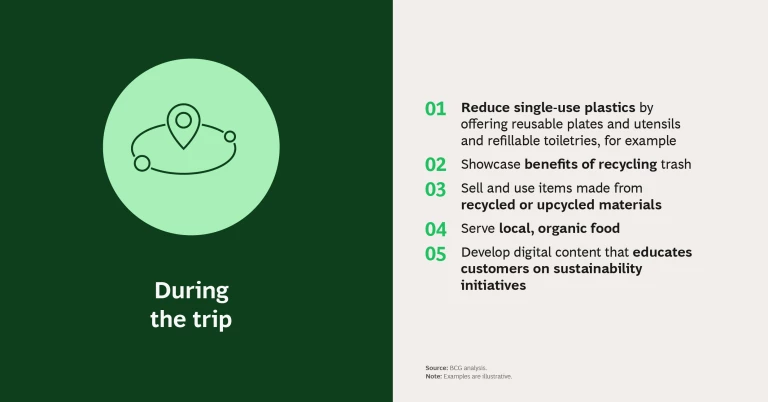

- Travel and tourism companies can promote recycling by ensuring that recycling and compost bins are widely available and clearly marked.

- They can reduce packaging by offering reusable tableware and refillable toiletry containers in place of disposable, single-use options.

- Another approach is to provide a “green experience.” Consumers at resorts or on cruises, for example, could have the option of participating in activities that positively contribute to the environment, such as planting trees or cleaning up a beach.

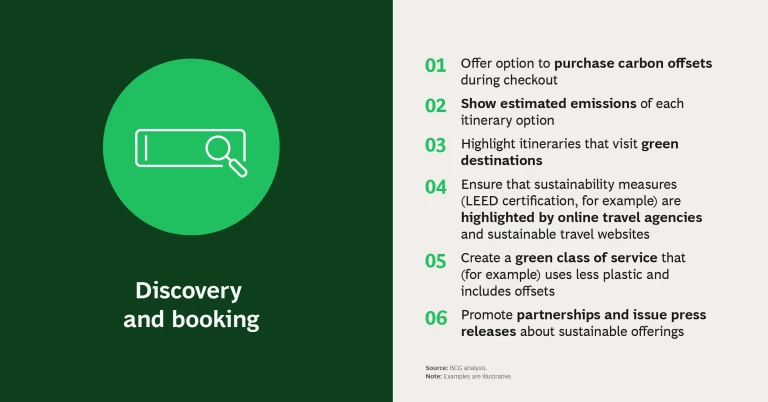

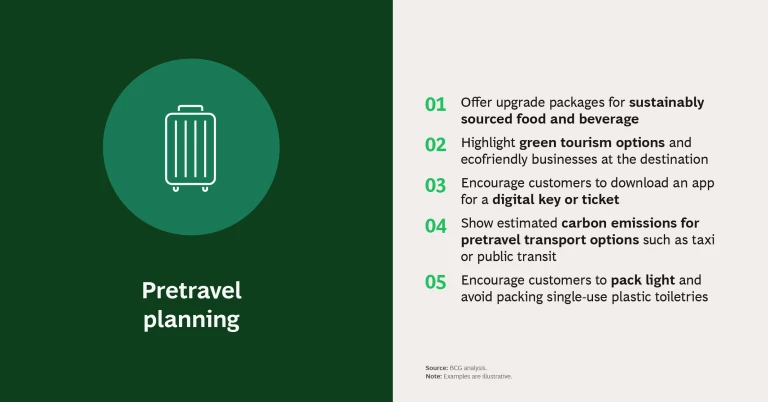

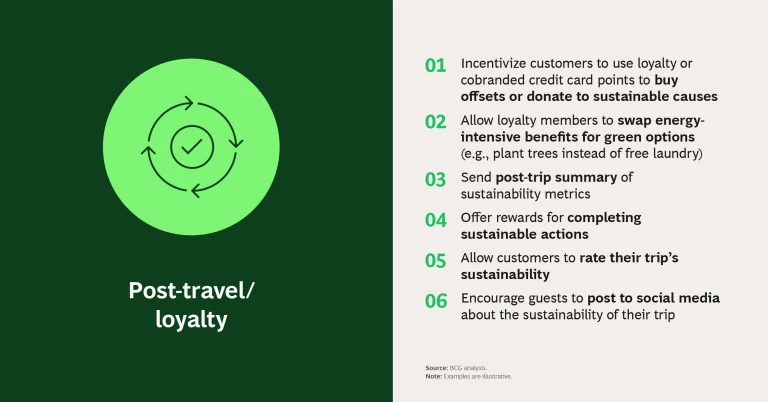

The levers that travel and tourism companies can apply—from the simpler, table-stakes options through the more sophisticated, differentiated moves—can be utilized at different points along the consumer journey. Here are some examples of what travel and tourism companies can offer to consumers at relevant times.

Step 3: Promote Sustainable Consumer Choices

Widespread adoption of sustainability offerings will require effective messaging to target consumers. Travel and tourism companies will need to:

- Make claims relevant.

- Broaden the dialogue.

- Break the tradeoffs.

Make claims relevant. The sustainability-related claims consumer groups value can differ based on the market and demographics involved; companies should tailor their sustainability claims accordingly, thereby maximizing effectiveness. For example, some 50% of consumers respond to claims about fuel and emissions, but only about 20% of airlines’ sustainability tweets target that theme.

Companies’ claims can span a variety of topics, including fuel and emissions, nature, packaging, and food. The relevance of those claims to a particular group of consumers will vary. Sometimes by country: consumers in higher-income countries respond to claims about efficient routing to save fuel, for example, whereas those in lower-income countries value claims about recyclable packaging.

The channel through which claims reach consumers matters too. Online reviews and messages from friends and family carry the greatest weight.

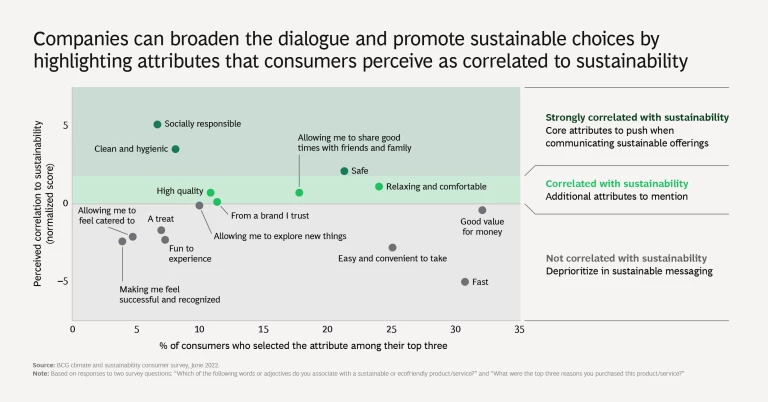

Broaden the dialogue. Although consumers don’t fall strictly into one of the three general categories, few consumers value sustainability as a top driver of choice. Many more, though, make decisions on the basis of attributes that are related to sustainability, such as cleanliness.

Companies can use insights about these associated attributes to attract a broader set of consumers, boosting their reach by three to seven times. For example, 10% of consumers choose sustainability as a top-three driver of choice; for these folks, messaging can efficiently highlight the impact of green choices on sustainability metrics.

A larger group—approximately 34%, corresponding to our motivated and inspired consumer segments—designate top-three drivers that are strongly correlated with sustainability: they seek products that are safe, clean and hygienic, and socially responsible. Messages that will resonate with them could emphasize, for example, how locally sourced options are good for the local economy. This will encourage uptake of sustainable choices even when sustainability itself is not a key driver.

Likewise, a still larger group, comprising about 70% of consumers, can be reached by emphasizing attributes they value that are somewhat correlated with sustainability. For example, some consumers in this group favor high-quality products, while others prioritize relaxation. Messaging (where appropriate) can emphasize the comfort or premium nature of products that happen to be sustainable, and innovation can help build more sustainable options that meet these consumers’ core needs.

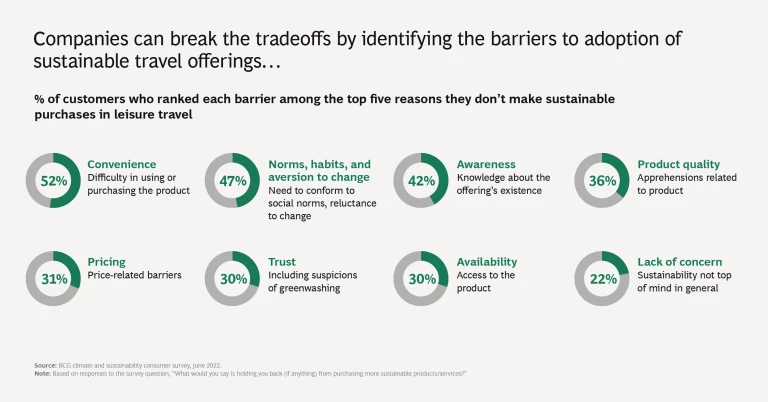

Break the tradeoffs. When choosing whether or not to purchase sustainable offerings, consumers face significant barriers—some of them real and some perceived.

Consider pricing. Sometimes, it’s a real barrier. A sustainable option can be more expensive than a conventional one. And sometimes a pricing barrier is merely something that consumers perceive. For example, buyers of conventional travel and tourism products and services believe that sustainable alternatives cost 20% more. People who choose sustainable travel and tourism options, meanwhile, believe that their choices yield a 10% savings.

Topping the list of barriers consumers cite are convenience; norms, habits, and aversion to change; and awareness. Travel and tourism companies can help consumers get over these barriers by identifying sticking points and deploying tactics and levers that drive sustainable choices.

For the travel and tourism industry, large-scale adoption of sustainability is necessary. Acting quickly and making consumers—all consumers—part of the solution is imperative.

Saving the planet is a primary motivator, of course. In addition, there’s proof of the business value for companies that pursue sustainability. Top environmental performers gain a 3-percentage-point advantage in total shareholder return, for instance, and 68% of employees say they are more willing to accept jobs from organizations they consider to be environmentally sustainable.

For travel and tourism companies that aim to take green mainstream by motivating large percentages of consumers, success will be measured in benefits to their profits as well as to the planet.

Acknowledgments

The authors thank BCG Center for Customer Insights and SurveyOps teams for their contributions to the research and insights informing this article.